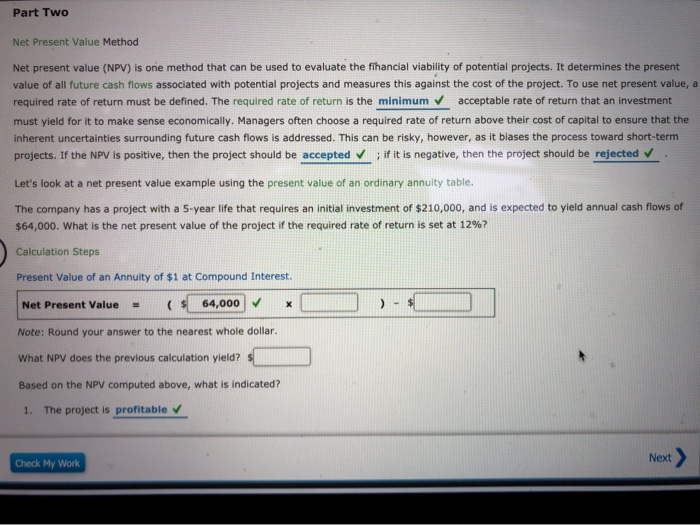

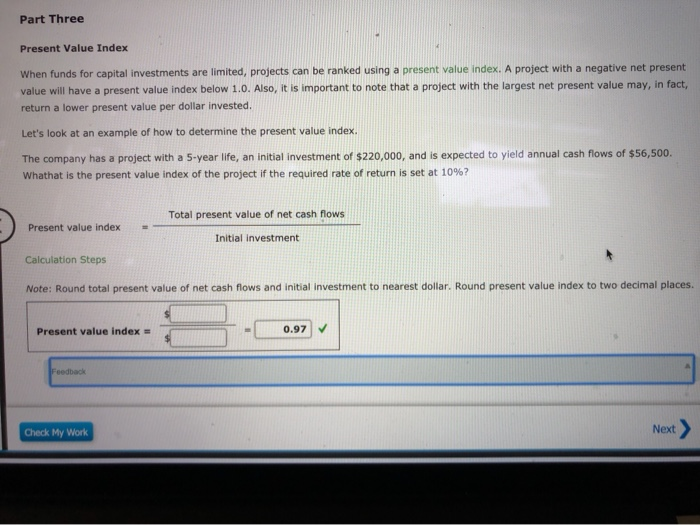

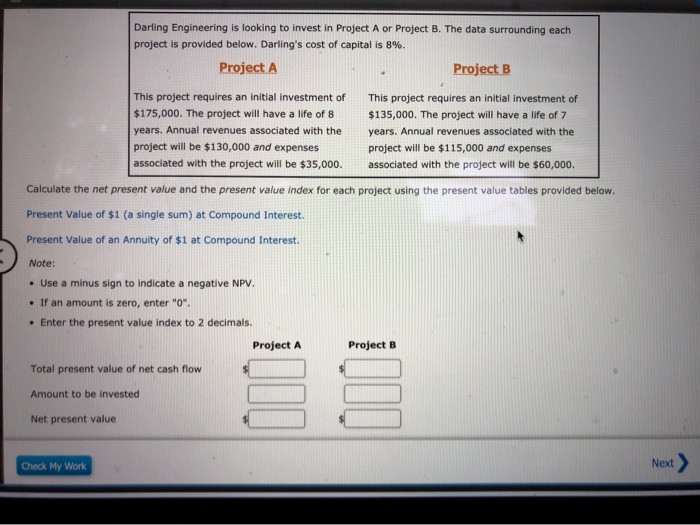

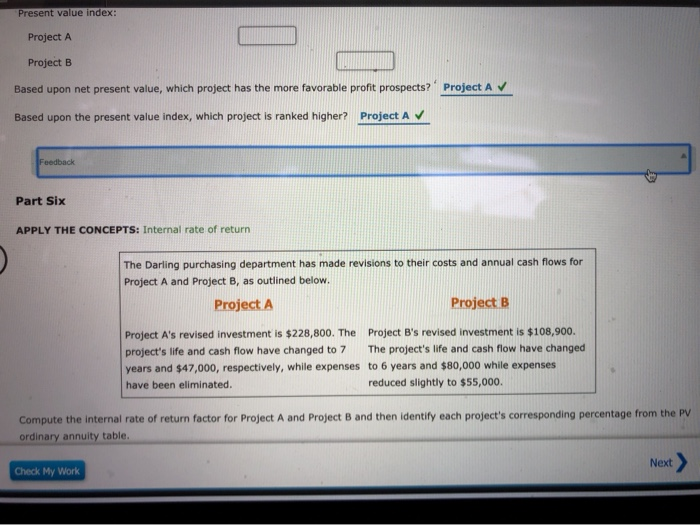

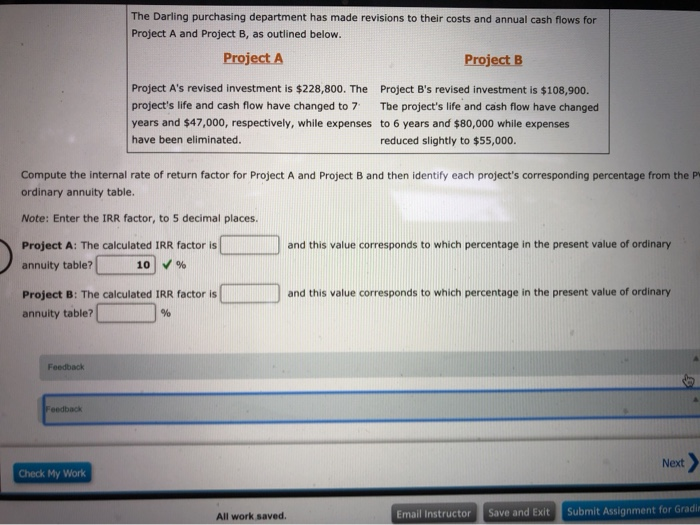

Part Two Net Present Value Method Net present value (NPV) is one method that can be used to evaluate the fihancial viability of potential projects. It determines the present value of all future cash flows associated with potential projects and measures this against the cost of the project. To use net present value, a required rate of return must be defined. The required rate of return is the minimum acceptable rate of return that an investment must yield for it to make sense economically, Managers often choose a required rate of return above their cost of capital to ensure that the Inherent uncertainties surrounding future cash flows is addressed. This can be risky, however, as it biases the process toward short-term projects. If the NPV is positive, then the project should be accepted ; if it is negative, then the project should be rejected Let's look at a net present value example using the present value of an ordinary annuity table. The company has a project with a 5-year life that requires an initial investment of $210,000, and is expected to yield annual cash flows of $64,000. What is the net present value of the project if the required rate of return is set at 12%? Calculation Steps Present Value of an Annuity of $1 at Compound Interest. Net Present Value = ($ 64,000 Note: Round your answer to the nearest whole dollar. What NPV does the previous calculation yield? Based on the NPV computed above, what is indicated? 1. The project is profitable Check My Work Next > Part Three Present Value Index When funds for capital investments are limited, projects can be ranked using a present value index. A project with a negative net present value will have a present value index below 1.0. Also, it is important to note that a project with the largest net present value may, in fact, return a lower present value per dollar invested. Let's look at an example of how to determine the present value index. The company has a project with a 5-year life, an initial investment of $220,000, and is expected to yield annual cash flows of $56,500. Whathat is the present value index of the project if the required rate of return is set at 10%? Total present value