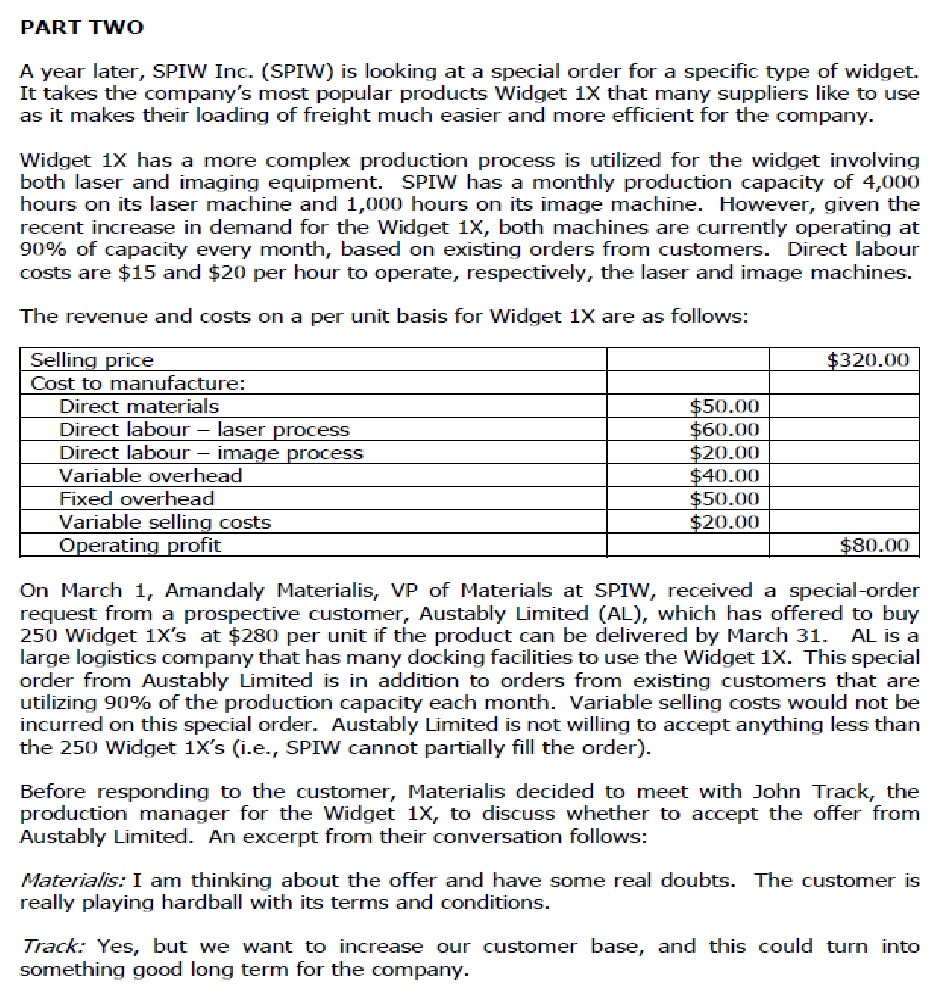

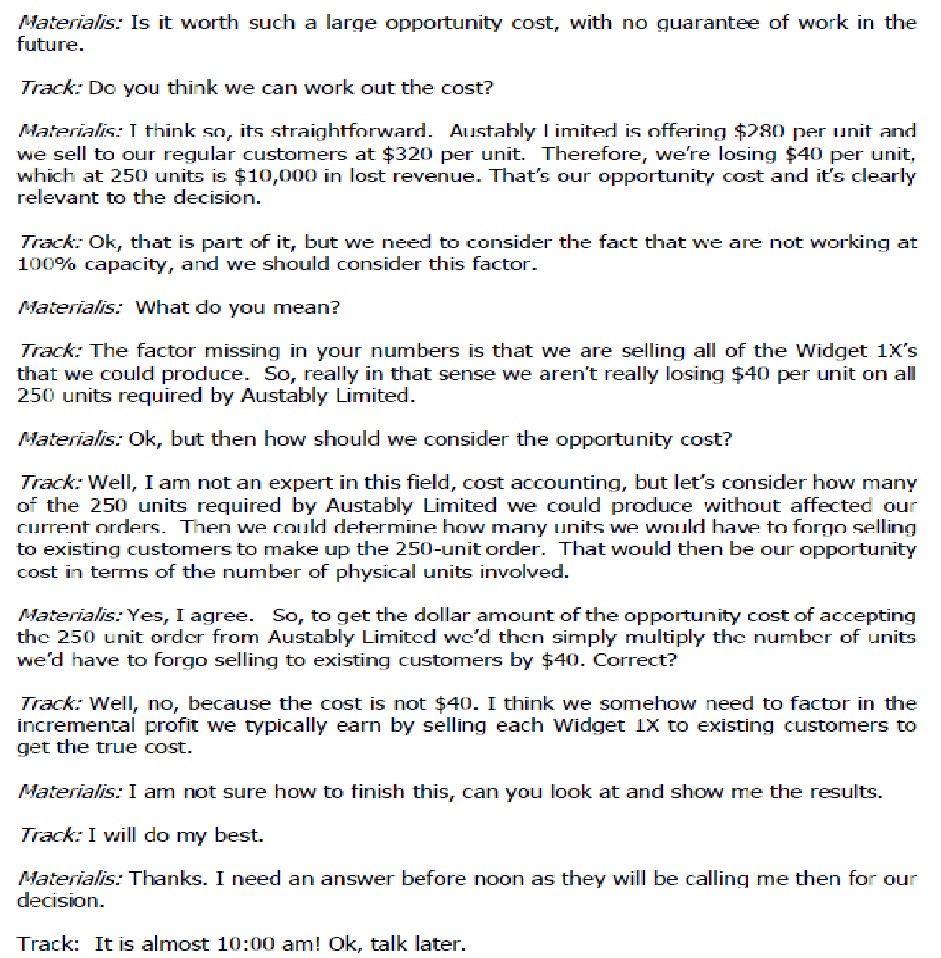

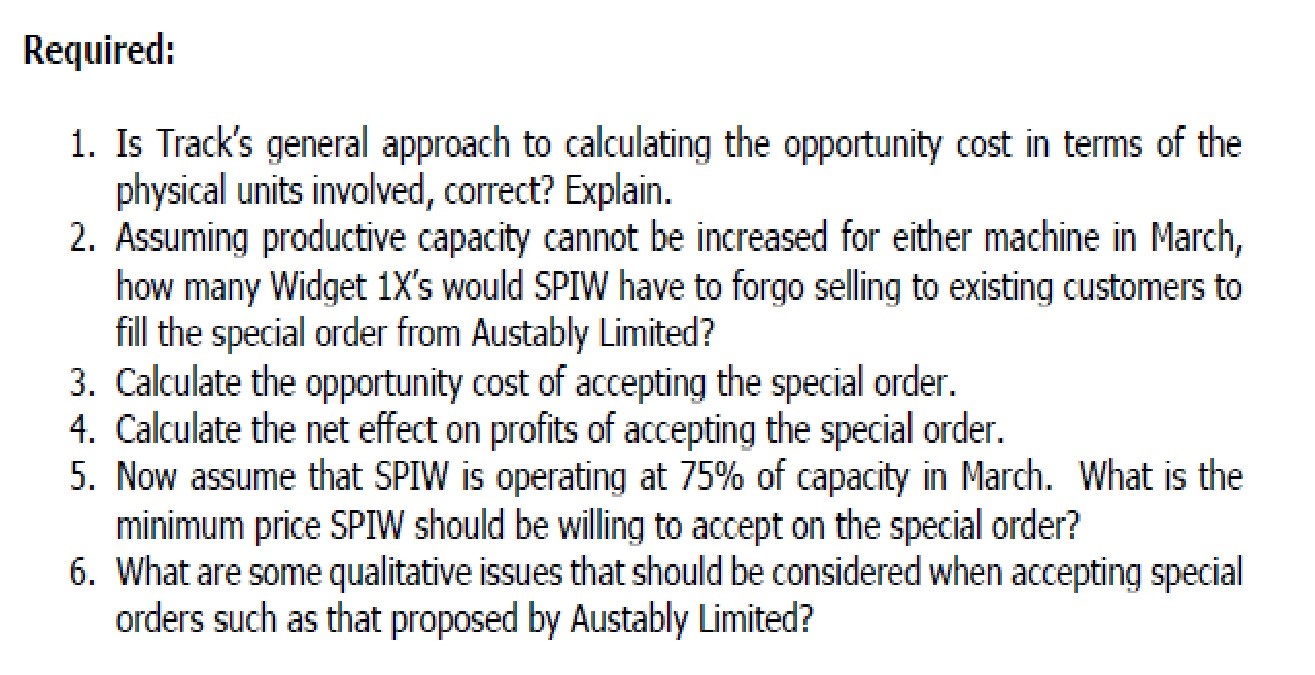

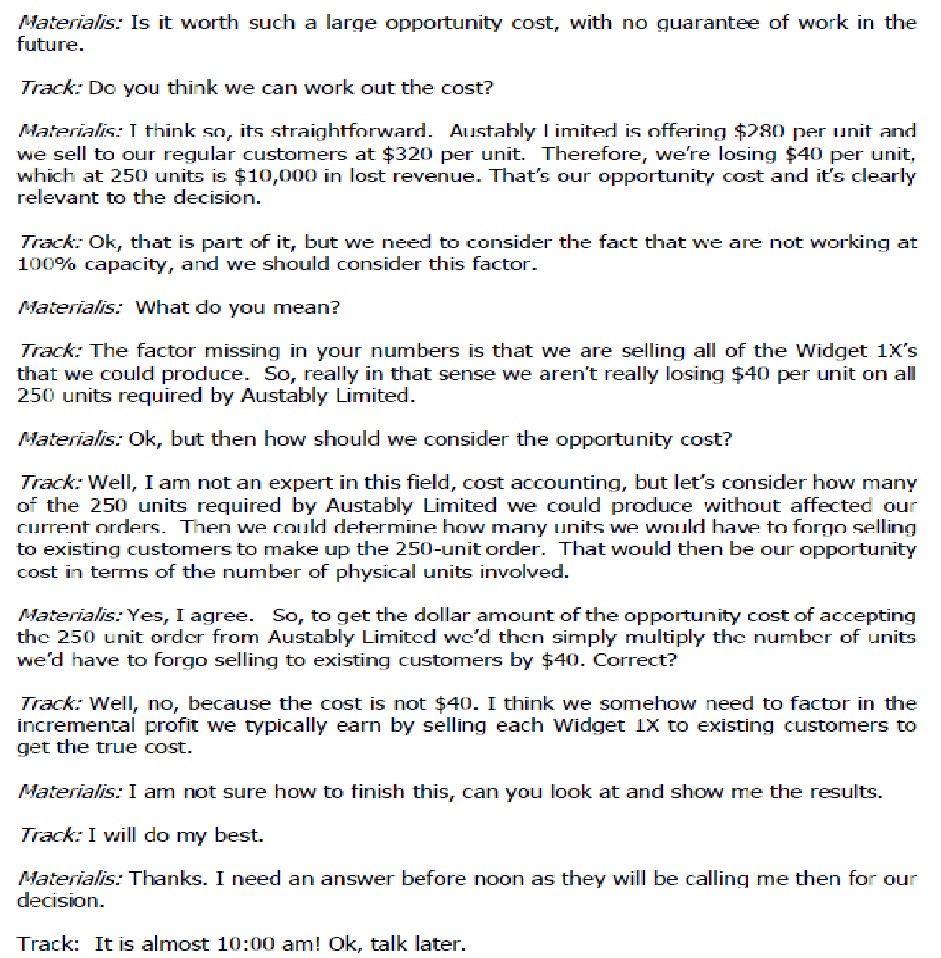

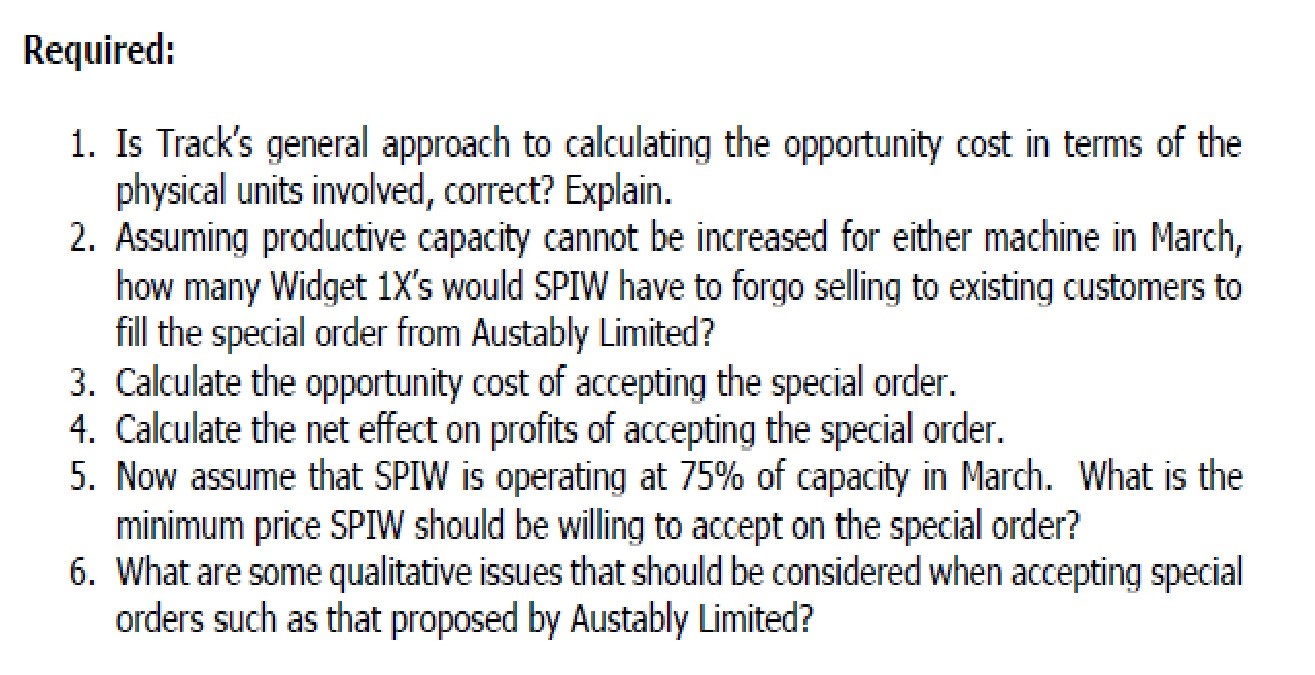

PART TWO A year later, SPIW Inc. (SPIW) is looking at a special order for a specific type of widget. It takes the company's most popular products Widget 1X that many suppliers like to use as it makes their loading of freight much easier and more efficient for the company. Widget 1X has a more complex production process is utilized for the widget involving both laser and imaging equipment. SPIW has a monthly production capacity of 4,000 hours on its laser machine and 1,000 hours on its image machine. However, given the recent increase in demand for the Widget 1X, both machines are currently operating at 90% of capacity every month, based on existing orders from customers. Direct labour costs are $15 and $20 per hour to operate, respectively, the laser and image machines. The revenue and costs on a per unit basis for Widget 1X are as follows: On March 1 , Amandaly Materialis, VP of Materials at SPIW, received a special-order request from a prospective customer, Austably Limited (AL), which has offered to buy 250 widget 1X s