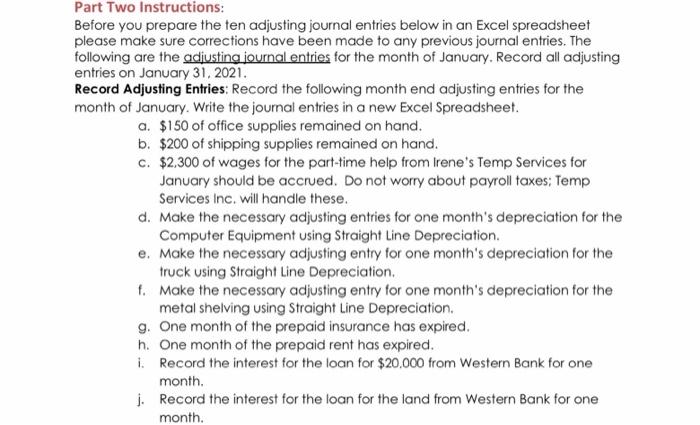

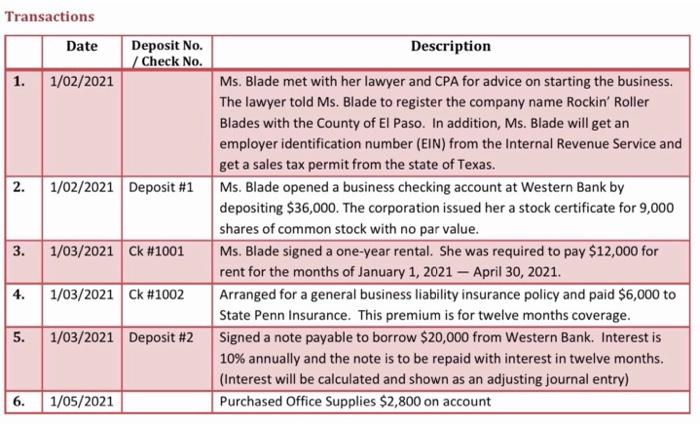

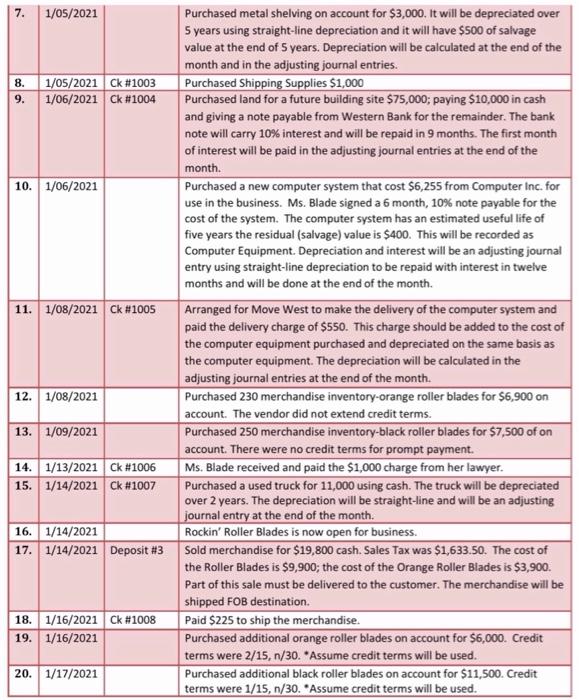

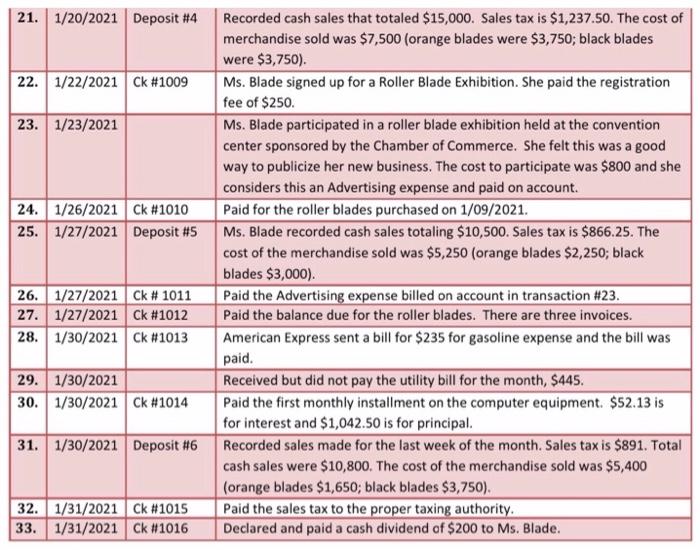

Part Two Instructions: Before you prepare the ten adjusting journal entries below in an Excel spreadsheet please make sure corrections have been made to any previous journal entries. The following are the adjusting journal entries for the month of January, Record all adjusting entries on January 31, 2021. Record Adjusting Entries: Record the following month end adjusting entries for the month of January. Write the journal entries in a new Excel Spreadsheet. a. $150 of office supplies remained on hand. b. $200 of shipping supplies remained on hand. C. $2,300 of wages for the part-time help from Irene's Temp Services for January should be accrued. Do not worry about payroll taxes: Temp Services Inc. will handle these. d. Make the necessary adjusting entries for one month's depreciation for the Computer Equipment using Straight Line Depreciation. e. Make the necessary adjusting entry for one month's depreciation for the truck using Straight Line Depreciation. 1. Make the necessary adjusting entry for one month's depreciation for the metal shelving using Straight Line Depreciation. g. One month of the prepaid insurance has expired. h. One month of the prepaid rent has expired. 1. Record the interest for the loan for $20,000 from Western Bank for one month. 1. Record the interest for the loan for the land from Western Bank for one month. Transactions Date Deposit No. Description Check No. 1. 1/02/2021 Ms. Blade met with her lawyer and CPA for advice on starting the business. The lawyer told Ms. Blade to register the company name Rockin' Roller Blades with the County of El Paso. In addition, Ms. Blade will get an employer identification number (EIN) from the Internal Revenue Service and get a sales tax permit from the state of Texas. 2. 1/02/2021 Deposit #1 Ms. Blade opened a business checking account at Western Bank by depositing $36,000. The corporation issued her a stock certificate for 9,000 shares of common stock with no par value. 3. 1/03/2021 Ck #1001 Ms. Blade signed a one-year rental. She was required to pay $12,000 for rent for the months of January 1, 2021 - April 30, 2021. 4. 1/03/2021 Ck #1002 Arranged for a general business liability insurance policy and paid $6,000 to State Penn Insurance. This premium is for twelve months coverage. 5. 1/03/2021 Deposit #2 Signed a note payable to borrow $20,000 from Western Bank. Interest is 10% annually and the note is to be repaid with interest in twelve months. (Interest will be calculated and shown as an adjusting journal entry) 6. 1/05/2021 Purchased Office Supplies $2,800 on account 7. 1/05/2021 Purchased metal shelving on account for $3,000. It will be depreciated over 5 years using straight-line depreciation and it will have $500 of salvage value at the end of 5 years. Depreciation will be calculated at the end of the month and in the adjusting journal entries. 8. 1/05/2021 Ck #1003 Purchased Shipping Supplies $1,000 9. 1/06/2021 Ck #1004 Purchased land for a future building site $75,000; paying $10,000 in cash and giving a note payable from Western Bank for the remainder. The bank note will carry 10% interest and will be repaid in 9 months. The first month of interest will be paid in the adjusting journal entries at the end of the month. 10. 