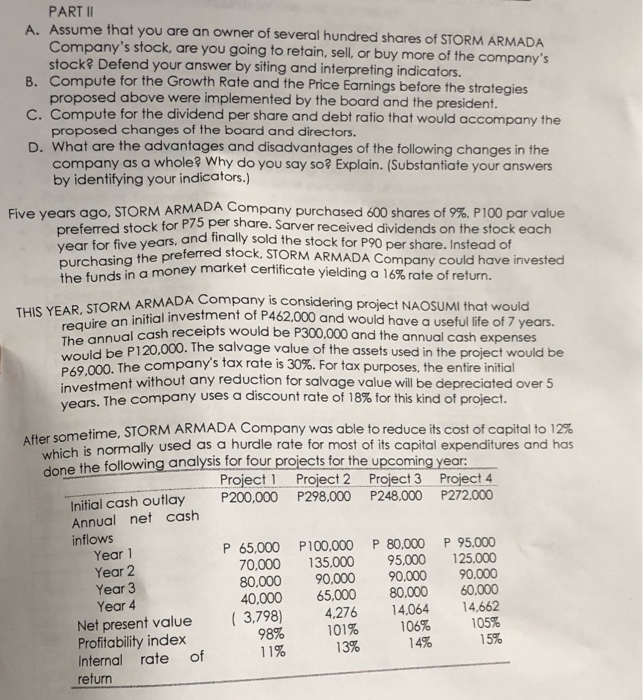

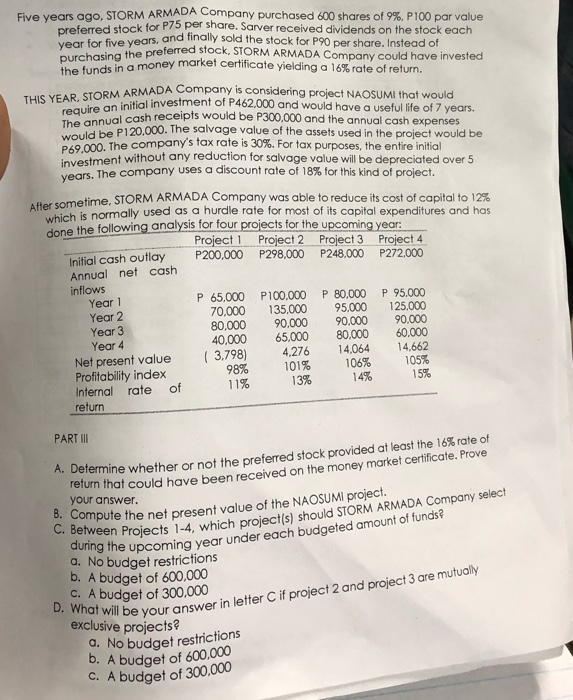

PART II A. Assume that you are an owner of several hundred shares of STORM ARMADA Company's stock, are you going to retain, sell, or buy more of the company's stock? Defend your answer by siting and interpreting indicatfors. B. Compute for the Growth Rate and the Price Earnings before the strategies proposed above were implemented by the board and the president. C.Compute for the dividend per share and debt ratio that would accompany the proposed changes of the board and directors. D. What are the advantages and disadvantages of the following changes in the company as a whole? Why do you say so? Explain. (Substantiate your answers by identifying your indicators.) Five years ago, STORM ARMADA Company purchased 600 shares of 9%, P100 par value preferred stock for P75 per share. Sarver received dividends on the stock each year for five years, and finally sold the stock for P90 per share. Instead of purchasing the preferred stock, STORM ARMADA Company could have invested the funds in a money market certificate yielding a 16% rate of return. THIS YEAR, STORM ARMADA Company is considering project NAOSUMI that would require an initial investment of P462,000 and would have a useful life of 7 years. The annual cash receipts would be P300,000 and the annual cash expenses would be P120,000. The salvage value of the assets used in the project would be PAS 000, The company's tax rate is 30%. For tax purposes, the entire initial investment without any reduction for salvage value will be depreciated over 5 vears. The company uses a discount rate of 18% for this kind of project. A fter sometime, STORM ARMADA Company was able to reduce its cost of capital to 12% which is normally used as a hurdle rate for most of its capital expenditures and has done the following analysis for four projects for the upcoming year Project 1 Project 2 Project 3 Project 4 P200,000 P298,000 P248,000 Initial cash outlay Annual net cash inflows Year Year 2 Year 3 Year 4 P272.000 P 65,000 P100,000 P 80,000 P 95,000 125,000 90,000 60,000 14,662 105% 15% 70,000 135.000 95,000 90,000 80,000 14,064 106% 14% 90,000 65,000 4,276 101% 13% 80,000 40,000 (3,798) 98% 11% Net present value Profitability index of Internal rate return Five years ago, STORM ARMADA Company purchased 600 shares of 9%, P100 par value preferred stock for P75 per share. Sarver received dividends on the stock each year for five years, and finally sold the stock for P0 per share. Instead of purchasing the preferred stock, STORM ARMADA Company could have invested the funds in a money market certificate yielding a 16% rate of return. THIS YEAR, STORM ARMADA Company is considering project NAOSUMI that would require an initial investment of P462,000 and would have a useful life of 7 years. The annual cash receipts would be P300,000 and the annual cash expenses would be P120,000. The salvage value of the assets used in the project would be P69.000. The company's tax rate is 30%. For tax purposes, the entire initial iovestment without any reduction for salvage value will be depreciated over 5 vears. The company uses a discount rate of 18% for this kind of project. After sometime, STORM ARMADA Company was able to reduce its cost of capital to 12 % which is normally used as a hurdle rate for most of its capital expenditures and has done the following analysis for four projects for the upcoming year Project 1 Project 2 Project 3 Project 4 P200,000 P298,000 P248.000 P272.000 Initial cash outlay Annual net cash inflows Year 1 Year 2 Year 3 Year 4 P 65,000 70,000 80,000 40,000 P100,000 P 80,000 P 95,000 95.000 90.000 80,000 14,064 106% 14% 135,000 125,000 90,000 90,000 60,000 14,662 105% 15% 65,000 (3,798) 98% 11% 4,276 101% 13% Net present value Profitability index Internal return rate of PART II A. Determine whether or not the preferred stock provided at least the 16% rate of return that could have been received on the money market certificate. Prove your answer Compute the net present value of the NAOSUMI project. C. Between Projects 1-4, which project(s) should STORM ARMADA Company select during the upcoming year under each budgeted amount of funds? a. No budget restrictions b. A budget of 600,000 C.A budget of 300,000 D. What will be your answer in letter C if project 2 and project 3 are mutually exclusive projects d. No budget restrictions b. A budget of 600,000 C. A budget of 300,000