Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Part II Adjustments to Income 11 Educator expenses 12 Certain business expenses of reservists, performing artists, and fee-basis government officials. Attach Form 2106 13 Health

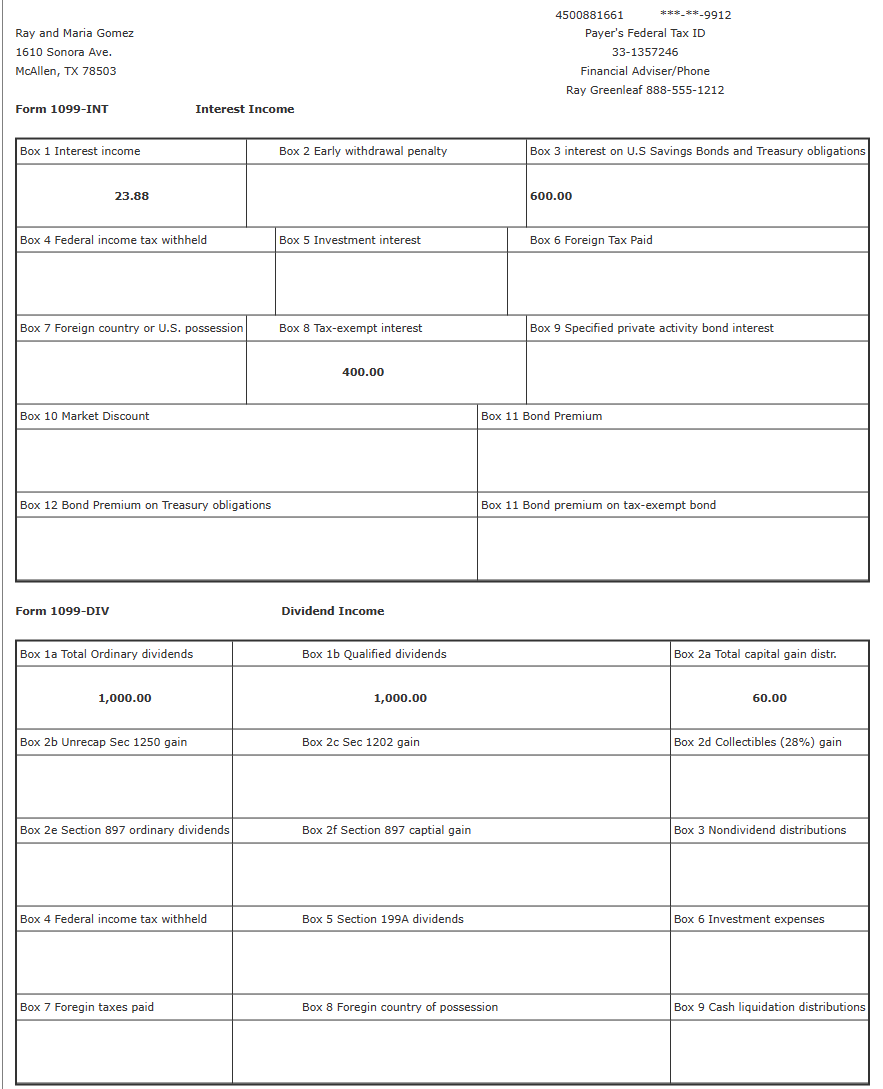

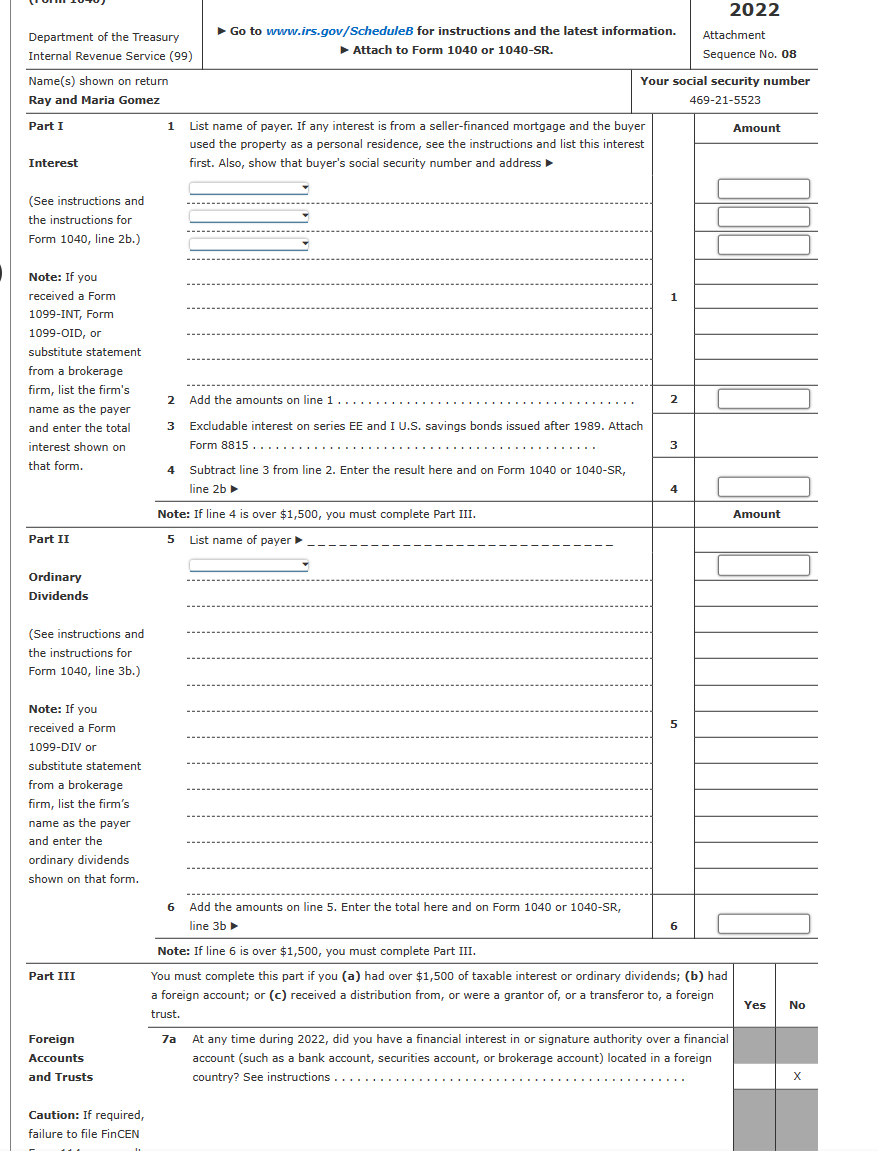

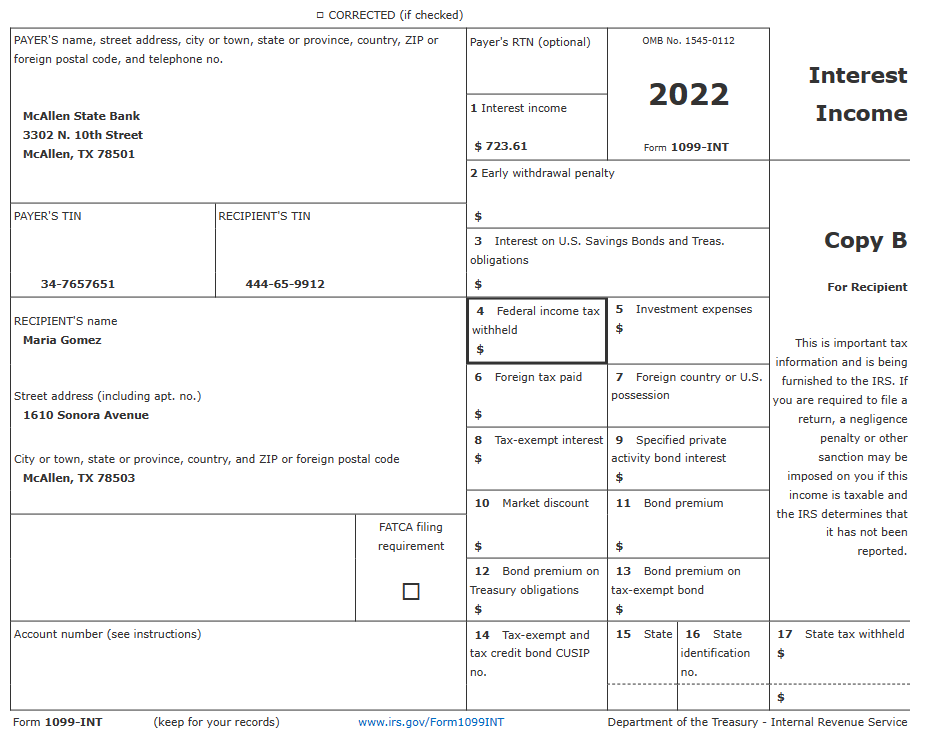

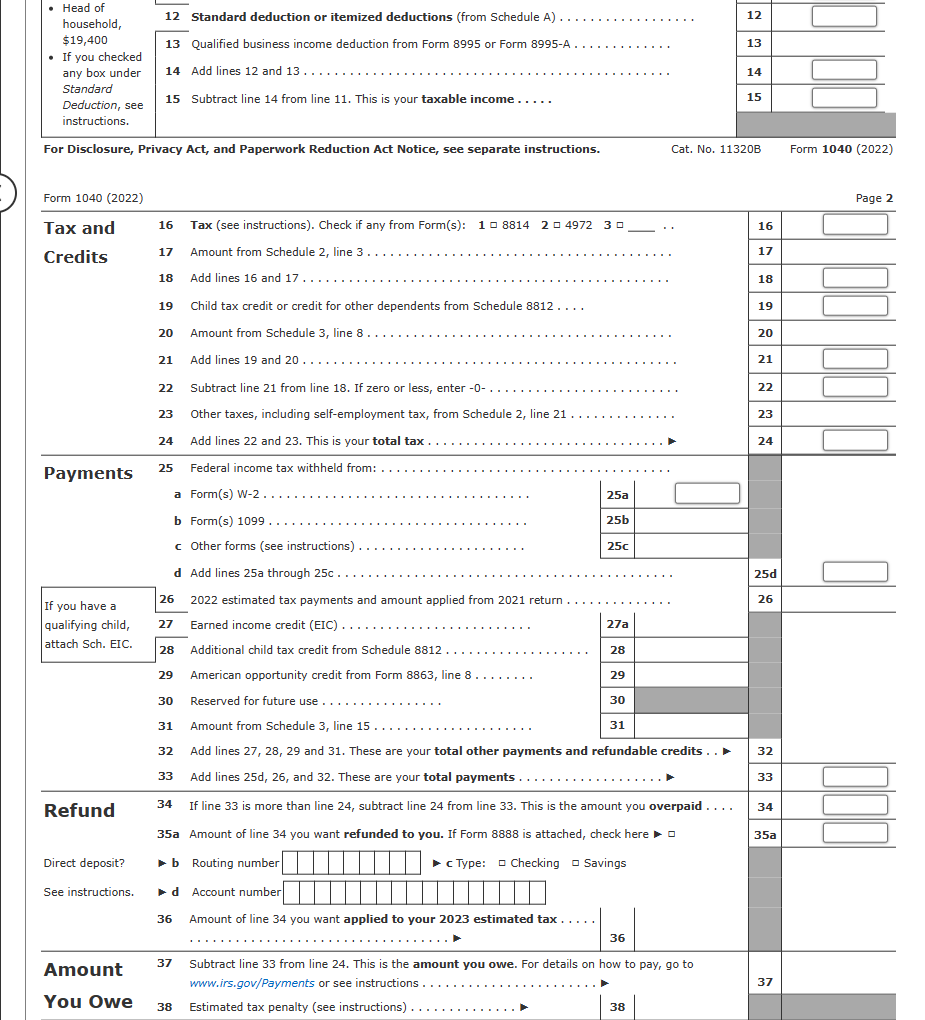

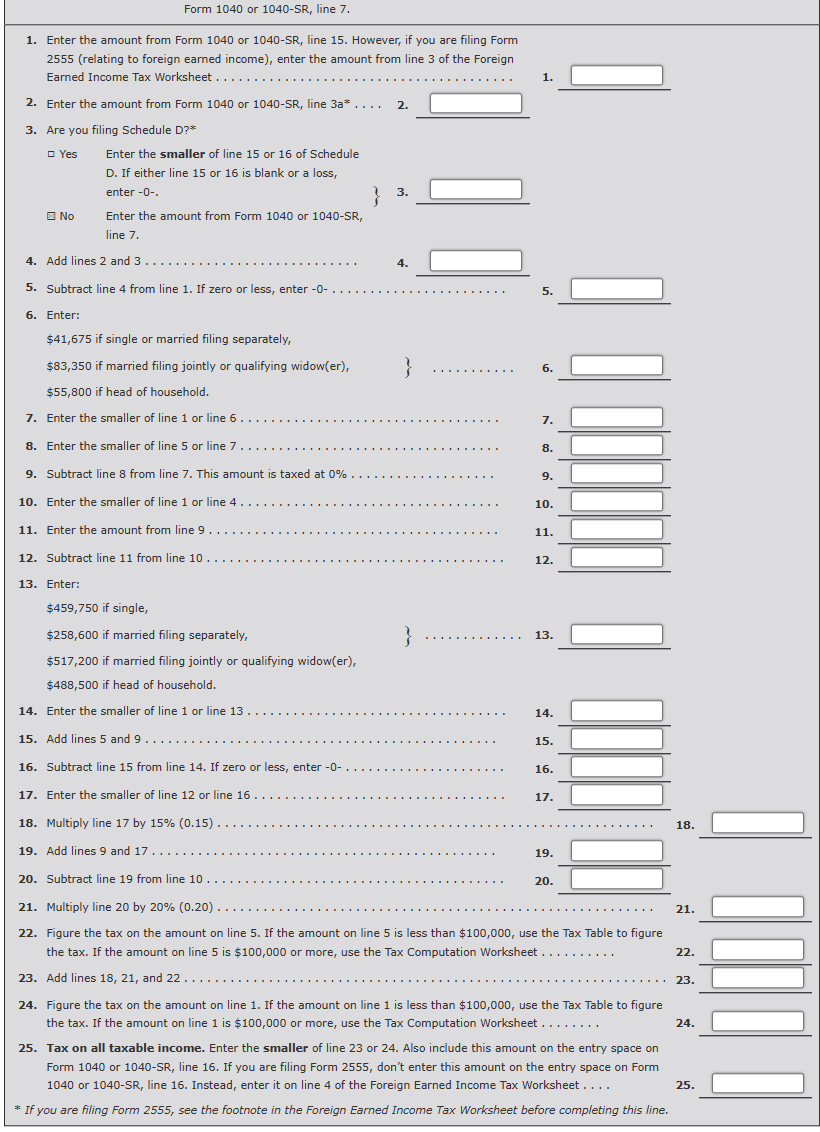

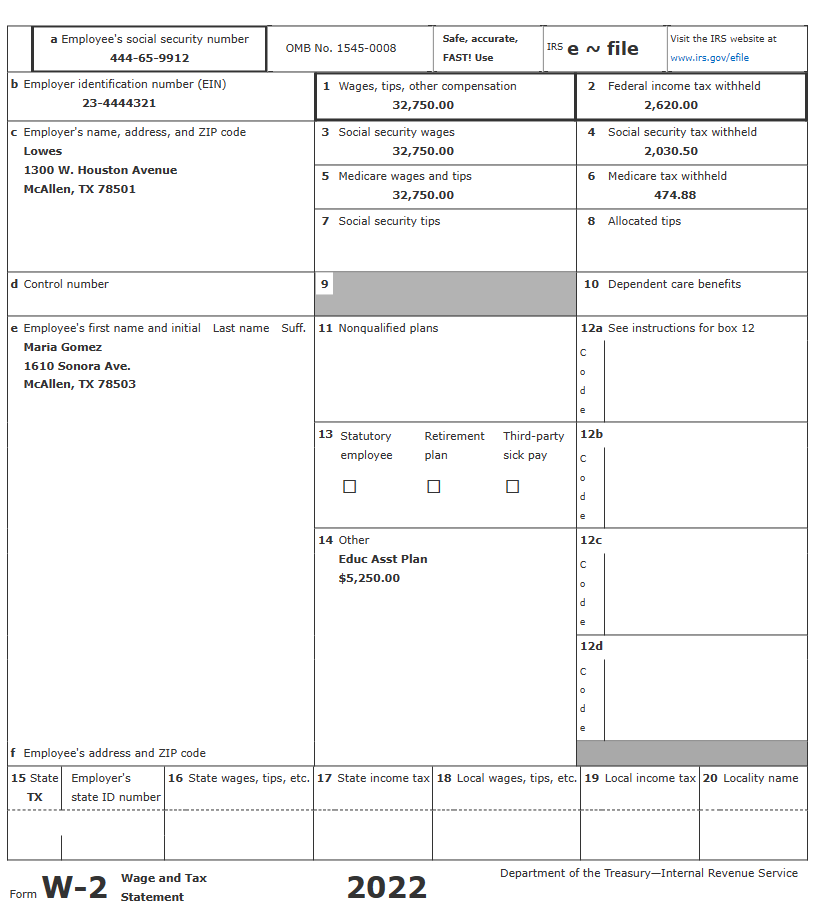

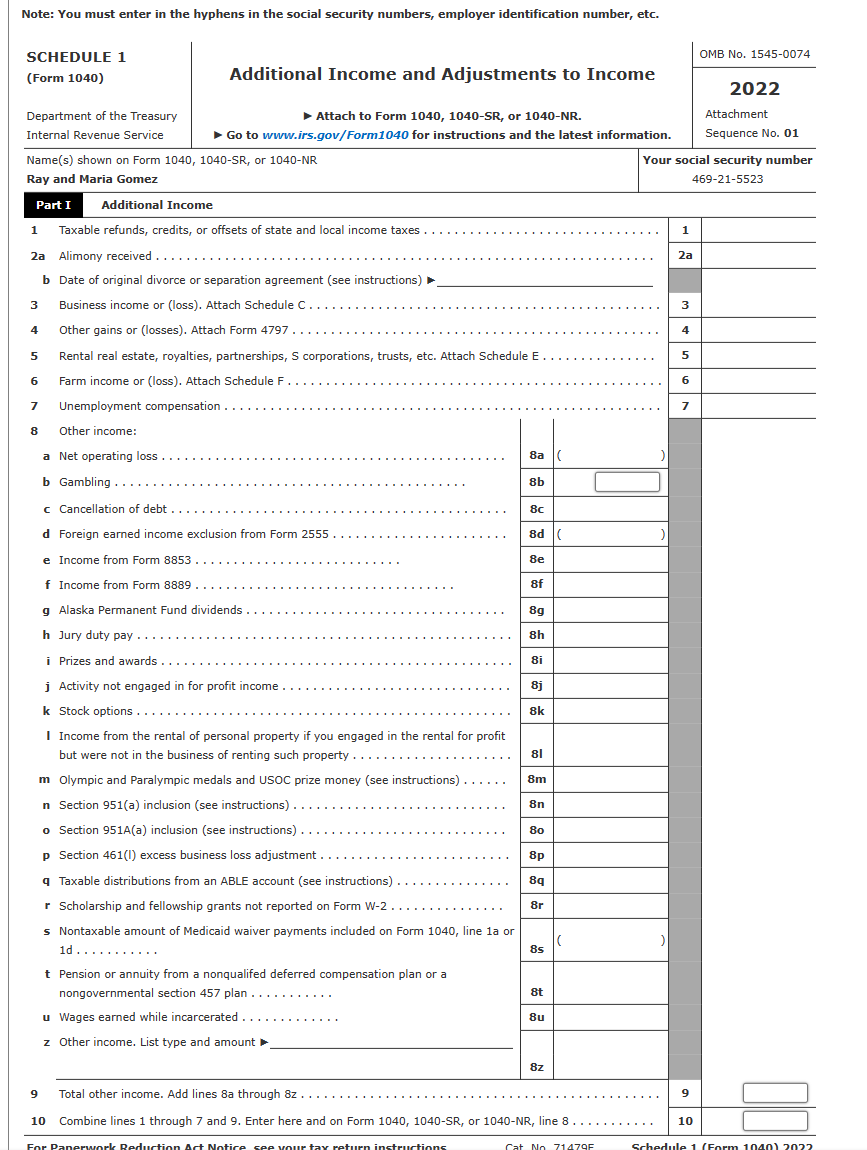

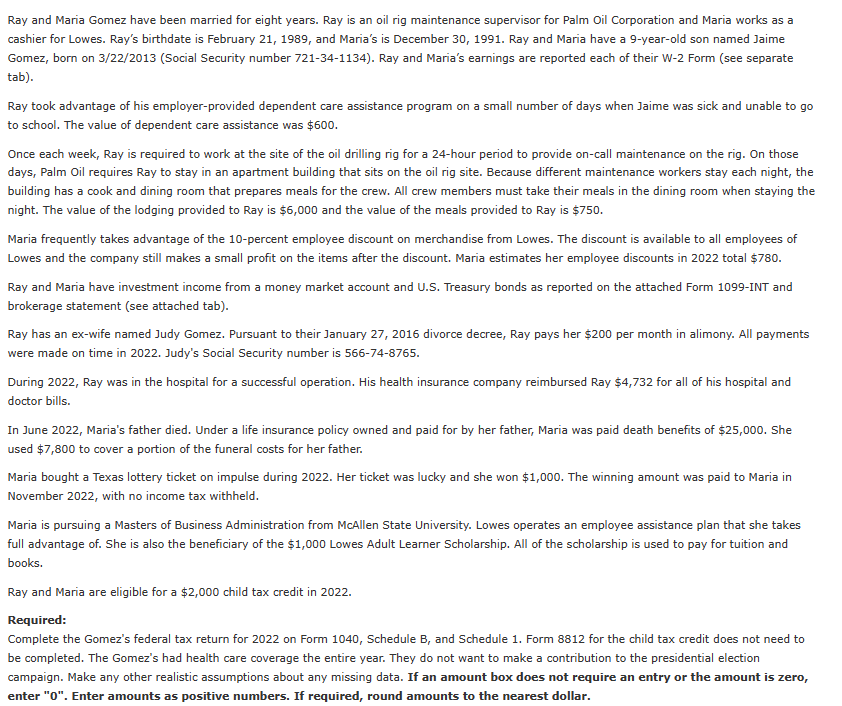

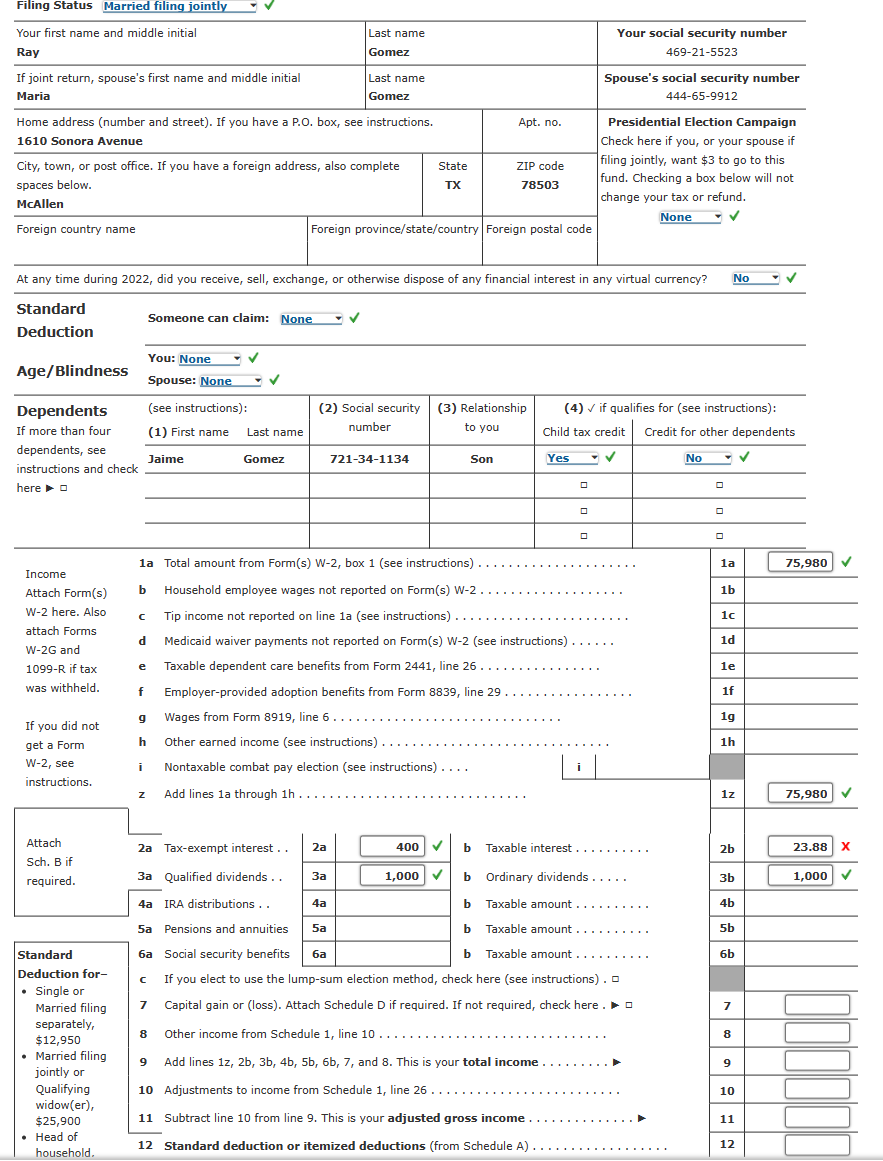

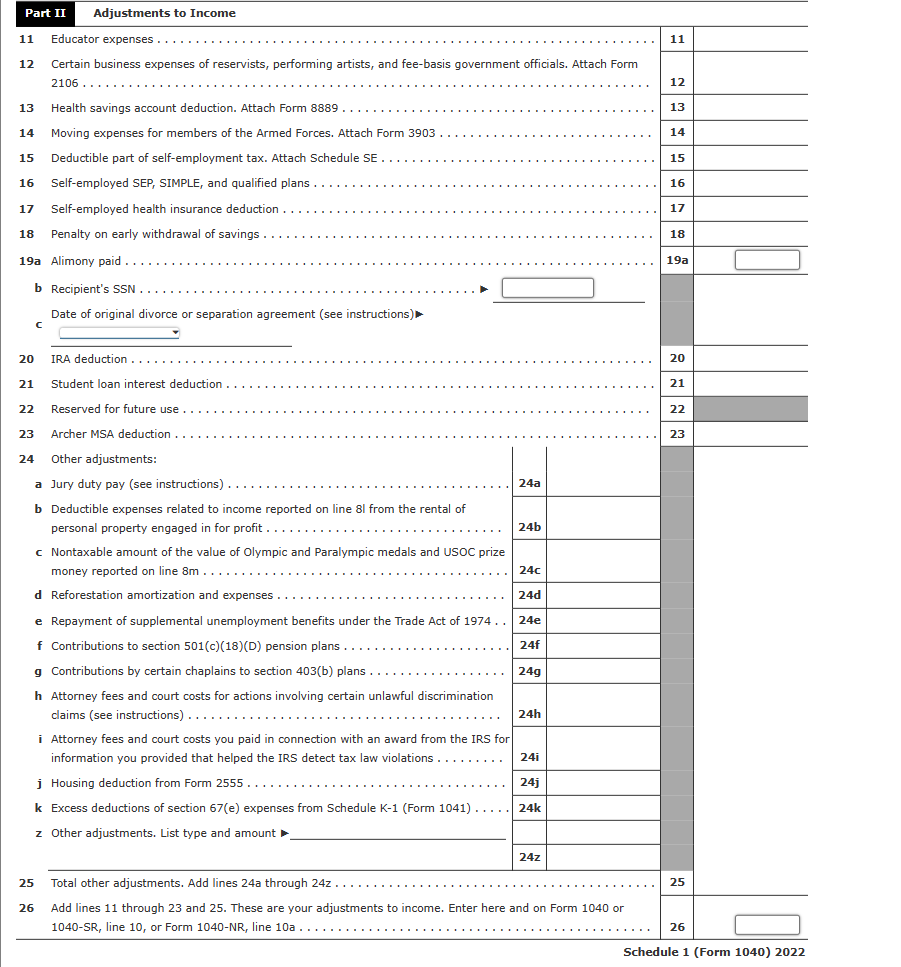

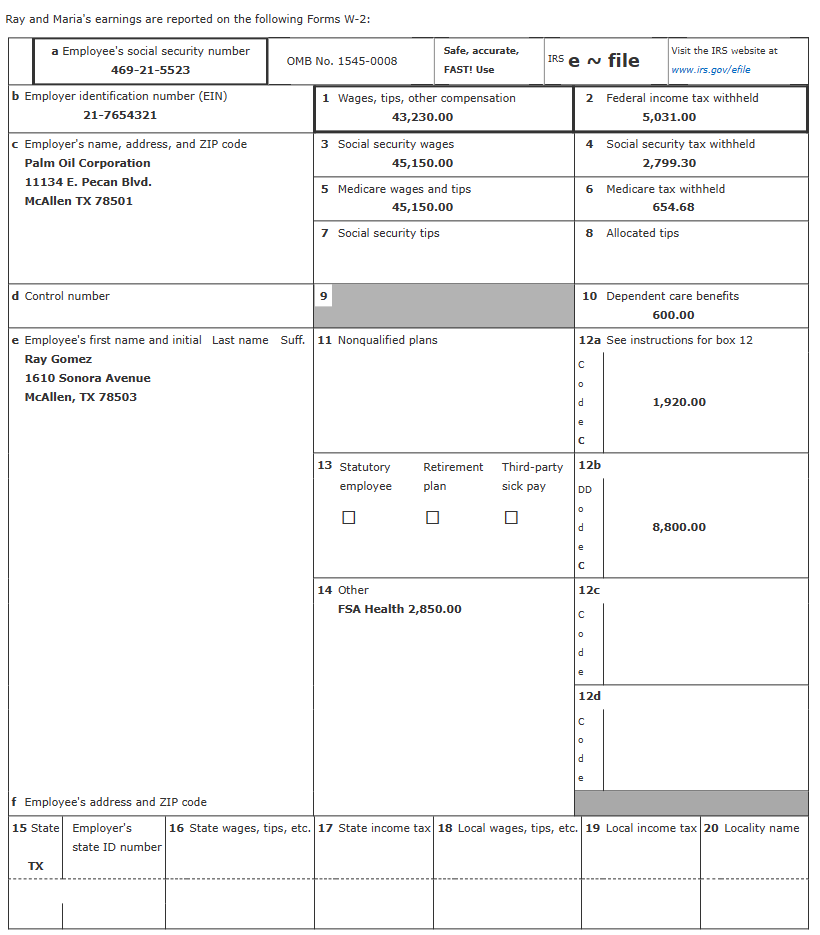

Part II Adjustments to Income 11 Educator expenses 12 Certain business expenses of reservists, performing artists, and fee-basis government officials. Attach Form 2106 13 Health savings account deduction. Attach Form 8889 14 Moving expenses for members of the Armed Forces. Attach Form 3903 15 Deductible part of self-employment tax. Attach Schedule SE 16 Self-employed SEP, SIMPLE, and qualified plans 17 Self-employed health insurance deduction 18 Penalty on early withdrawal of savings... 19a Alimony paid b Recipient's SSN Date of original divorce or separation agreement (see instructions) c 20 IRA deduction 21 Student loan interest deduction 22 Reserved for future use 23 Archer MSA deduction 24 Other adjustments: a Jury duty pay (see instructions) b Deductible expenses related to income reported on line 81 from the rental of personal property engaged in for profit . . c Nontaxable amount of the value of Olympic and Paralympic medals and USOC prize money reported on line 8m d Reforestation amortization and expenses e Repayment of supplemental unemployment benefits under the Trade Act of 1974 . . f Contributions to section 501(c)(18)(D) pension plans g Contributions by certain chaplains to section 403 (b) plans h Attorney fees and court costs for actions involving certain unlawful discrimination claims (see instructions) i Attorney fees and court costs you paid in connection with an award from the IRS for information you provided that helped the IRS detect tax law violations j Housing deduction from Form 2555 k Excess deductions of section 67(e) expenses from Schedule K-1 (Form 1041) z Other adjustments. List type and amount \begin{tabular}{|l|l|} \hline 24a & \\ \hline 24b & \\ \hline 24c & \\ \hline 24d & \\ \hline 24e & \\ \hline 24f & \\ \hline 24g & \\ \hline 24h & \\ \hline 24i & \\ \hline 24j & \\ \hline 24k & \\ \hline & \\ \hline 24z & \\ \hline \end{tabular} \begin{tabular}{|l|l} \hline 11 & \\ \hline 12 & \\ \hline 13 & \\ \hline 14 & \\ \hline 15 & \\ \hline 16 & \\ \hline 17 & \\ \hline 18 & \\ \hline 19a & \\ \hline 25 & \\ \hline 20 & \\ \hline 21 & \\ \hline 22 & \\ \hline 23 & \\ \hline & \\ & \\ & \\ & \\ & \\ \hline \end{tabular} 25 Total other adjustments. Add lines 24 a through 24z 26 Add lines 11 through 23 and 25. These are your adjustments to income. Enter here and on Form 1040 or 1040-SR, line 10, or Form 1040-NR, line 10a Schedule 1 (Form 1040) 2022 Ray and Maria Gomez have been married for eight years. Ray is an oil rig maintenance supervisor for Palm Oil Corporation and Maria works as a cashier for Lowes. Ray's birthdate is February 21, 1989, and Maria's is December 30, 1991. Ray and Maria have a 9-year-old son named Jaime Gomez, born on 3/22/2013 (Social Security number 721-34-1134). Ray and Maria's earnings are reported each of their W-2 Form (see separate tab). Ray took advantage of his employer-provided dependent care assistance program on a small number of days when Jaime was sick and unable to go to school. The value of dependent care assistance was $600. Once each week, Ray is required to work at the site of the oil drilling rig for a 24-hour period to provide on-call maintenance on the rig. On those days, Palm Oil requires Ray to stay in an apartment building that sits on the oil rig site. Because different maintenance workers stay each night, the building has a cook and dining room that prepares meals for the crew. All crew members must take their meals in the dining room when staying the night. The value of the lodging provided to Ray is $6,000 and the value of the meals provided to Ray is $750. Maria frequently takes advantage of the 10-percent employee discount on merchandise from Lowes. The discount is available to all employees of Lowes and the company still makes a small profit on the items after the discount. Maria estimates her employee discounts in 2022 total $780. Ray and Maria have investment income from a money market account and U.S. Treasury bonds as reported on the attached Form 1099-INT and brokerage statement (see attached tab). Ray has an ex-wife named Judy Gomez. Pursuant to their January 27, 2016 divorce decree, Ray pays her $200 per month in alimony. All payments were made on time in 2022. Judy's Social Security number is 566-74-8765. During 2022, Ray was in the hospital for a successful operation. His health insurance company reimbursed Ray $4,732 for all of his hospital and doctor bills. In June 2022, Maria's father died. Under a life insurance policy owned and paid for by her father, Maria was paid death benefits of $25,000. She used $7,800 to cover a portion of the funeral costs for her father. Maria bought a Texas lottery ticket on impulse during 2022. Her ticket was lucky and she won $1,000. The winning amount was paid to Maria in November 2022, with no income tax withheld. Maria is pursuing a Masters of Business Administration from McAllen State University. Lowes operates an employee assistance plan that she takes full advantage of. She is also the beneficiary of the $1,000 Lowes Adult Learner Scholarship. All of the scholarship is used to pay for tuition and books. Ray and Maria are eligible for a $2,000 child tax credit in 2022. Required: Complete the Gomez's federal tax return for 2022 on Form 1040, Schedule B, and Schedule 1. Form 8812 for the child tax credit does not need to be completed. The Gomez's had health care coverage the entire year. They do not want to make a contribution to the presidential election campaign. Make any other realistic assumptions about any missing data. If an amount box does not require an entry or the amount is zero, enter " 0 ". Enter amounts as positive numbers. If required, round amounts to the nearest dollar. Form 1040 or 1040SR, line 7. 