1/06/2021 Purchased a new computer system that cost $6,255 from Computer Inc. for use in the business. Ms. Blade signed a 6 month, 10% note payable for the cost of the system. The computer system has an estimated useful life of five years the residual (salvage) value is $400. This will be recorded as Computer Equipment. Depreciation and interest will be an adjusting journal entry using straight-line depreciation to be repaid with interest in twelve months and will be done at the end of the month. 11. 1/08/2021 Ck #1005 Arranged for Move West to make the delivery of the computer system and paid the delivery charge of $550. This charge should be added to the cost of the computer equipment purchased and depreciated on the same basis as the computer equipment. The depreciation will be calculated in the adjusting journal entries at the end of the month. 12. 1/08/2021 Purchased 230 merchandise inventory-orange roller blades for $6,900 on account. The vendor did not extend credit terms. 13. 1/09/2021 Purchased 250 merchandise inventory-black roller blades for $7,500 of on account. There were no credit terms for prompt payment. 14. 1/13/2021 Ck #1006 Ms. Blade received and paid the $1,000 charge from her lawyer. 15. 1/14/2021 Ck #1007 Purchased a used truck for 11,000 using cash. The truck will be depreciated over 2 years. The depreciation will be straight-line and will be an adjusting journal entry at the end of the month. 16. 1/14/2021 Rockin' Roller Blades is now open for business. 17. 1/14/2021 Deposit #3 Sold merchandise for $19,800 cash. Sales Tax was $1,633.50. The cost of the Roller Blades is $9,900; the cost of the Orange Roller Blades is $3,900. Part of this sale must be delivered to the customer. The merchandise will be shipped FOB destination 18. 1/16/2021 Ck #1008 Paid $225 to ship the merchandise. 19. 1/16/2021 Purchased additional orange roller blades on account for $6,000. Credit terms were 2/15, n/30. Assume credit terms will be used. 20. 1/17/2021 Purchased additional black roller blades on account for $11,500. Credit terms were 1/15, 1/30. Assume credit terms will be used. 21. 1/20/2021 Deposit #4 Recorded cash sales that totaled $15,000. Sales tax is $1,237.50. The cost of merchandise sold was $7,500 (orange blades were $3,750; black blades were $3,750). 22. 1/22/2021 Ck #1009 Ms. Blade signed up for a Roller Blade Exhibition. She paid the registration fee of $250. 23. 1/23/2021 Ms. Blade participated in a roller blade exhibition held at the convention center sponsored by the Chamber of Commerce. She felt this was a good way to publicize her new business. The cost to participate was $800 and she considers this an Advertising expense and paid on account. 24. 1/26/2021 Ck #1010 Paid for the roller blades purchased on 1/09/2021. 25. 1/27/2021 Deposit #5 Ms. Blade recorded cash sales totaling $10,500. Sales tax is $866.25. The cost of the merchandise sold was $5,250 (orange blades $2,250; black blades $3,000). 26. 1/27/2021 Ck # 1011 Paid the Advertising expense billed on account in transaction #23. 27. 1/27/2021 Ck #1012 Paid the balance due for the roller blades. There are three invoices. 28. 1/30/2021 Ck #1013 American Express sent a bill for $235 for gasoline expense and the bill was paid. 29. 1/30/2021 Received but did not pay the utility bill for the month, $445. 30. 1/30/2021 Ck #1014 Paid the first monthly installment on the computer equipment. $52.13 is for interest and $1,042.50 is for principal. 31. 1/30/2021 Deposit #6 Recorded sales made for the last week of the month. Sales tax is $891. Total cash sales were $10,800. The cost of the merchandise sold was $5,400 (orange blades $1,650; black blades $3,750). 32. 1/31/2021 Ck #1015 Paid the sales tax to the proper taxing authority 33. 1/31/2021 Ck #1016 Declared and paid a cash dividend of $200 to Ms. Blade