Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Part III (36%) The Light Motors Company (LMC) is privately held. Its owners are thinking of listing at least 45 percent of their company's equity

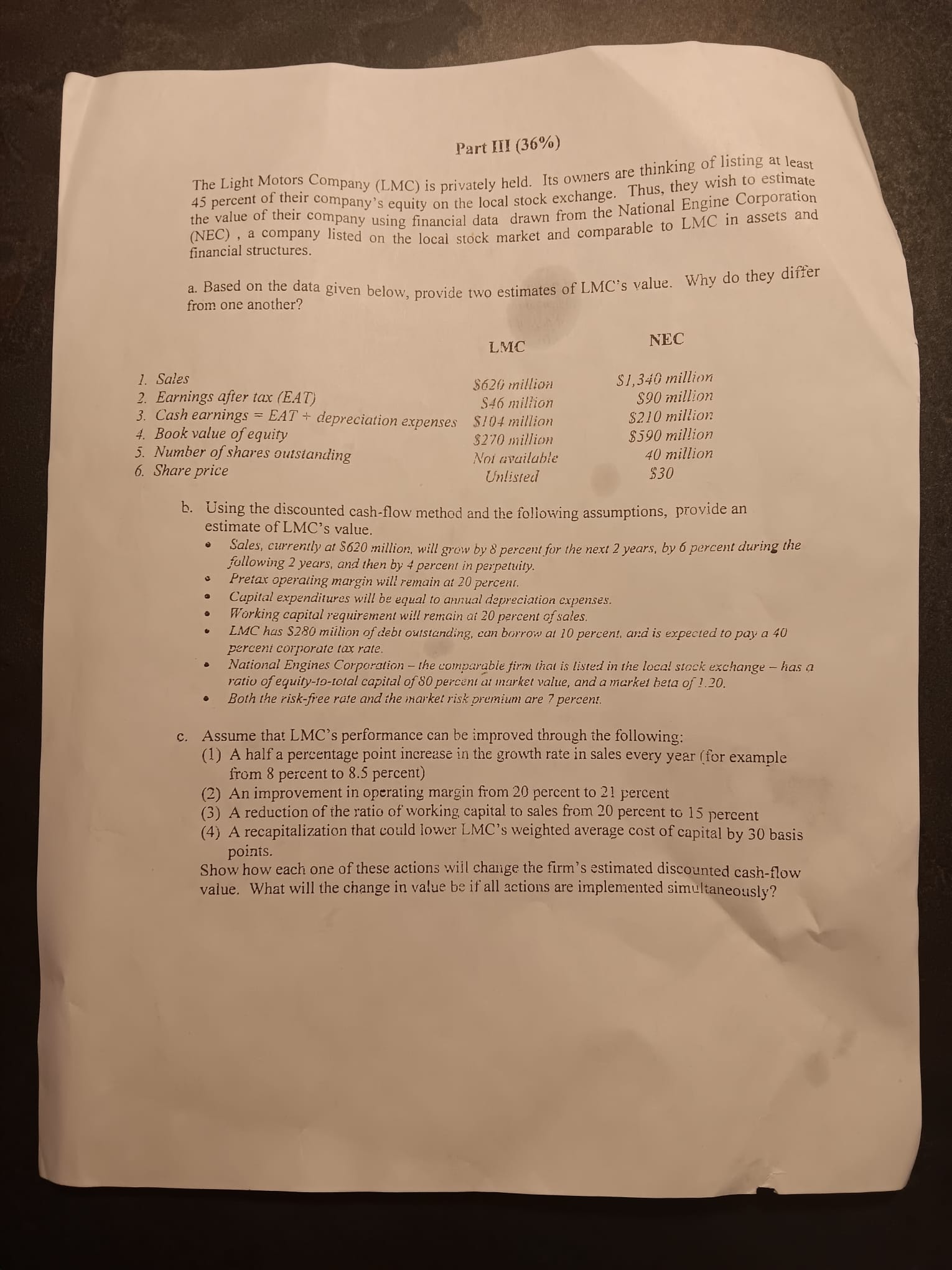

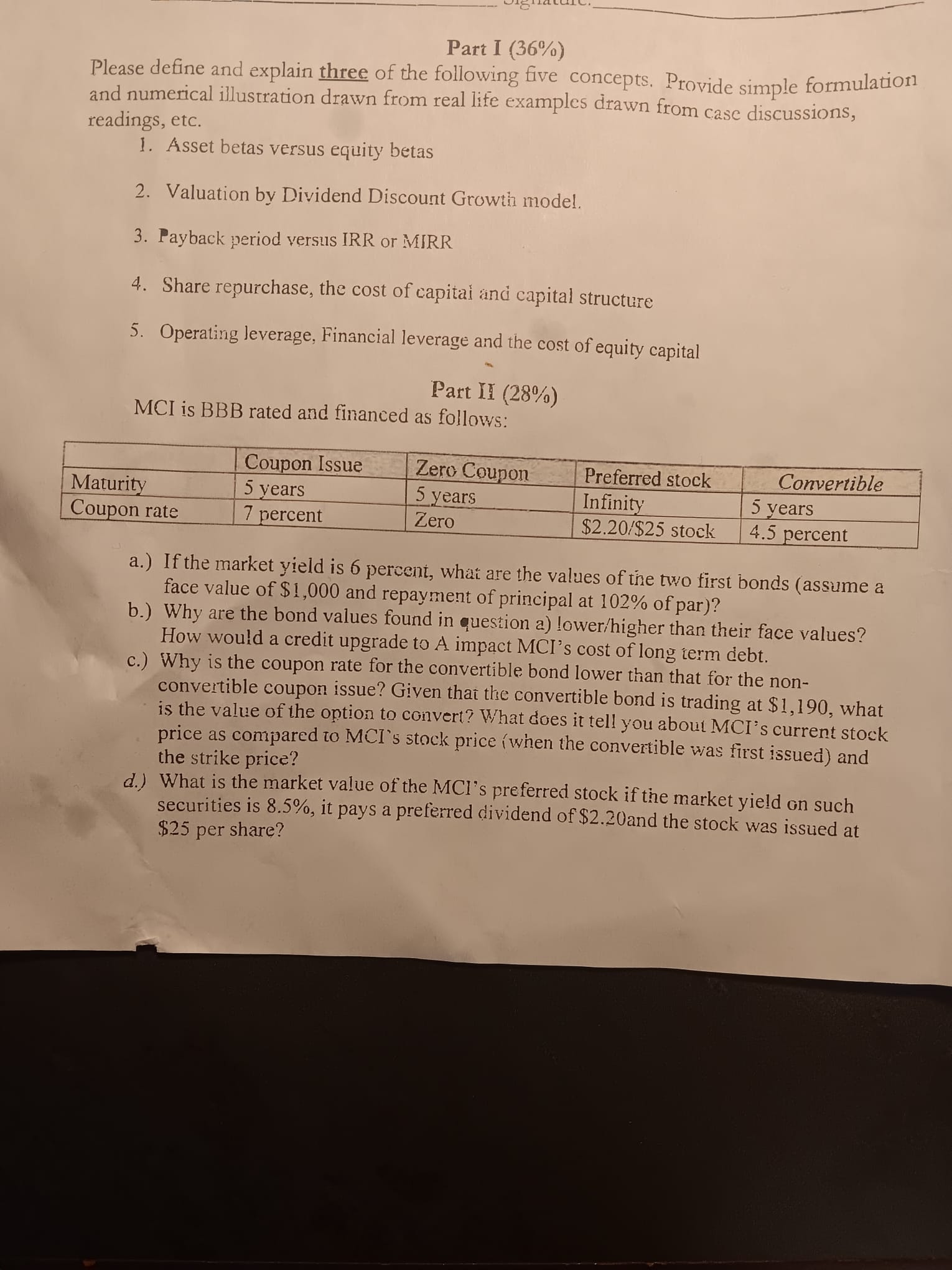

Part III (36%) The Light Motors Company (LMC) is privately held. Its owners are thinking of listing at least 45 percent of their company's equity on the local stock exchange. Thus, they wish to estimate the value of their company using financial data drawn from the National Engine Corporation (NEC), a company listed on the local stock market and comparable to LMC in assets and financial structures. a. Based on the data given below, provide two estimates of LMC's value. Why do they differ from one another? b. Using the discounted cash-flow method and the following assumptions, provide an estimate of LMC's value. - Sales, currently at $620 million, will grow by o percent for the next 2 years, by 6 percent during the fallowing 2 years, and then by 4 percent in perpetuity. - Pretar operaling margin will remain at 20 percenr. - Cupital expenditures will be equal to arnual depreciation expenses. - Working capital requirement will remcin ai 20 percent of sales. - LMC has \$280 million of debo outstanding, can borron at 10 percent, as: is expected to pay a 40 perceni corporate tax rate. - National Engines Corporstion - the comparable firm that is listed in the local stock exchange - has a, ratio of equity-10-total capital of 80 percent at market value, and a market beta of 1.20 . - Both the risk-fiee rate and the irarket risk premium are 7 percent. c. Assume that LMC's performance can be improved through the following: (1) A half a percentage point increase in the growth rate in sales every year for example from 8 percent to 8.5 percent) (2) An improvement in operating margin from 20 percent to 21 percent (3) A reduction of the ratio of working capital to sales from 20 percent to 15 percent (4) A recapitalization that could lower LMC's weighted average cost of capital by 30 basis points. Show how each one of these actions wiil charige the firm's estimated discounted cash-flow value. What will the change in value be if all actions are implemented simultaneously? Part I (36%) Please define and explain three of the following five concepts. Provide simple formulation and numerical illustration drawn from real life examples drawn from case discussions, readings, etc. 1. Asset betas versus equity betas 2. Valuation by Dividend Discount Growt model. 