1. Enter the amount from Form 1040 or 1040SR, line 15. However, if you are filing Form 2555 (relating to foreign earned income), enter the amount from line 3 of the Foreign Earned Income Tax Worksheet . . . 1. 2. Enter the amount from Form 1040 or 1040SR, line 3a.2. 3. Are you filing Schedule D?* es Enter the smaller of line 15 or 16 of Schedule D. If either line 15 or 16 is blank or a loss, enter -0-. 3. No Enter the amount from Form 1040 or 1040-SR, line 7. 4. Add lines 2 and 3 4. 5. 5. Subtract line 4 from line 1 . If zero or less, enter -0 1. 6. Enter: $41,675 if single or married filing separately, $83,350 if married filing jointly or qualifying widow(er), 6. $55,800 if head of household. 7. Enter the smaller of line 1 or line 6 . 7. 8. Enter the smaller of line 5 or line 7 8. 9. Subtract line 8 from line 7 . This amount is taxed at 0% 9. 10. Enter the smaller of line 1 or line 4 10. 11. Enter the amount from line 9 11. 12. Subtract line 11 from line 10 12. 13. Enter: $459,750 if single, $258,600 if married filing separately, 13. $517,200 if married filing jointly or qualifying widow(er), $488,500 if head of household. 14. Enter the smaller of line 1 or line 13 14. 15. Add lines 5 and 9 15. 16. Subtract line 15 from line 14. If zero or less, enter -0 16. 17. Enter the smaller of line 12 or line 16 17. 18. Multiply line 17 by 15%(0.15) 18. 19. Add lines 9 and 17 19. 20. Subtract line 19 from line 10 20. 21. Multiply line 20 by 20%(0.20) 21. 22. Figure the tax on the amount on line 5 . If the amount on line 5 is less than $100,000, use the Tax Table to figure the tax. If the amount on line 5 is $100,000 or more, use the Tax Computation Worksheet . . . 22. 23. Add lines 18,21 , and 22 . 23. 24. Figure the tax on the amount on line 1 . If the amount on line 1 is less than $100,000, use the Tax Table to figure the tax. If the amount on line 1 is $100,000 or more, use the Tax Computation Worksheet. 24. 25. Tax on all taxable income. Enter the smaller of line 23 or 24 . Also include this amount on the entry space on Form 1040 or 1040SR, line 16 . If you are filing Form 2555, don't enter this amount on the entry space on Form 1040 or 1040SR, line 16. Instead, enter it on line 4 of the Foreign Earned Income Tax Worksheet .... . 25. * If you are filing Form 2555, see the footnote in the Foreign Earned Income Tax Worksheet before completing this line. CORRECTED (if checked) Note: You must enter in the hyphens in the social security numbers, employer identification number, etc. SCHEDULE 1 (Form 1040) Department of the Treasury Internal Revenue Service Additional Income and Adjustments to Income Attach to Form 1040, 1040-SR, or 1040-NR. Go to www.irs.gov/Form1040 for instructions and the latest information. OMB No. 15450074 2022 Attachment Sequence No. 01 Name(s) shown on Form 1040, 1040-SR, or 1040-NR Your social security number Ray and Maria Gomez 469215523 Part I Additional Income 1 Taxable refunds, credits, or offsets of state and local income taxes 2a Alimony received b Date of original divorce or separation agreement (see instructions) 3 Business income or (loss). Attach Schedule C 4 Other gains or (losses). Attach Form 4797 5 Rental real estate, royalties, partnerships, S corporations, trusts, etc. Attach Schedule E 6 Farm income or (loss). Attach Schedule F 7 Unemployment compensation 8 Other income: a Net operating loss b Gambling c Cancellation of debt d Foreign earned income exclusion from Form 2555 e Income from Form 8853 f Income from Form 8889 g Alaska Permanent Fund dividends h Jury duty pay i Prizes and awards j Activity not engaged in for profit income k Stock options I Income from the rental of personal property if you engaged in the rental for profit but were not in the business of renting such property m Olympic and Paralympic medals and USOC prize money (see instructions) n Section 951(a) inclusion (see instructions) - Section 951A(a) inclusion (see instructions) p Section 461(I) excess business loss adjustment . . q Taxable distributions from an ABLE account (see instructions) r Scholarship and fellowship grants not reported on Form W-2 s Nontaxable amount of Medicaid waiver payments included on Form 1040, line 1a or 1d.......... t Pension or annuity from a nonqualifed deferred compensation plan or a nongovernmental section 457 plan . . . . . . . . u Wages earned while incarcerated z Other income. List type and amount \begin{tabular}{|c|l} \hline 1 & \\ \hline 2a & \\ \hline & \\ \hline 3 & \\ \hline \end{tabular} 4 5 6 7 + Filing Status Married filing jointly Ray and Maria's earnings are reported on the following Forms W-2: - Head of household, $19,400 - If you checked any box under Standard Deduction, see instructions. 12 Standard deduction or itemized deductions (from Schedule A) . . . . . . . . . . . 13 Qualified business income deduction from Form 8995 or Form 8995-A . . . . . . . . . . . 14 Add lines 12 and 13 15 Subtract line 14 from line 11 . This is your taxable income \begin{tabular}{|c|c|} \hline 12 & \\ \hline 13 & \\ \hline 14 & \\ \hline 15 & \\ \hline \end{tabular} For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. Cat. No. 11320B Form 1040 (2022) Form 1040 (2022) Page 2 4500881661 ***_***-9912 Ray and Maria Gomez Payer's Federal Tax ID 1610 Sonora Ave. 33-1357246 McAllen, TX 78503 Financial Adviser/Phone Ray Greenleaf 888-555-1212 Form 1099-INT Interest Income \begin{tabular}{|c|c|c|} \hline Box 1 Interest income & Box 2 Early withdrawal penalty & Box 3 interest on U.S Savings Bonds and Treasury obligations \\ \hline 23.88 & & 600.00 \\ \hline Box 4 Federal income tax withheld & Box 5 Investment interest & Box 6 Foreign Tax Paid \\ \hline Box 7 Foreign country or U.S. possession & Box 8 Tax-exempt interest & Box 9 Specified private activity bond interest \\ \hline & 400.00 & \\ \hline \multicolumn{2}{|l|}{ Box 10 Market Discount } & Box 11 Bond Premium \\ \hline \multicolumn{2}{|l|}{ Box 12 Bond Premium on Treasury obligations } & Box 11 Bond premium on tax-exempt bond \\ \hline \end{tabular} Form 1099-DIV Dividend Income \begin{tabular}{|c|c|c|} \hline Box 1a Total Ordinary dividends & Box 1b Qualified dividends & Box 2a Total