Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Part IV: Rolling a Hedge (10 points) A producer short hedges the market in June against the December futures market. The producer notices the market

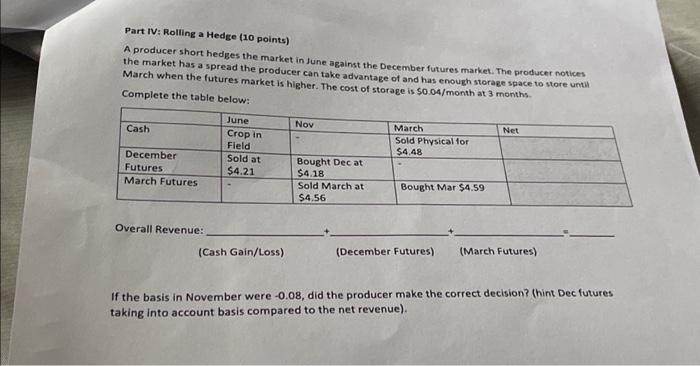

Part IV: Rolling a Hedge (10 points) A producer short hedges the market in June against the December futures market. The producer notices the market has a spread the producer can take advantage of and has enough storage space to store until March when the futures market is higher. The cost of storage is $0.04/month at 3 months. Complete the table below: Cash December Futures March Futures Overall Revenue: June Crop in Field Sold at $4.21 (Cash Gain/Loss) Nov Bought Dec at $4.18 Sold March at $4.56 March Sold Physical for $4.48 Bought Mar $4.59 (December Futures) Net (March Futures) If the basis in November were -0.08, did the producer make the correct decision? (hint Dec futures taking into account basis compared to the net revenue).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started