Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PART IIl Using BlockWorks and the information below, prepare a tax return for Bruce and Lois Harrison Client Information Taxpayer name Taxpayer SSN Taxpayer DOB

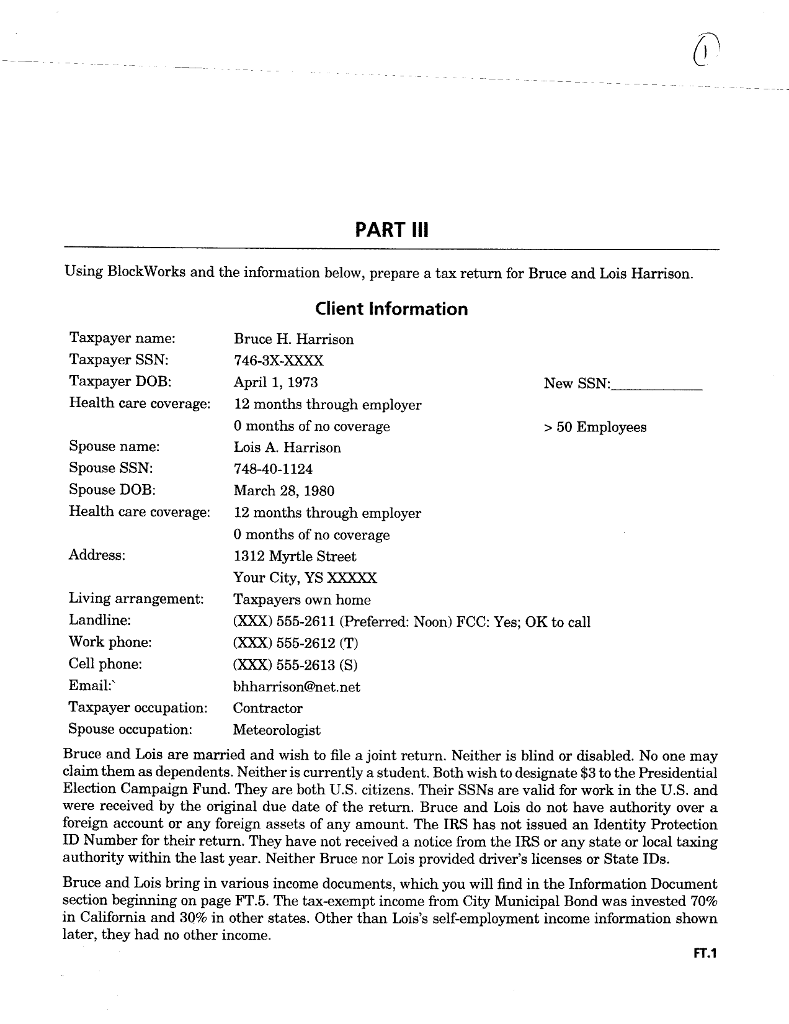

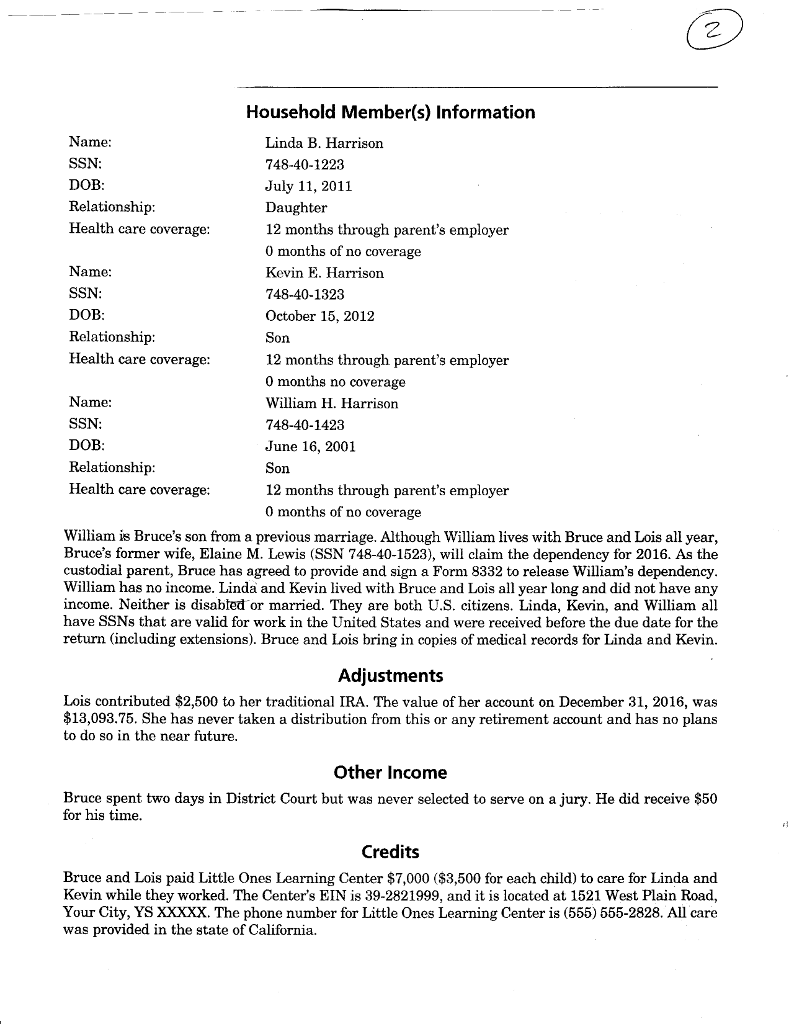

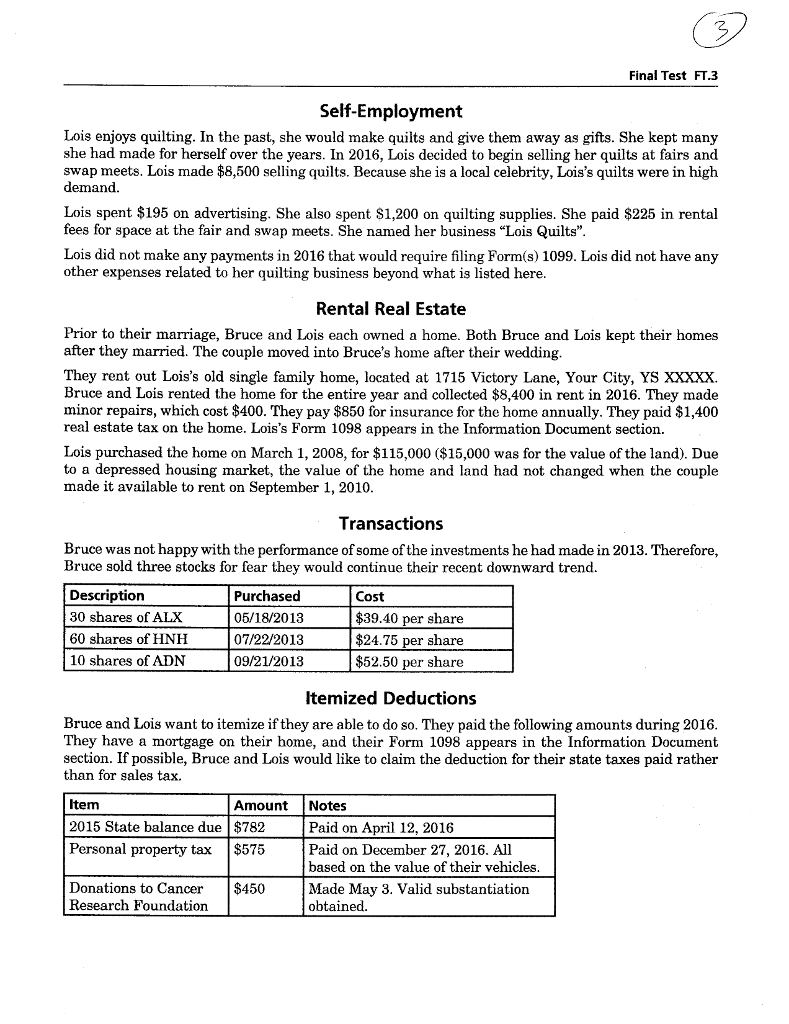

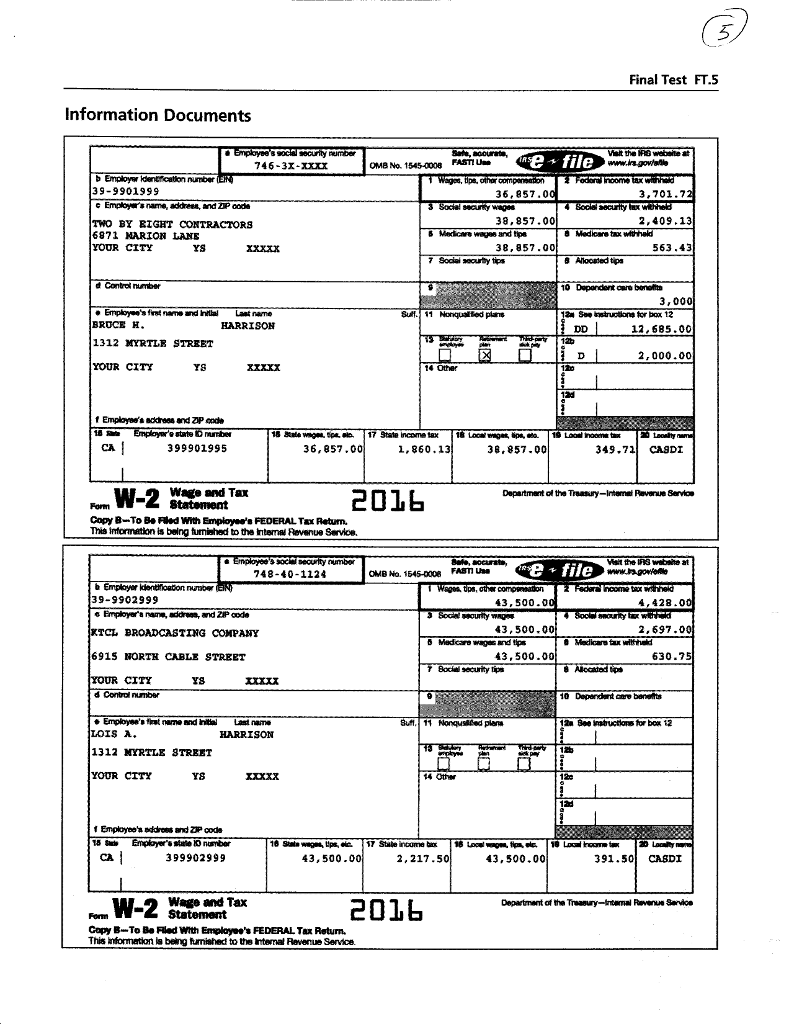

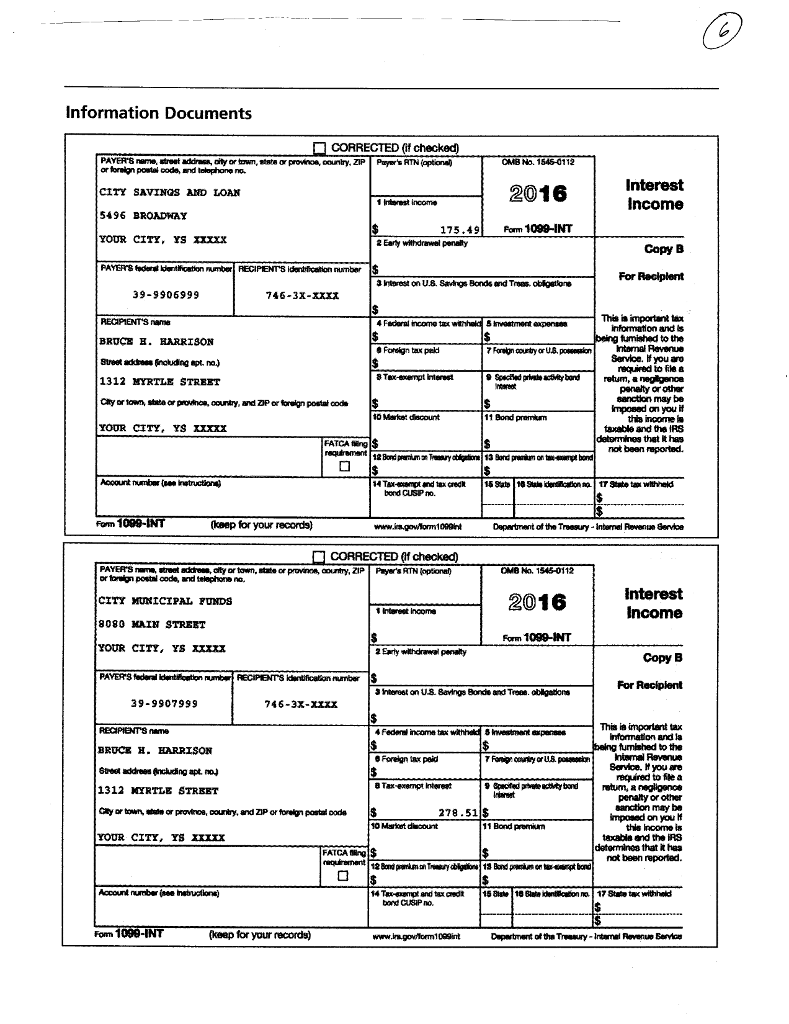

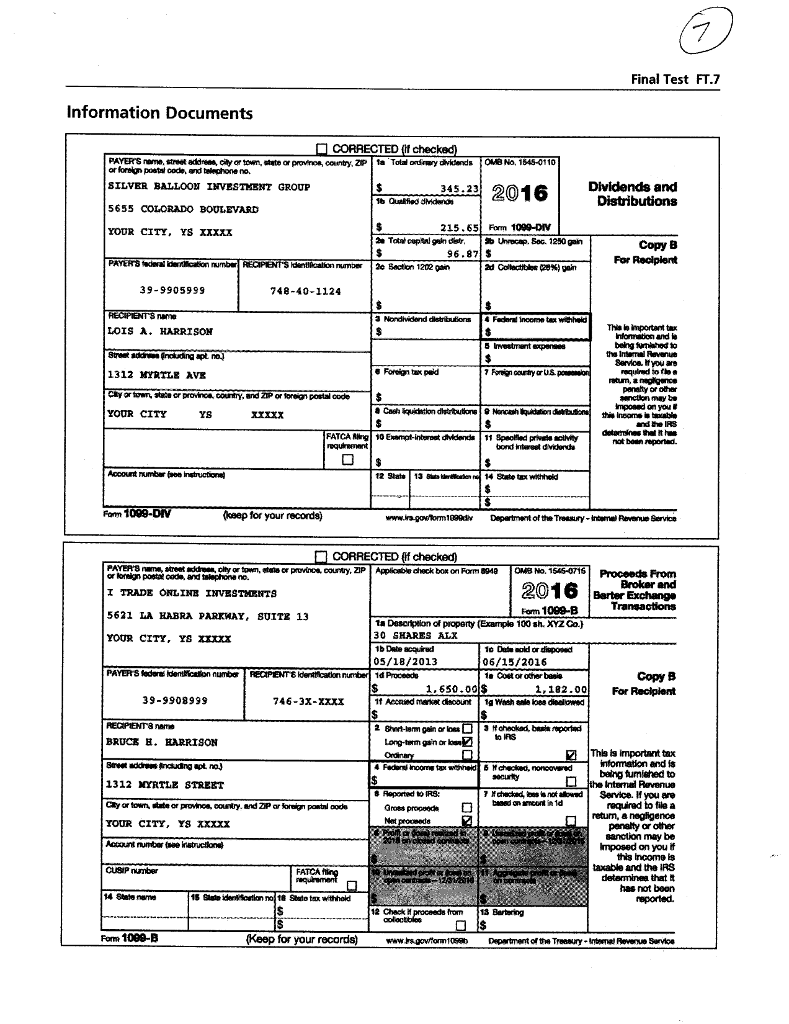

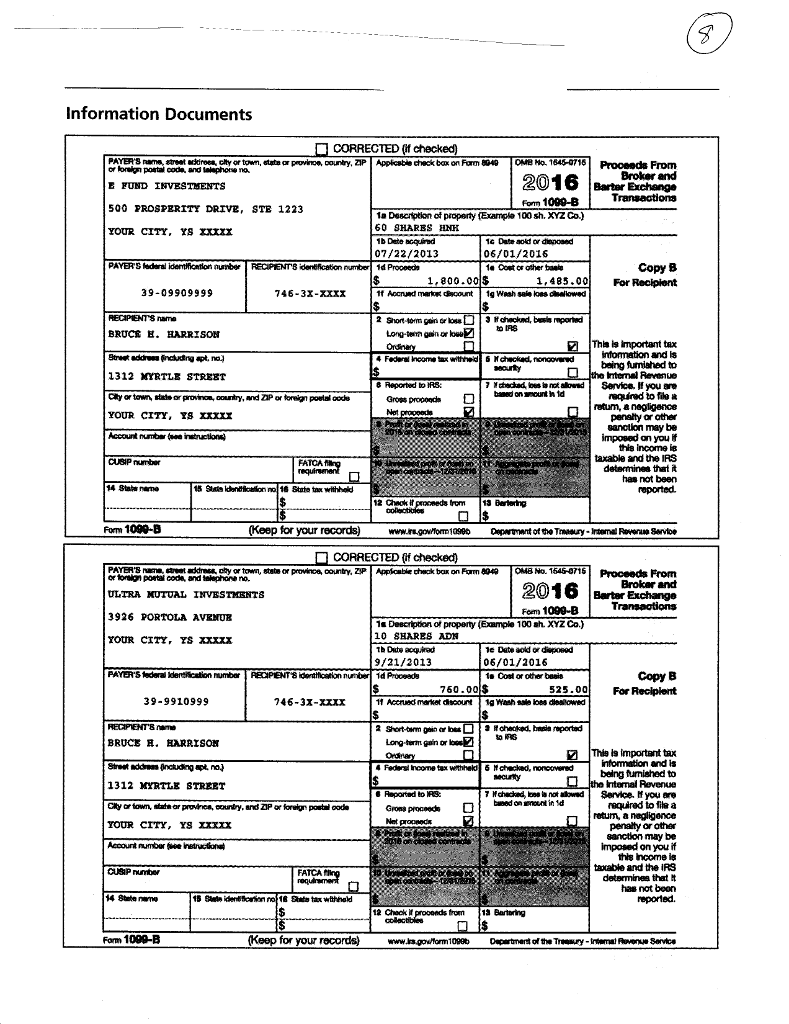

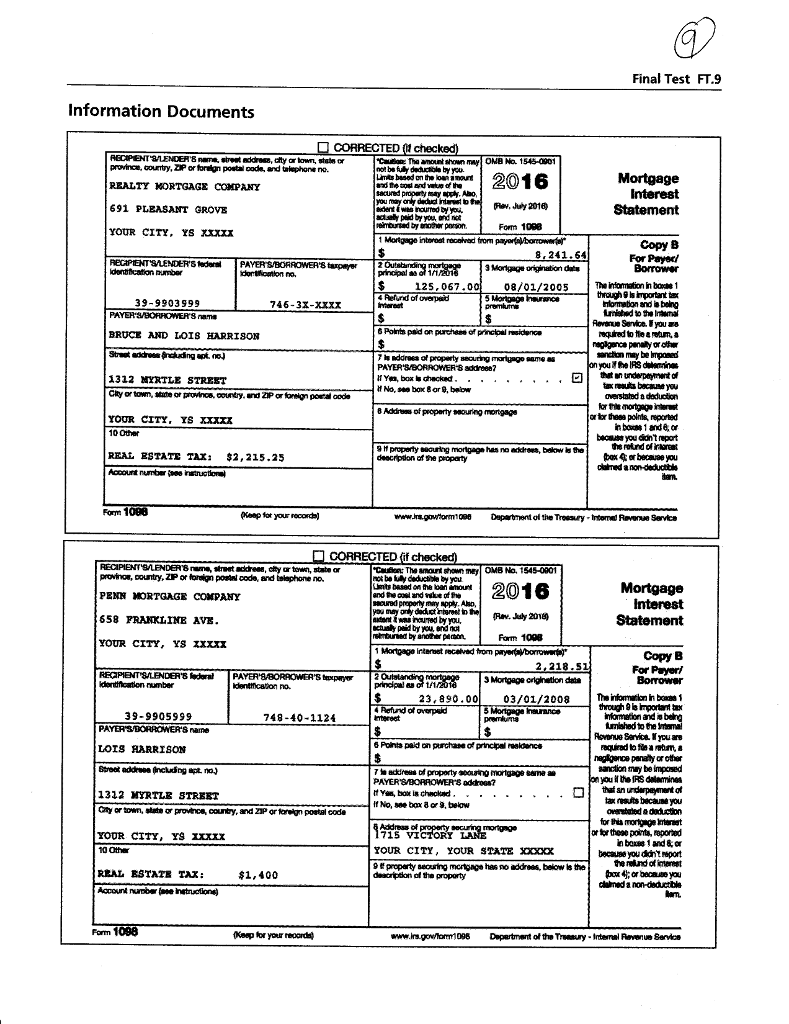