capital gain distr. \\ \hline 1,000.00 & 1,000.00 & 60.00 \\ \hline Box 2b Unrecap Sec 1250 gain & Box 2c Sec 1202 gain & Box 2d Collectibles (28\%) gain \\ \hline Box 2e Section 897 ordinary dividends & Box 2f Section 897 captial gain & Box 3 Nondividend distributions \\ \hline Box 4 Federal income tax withheld & Box 5 Section 199A dividends & Box 6 Investment expenses \\ \hline Box 7 Foregin taxes paid & Box 8 Foregin country of possession & Box 9 Cash liquidation distributions \\ \hline \end{tabular} Part II Adjustments to Income 11 Educator expenses 12 Certain business expenses of reservists, performing artists, and fee-basis government officials. Attach Form 2106 13 Health savings account deduction. Attach Form 8889 14 Moving expenses for members of the Armed Forces. Attach Form 3903 15 Deductible part of self-employment tax. Attach Schedule SE 16 Self-employed SEP, SIMPLE, and qualified plans 17 Self-employed health insurance deduction 18 Penalty on early withdrawal of savings... 19a Alimony paid b Recipient's SSN Date of original divorce or separation agreement (see instructions) c 20 IRA deduction 21 Student loan interest deduction 22 Reserved for future use 23 Archer MSA deduction 24 Other adjustments: a Jury duty pay (see instructions) b Deductible expenses related to income reported on line 81 from the rental of personal property engaged in for profit . . c Nontaxable amount of the value of Olympic and Paralympic medals and USOC prize money reported on line 8m d Reforestation amortization and expenses e Repayment of supplemental unemployment benefits under the Trade Act of 1974 . . f Contributions to section 501(c)(18)(D) pension plans g Contributions by certain chaplains to section 403 (b) plans h Attorney fees and court costs for actions involving certain unlawful discrimination claims (see instructions) i Attorney fees and court costs you paid in connection with an award from the IRS for information you provided that helped the IRS detect tax law violations j Housing deduction from Form 2555 k Excess deductions of section 67(e) expenses from Schedule K-1 (Form 1041) z Other adjustments. List type and amount \begin{tabular}{|l|l|} \hline 24a & \\ \hline 24b & \\ \hline 24c & \\ \hline 24d & \\ \hline 24e & \\ \hline 24f & \\ \hline 24g & \\ \hline 24h & \\ \hline 24i & \\ \hline 24j & \\ \hline 24k & \\ \hline & \\ \hline 24z & \\ \hline \end{tabular} \begin{tabular}{|l|l} \hline 11 & \\ \hline 12 & \\ \hline 13 & \\ \hline 14 & \\ \hline 15 & \\ \hline 16 & \\ \hline 17 & \\ \hline 18 & \\ \hline 19a & \\ \hline 25 & \\ \hline 20 & \\ \hline 21 & \\ \hline 22 & \\ \hline 23 & \\ \hline & \\ & \\ & \\ & \\ & \\ \hline \end{tabular} 25 Total other adjustments. Add lines 24 a through 24z 26 Add lines 11 through 23 and 25. These are your adjustments to income. Enter here and on Form 1040 or 1040-SR, line 10, or Form 1040-NR, line 10a Schedule 1 (Form 1040) 2022 Ray and Maria Gomez have been married for eight years. Ray is an oil rig maintenance supervisor for Palm Oil Corporation and Maria works as a cashier for Lowes. Ray's birthdate is February 21, 1989, and Maria's is December 30, 1991. Ray and Maria have a 9-year-old son named Jaime Gomez, born on 3/22/2013 (Social Security number 721-34-1134). Ray and Maria's earnings are reported each of their W-2 Form (see separate tab). Ray took advantage of his employer-provided dependent care assistance program on a small number of days when Jaime was sick and unable to go to school. The value of dependent care assistance was $600. Once each week, Ray is required to work at the site of the oil drilling rig for a 24-hour period to provide on-call maintenance on the rig. On those days, Palm Oil requires Ray to stay in an apartment building that sits on the oil rig site. Because different maintenance workers stay each night, the building has a cook and dining room that prepares meals for the crew. All crew members must take their meals in the dining room when staying the night. The value of the lodging provided to Ray is $6,000 and the value of the meals provided to Ray is $750. Maria frequently takes advantage of the 10-percent employee discount on merchandise from Lowes. The discount is available to all employees of Lowes and the company still makes a small profit on the items after the discount. Maria estimates her employee discounts in 2022 total $780. Ray and Maria have investment income from a money market account and U.S. Treasury bonds as reported on the attached Form 1099-INT and brokerage statement (see attached tab). Ray has an ex-wife named Judy Gomez. Pursuant to their January 27, 2016 divorce decree, Ray pays her $200 per month in alimony. All payments were made on time in 2022. Judy's Social Security number is 566-74-8765. During 2022, Ray was in the hospital for a successful operation. His health insurance company reimbursed Ray $4,732 for all of his hospital and doctor bills. In June 2022, Maria's father died. Under a life insurance policy owned and paid for by her father, Maria was paid death benefits of $25,000. She used $7,800 to cover a portion of the funeral costs for her father. Maria bought a Texas lottery ticket on impulse during 2022. Her ticket was lucky and she won $1,000. The winning amount was paid to Maria in November 2022, with no income tax withheld. Maria is pursuing a Masters of Business Administration from McAllen State University. Lowes operates an employee assistance plan that she takes full advantage of. She is also the beneficiary of the $1,000 Lowes Adult Learner Scholarship. All of the scholarship is used to pay for tuition and books. Ray and Maria are eligible for a $2,000 child tax credit in 2022. Required: Complete the Gomez's federal tax return for 2022 on Form 1040, Schedule B, and Schedule 1. Form 8812 for the child tax credit does not need to be completed. The Gomez's had health care coverage the entire year. They do not want to make a contribution to the presidential election campaign. Make any other realistic assumptions about any missing data. If an amount box does not require an entry or the amount is zero, enter " 0 ". Enter amounts as positive numbers. If required, round amounts to the nearest dollar. Form 1040 or 1040SR, line 7. 