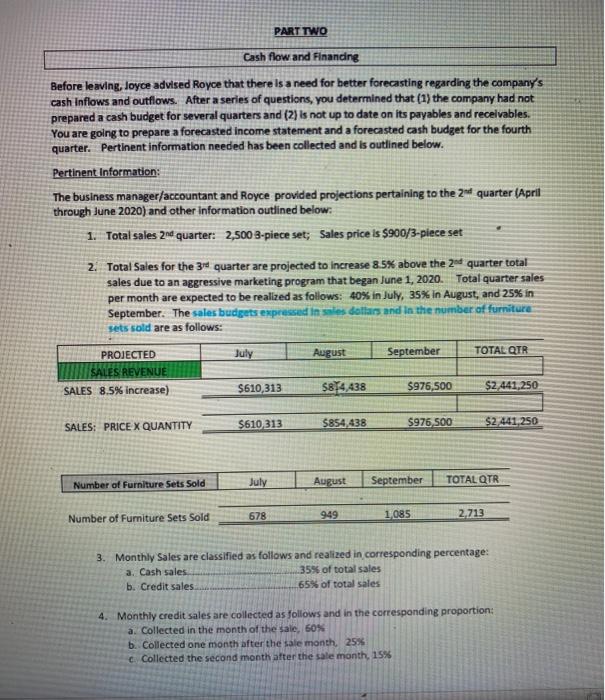

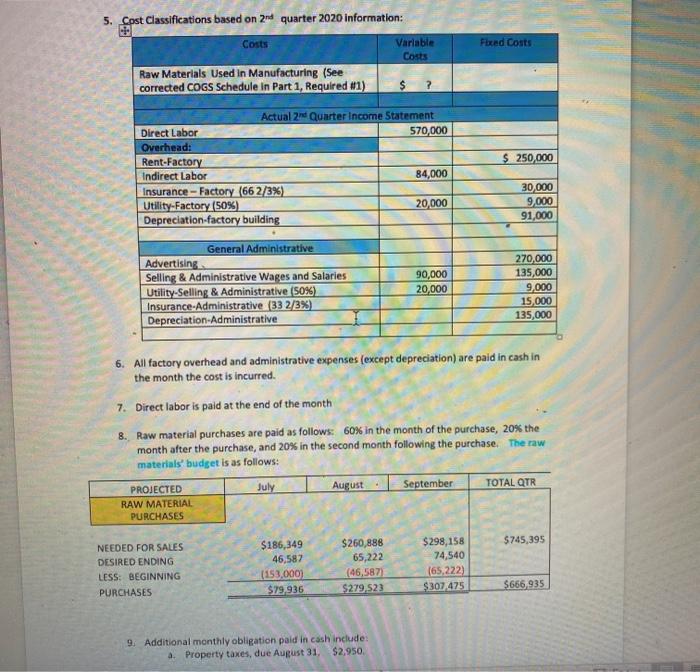

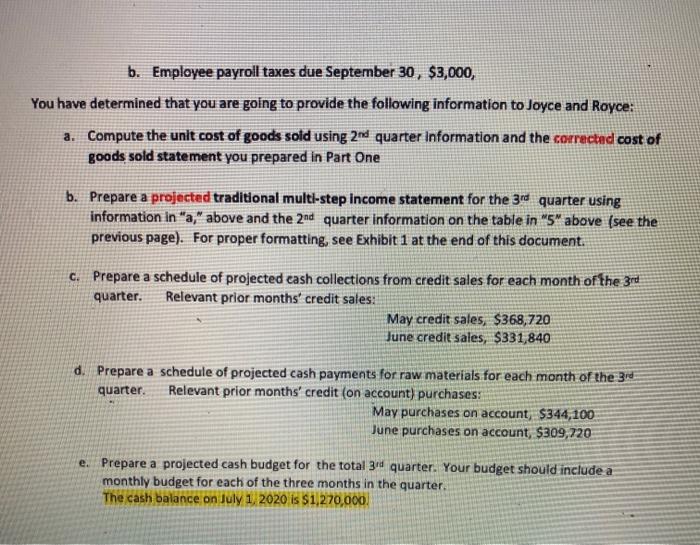

PART TWO Cash flow and Financing Before leaving, Joyce advised Royce that there is a need for better forecasting regarding the company's cash Inflows and outflows. After a series of questions, you determined that (1) the company had not prepared a cash budget for several quarters and (2) is not up to date on its payables and receivables. You are going to prepare a forecasted income statement and a forecasted cash budget for the fourth quarter. Pertinent information needed has been collected and is outlined below. Pertinent Information: The business manager/accountant and Royce provided projections pertaining to the 2m quarter (April through June 2020) and other information outlined below: 1. Total sales 2nd quarter: 2,500 3-piece set; Sales price is $900/3-piece set 2. Total Sales for the 34 quarter are projected to increase 8.5% above the 2nd quarter total sales due to an aggressive marketing program that began June 1, 2020. Total quarter sales per month are expected to be realized as follows: 40% in July, 35% in August, and 25% in September. The sales budgets expressed in sales dollars and in the number of furniture sets sold are as follows: July August September TOTAL QIR PROJECTED SALES REVENUE SALES 8.5% increase) $610,313 5874.438 $976,500 $2,441,250 SALES: PRICE X QUANTITY $610313 5854 438 $976 500 $2441,250 July Number of furniture Sets Sold August September TOTAL QTR Number of Furniture Sets Sold 678 949 1.085 2.713 3. Monthly Sales are classified as follows and realized in corresponding percentage: a. Cash sales 35% of total sales b. Credit sales 65% of total sales 4. Monthly credit sales are collected as follows and in the corresponding proportion: a. Collected in the month of the sale, 60% b. Collected one month after the sale month, 25% c. Collected the second month after the sale month, 15% Fixed Costs 5. Cost Classifications based on 2nd quarter 2020 information: Costs Variable Costs Raw Materials used in Manufacturing (See corrected COGS Schedule in Part 1, Required #1) $ $ 250,000 Actual 2nd Quarter Income Statement Direct Labor 570,000 Overhead: Rent-Factory Indirect Labor 84,000 Insurance - Factory (66 2/3%) Utility-Factory (50%) 20,000 Depreciation-factory building 30,000 9,000 91,000 General Administrative Advertising Selling & Administrative Wages and Salaries Utility-Selling & Administrative (50%) Insurance-Administrative (332/3%) Depreciation Administrative 90,000 20,000 270,000 135,000 9,000 15,000 135,000 6. All factory overhead and administrative expenses (except depreciation) are paid in cash in the month the cost is incurred. 