3. Payback period versus IRR or MIRR 4. Share repurchase, the cost of capitai anci capital structure 5. Operating leverage, Financial leverage and the cost of equity capital Part II (28%) MCI is BBB rated and financed as follows: a.) If the market yield is 6 percent, what are the values of the two first bonds (assume a face value of $1,000 and repayment of principal at 102% of par)? b.) Why are the bond values found in question a) !ower/higher than their face values? How would a credit upgrade to A impact MCI's cost of long term debt. c.) Why is the coupon rate for the convertible bond lower than that for the nonconvertible coupon issue? Given that the convertible bond is trading at $1,190, what is the value of the option to convert? W/hat does it tell you about MCI's current stock price as compared to MCI 's stock price (when the convertible was first issued) and the strike price? d.) What is the market value of the MCl's preferred stock if the market yield on such securities is 8.5%, it pays a preferred dividend of $2.20 and the stock was issued at $25 per share

Part III (36%) The Light Motors Company (LMC) is privately held. Its owners are thinking of listing at least 45 percent of their company's equity on the local stock exchange. Thus, they wish to estimate the value of their company using financial data drawn from the National Engine Corporation (NEC), a company listed on the local stock market and comparable to LMC in assets and financial structures. a. Based on the data given below, provide two estimates of LMC's value. Why do they differ from one another? b. Using the discounted cash-flow method and the following assumptions, provide an estimate of LMC's value. - Sales, currently at $620 million, will grow by o percent for the next 2 years, by 6 percent during the fallowing 2 years, and then by 4 percent in perpetuity. - Pretar operaling margin will remain at 20 percenr. - Cupital expenditures will be equal to arnual depreciation expenses. - Working capital requirement will remcin ai 20 percent of sales. - LMC has \$280 million of debo outstanding, can borron at 10 percent, as: is expected to pay