1. Enter the amount from Form 1040 or 1040SR, line 15. However, if you are filing Form 2555 (relating to foreign earned income), enter the amount from line 3 of the Foreign Earned Income Tax Worksheet . . . 1. 2. Enter the amount from Form 1040 or 1040SR, line 3a.2. 3. Are you filing Schedule D?* es Enter the smaller of line 15 or 16 of Schedule D. If either line 15 or 16 is blank or a loss, enter -0-. 3. No Enter the amount from Form 1040 or 1040-SR, line 7. 4. Add lines 2 and 3 4. 5. 5. Subtract line 4 from line 1 . If zero or less, enter -0 1. 6. Enter: $41,675 if single or married filing separately, $83,350 if married filing jointly or qualifying widow(er), 6. $55,800 if head of household. 7. Enter the smaller of line 1 or line 6 . 7. 8. Enter the smaller of line 5 or line 7 8. 9. Subtract line 8 from line 7 . This amount is taxed at 0% 9. 10. Enter the smaller of line 1 or line 4 10. 11. Enter the amount from line 9 11. 12. Subtract line 11 from line 10 12. 13. Enter: $459,750 if single, $258,600 if married filing separately, 13. $517,200 if married filing jointly or qualifying widow(er), $488,500 if head of household. 14. Enter the smaller of line 1 or line 13 14. 15. Add lines 5 and 9 15. 16. Subtract line 15 from line 14. If zero or less, enter -0 16. 17. Enter the smaller of line 12 or line 16 17. 18. Multiply line 17 by 15%(0.15) 18. 19. Add lines 9 and 17 19. 20. Subtract line 19 from line 10 20. 21. Multiply line 20 by 20%(0.20) 21. 22. Figure the tax on the amount on line 5 . If the amount on line 5 is less than $100,000, use the Tax Table to figure the tax. If the amount on line 5 is $100,000 or more, use the Tax Computation Worksheet . . . 22. 23. Add lines 18,21 , and 22 . 23. 24. Figure the tax on the amount on line 1 . If the amount on line 1 is less than $100,000, use the Tax Table to figure the tax. If the amount on line 1 is $100,000 or more, use the Tax Computation Worksheet. 24. 25. Tax on all taxable income. Enter the smaller of line 23 or 24 . Also include this amount on the entry space on Form 1040 or 1040SR, line 16 . If you are filing Form 2555, don't enter this amount on the entry space on Form 1040 or 1040SR, line 16. Instead, enter it on line 4 of the Foreign Earned Income Tax Worksheet .... . 25. * If you are filing Form 2555, see the footnote in the Foreign Earned Income Tax Worksheet before completing this line. CORRECTED (if checked) Note: You must enter in the hyphens in the social security numbers, employer identification number, etc. SCHEDULE 1 (Form 1040) Department of the Treasury Internal Revenue Service Additional Income and Adjustments to Income Attach to Form 1040, 1040-SR, or 1040-NR. Go to www.irs.gov/Form1040 for instructions and the latest information. OMB No. 15450074 2022 Attachment Sequence No. 01 Name(s) shown on Form 1040, 1040-SR, or 1040-NR Your social security number Ray and Maria Gomez 469215523 Part I Additional Income 1 Taxable refunds, credits, or offsets of state and local income taxes 2a Alimony received b Date of original divorce or separation agreement (see instructions) 3 Business income or (loss). Attach Schedule C 4 Other gains or (losses). Attach Form 4797 5 Rental real estate, royalties, partnerships, S corporations, trusts, etc. Attach Schedule E 6 Farm income or (loss). Attach Schedule F 7 Unemployment compensation 8 Other income: a Net operating loss b Gambling c Cancellation of debt d Foreign earned income exclusion from Form 2555 e Income from Form 8853 f Income from Form 8889 g Alaska Permanent Fund dividends h Jury duty pay i Prizes and awards j Activity not engaged in for profit income k Stock options I Income from the rental of personal property if you engaged in the rental for profit but were not in the business of renting such property m Olympic and Paralympic medals and USOC prize money (see instructions) n Section 951(a) inclusion (see instructions) - Section 951A(a) inclusion (see instructions) p Section 461(I) excess business loss adjustment . . q Taxable distributions from an ABLE account (see instructions) r Scholarship and fellowship grants not reported on Form W-2 s Nontaxable amount of Medicaid waiver payments included on Form 1040, line 1a or 1d.......... t Pension or annuity from a nonqualifed deferred compensation plan or a nongovernmental section 457 plan . . . . . . . . u Wages earned while incarcerated z Other income. List type and amount \begin{tabular}{|c|l} \hline 1 & \\ \hline 2a & \\ \hline & \\ \hline 3 & \\ \hline \end{tabular} 4 5 6 7 + Filing Status Married filing jointly Ray and Maria's earnings are reported on the following Forms W-2: - Head of household, $19,400 - If you checked any box under Standard Deduction, see instructions. 12 Standard deduction or itemized deductions (from Schedule A) . . . . . . . . . . . 13 Qualified business income deduction from Form 8995 or Form 8995-A . . . . . . . . . . . 14 Add lines 12 and 13 15 Subtract line 14 from line 11 . This is your taxable income \begin{tabular}{|c|c|} \hline 12 & \\ \hline 13 & \\ \hline 14 & \\ \hline 15 & \\ \hline \end{tabular} For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. Cat. No. 11320B Form 1040 (2022) Form 1040 (2022) Page 2 4500881661 ***_***-9912 Ray and Maria Gomez Payer's Federal Tax ID 1610 Sonora Ave. 33-1357246 McAllen, TX 78503 Financial Adviser/Phone Ray Greenleaf 888-555-1212 Form 1099-INT Interest Income \begin{tabular}{|c|c|c|} \hline Box 1 Interest income & Box 2 Early withdrawal penalty & Box 3 interest on U.S Savings Bonds and Treasury obligations \\ \hline 23.88 & & 600.00 \\ \hline Box 4 Federal income tax withheld & Box 5 Investment interest & Box 6 Foreign Tax Paid \\ \hline Box 7 Foreign country or U.S. possession & Box 8 Tax-exempt interest & Box 9 Specified private activity bond interest \\ \hline & 400.00 & \\ \hline \multicolumn{2}{|l|}{ Box 10 Market Discount } & Box 11 Bond Premium \\ \hline \multicolumn{2}{|l|}{ Box 12 Bond Premium on Treasury obligations } & Box 11 Bond premium on tax-exempt bond \\ \hline \end{tabular} Form 1099-DIV Dividend Income \begin{tabular}{|c|c|c|} \hline Box 1a Total Ordinary dividends & Box 1b Qualified dividends & Box 2a Total capital gain distr. \\ \hline 1,000.00 & 1,000.00 & 60.00 \\ \hline Box 2b Unrecap Sec 1250 gain & Box 2c Sec 1202 gain & Box 2d Collectibles (28\%) gain \\ \hline Box 2e Section 897 ordinary dividends & Box 2f Section 897 captial gain & Box 3 Nondividend distributions \\ \hline Box 4 Federal income tax withheld & Box 5 Section 199A dividends & Box 6 Investment expenses \\ \hline Box 7 Foregin taxes paid & Box 8 Foregin country of possession & Box 9 Cash liquidation distributions \\ \hline \end{tabular}

