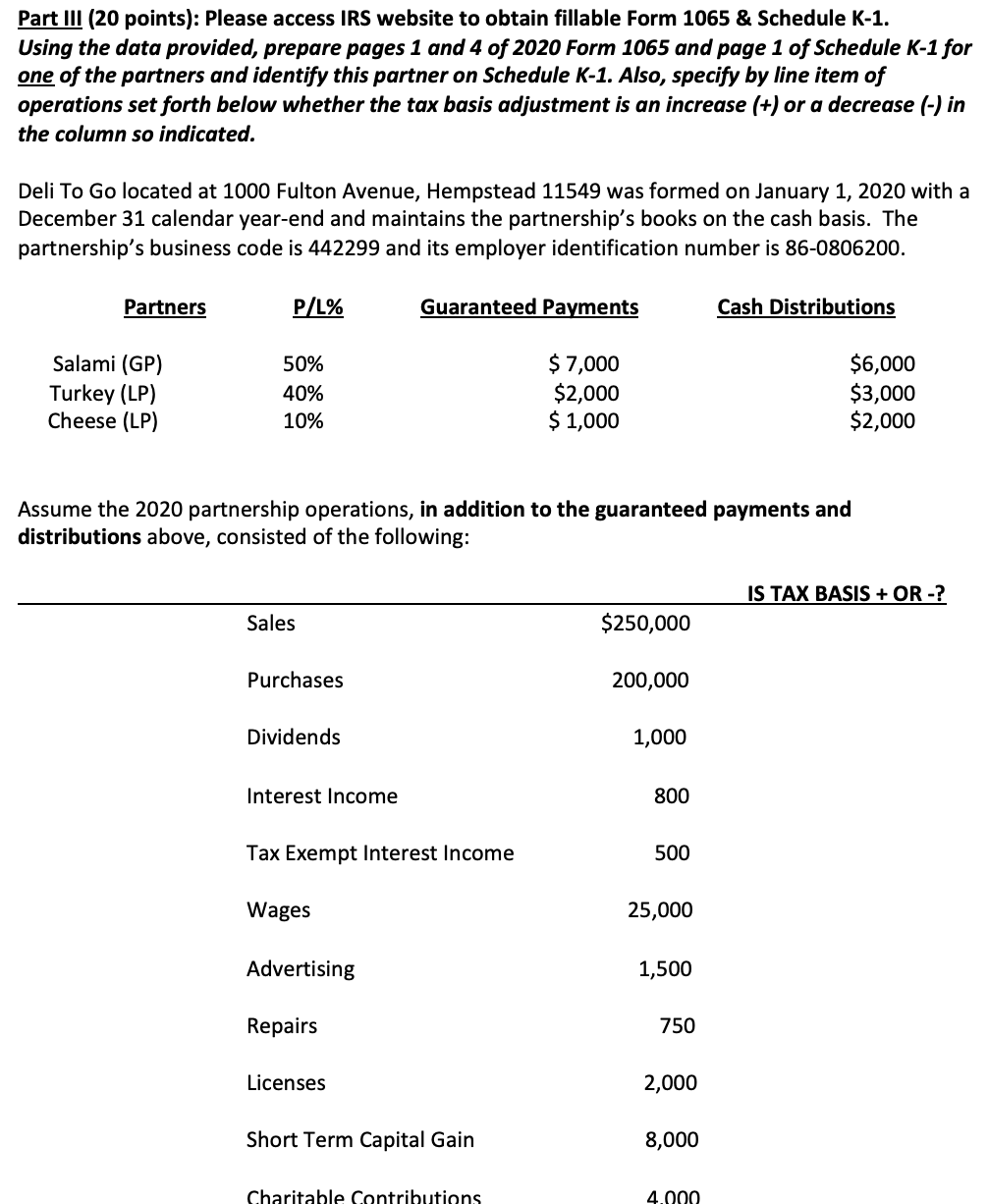

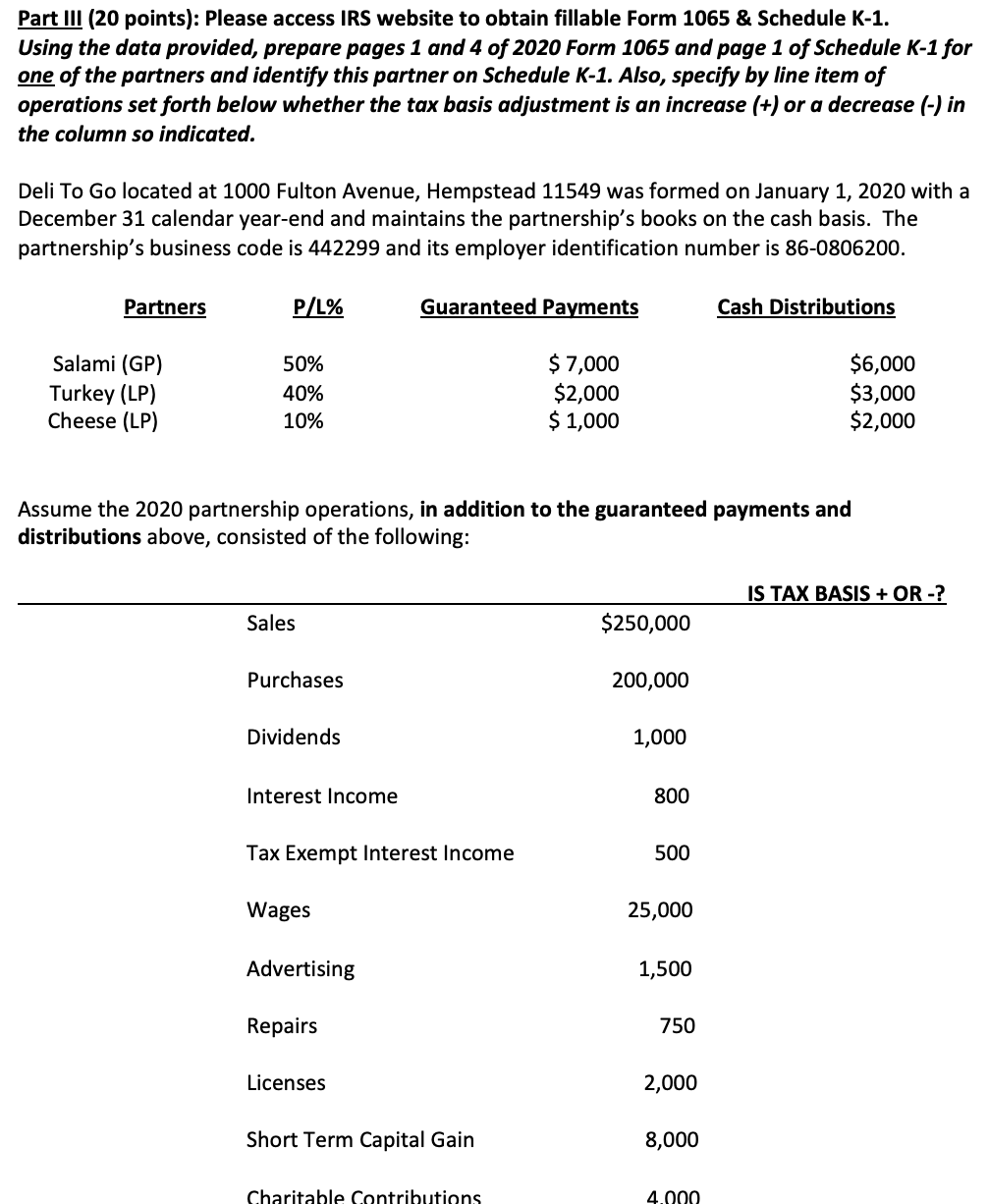

Part III (20 points): Please access IRS website to obtain fillable Form 1065 & Schedule K-1. Using the data provided, prepare pages 1 and 4 of 2020 Form 1065 and page 1 of Schedule K-1 for one of the partners and identify this partner on Schedule K-1. Also, specify by line item of operations set forth below whether the tax basis adjustment is an increase (+) or a decrease (-) in the column so indicated. Deli To Go located at 1000 Fulton Avenue, Hempstead 11549 was formed on January 1, 2020 with a December 31 calendar year-end and maintains the partnership's books on the cash basis. The partnership's business code is 442299 and its employer identification number is 86-0806200. Partners P/L% Guaranteed Payments Cash Distributions Salami (GP) Turkey (LP) Cheese (LP) 50% 40% 10% $7,000 $2,000 $ 1,000 $6,000 $3,000 $2,000 Assume the 2020 partnership operations, in addition to the guaranteed payments and distributions above, consisted of the following: IS TAX BASIS + OR -? Sales $250,000 Purchases 200,000 Dividends 1,000 Interest Income 800 Tax Exempt Interest Income 500 Wages 25,000 Advertising 1,500 Repairs 750 Licenses 2,000 Short Term Capital