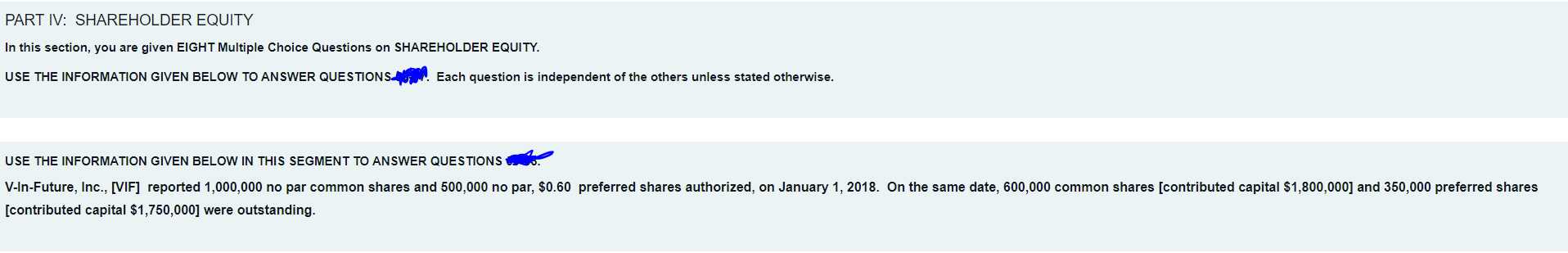

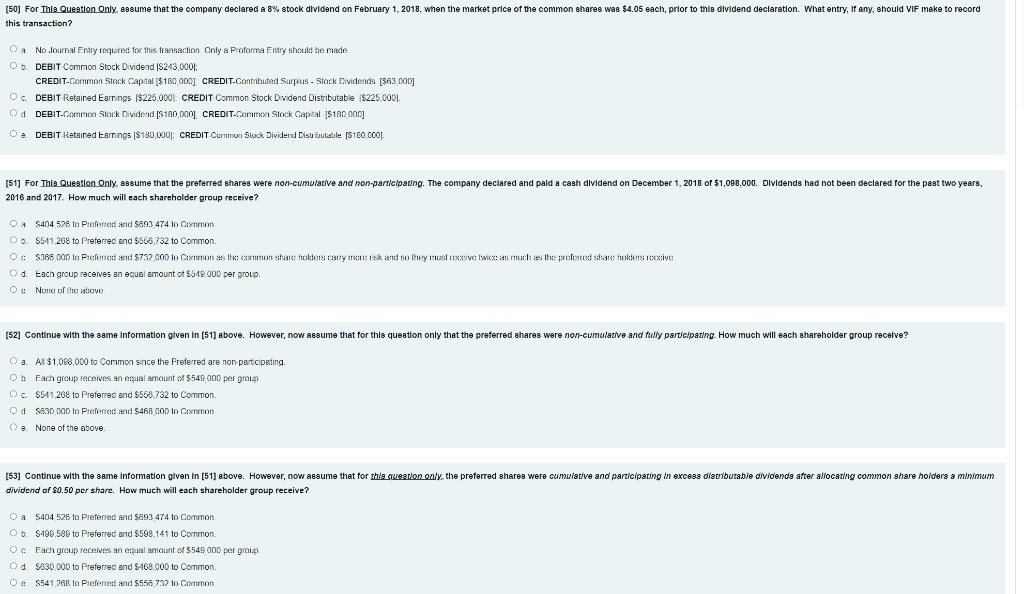

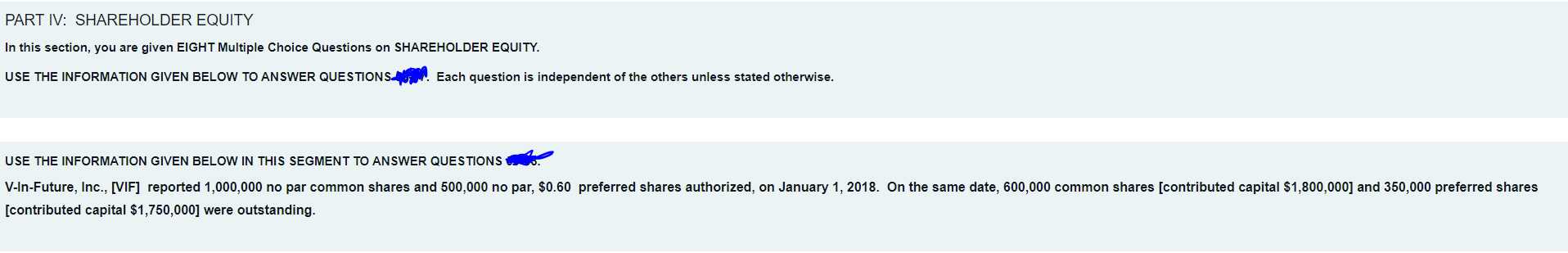

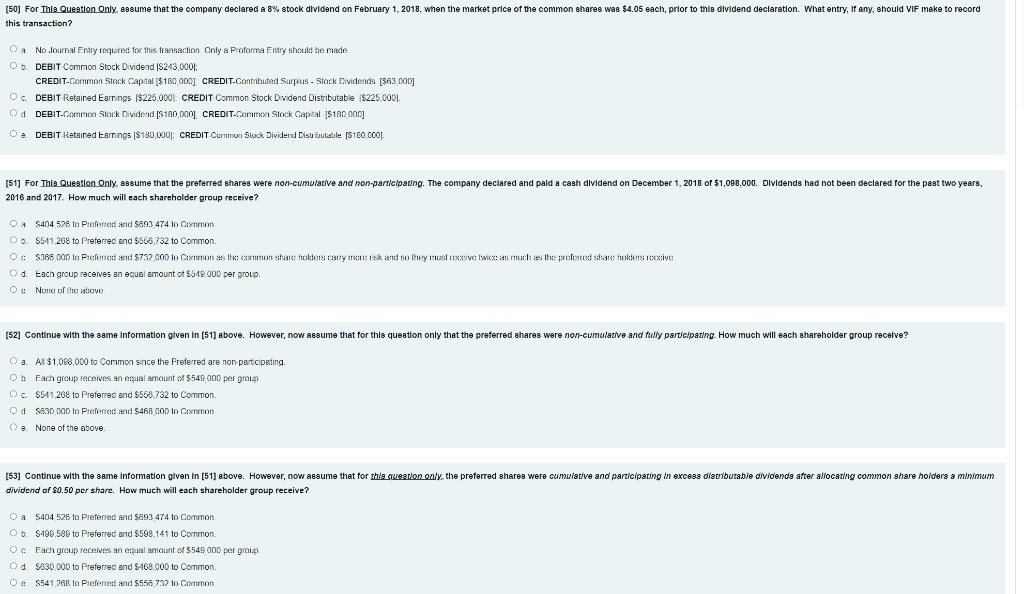

PART IV: SHAREHOLDER EQUITY In this section, you are given EIGHT Multiple Choice Questions on SHAREHOLDER EQUITY. USE THE INFORMATION GIVEN BELOW TO ANSWER QUESTIONS. Each question is independent of the others unless stated otherwise. USE THE INFORMATION GIVEN BELOW IN THIS SEGMENT TO ANSWER QUESTIONS V-In-Future, Inc., [VIF] reported 1,000,000 no par common shares and 500,000 no par, $0.60 preferred shares authorized, on January 1, 2018. On the same date, 600,000 common shares [contributed capital $1,800,000] and 350,000 preferred shares [contributed capital $1,750,000] were outstanding. [50] For This Question Only, assume that the company declared a 8% stock dividend on February 1, 2018, when the market price of the common shares was $4.05 each, prior to this dividend declaration. What entry, if any, should VIF make to record this transaction? Oa No Journal Entry required for this transaction Only a Proforma Entry should be made O. DEBIT Common Stock Dividend |S243,000 CREDIT-Common Stock Capital ($180 000] CREDIT-Contributed Surplus - Stock Dividends ($63 000) OC DEBIT Retained Earnings ($225,0001 CREDIT Common Stock Dividend Distributable $225.000). Od DEBIT-Common Stock Dividend [S180,000). CREDIT-Comm Stock Capital S100 000 O. DEBIT Retained Earnings ($180,000): CREDIT Curition Stock Dividend Distributable [S100,000). [51] For This Question Only, assume that the preferred shares were non-cumulative and