7. Direct labor is paid at the end of the month 8. Raw material purchases are paid as follows: 60% in the month of the purchase, 20% the month after the purchase, and 20% in the second month following the purchase. The raw materials budget is as follows: July August September TOTAL QTR RAW MATERIAL PURCHASES PROJECTED $745,395 NEEDED FOR SALES DESIRED ENDING LESS: BEGINNING PURCHASES $186,349 46,587 (153,000 $79.936 $260,888 65,222 (46,587) $279,523 $298,158 74,540 165,222) $307,475 $666,935 9. Additional monthly obligation paid in cash include: a. Property taxes, due August 31, $2,950 b. Employee payroll taxes due September 30, $3,000, You have determined that you are going to provide the following information to Joyce and Royce: a. Compute the unit cost of goods sold using 2nd quarter Information and the corrected cost of goods sold statement you prepared in Part One b. Prepare a projected traditional multi-step Income statement for the 3rd quarter using information in "a," above and the 2nd quarter information on the table in "S" above (see the previous page). For proper formatting, see Exhibit 1 at the end of this document. C. Prepare a schedule of projected cash collections from credit sales for each month of the 3rd quarter. Relevant prior months' credit sales: May credit sales, $368,720 June credit sales, $331,840 d. Prepare a schedule of projected cash payments for raw materials for each month of the 3rd quarter Relevant prior months' credit (on account) purchases: May purchases on account, $344,100 June purchases on account, $309,720 e. Prepare a projected cash budget for the total 3rd quarter. Your budget should include a monthly budget for each of the three months in the quarter. The cash balance on July 1, 2020 is $1,270,000 PART TWO Cash flow and Financing Before leaving, Joyce advised Royce that there is a need for better forecasting regarding the company's cash Inflows and outflows. After a series of questions, you determined that (1) the company had not prepared a cash budget for several quarters and (2) is not up to date on its payables and receivables. You are going to prepare a forecasted income statement and a forecasted cash budget for the fourth quarter. Pertinent information needed has been collected and is outlined below. Pertinent Information: The business manager/accountant and Royce provided projections pertaining to the 2m quarter (April through June 2020) and other information outlined below: 1. Total sales 2nd quarter: 2,500 3-piece set; Sales price is $900/3-piece set 2. Total Sales for the 34 quarter are projected to increase 8.5% above the 2nd quarter total sales due to an aggressive marketing program that began June 1, 2020. Total quarter sales per month are expected to be realized as follows: 40% in July, 35% in August, and 25% in September. The sales budgets expressed in sales dollars and in the number of furniture sets sold are as follows: July August September TOTAL QIR PROJECTED SALES REVENUE SALES 8.5% increase) $610,313 5874.438 $976,500 $2,441,250 SALES: PRICE X QUANTITY $610313 5854 438 $976 500 $2441,250 July Number of furniture Sets Sold August September TOTAL QTR Number of