Part II Adjustments to Income 11 Educator expenses 12 Certain business expenses of reservists, performing artists, and fee-basis government officials. Attach Form 2106 13 Health savings account deduction. Attach Form 8889 14 Moving expenses for members of the Armed Forces. Attach Form 3903 15 Deductible part of self-employment tax. Attach Schedule SE 16 Self-employed SEP, SIMPLE, and qualified plans 17 Self-employed health insurance deduction 18 Penalty on early withdrawal of savings... 19a Alimony paid b Recipient's SSN Date of original divorce or separation agreement (see instructions) c 20 IRA deduction 21 Student loan interest deduction 22 Reserved for future use 23 Archer MSA deduction 24 Other adjustments: a Jury duty pay (see instructions) b Deductible expenses related to income reported on line 81 from the rental of personal property engaged in for profit . . c Nontaxable amount of the value of Olympic and Paralympic medals and USOC prize money reported on line 8m d Reforestation amortization and expenses e Repayment of supplemental unemployment benefits under the Trade Act of 1974 . . f Contributions to section 501(c)(18)(D) pension plans g Contributions by certain chaplains to section 403 (b) plans h Attorney fees and court costs for actions involving certain unlawful discrimination claims (see instructions) i Attorney fees and court costs you paid in connection with an award from the IRS for information you provided that helped the IRS detect tax law violations j Housing deduction from Form 2555 k Excess deductions of section 67(e) expenses from Schedule K-1 (Form 1041) z Other adjustments. List type and amount \begin{tabular}{|l|l|} \hline 24a & \\ \hline 24b & \\ \hline 24c & \\ \hline 24d & \\ \hline 24e & \\ \hline 24f & \\ \hline 24g & \\ \hline 24h & \\ \hline 24i & \\ \hline 24j & \\ \hline 24k & \\ \hline & \\ \hline 24z & \\ \hline \end{tabular} \begin{tabular}{|l|l} \hline 11 & \\ \hline 12 & \\ \hline 13 & \\ \hline 14 & \\ \hline 15 & \\ \hline 16 & \\ \hline 17 & \\ \hline 18 & \\ \hline 19a & \\ \hline 25 & \\ \hline 20 & \\ \hline 21 & \\ \hline 22 & \\ \hline 23 & \\ \hline & \\ & \\ & \\ & \\ & \\ \hline \end{tabular} 25 Total other adjustments. Add lines 24 a through 24z 26 Add lines 11 through 23 and 25. These are your adjustments to income. Enter here and on Form 1040 or 1040-SR, line 10, or Form 1040-NR, line 10a Schedule 1 (Form 1040) 2022 Ray and Maria Gomez have been married for eight years. Ray is an oil rig maintenance supervisor for Palm Oil Corporation and Maria works as a cashier for Lowes. Ray's birthdate is February 21, 1989, and Maria's is December 30, 1991. Ray and Maria have a 9-year-old son named Jaime Gomez, born on 3/22/2013 (Social Security number 721-34-1134). Ray and Maria's earnings are reported each of their W-2 Form (see separate tab). Ray took advantage of his employer-provided dependent care assistance program on a small number of days when Jaime was sick and unable to go to school. The value of dependent care assistance was $600. Once each week, Ray is required to work at the site of the oil drilling rig for a 24-hour period to provide on-call maintenance on the rig. On those days, Palm Oil requires Ray to stay in an apartment building that sits on the oil rig site. Because different maintenance workers stay each night, the building has a cook and dining room that prepares meals for the crew. All crew members must take their meals in the dining room when staying the night. The value of the lodging provided to Ray is $6,000 and the value of the meals provided to Ray is $750. Maria frequently takes advantage of the 10-percent employee discount on merchandise from Lowes. The discount is available to all employees of Lowes and the company still makes a small profit on the items after the discount. Maria estimates her employee discounts in 2022 total $780. Ray and Maria have investment income from a money market account and U.S. Treasury bonds as reported on the attached Form 1099-INT and brokerage statement (see attached tab). Ray has an ex-wife named Judy Gomez. Pursuant to their January 27, 2016 divorce decree, Ray pays her $200 per month in alimony. All payments were made on time in 2022. Judy's Social Security number is 566-74-8765. During 2022, Ray was in the hospital for a successful operation. His health insurance company reimbursed Ray $4,732 for all of his hospital and doctor bills. In June 2022, Maria's father died. Under a life insurance policy owned and paid for by her father, Maria was paid death benefits of $25,000. She used $7,800 to cover a portion of the funeral costs for her father. Maria bought a Texas lottery ticket on impulse during 2022. Her ticket was lucky and she won $1,000. The winning amount was paid to Maria in November 2022, with no income tax withheld. Maria is pursuing a Masters of Business Administration from McAllen State University. Lowes operates an employee assistance plan that she takes full advantage of. She is also the beneficiary of the $1,000 Lowes Adult Learner Scholarship. All of the scholarship is used to pay for tuition and books. Ray and Maria are eligible for a $2,000 child tax credit in 2022. Required: Complete the Gomez's federal tax return for 2022 on Form 1040, Schedule B, and Schedule 1. Form 8812 for the child tax credit does not need to be completed. The Gomez's had health care coverage the entire year. They do not want to make a contribution to the presidential election campaign. Make any other realistic assumptions about any missing data. If an amount box does not require an entry or the amount is zero, enter " 0 ". Enter amounts as positive numbers. If required, round amounts to the nearest dollar. Form 1040 or 1040SR, line 7. 1. Enter the amount from Form 1040 or 1040SR, line 15. However, if you are filing Form 2555 (relating to foreign earned income), enter the amount from line 3 of the Foreign Earned Income Tax Worksheet . . . 1. 