Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A financial services provider that provides computer software systems approaches you. The company started off as a small private company and has grown strongly

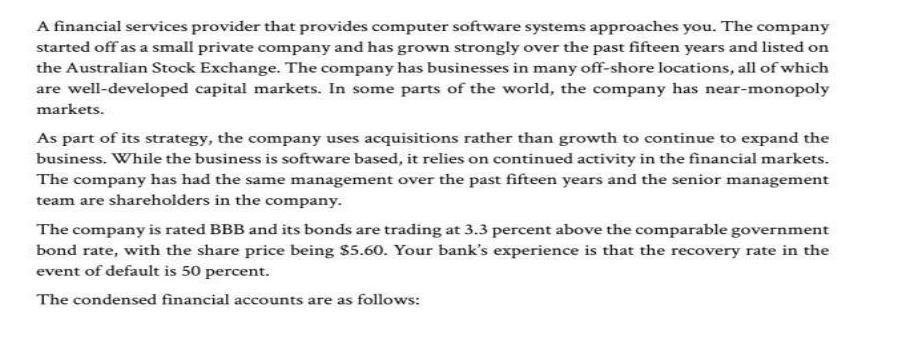

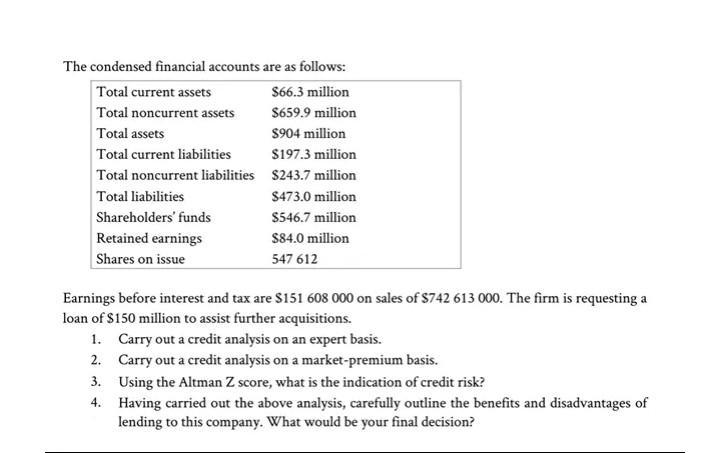

A financial services provider that provides computer software systems approaches you. The company started off as a small private company and has grown strongly over the past fifteen years and listed on the Australian Stock Exchange. The company has businesses in many off-shore locations, all of which are well-developed capital markets. In some parts of the world, the company has near-monopoly markets. As part of its strategy, the company uses acquisitions rather than growth to continue to expand the business. While the business is software based, it relies on continued activity in the financial markets. The company has had the same management over the past fifteen years and the senior management team are shareholders in the company. The company is rated BBB and its bonds are trading at 3.3 percent above the comparable government bond rate, with the share price being $5.60. Your bank's experience is that the recovery rate in the event of default is 50 percent. The condensed financial accounts are as follows: The condensed financial accounts are as follows: Total current assets S66.3 million Total noncurrent assets S659.9 million Total assets S904 million Total current liabilities $197.3 million Total noncurrent liabilities $243.7 million Total liabilities $473.0 million Shareholders' funds S546.7 million Retained earnings S84.0 million Shares on issue 547 612 Earnings before interest and tax are S151 608 000 on sales of S742 613 000. The firm is requesting a loan of $150 million to assist further acquisitions. 1. Carry out a credit analysis on an expert basis. 2. Carry out a credit analysis on a market-premium basis. 3. Using the Altman Z score, what is the indication of credit risk? 4. Having carried out the above analysis, carefully outline the benefits and disadvantages of lending to this company. What would be your final decision?

Step by Step Solution

★★★★★

3.56 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

1 Credit analysis can be done by using the 5c model 5Cs include Character capacity capital conditions collateral Character Company in this question di...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

6364da58e9ab5_239608.pdf

180 KBs PDF File

6364da58e9ab5_239608.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started