Furniture Sets Sold 678 949 1.085 2.713 3. Monthly Sales are classified as follows and realized in corresponding percentage: a. Cash sales 35% of total sales b. Credit sales 65% of total sales 4. Monthly credit sales are collected as follows and in the corresponding proportion: a. Collected in the month of the sale, 60% b. Collected one month after the sale month, 25% c. Collected the second month after the sale month, 15% Fixed Costs 5. Cost Classifications based on 2nd quarter 2020 information: Costs Variable Costs Raw Materials used in Manufacturing (See corrected COGS Schedule in Part 1, Required #1) $ $ 250,000 Actual 2nd Quarter Income Statement Direct Labor 570,000 Overhead: Rent-Factory Indirect Labor 84,000 Insurance - Factory (66 2/3%) Utility-Factory (50%) 20,000 Depreciation-factory building 30,000 9,000 91,000 General Administrative Advertising Selling & Administrative Wages and Salaries Utility-Selling & Administrative (50%) Insurance-Administrative (332/3%) Depreciation Administrative 90,000 20,000 270,000 135,000 9,000 15,000 135,000 6. All factory overhead and administrative expenses (except depreciation) are paid in cash in the month the cost is incurred. 7. Direct labor is paid at the end of the month 8. Raw material purchases are paid as follows: 60% in the month of the purchase, 20% the month after the purchase, and 20% in the second month following the purchase. The raw materials budget is as follows: July August September TOTAL QTR RAW MATERIAL PURCHASES PROJECTED $745,395 NEEDED FOR SALES DESIRED ENDING LESS: BEGINNING PURCHASES $186,349 46,587 (153,000 $79.936 $260,888 65,222 (46,587) $279,523 $298,158 74,540 165,222) $307,475 $666,935 9. Additional monthly obligation paid in cash include: a. Property taxes, due August 31, $2,950 b. Employee payroll taxes due September 30, $3,000, You have determined that you are going to provide the following information to Joyce and Royce: a. Compute the unit cost of goods sold using 2nd quarter Information and the corrected cost of goods sold statement you prepared in Part One b. Prepare a projected traditional multi-step Income statement for the 3rd quarter using information in "a," above and the 2nd quarter information on the table in "S" above (see the previous page). For proper formatting, see Exhibit 1 at the end of this document. C. Prepare a schedule of projected cash collections from credit sales for each month of the 3rd quarter. Relevant prior months' credit sales: May credit sales, $368,720 June credit sales, $331,840 d. Prepare a schedule of projected cash payments for raw materials for each month of the 3rd quarter Relevant prior months' credit (on account) purchases: May purchases on account, $344,100 June purchases on account, $309,720 e. Prepare a projected cash budget for the total 3rd quarter. Your budget should include a monthly budget for each of the three months in the quarter. The cash balance on July 1, 2020 is $1,270,000