2. Enter the amount from Form 1040 or 1040SR, line 3a.2. 3. Are you filing Schedule D?* es Enter the smaller of line 15 or 16 of Schedule D. If either line 15 or 16 is blank or a loss, enter -0-. 3. No Enter the amount from Form 1040 or 1040-SR, line 7. 4. Add lines 2 and 3 4. 5. 5. Subtract line 4 from line 1 . If zero or less, enter -0 1. 6. Enter: $41,675 if single or married filing separately, $83,350 if married filing jointly or qualifying widow(er), 6. $55,800 if head of household. 7. Enter the smaller of line 1 or line 6 . 7. 8. Enter the smaller of line 5 or line 7 8. 9. Subtract line 8 from line 7 . This amount is taxed at 0% 9. 10. Enter the smaller of line 1 or line 4 10. 11. Enter the amount from line 9 11. 12. Subtract line 11 from line 10 12. 13. Enter: $459,750 if single, $258,600 if married filing separately, 13. $517,200 if married filing jointly or qualifying widow(er), $488,500 if head of household. 14. Enter the smaller of line 1 or line 13 14. 15. Add lines 5 and 9 15. 16. Subtract line 15 from line 14. If zero or less, enter -0 16. 17. Enter the smaller of line 12 or line 16 17. 18. Multiply line 17 by 15%(0.15) 18. 19. Add lines 9 and 17 19. 20. Subtract line 19 from line 10 20. 21. Multiply line 20 by 20%(0.20) 21. 22. Figure the tax on the amount on line 5 . If the amount on line 5 is less than $100,000, use the Tax Table to figure the tax. If the amount on line 5 is $100,000 or more, use the Tax Computation Worksheet . . . 22. 23. Add lines 18,21 , and 22 . 23. 24. Figure the tax on the amount on line 1 . If the amount on line 1 is less than $100,000, use the Tax Table to figure the tax. If the amount on line 1 is $100,000 or more, use the Tax Computation Worksheet. 24. 25. Tax on all taxable income. Enter the smaller of line 23 or 24 . Also include this amount on the entry space on Form 1040 or 1040SR, line 16 . If you are filing Form 2555, don't enter this amount on the entry space on Form 1040 or 1040SR, line 16. Instead, enter it on line 4 of the Foreign Earned Income Tax Worksheet .... . 25. * If you are filing Form 2555, see the footnote in the Foreign Earned Income Tax Worksheet before completing this line. CORRECTED (if checked) Note: You must enter in the hyphens in the social security numbers, employer identification number, etc. SCHEDULE 1 (Form 1040) Department of the Treasury Internal Revenue Service Additional Income and Adjustments to Income Attach to Form 1040, 1040-SR, or 1040-NR. Go to www.irs.gov/Form1040 for instructions and the latest information. OMB No. 15450074 2022 Attachment Sequence No. 01 Name(s) shown on Form 1040, 1040-SR, or 1040-NR Your social security number Ray and Maria Gomez 469215523 Part I Additional Income 1 Taxable refunds, credits, or offsets of state and local income taxes 2a Alimony received b Date of original divorce or separation agreement (see instructions) 3 Business income or (loss). Attach Schedule C 4 Other gains or (losses). Attach Form 4797 5 Rental real estate, royalties, partnerships, S corporations, trusts, etc. Attach Schedule E 6 Farm income or (loss). Attach Schedule F 7 Unemployment compensation 8 Other income: a Net operating loss b Gambling c Cancellation of debt d Foreign earned income exclusion from Form 2555 e Income from Form 8853 f Income from Form 8889 g Alaska Permanent Fund dividends h Jury duty pay i Prizes and awards j Activity not engaged in for profit income k Stock options I Income from the rental of personal property if you engaged in the rental for profit but were not in the business of renting such property m Olympic and Paralympic medals and USOC prize money (see instructions) n Section 951(a) inclusion (see instructions) - Section 951A(a) inclusion (see instructions) p Section 461(I) excess business loss adjustment . . q Taxable distributions from an ABLE account (see instructions) r Scholarship and fellowship grants not reported on Form W-2 s Nontaxable amount of Medicaid waiver payments included on Form 1040, line 1a or 1d.......... t Pension or annuity from a nonqualifed deferred compensation plan or a nongovernmental section 457 plan . . . . . . . . u Wages earned while incarcerated z Other income. List type and amount \begin{tabular}{|c|l} \hline 1 & \\ \hline 2a & \\ \hline & \\ \hline 3 & \\ \hline \end{tabular} 4 5 6 7 + Filing Status Married filing jointly Ray and Maria's earnings are reported on the following Forms W-2: - Head of household, $19,400 - If you checked any box under Standard Deduction, see instructions. 12 Standard deduction or itemized deductions (from Schedule A) . . . . . . . . . . . 13 Qualified business income deduction from Form 8995 or Form 8995-A . . . . . . . . . . . 14 Add lines 12 and 13 15 Subtract line 14 from line 11 . This is your taxable income \begin{tabular}{|c|c|} \hline 12 & \\ \hline 13 & \\ \hline 14 & \\ \hline 15 & \\ \hline \end{tabular} For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. Cat. No. 11320B Form 1040 (2022) Form 1040 (2022) Page 2 4500881661 ***_***-9912 Ray and Maria Gomez Payer's Federal Tax ID 1610 Sonora Ave. 33-1357246 McAllen, TX 78503 Financial Adviser/Phone Ray Greenleaf 888-555-1212 Form 1099-INT Interest Income \begin{tabular}{|c|c|c|} \hline Box 1 Interest income & Box 2 Early withdrawal penalty & Box 3 interest on U.S Savings Bonds and Treasury obligations \\ \hline 23.88 & & 600.00 \\ \hline Box 4 Federal income tax withheld & Box 5 Investment interest & Box 6 Foreign Tax Paid \\ \hline Box 7 Foreign country or U.S. possession & Box 8 Tax-exempt interest & Box 9 Specified private activity bond interest \\ \hline & 400.00 & \\ \hline \multicolumn{2}{|l|}{ Box 10 Market Discount } & Box 11 Bond Premium \\ \hline \multicolumn{2}{|l|}{ Box 12 Bond Premium on Treasury obligations } & Box 11 Bond premium on tax-exempt bond \\ \hline \end{tabular} Form 1099-DIV Dividend Income \begin{tabular}{|c|c|c|} \hline Box 1a Total Ordinary dividends & Box 1b Qualified dividends & Box 2a Total capital gain distr. \\ \hline 1,000.00 & 1,000.00 & 60.00 \\ \hline Box 2b Unrecap Sec 1250 gain & Box 2c Sec 1202 gain & Box 2d Collectibles (28\%) gain \\ \hline Box 2e Section 897 ordinary dividends & Box 2f Section 897 captial gain & Box 3 Nondividend distributions \\ \hline Box 4 Federal income tax withheld & Box 5 Section 199A dividends & Box 6 Investment expenses \\ \hline Box 7 Foregin taxes paid & Box 8 Foregin country of possession & Box 9 Cash liquidation distributions \\ \hline \end{tabular} Part II Adjustments to Income 11 Educator expenses 12 Certain business expenses of reservists, performing artists, and fee-basis government officials. Attach Form 2106 13 Health savings account deduction. Attach Form 8889 14 Moving expenses for members of the Armed Forces. Attach Form 3903 15 Deductible part of self-employment tax. Attach Schedule SE 16 Self-employed SEP, SIMPLE, and qualified plans 17 Self-employed health insurance deduction 18 Penalty on early withdrawal of savings... 