Now that you know the basics of how these four types of savings accounts work, let's take a closer look at how these accounts

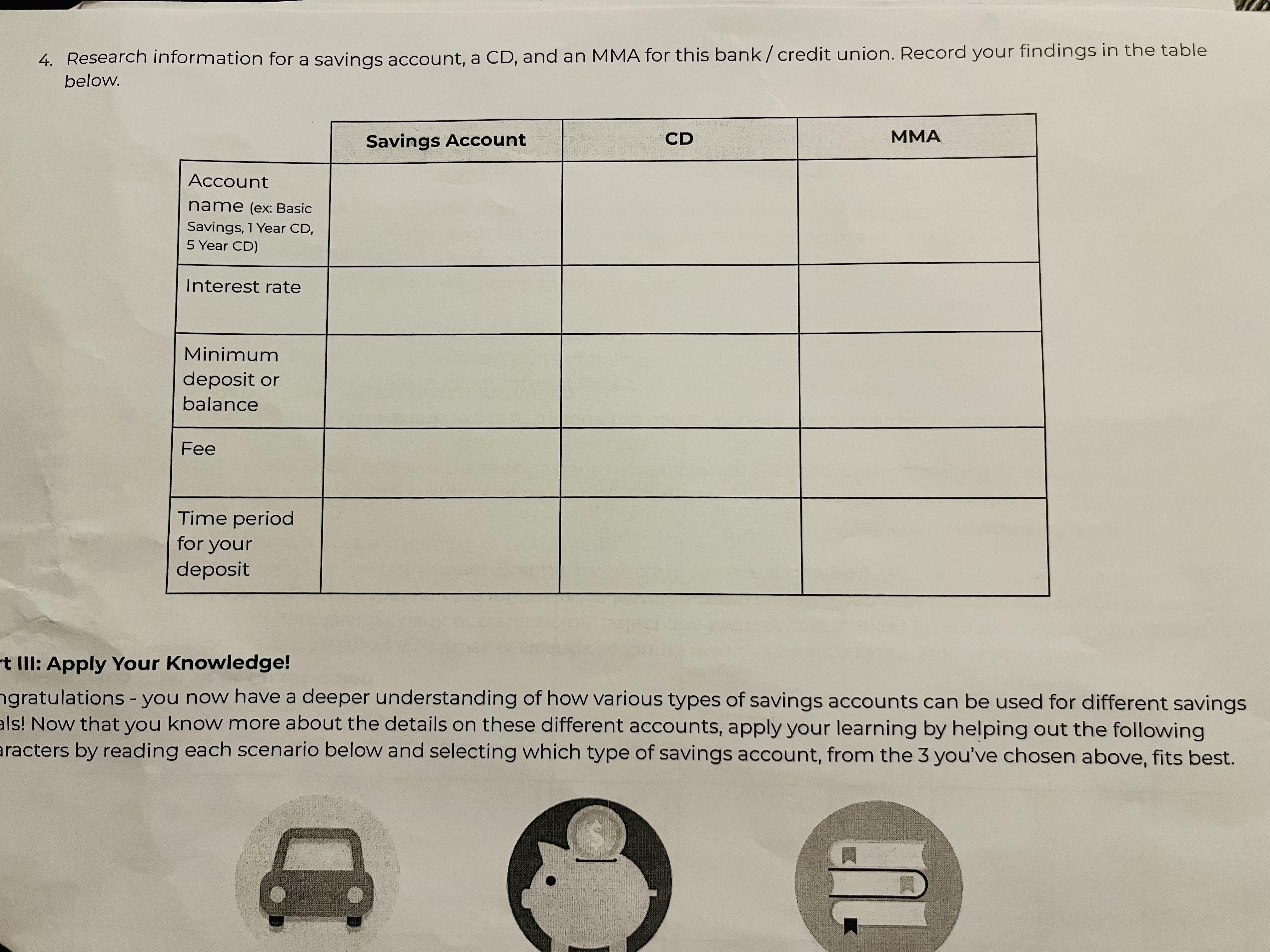

Now that you know the basics of how these four types of savings accounts work, let's take a closer look at how these accounts compare against each other at your favorite bank or credit union. Select one bank or credit union (it can be one that you or your parents/guardians currently use, or one that you are interested in learning more about). Then, research the bank or credit union's options for savings accounts. NOTE: If the bank offers multiple products in the same category (ex: two tiers of MMA or CDs at 10 different time intervals) just record answers for ONE of the options. # Teacher Tip: Part II of this activity can continue to be completed with the same teams, or you can also have students work in pairs or individually if they want to research a specific bank or credit union they are interested in learning more about! 3. What bank or credit union do you want to explore? Include the name, website link and indicate if this bank/credit union is an ONLINE or a TRADITIONAL brick & mortar institution. 4. Research information for a savings account, a CD, and an MMA for this bank/credit union. Record your findings in the table below. Account name (ex: Basic Savings, 1 Year CD, 5 Year CD) Interest rate Minimum deposit or balance Fee Time period for your deposit Savings Account CD MMA t III: Apply Your Knowledge! ngratulations - you now have a deeper understanding of how various types of savings accounts can be used for different savings als! Now that you know more about the details on these different accounts, apply your learning by helping out the following aracters by reading each scenario below and selecting which type of savings account, from the 3 you've chosen above, fits best. 5. Robert wants to get serious about saving for a new car. Which account would you recommend? Why? 6. Cindy has been working for 8 years, and she's built up a huge emergency fund -- $45,000, which would be 6 months of he salary. She's hoping to earn a bit more interest than she currently is with that $45,000 just sitting in her traditional bank's savings account. Which account would you recommend? Why? 7. Janelle likes to keep all her savings goals separate, so she has an account for each one, including an account to save for h college textbooks every semester. She buys books about every 6 months, with roughly $550 due each time. She likes to s the money up in installments, with auto-deposits from each of her twice monthly paychecks. She's wondering if her onlin savings account, earning 0.75%, is still her best option for monthly deposits toward her textbooks. Which account would y recommend? Why?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Question 3 Bank or Credit Union to Explore Selection Choose a bank or credit union youre interested in such as Ally Bank Online or Chase Bank Traditio...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started