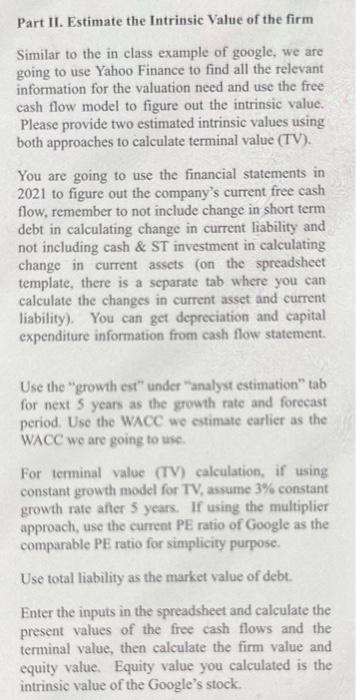

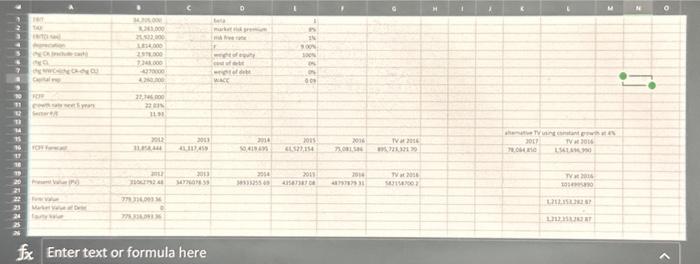

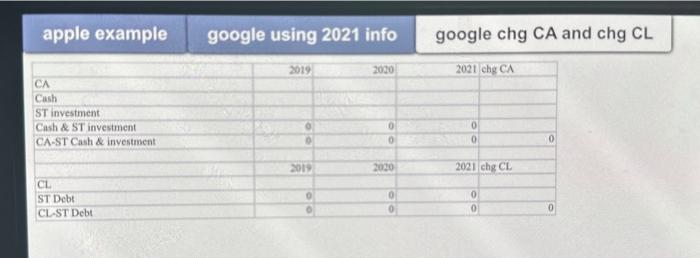

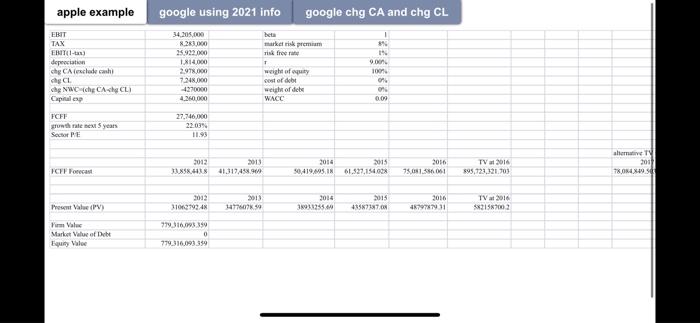

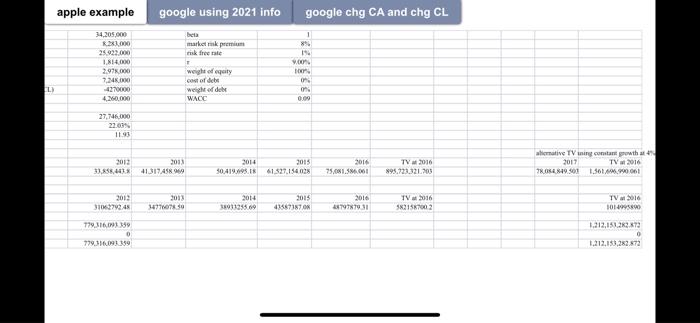

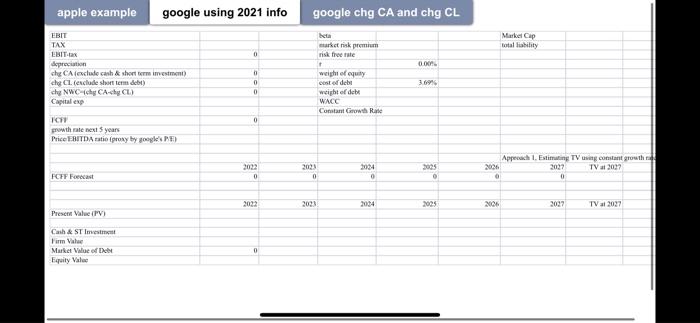

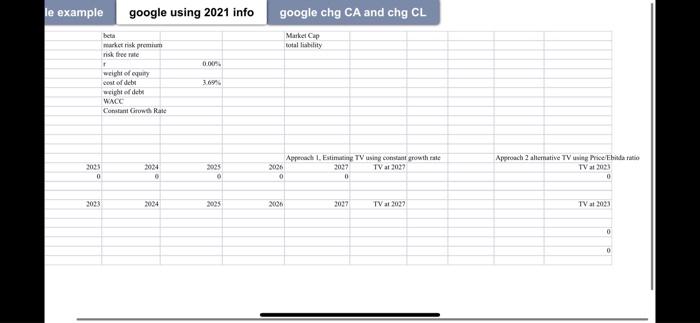

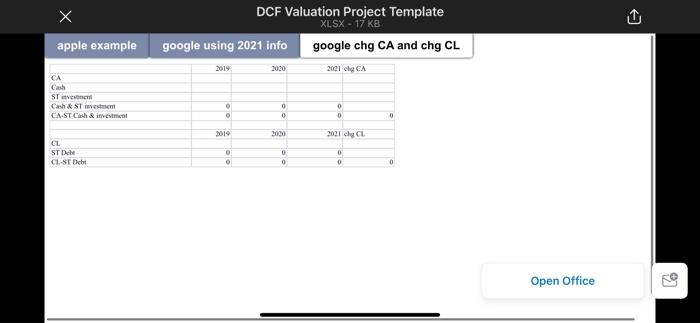

Part II. Estimate the Intrinsic Value of the firm Similar to the in class example of google, we are going to use Yahoo Finance to find all the relevant information for the valuation need and use the free cash flow model to figure out the intrinsic value. Please provide two estimated intrinsic values using both approaches to calculate terminal value (TV). You are going to use the financial statements in 2021 to figure out the company's current free cash flow, remember to not include change in short term debt in calculating change in current liability and not including cash \& ST investment in calculating change in current assets (on the spreadsheet template, there is a scparate tab where you can calculate the changes in current asset and current liability). You can get depreciation and capital expenditure information from cash flow statement. Use the "growth est" under "analyst estimation" tab for next 5 years as the growth rate and forecast period. Use the WACC we estimate carlier as the WACC we are going to use. For terminal value (TV) calculation, if using constant growth model for TV, assume 3% constant growth rate after 5 years. If using the multiplier approach, use the current PE ratio of Google as the comparable PE ratio for simplicity purpose. Use total liability as the market value of debt. Enter the inputs in the spreadsheet and calculate the present values of the free cash flows and the terminal value, then calculate the firm value and equity value. Equity value you calculated is the intrinsic value of the Google's stock. Enter text or formula here apple example google using 2021 info google chg CA and chg CL apple example google using 2021 info google chg CA and