19a Alimony paid b Recipient's SSN Date of original divorce or separation agreement (see instructions) c 20 IRA deduction 21 Student loan interest deduction 22 Reserved for future use 23 Archer MSA deduction 24 Other adjustments: a Jury duty pay (see instructions) b Deductible expenses related to income reported on line 81 from the rental of personal property engaged in for profit . . c Nontaxable amount of the value of Olympic and Paralympic medals and USOC prize money reported on line 8m d Reforestation amortization and expenses e Repayment of supplemental unemployment benefits under the Trade Act of 1974 . . f Contributions to section 501(c)(18)(D) pension plans g Contributions by certain chaplains to section 403 (b) plans h Attorney fees and court costs for actions involving certain unlawful discrimination claims (see instructions) i Attorney fees and court costs you paid in connection with an award from the IRS for information you provided that helped the IRS detect tax law violations j Housing deduction from Form 2555 k Excess deductions of section 67(e) expenses from Schedule K-1 (Form 1041) z Other adjustments. List type and amount \begin{tabular}{|l|l|} \hline 24a & \\ \hline 24b & \\ \hline 24c & \\ \hline 24d & \\ \hline 24e & \\ \hline 24f & \\ \hline 24g & \\ \hline 24h & \\ \hline 24i & \\ \hline 24j & \\ \hline 24k & \\ \hline & \\ \hline 24z & \\ \hline \end{tabular} \begin{tabular}{|l|l} \hline 11 & \\ \hline 12 & \\ \hline 13 & \\ \hline 14 & \\ \hline 15 & \\ \hline 16 & \\ \hline 17 & \\ \hline 18 & \\ \hline 19a & \\ \hline 25 & \\ \hline 20 & \\ \hline 21 & \\ \hline 22 & \\ \hline 23 & \\ \hline & \\ & \\ & \\ & \\ & \\ \hline \end{tabular} 25 Total other adjustments. Add lines 24 a through 24z 26 Add lines 11 through 23 and 25. These are your adjustments to income. Enter here and on Form 1040 or 1040-SR, line 10, or Form 1040-NR, line 10a Schedule 1 (Form 1040) 2022 Ray and Maria Gomez have been married for eight years. Ray is an oil rig maintenance supervisor for Palm Oil Corporation and Maria works as a cashier for Lowes. Ray's birthdate is February 21, 1989, and Maria's is December 30, 1991. Ray and Maria have a 9-year-old son named Jaime Gomez, born on 3/22/2013 (Social Security number 721-34-1134). Ray and Maria's earnings are reported each of their W-2 Form (see separate tab). Ray took advantage of his employer-provided dependent care assistance program on a small number of days when Jaime was sick and unable to go to school. The value of dependent care assistance was $600. Once each week, Ray is required to work at the site of the oil drilling rig for a 24-hour period to provide on-call maintenance on the rig. On those days, Palm Oil requires Ray to stay in an apartment building that sits on the oil rig site. Because different maintenance workers stay each night, the building has a cook and dining room that prepares meals for the crew. All crew members must take their meals in the dining room when staying the night. The value of the lodging provided to Ray is $6,000 and the value of the meals provided to Ray is $750. Maria frequently takes advantage of the 10-percent employee discount on merchandise from Lowes. The discount is available to all employees of Lowes and the company still makes a small profit on the items after the discount. Maria estimates her employee discounts in 2022 total $780. Ray and Maria have investment income from a money market account and U.S. Treasury bonds as reported on the attached Form 1099-INT and brokerage statement (see attached tab). Ray has an ex-wife named Judy Gomez. Pursuant to their January 27, 2016 divorce decree, Ray pays her $200 per month in alimony. All payments were made on time in 2022. Judy's Social Security number is 566-74-8765. During 2022, Ray was in the hospital for a successful operation. His health insurance company reimbursed Ray $4,732 for all of his hospital and doctor bills. In June 2022, Maria's father died. Under a life insurance policy owned and paid for by her father, Maria was paid death benefits of $25,000. She used $7,800 to cover a portion of the funeral costs for her father. Maria bought a Texas lottery ticket on impulse during 2022. Her ticket was lucky and she won $1,000. The winning amount was paid to Maria in November 2022, with no income tax withheld. Maria is pursuing a Masters of Business Administration from McAllen State University. Lowes operates an employee assistance plan that she takes full advantage of. She is also the beneficiary of the $1,000 Lowes Adult Learner Scholarship. All of the scholarship is used to pay for tuition and books. Ray and Maria are eligible for a $2,000 child tax credit in 2022. Required: Complete the Gomez's federal tax return for 2022 on Form 1040, Schedule B, and Schedule 1. Form 8812 for the child tax credit does not need to be completed. The Gomez's had health care coverage the entire year. They do not want to make a contribution to the presidential election campaign. Make any other realistic assumptions about any missing data. If an amount box does not require an entry or the amount is zero, enter " 0 ". Enter amounts as positive numbers. If required, round amounts to the nearest dollar. Form 1040 or 1040SR, line 7. 1. Enter the amount from Form 1040 or 1040SR, line 15. However, if you are filing Form 2555 (relating to foreign earned income), enter the amount from line 3 of the Foreign Earned Income Tax Worksheet . . . 1. 2. Enter the amount from Form 1040 or 1040SR, line 3a.2. 3. Are you filing Schedule D?* es Enter the smaller of line 15 or 16 of Schedule D. If either line 15 or 16 is blank or a loss, enter -0-. 