at $280 per unit if the product can be delivered by March 31 . AL is a large logistics company that has many docking facilities to use the Widget 1X. This special order from Austably Limited is in addition to orders from existing customers that are utilizing 90% of the production capacity each month. Variable selling costs would not be incurred on this special order. Austably Limited is not willing to accept anything less than the 250 widget 1X 's (i.e., SPIW cannot partially fill the order). Before responding to the customer, Materialis decided to meet with John Track, the production manager for the Widget 1X, to discuss whether to accept the offer from Austably Limited. An excerpt from their conversation follows: Materialis: I am thinking about the offer and have some real doubts. The customer is really playing hardball with its terms and conditions. Track: Yes, but we want to increase our customer base, and this could turn into something good long term for the company. Materialis: Is it worth such a large opportunity cost, with no quarantee of work in the future. Track: Do you think we can work out the cost? Materiallis: T think sr its straightforward. Austably l imited is offering $280 per unit and we sell to our regular customers at $320 per unit. Therefore, we're losing $40 per unit, which at 250 units is $10,000 in lost revenue. That's our opportunity cost and it's clearly relevant to the decision. Track: Ok, that is part of it, but we need to consider the fact that we are not working at 100% capacity, and we should consider this factor. Materialis: What do you mean? Track: The factor missing in your numbers is that we are selling all of the Widget 1X s that we could produce. So, really in that sense we aren't really losing $40 per unit on all 250 units required by Austably Limited. Materialis: Ok, but then how should we consider the opportunity cost? Track: Well, I am not an expert in this field, cost accounting, but let's consider how many of the 250 units required by Austably Limited we could produce without affected our rurrent orders. Then we rould determine how many units we would have to forgn selling to existing customers to make up the 250 -unit order. That would then be our opportunity cost in terms of the number of physical units involved. Materialis: Yes, I agree. So, to get the dollar amount of the opportunity cost of accepting the 250 unit order from Austably Limited we'd then simply multiply the number of units we"d have to forgo selling to existing customers by $40. Correct? Track: Well, no, because the cost is not $40. I think we somehow need to factor in the incremental profit we typically earn by selling each widget 1x to existing customers to get the true cost. Materialis: I am not sure how to finish this, can you look at and show me the results. Track: I will do my best. Materialis: Thanks. I need an answer before noon as they will be calling me then for our decision. Track: It is almost 10:00 am! Ok, talk later. 1. Is Track's general approach to calculating the opportunity cost in terms of the physical units involved, correct? Explain. 2. Assuming productive capacity cannot be increased for either machine in March, how many Widget 1X's would SPIW have to forgo selling to existing customers to fill the special order from Austably Limited? 3. Calculate the opportunity cost of accepting the special order. 4. Calculate the net effect on profits of accepting the special order. 5. Now assume that SPIW is operating at 75% of capacity in March. What is the minimum price SPIW should be willing to accept on the special order? 6. What are some qualitative issues that should be considered when accepting special orders such as that proposed by Austably Limited