Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Part One Calculate the five - year net sales, operating expenses, operating income, and net income of JIRANNA healthcare.once the calculations are complete, interpret the

Part One

Calculate the fiveyear net sales, operating expenses, operating income, and net income of JIRANNA healthcare.once the calculations are complete, interpret the resulting data and explain the significant of the trend results.

Calculate the five here total profit margin asset turnover return on assets and return on net worth. Once the calculations are complete, interpret the resulting data and determine the companies profitability.

The five year current ratio days, cash on hand, and working capital. Once the calculations are complete, interpret the resulting data and access the companies liquidity.

Calculate the fiveyear debt ratio and times interest earned ratio. Once the calculations are complete, interpret the resulting data and explain the companies longterm solvency.

The dewpoint analysis for each of the five most recent years once calculations are complete interpret the resulting data and determine the companies, individual Dupont characteristics and trends across the analysis period

ultimately decision has to be made. Would you recommend the capital project to JIRANNA healthcare explain your decosion?

E

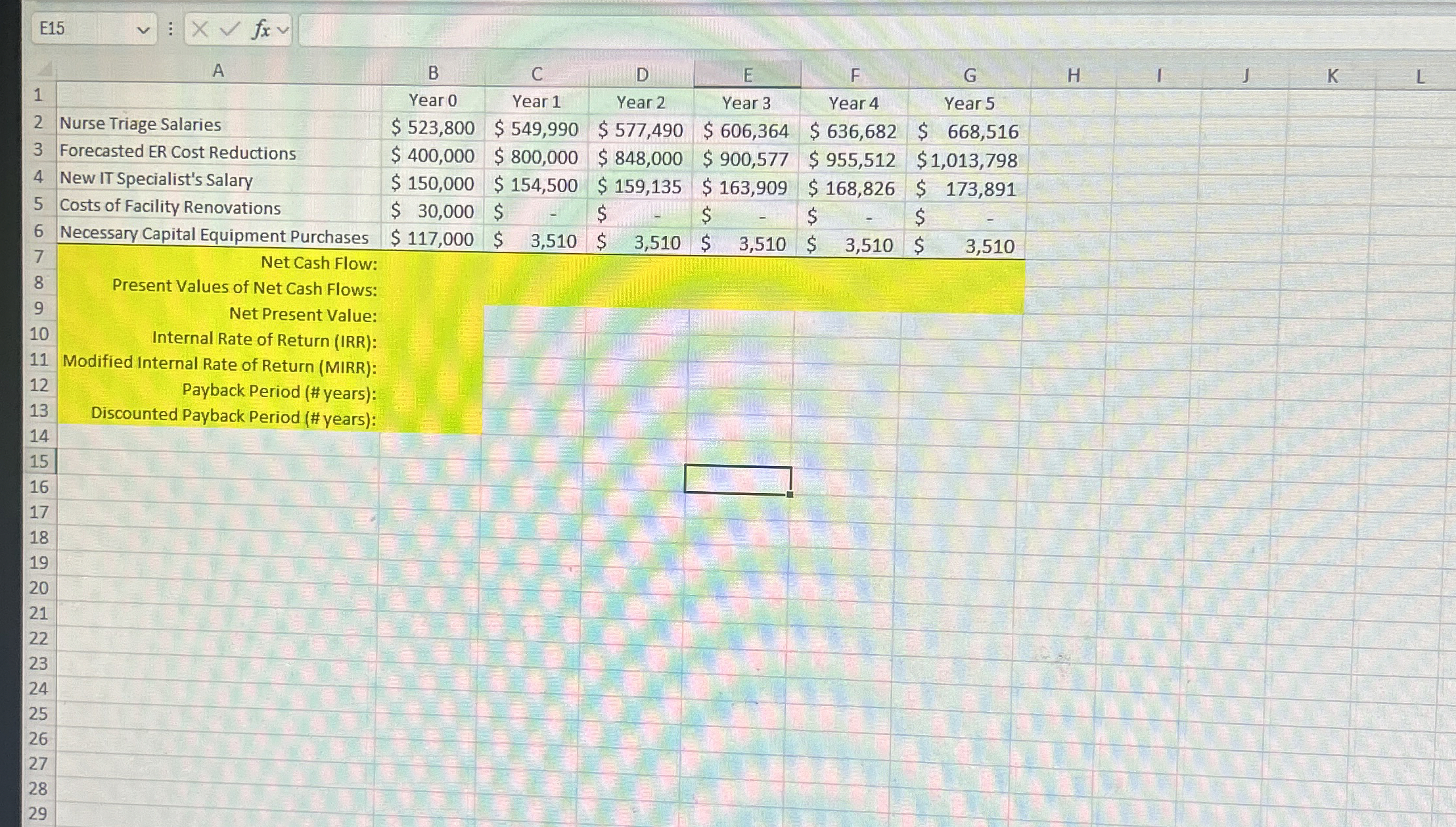

Present Values of Net Cash Flows:

Net Present Value:

Internal Rate of Return IRR:

Modified Internal Rate of Return MIRR:

Payback Period # years:

Discounted Payback Period # years:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started