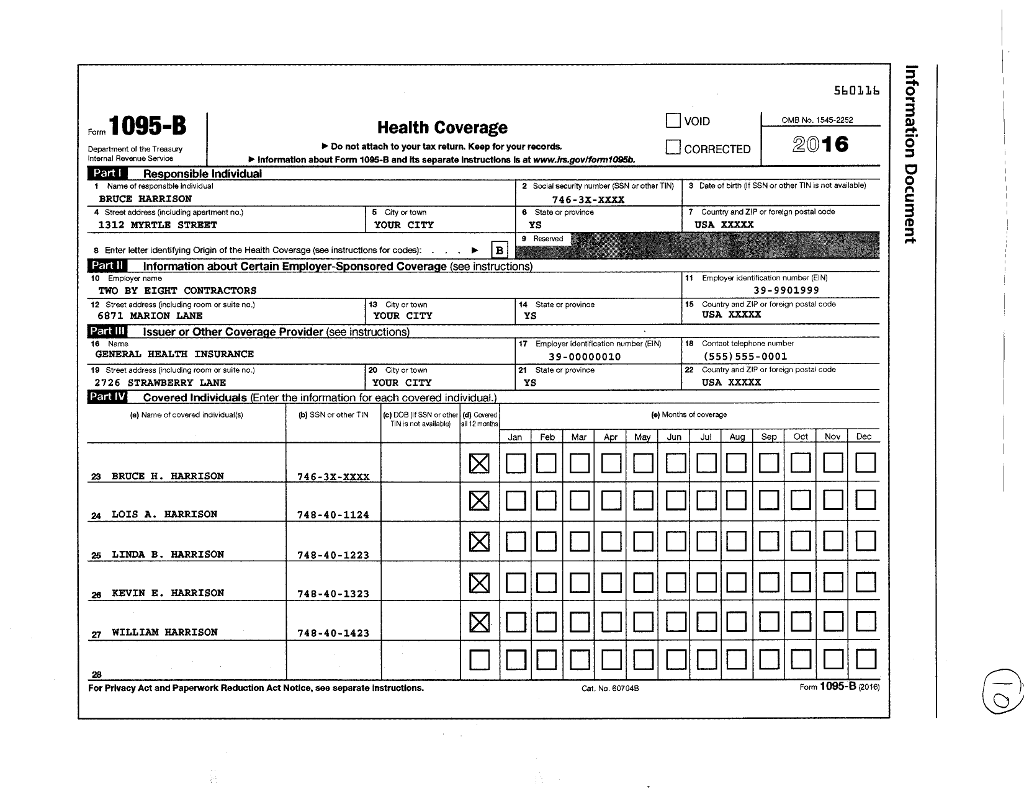

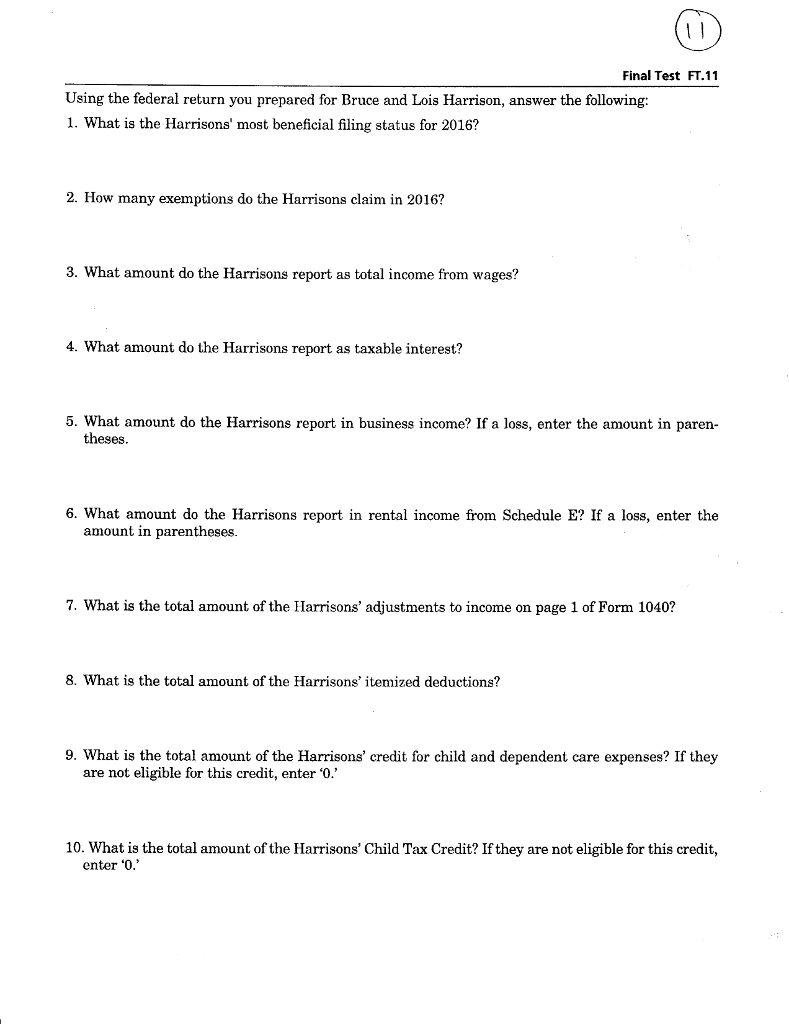

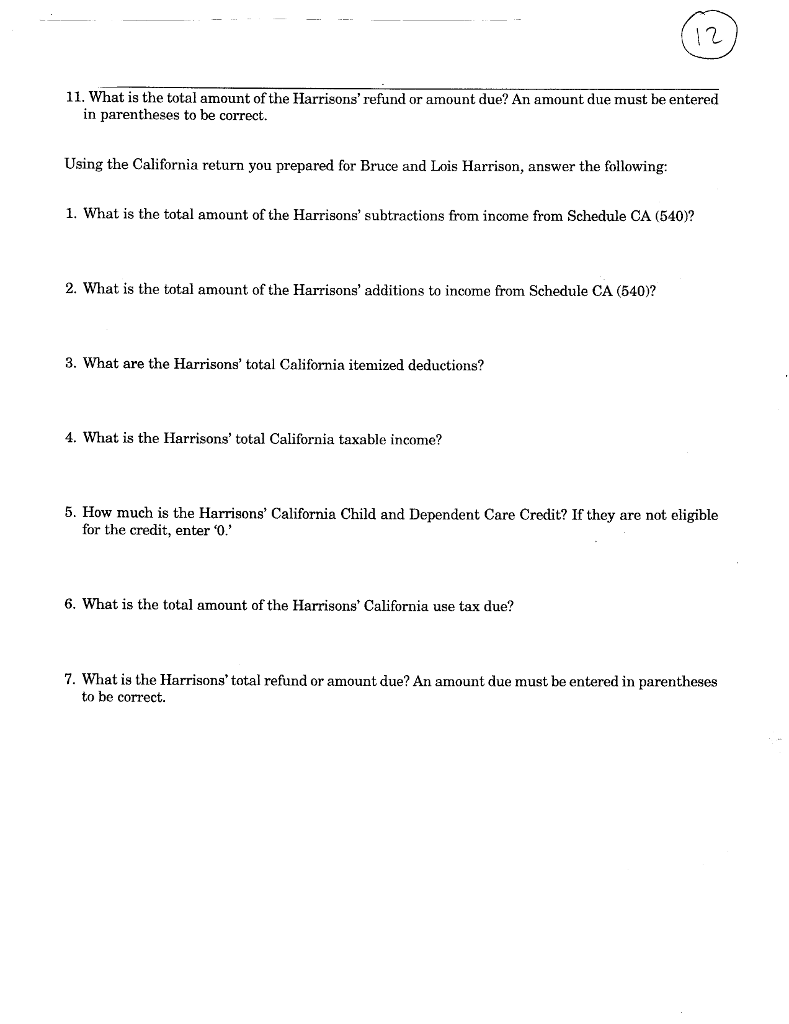

PART IIl Using BlockWorks and the information below, prepare a tax return for Bruce and Lois Harrison Client Information Taxpayer name Taxpayer SSN Taxpayer DOB Health care coverage: Bruce H. Harrison 746-3X-XXXX April 1, 1973 12 months through employer 0 months of no coverage Lois A. Harrison 748-40-1124 March 28, 1980 12 months through employer 0 months of no coverage 1312 Myrtle Street Your