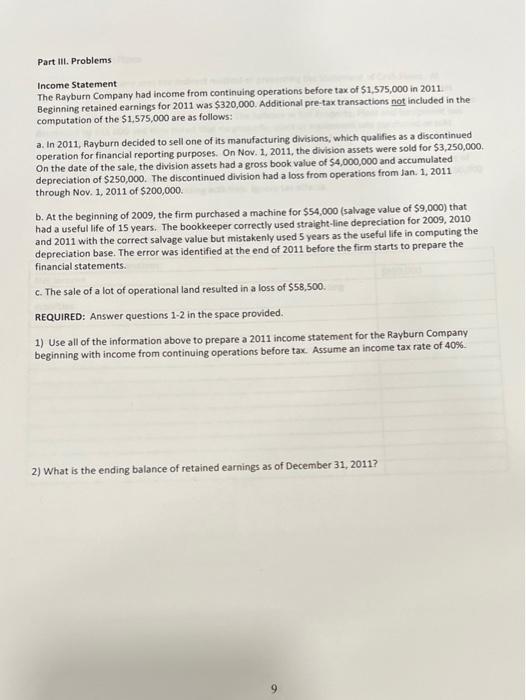

Part III. Problems Income Statement The Rayburn Company had income from continuing operations before tax of $1,575,000 in 2011 Beginning retained earnings for 2011 was $320,000. Additional pre-tax transactions not included in the computation of the $1.575,000 are as follows: a. In 2011, Rayburn decided to sell one of its manufacturing divisions, which qualifies as a discontinued operation for financial reporting purposes. On Nov. 1, 2011, the division assets were sold for $3,250,000 On the date of the sale, the division assets had a gross book value of $4,000,000 and accumulated depreciation of $250,000. The discontinued division had a loss from operations from Jan 1, 2011 through Nov. 1, 2011 of $200,000 b. At the beginning of 2009, the firm purchased a machine for $54,000 (salvage value of $9,000) that had a useful life of 15 years. The bookkeeper correctly used straight-line depreciation for 2009, 2010 and 2011 with the correct salvage value but mistakenly used 5 years as the useful life in computing the depreciation base. The error was identified at the end of 2011 before the firm starts to prepare the financial statements c. The sale of a lot of operational land resulted in a loss of $58,500 REQUIRED: Answer questions 1-2 in the space provided 1) Use all of the information above to prepare a 2011 income statement for the Rayburn Company beginning with income from continuing operations before tax. Assume an income tax rate of 40% 2) What is the ending balance of retained earnings as of December 31, 2011? Part III. Problems Income Statement The Rayburn Company had income from continuing operations before tax of $1,575,000 in 2011 Beginning retained earnings for 2011 was $320,000. Additional pre-tax transactions not included in the computation of the $1.575,000 are as follows: a. In 2011, Rayburn decided to sell one of its manufacturing divisions, which qualifies as a discontinued operation for financial reporting purposes. On Nov. 1, 2011, the division assets were sold for $3,250,000 On the date of the sale, the division assets had a gross book value of $4,000,000 and accumulated depreciation of $250,000. The discontinued division had a loss from operations from Jan 1, 2011 through Nov. 1, 2011 of $200,000 b. At the beginning of 2009, the firm purchased a machine for $54,000 (salvage value of $9,000) that had a useful life of 15 years. The bookkeeper correctly used straight-line depreciation for 2009, 2010 and 2011 with the correct salvage value but mistakenly used 5 years as the useful life in computing the depreciation base. The error was identified at the end of 2011 before the firm starts to prepare the financial statements c. The sale of a lot of operational land resulted in a loss of $58,500 REQUIRED: Answer questions 1-2 in the space provided 1) Use all of the information above to prepare a 2011 income statement for the Rayburn Company beginning with income from continuing operations before tax. Assume an income tax rate of 40% 2) What is the ending balance of retained earnings as of December 31, 2011