Answered step by step

Verified Expert Solution

Question

1 Approved Answer

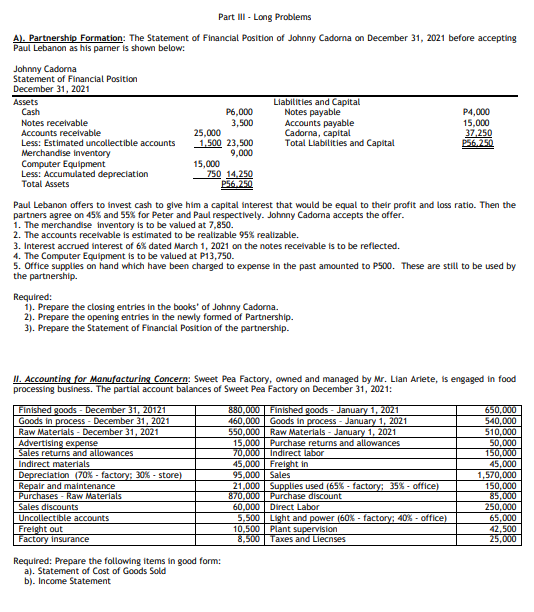

Part III - Long Problems A). Partnership Formation: The Statement of Financial Position of Johnny Cadorna on December 31, 2021 before accepting Paul Lebanon

Part III - Long Problems A). Partnership Formation: The Statement of Financial Position of Johnny Cadorna on December 31, 2021 before accepting Paul Lebanon as his parner is shown below: Johnny Cadorna Statement of Financial Position December 31, 2021 Assets Liabilities and Capital Cash P6,000 Notes payable P4,000 Notes receivable 3,500 Accounts payable 15,000 Accounts receivable Less: Estimated uncollectible accounts Merchandise Inventory 25,000 1,500 23,500 9,000 Cadorna, capital 37,250 Total Liabilities and Capital P56.250 Computer Equipment 15,000 Less: Accumulated depreciation Total Assets 750 14,250 P56.250 Paul Lebanon offers to invest cash to give him a capital interest that would be equal to their profit and loss ratio. Then the partners agree on 45% and 55% for Peter and Paul respectively. Johnny Cadorna accepts the offer. 1. The merchandise inventory is to be valued at 7,850. 2. The accounts receivable is estimated to be realizable 95% realizable. 3. Interest accrued interest of 6% dated March 1, 2021 on the notes receivable is to be reflected. 4. The Computer Equipment is to be valued at P13,750. 5. Office supplies on hand which have been charged to expense in the past amounted to P500. These are still to be used by the partnership. Required: 1). Prepare the closing entries in the books' of Johnny Cadorna. 2). Prepare the opening entries in the newly formed of Partnership. 3). Prepare the Statement of Financial Position of the partnership. II. Accounting for Manufacturing Concern: Sweet Pea Factory, owned and managed by Mr. Lian Ariete, is engaged in food processing business. The partial account balances of Sweet Pea Factory on December 31, 2021: Finished goods - December 31, 20121 Goods in process - December 31, 2021 Raw Materials - December 31, 2021 Advertising expense Sales returns and allowances Indirect materials Depreciation (70% - factory; 30% - store) Repair and maintenance Purchases - Raw Materials Sales discounts Uncollectible accounts Freight out Factory insurance Required: Prepare the following items in good form: a). Statement of Cost of Goods Sold b). Income Statement 880,000 | Finished goods - January 1, 2021 460,000 | Goods in process - January 1, 2021 550,000 Raw Materials - January 1, 2021 15,000 Purchase returns and allowances 650,000 540,000 510,000 50,000 70,000 Indirect labor 150,000 45,000 Freight in 45,000 95,000 Sales 1,570,000 21,000 Supplies used (65% - factory; 35%-office) 870,000 | Purchase discount 150,000 85,000 60,000 Direct Labor 250,000 5,500 Light and power (60%-factory; 40% - office) 65,000 10,500 Plant supervision 42,500 8,500 Taxes and Liecnses 25,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started