City, YS XXXXX Taxpayers own home (XXX) 555-2611 (Preferred: Noon) FCC: Yes; OK to call (XXX) 555-2612 (T) (XXX) 555-2613 (S) bhharrison@net.net Contractor Meteorologist New SSN >50 Employees Spouse name Spouse SSN Spouse DOB Health care coverage: Address Living arrangement: Landline Work phone Cell phone Email Taxpayer occupation: Spouse occupation: Bruce and Lois are married and wish to file a joint return. Neither is blind or disabled. No one may claim them as dependents. Neither is currently a student. Both wish to designate $3 to the Presidential Election Campaign Fund. They are both U.S. citizens. Their SSNs are valid for work in the U.S. and were received by the original due date of the return. Bruce and Lois do not have authority over a foreign account or any foreign assets of any amount. The IRS has not issued an Identity Protection ID Number for their return. They have not received a notice from the IRS or any state or local taxing authority within the last year. Neither Bruce nor Lois provided driver's licenses or State IDs Bruce and Lois bring in various income documents, which you will find in the Information Document section beginning on page FT.5. The tax-exempt income from City Municipal Bond was invested 70% in California and 30% in other states. Other than Lois's self-employment income information shown later, they had no other income FT.1 PART IIl Using BlockWorks and the information below, prepare a tax return for Bruce and Lois Harrison Client Information Taxpayer name Taxpayer SSN Taxpayer DOB Health care coverage: Bruce H. Harrison 746-3X-XXXX April 1, 1973 