3. No Enter the amount from Form 1040 or 1040-SR, line 7. 4. Add lines 2 and 3 4. 5. 5. Subtract line 4 from line 1 . If zero or less, enter -0 1. 6. Enter: $41,675 if single or married filing separately, $83,350 if married filing jointly or qualifying widow(er), 6. $55,800 if head of household. 7. Enter the smaller of line 1 or line 6 . 7. 8. Enter the smaller of line 5 or line 7 8. 9. Subtract line 8 from line 7 . This amount is taxed at 0% 9. 10. Enter the smaller of line 1 or line 4 10. 11. Enter the amount from line 9 11. 12. Subtract line 11 from line 10 12. 13. Enter: $459,750 if single, $258,600 if married filing separately, 13. $517,200 if married filing jointly or qualifying widow(er), $488,500 if head of household. 14. Enter the smaller of line 1 or line 13 14. 15. Add lines 5 and 9 15. 16. Subtract line 15 from line 14. If zero or less, enter -0 16. 17. Enter the smaller of line 12 or line 16 17. 18. Multiply line 17 by 15%(0.15) 18. 19. Add lines 9 and 17 19. 20. Subtract line 19 from line 10 20. 21. Multiply line 20 by 20%(0.20) 21. 22. Figure the tax on the amount on line 5 . If the amount on line 5 is less than $100,000, use the Tax Table to figure the tax. If the amount on line 5 is $100,000 or more, use the Tax Computation Worksheet . . . 22. 23. Add lines 18,21 , and 22 . 23. 24. Figure the tax on the amount on line 1 . If the amount on line 1 is less than $100,000, use the Tax Table to figure the tax. If the amount on line 1 is $100,000 or more, use the Tax Computation Worksheet. 24. 25. Tax on all taxable income. Enter the smaller of line 23 or 24 . Also include this amount on the entry space on Form 1040 or 1040SR, line 16 . If you are filing Form 2555, don't enter this amount on the entry space on Form 1040 or 1040SR, line 16. Instead, enter it on line 4 of the Foreign Earned Income Tax Worksheet .... . 25. * If you are filing Form 2555, see the footnote in the Foreign Earned Income Tax Worksheet before completing this line. CORRECTED (if checked) Note: You must enter in the hyphens in the social security numbers, employer identification number, etc. SCHEDULE 1 (Form 1040) Department of the Treasury Internal Revenue Service Additional Income and Adjustments to Income Attach to Form 1040, 1040-SR, or 1040-NR. Go to www.irs.gov/Form1040 for instructions and the latest information. OMB No. 15450074 2022 Attachment Sequence No. 01 Name(s) shown on Form 1040, 1040-SR, or 1040-NR Your social security number Ray and Maria Gomez 469215523 Part I Additional Income 1 Taxable refunds, credits, or offsets of state and local income taxes 2a Alimony received b Date of original divorce or separation agreement (see instructions) 3 Business income or (loss). Attach Schedule C 4 Other gains or (losses). Attach Form 4797 5 Rental real estate, royalties, partnerships, S corporations, trusts, etc. Attach Schedule E 6 Farm income or (loss). Attach Schedule F 7 Unemployment compensation 8 Other income: a Net operating loss b Gambling c Cancellation of debt d Foreign earned income exclusion from Form 2555 e Income from Form 8853 f Income from Form 8889 g Alaska Permanent Fund dividends h Jury duty pay i Prizes and awards j Activity not engaged in for profit income k Stock options I Income from the rental of personal property if you engaged in the rental for profit but were not in the business of renting such property m Olympic and Paralympic medals and USOC prize money (see instructions) n Section 951(a) inclusion (see instructions) - Section 951A(a) inclusion (see instructions) p Section 461(I) excess business loss adjustment . . q Taxable distributions from an ABLE account (see instructions) r Scholarship and fellowship grants not reported on Form W-2 s Nontaxable amount of Medicaid waiver payments included on Form 1040, line 1a or 1d.......... t Pension or annuity from a nonqualifed deferred compensation plan or a nongovernmental section 457 plan . . . . . . . . u Wages earned while incarcerated z Other income. List type and amount \begin{tabular}{|c|l} \hline 1 & \\ \hline 2a & \\ \hline & \\ \hline 3 & \\ \hline \end{tabular} 4 5 6 7 + Filing Status Married filing jointly Ray and Maria's earnings are reported on the following Forms W-2: - Head of household, $19,400 - If you checked any box under Standard Deduction, see instructions. 12 Standard deduction or itemized deductions (from Schedule A) . . . . . . . . . . . 13 Qualified business income deduction from Form 8995 or Form 8995-A . . . . . . . . . . . 14 Add lines 12 and 13 15 Subtract line 14 from line 11 . This is your taxable income \begin{tabular}{|c|c|} \hline 12 & \\ \hline 13 & \\ \hline 14 & \\ \hline 15 & \\ \hline \end{tabular} For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. Cat. No. 11320B Form 1040 (2022) Form 1040 (2022) Page 2 4500881661 ***_***-9912 Ray and Maria Gomez Payer's Federal Tax ID 1610 Sonora Ave. 33-1357246 McAllen, TX 78503 Financial Adviser/Phone Ray Greenleaf 888-555-1212 Form 1099-INT Interest Income \begin{tabular}{|c|c|c|} \hline Box 1 Interest income & Box 2 Early withdrawal penalty & Box 3 interest on U.S Savings Bonds and Treasury obligations \\ \hline 23.88 & & 600.00 \\ \hline Box 4 Federal income tax withheld & Box 5 Investment interest & Box 6 Foreign Tax Paid \\ \hline Box 7 Foreign country or U.S. possession & Box 8 Tax-exempt interest & Box 9 Specified private activity bond interest \\ \hline & 400.00 & \\ \hline \multicolumn{2}{|l|}{ Box 10 Market Discount } & Box 11 Bond Premium \\ \hline \multicolumn{2}{|l|}{ Box 12 Bond Premium on Treasury obligations } & Box 11 Bond premium on tax-exempt bond \\ \hline \end{tabular} Form 1099-DIV Dividend Income \begin{tabular}{|c|c|c|} \hline Box 1a Total Ordinary dividends & Box 1b Qualified dividends & Box 2a Total capital gain distr. \\ \hline 1,000.00 & 1,000.00 & 60.00 \\ \hline Box 2b Unrecap Sec 1250 gain & Box 2c Sec 1202 gain & Box 2d Collectibles (28\%) gain \\ \hline Box 2e Section 897 ordinary dividends & Box 2f Section 897 captial gain & Box 3 Nondividend distributions \\ \hline Box 4 Federal income tax withheld & Box 5 Section 199A dividends & Box 6 Investment expenses \\ \hline Box 7 Foregin taxes paid & Box 8 Foregin country of possession & Box 9 Cash liquidation distributions \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started