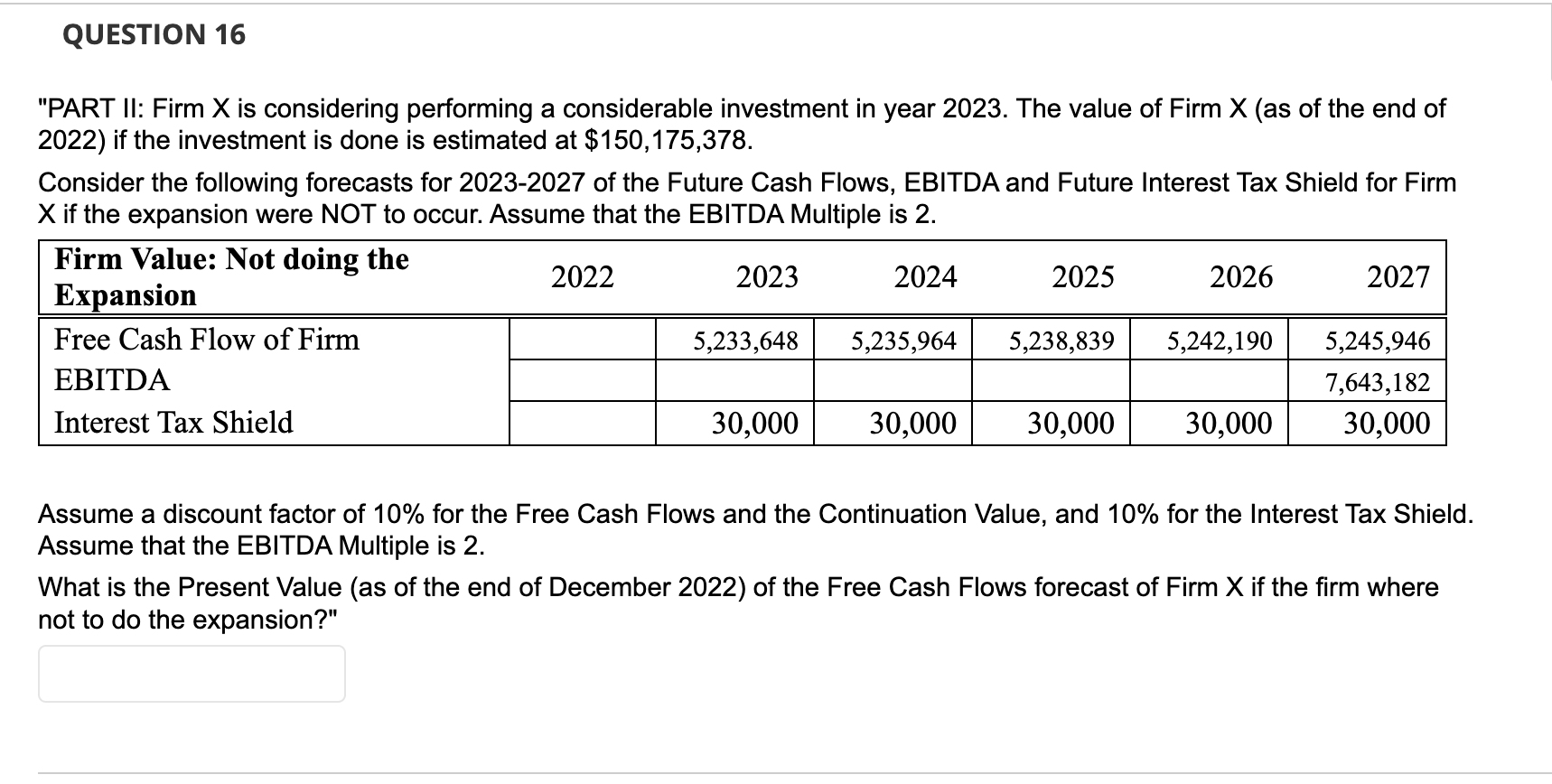

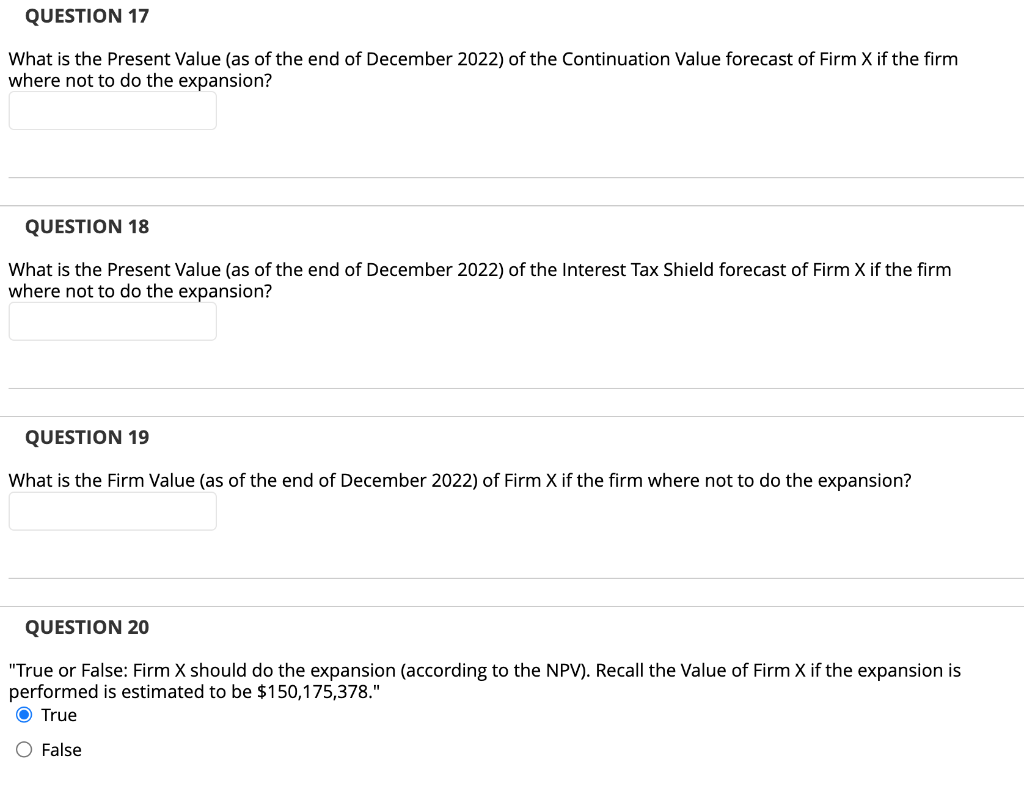

"PART II: Firm X is considering performing a considerable investment in year 2023 . The value of Firm X (as of the end of 2022) if the investment is done is estimated at $150,175,378. Consider the following forecasts for 2023-2027 of the Future Cash Flows, EBITDA and Future Interest Tax Shield for Firm X if the expansion were NOT to occur. Assume that the EBITDA Multiple is 2. Assume a discount factor of 10% for the Free Cash Flows and the Continuation Value, and 10% for the Interest Tax Shield. Assume that the EBITDA Multiple is 2. What is the Present Value (as of the end of December 2022) of the Free Cash Flows forecast of Firm X if the firm where not to do the expansion?" What is the Present Value (as of the end of December 2022) of the Continuation Value forecast of Firm X if the firm where not to do the expansion? QUESTION 18 What is the Present Value (as of the end of December 2022) of the Interest Tax Shield forecast of Firm X if the firm where not to do the expansion? QUESTION 19 What is the Firm Value (as of the end of December 2022) of Firm X if the firm where not to do the expansion? QUESTION 20 "True or False: Firm X should do the expansion (according to the NPV). Recall the Value of Firm X if the expansion is performed is estimated to be $150,175,378." True False "PART II: Firm X is considering performing a considerable investment in year 2023 . The value of Firm X (as of the end of 2022) if the investment is done is estimated at $150,175,378. Consider the following forecasts for 2023-2027 of the Future Cash Flows, EBITDA and Future Interest Tax Shield for Firm X if the expansion were NOT to occur. Assume that the EBITDA Multiple is 2. Assume a discount factor of 10% for the Free Cash Flows and the Continuation Value, and 10% for the Interest Tax Shield. Assume that the EBITDA Multiple is 2. What is the Present Value (as of the end of December 2022) of the Free Cash Flows forecast of Firm X if the firm where not to do the expansion?" What is the Present Value (as of the end of December 2022) of the Continuation Value forecast of Firm X if the firm where not to do the expansion? QUESTION 18 What is the Present Value (as of the end of December 2022) of the Interest Tax Shield forecast of Firm X if the firm where not to do the expansion? QUESTION 19 What is the Firm Value (as of the end of December 2022) of Firm X if the firm where not to do the expansion? QUESTION 20 "True or False: Firm X should do the expansion (according to the NPV). Recall the Value of Firm X if the expansion is performed is estimated to be $150,175,378." True False