a 40 perceni corporate tax rate. - National Engines Corporstion - the comparable firm that is listed in the local stock exchange - has a, ratio of equity-10-total capital of 80 percent at market value, and a market beta of 1.20 . - Both the risk-fiee rate and the irarket risk premium are 7 percent. c. Assume that LMC's performance can be improved through the following: (1) A half a percentage point increase in the growth rate in sales every year for example from 8 percent to 8.5 percent) (2) An improvement in operating margin from 20 percent to 21 percent (3) A reduction of the ratio of working capital to sales from 20 percent to 15 percent (4) A recapitalization that could lower LMC's weighted average cost of capital by 30 basis points. Show how each one of these actions wiil charige the firm's estimated discounted cash-flow value. What will the change in value be if all actions are implemented simultaneously? Part I (36%) Please define and explain three of the following five concepts. Provide simple formulation and numerical illustration drawn from real life examples drawn from case discussions, readings, etc. 1. Asset betas versus equity betas 2. Valuation by Dividend Discount Growt model. 3. Payback period versus IRR or MIRR 4. Share repurchase, the cost of capitai anci capital structure 5. Operating leverage, Financial leverage and the cost of equity capital Part II (28%) MCI is BBB rated and financed as follows: a.) If the market yield is 6 percent, what are the values of the two first bonds (assume a face value of $1,000 and repayment of principal at 102% of par)? b.) Why are the bond values found in question a) !ower/higher than their face values? How would a credit upgrade to A impact MCI's cost of long term debt. c.) Why is the coupon rate for the convertible bond lower than that for the nonconvertible coupon issue? Given that the convertible bond is trading at $1,190, what is the value of the option to convert? W/hat does it tell you about MCI's current stock price as compared to MCI 's stock price (when the convertible was first issued) and the strike price? d.) What is the market value of the MCl's preferred stock if the market yield on such securities is 8.5%, it pays a preferred dividend of $2.20 and the stock was issued at $25 per share Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started