chg CL \begin{tabular}{l|l|l|l|} apple example & google using 2021 info google chg CA and chg CL \end{tabular} 3 DCF Valuation Project Template XLSX - 17KB Open Office Part II. Estimate the Intrinsic Value of the firm Similar to the in class example of google, we are going to use Yahoo Finance to find all the relevant information for the valuation need and use the free cash flow model to figure out the intrinsic value. Please provide two estimated intrinsic values using both approaches to calculate terminal value (TV). You are going to use the financial statements in 2021 to figure out the company's current free cash flow, remember to not include change in short term debt in calculating change in current liability and not including cash \& ST investment in calculating change in current assets (on the spreadsheet template, there is a scparate tab where you can calculate the changes in current asset and current liability). You can get depreciation and capital expenditure information from cash flow statement. Use the "growth est" under "analyst estimation" tab for next 5 years as the growth rate and forecast period. Use the WACC we estimate carlier as the WACC we are going to use. For terminal value (TV) calculation, if using constant growth model for TV, assume 3% constant growth rate after 5 years. If using the multiplier approach, use the current PE ratio of Google as the comparable PE ratio for simplicity purpose. Use total liability as the market value of debt. Enter the inputs in the spreadsheet and calculate the present values of the free cash flows and the terminal value, then calculate the firm value and equity value. Equity value you calculated is the intrinsic value of the Google's stock. Enter text or formula here apple example google using 2021 info google chg CA and chg CL apple example google using 2021 info google chg CA and chg CL \begin{tabular}{l|l|l|l|} apple example & google using 2021 info google chg CA and chg CL \end{tabular} 3 DCF Valuation Project Template XLSX - 17KB Open Office