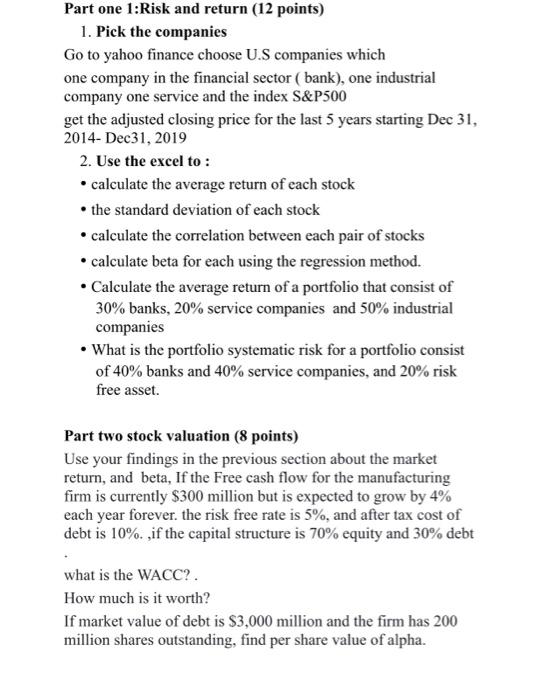

Part one 1: Risk and return (12 points) 1. Pick the companies Go to yahoo finance choose U.S companies which one company in the financial sector ( bank), one industrial company one service and the index S&P500 get the adjusted closing price for the last 5 years starting Dec 31, 2014-Dec31, 2019 2. Use the excel to : calculate the average return of each stock the standard deviation of each stock calculate the correlation between each pair of stocks calculate beta for each using the regression method. Calculate the average return of a portfolio that consist of 30% banks, 20% service companies and 50% industrial companies What is the portfolio systematic risk for a portfolio consist of 40% banks and 40% service companies, and 20% risk free asset. Part two stock valuation (8 points) Use your findings in the previous section about the market return, and beta, If the Free cash flow for the manufacturing firm is currently $300 million but is expected to grow by 4% each year forever, the risk free rate is 5%, and after tax cost of debt is 10%. ,if the capital structure is 70% equity and 30% debt what is the WACC?. How much is it worth? If market value of debt is $3,000 million and the firm has 200 million shares outstanding, find per share value of alpha. Part one 1: Risk and return (12 points) 1. Pick the companies Go to yahoo finance choose U.S companies which one company in the financial sector ( bank), one industrial company one service and the index S&P500 get the adjusted closing price for the last 5 years starting Dec 31, 2014-Dec31, 2019 2. Use the excel to : calculate the average return of each stock the standard deviation of each stock calculate the correlation between each pair of stocks calculate beta for each using the regression method. Calculate the average return of a portfolio that consist of 30% banks, 20% service companies and 50% industrial companies What is the portfolio systematic risk for a portfolio consist of 40% banks and 40% service companies, and 20% risk free asset. Part two stock valuation (8 points) Use your findings in the previous section about the market return, and beta, If the Free cash flow for the manufacturing firm is currently $300 million but is expected to grow by 4% each year forever, the risk free rate is 5%, and after tax cost of debt is 10%. ,if the capital structure is 70% equity and 30% debt what is the WACC?. How much is it worth? If market value of debt is $3,000 million and the firm has 200 million shares outstanding, find per share value of alpha