Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PART III: CASE ANALYSIS. Total sanay kang nagpapaliwanag, pwes ilahad mo ang lahat, yong wala kang tinatago. CASE I The National Development Company (NDC)

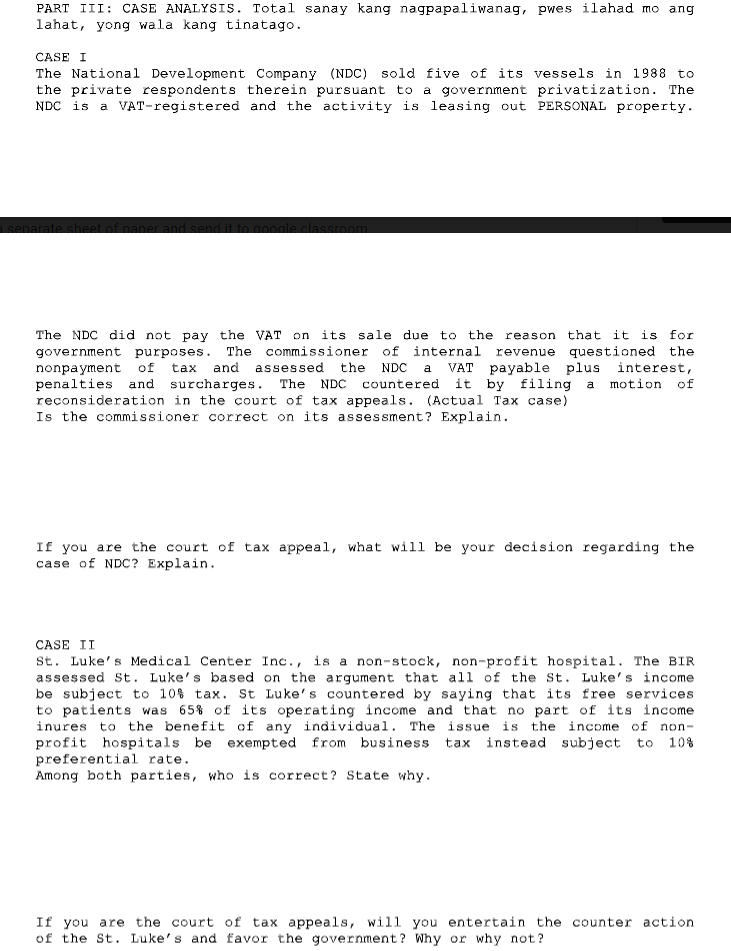

PART III: CASE ANALYSIS. Total sanay kang nagpapaliwanag, pwes ilahad mo ang lahat, yong wala kang tinatago. CASE I The National Development Company (NDC) sold five of its vessels in 1988 to the private respondents therein pursuant to a government privatization. The NDC is a VAT-registered and the activity is leasing out PERSONAL property. The NDC did not pay the VAT on its sale due to the reason that it is for government purposes. The commissioner of internal revenue questioned the nonpayment of tax and assessed the NDC a VAT payable plus interest, penalties and surcharges. The NDC countered it by filing a motion of reconsideration in the court of tax appeals. (Actual Tax case) Is the commissioner correct on its assessment? Explain. If you are the court of tax appeal, what will be your decision regarding the case of NDC? Explain. CASE II St. Luke's Medical Center Inc., is a non-stock, non-profit hospital. The BIR assessed St. Luke's based on the argument that all of the St. Luke's income be subject to 10% tax. St Luke's countered by saying that its free services to patients was 65% of its operating income and that no part of its income inures to the benefit of any individual. The issue is the income of non- profit hospitals be exempted from business tax instead subject to 10% preferential rate. Among both parties, who is correct? State why. If you are the court of tax appeals, will you entertain the counter action of the St. Luke's and favor the government? Why or why not?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Tax law is a complex and nuanced field that stands at the intersection of legal principle public policy and economic reality It involves the interpretation of statutes regulations and case law all of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started