12 months through employer 0 months of no coverage Lois A. Harrison 748-40-1124 March 28, 1980 12 months through employer 0 months of no coverage 1312 Myrtle Street Your City, YS XXXXX Taxpayers own home (XXX) 555-2611 (Preferred: Noon) FCC: Yes; OK to call (XXX) 555-2612 (T) (XXX) 555-2613 (S) bhharrison@net.net Contractor Meteorologist New SSN >50 Employees Spouse name Spouse SSN Spouse DOB Health care coverage: Address Living arrangement: Landline Work phone Cell phone Email Taxpayer occupation: Spouse occupation: Bruce and Lois are married and wish to file a joint return. Neither is blind or disabled. No one may claim them as dependents. Neither is currently a student. Both wish to designate $3 to the Presidential Election Campaign Fund. They are both U.S. citizens. Their SSNs are valid for work in the U.S. and were received by the original due date of the return. Bruce and Lois do not have authority over a foreign account or any foreign assets of any amount. The IRS has not issued an Identity Protection ID Number for their return. They have not received a notice from the IRS or any state or local taxing authority within the last year. Neither Bruce nor Lois provided driver's licenses or State IDs Bruce and Lois bring in various income documents, which you will find in the Information Document section beginning on page FT.5. The tax-exempt income from City Municipal Bond was invested 70% in California and 30% in other states. Other than Lois's self-employment income information shown later, they had no other income FT.1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started