Answered step by step

Verified Expert Solution

Question

1 Approved Answer

part of the employee's wages. In 1996, the Small Business Job Protection Act froze the minimum cash wage required for tipped employees at $ report

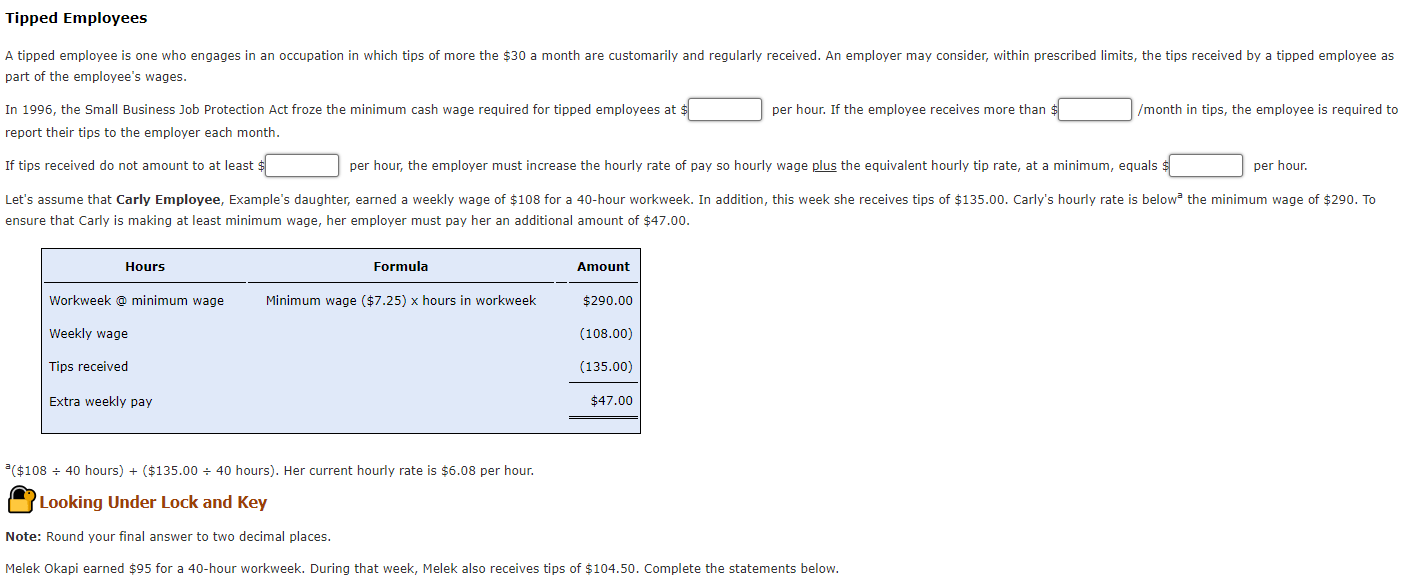

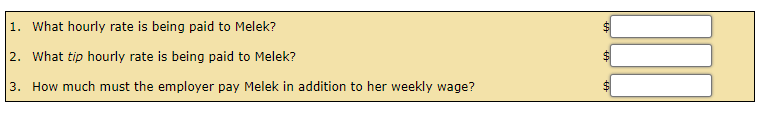

part of the employee's wages. In 1996, the Small Business Job Protection Act froze the minimum cash wage required for tipped employees at $ report their tips to the employer each month. per hour. If the employee receives more than per hour, the employer must increase the hourly rate of pay so hourly wage plus the equivalent hourly tip rate, at a minimum, equals : /month in tips, the employee is required to ensure that Carly is making at least minimum wage, her employer must pay her an additional amount of $47.00. a($10840 hours )+($135.0040 hours ). Her current hourly rate is $6.08 per hour. Looking Under Lock and Key Note: Round your final answer to two decimal places. Melek Okapi earned $95 for a 40 -hour workweek. During that week, Melek also receives tips of $104.50. Complete the statements below. 1. What hourly rate is being paid to Melek? 2. What tip hourly rate is being paid to Melek? 3. How much must the employer pay Melek in addition to her weekly wage

part of the employee's wages. In 1996, the Small Business Job Protection Act froze the minimum cash wage required for tipped employees at $ report their tips to the employer each month. per hour. If the employee receives more than per hour, the employer must increase the hourly rate of pay so hourly wage plus the equivalent hourly tip rate, at a minimum, equals : /month in tips, the employee is required to ensure that Carly is making at least minimum wage, her employer must pay her an additional amount of $47.00. a($10840 hours )+($135.0040 hours ). Her current hourly rate is $6.08 per hour. Looking Under Lock and Key Note: Round your final answer to two decimal places. Melek Okapi earned $95 for a 40 -hour workweek. During that week, Melek also receives tips of $104.50. Complete the statements below. 1. What hourly rate is being paid to Melek? 2. What tip hourly rate is being paid to Melek? 3. How much must the employer pay Melek in addition to her weekly wage Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started