non-participating. The company declared and paid a cash dividend on December 1, 2018 of $1,098.000. Dividends had not been declared for the past two years, 2018 and 2017. How much will each shareholder group receive? O S404,525 to Preferred and $493 474 to Common Ob. $541 268 to Preferred and $656,732 to Common Oc S385 000 la Preferred and $732 000 to Common as the common share hokiers carry more risk and so they must receive twice as much as the preferred sharehokiers receive Od. Each group receives an equal amount of 5519.000 per group O None of the stove [52] Continue with the same information given in [51] above. However, now assume that for this question only that the preferred shares were non-cumulative and fully participating. How much will each shareholder group receive? 02. Al $1,098,000 to Common since the Preferred are non-participating. O Each group receives an equal amount of $549 000 per group O c. $541.268 to Preferred and 5668.732 to Common Od SA30 pon ta Preferred and $46R COD to Common e None of the above. [53] Continue with the same Information glven in [51] above. However, now assume that for this question only the preferred shares were cumulative and participating in excess distributable dividends after allocating common shareholders a minimum dividend of $0.50 per share. How much will each shareholder group receive? a 5404 525 to Preferred and $493 474 to Common O b. S499,589 to Preferred and $598,141 to Common Oc. Fach group receives an equal amount of $549 000 per group d 5630,000 to Preferred and $468,000 to Common Oe S541 268 to Preferred and $558 732 to Common