Gain 8,000 Charitable Contributions 4.000 Part III (20 points): Please access IRS website to obtain fillable Form 1065 & Schedule K-1. Using the data provided, prepare pages 1 and 4 of 2020 Form 1065 and page 1 of Schedule K-1 for one of the partners and identify this partner on Schedule K-1. Also, specify by line item of operations set forth below whether the tax basis adjustment is an increase (+) or a decrease (-) in the column so indicated. Deli To Go located at 1000 Fulton Avenue, Hempstead 11549 was formed on January 1, 2020 with a December 31 calendar year-end and maintains the partnership's books on the cash basis. The partnership's business code is 442299 and its employer identification number is 86-0806200. Partners P/L% Guaranteed Payments Cash Distributions Salami (GP) Turkey (LP) Cheese (LP) 50% 40% 10% $7,000 $2,000 $ 1,000 $6,000 $3,000 $2,000 Assume the 2020 partnership operations, in addition to the guaranteed payments and distributions above, consisted of the following: IS TAX BASIS + OR -? Sales $250,000 Purchases 200,000 Dividends 1,000 Interest Income 800 Tax Exempt Interest Income 500 Wages 25,000 Advertising 1,500 Repairs 750 Licenses 2,000 Short Term Capital Gain 8,000 Charitable Contributions 4.000