of net cash flows Present value index Initial investment Calculation Steps Note: Round total present value of net cash flows and initial Investment to nearest dollar. Round present value index to two decimal places. Present value index 0.97 Feedback Check My Work Next > Darling Engineering is looking to invest in Project A or Project B. The data surrounding each project is provided below. Darling's cost of capital is 8%. Project A Project B This project requires an initial investment of $175,000. The project will have a life of 8 years. Annual revenues associated with the project will be $130,000 and expenses associated with the project will be $35,000. This project requires an initial investment of $135,000. The project will have a life of 7 years. Annual revenues associated with the project will be $115,000 and expenses associated with the project will be $60,000. Calculate the net present value and the present value Index for each project using the present value tables provided below. Present Value of $1 (a single sum) at Compound Interest. Present Value of an Annuity of $1 at Compound Interest. Note: Use a minus sign to indicate a negative NPV. If an amount is zero, enter "O". Enter the present value index to 2 decimals. Project A Project B Total present value of net cash flow Amount to be invested Net present value Check My Work Next > Present value index: Project A Project B Based upon net present value, which project has the more favorable profit prospects?' Project A Based upon the present value index, which project is ranked higher? Project AV Feedback Part Six APPLY THE CONCEPTS: Internal rate of return The Darling purchasing department has made revisions to their costs and annual cash flows for Project A and Project B, as outlined below. Project A Project B Project A's revised investment is $228,800. The Project B's revised investment is $108,900. project's life and cash flow have changed to 7 The project's life and cash flow have changed years and $47,000, respectively, while expenses to 6 years and $80,000 while expenses have been eliminated. reduced slightly to $55,000. Compute the internal rate of return factor for Project A and Project B and then identify each project's corresponding percentage from the PV ordinary annuity table. Check My Work Next > The Darling purchasing department has made revisions to their costs and annual cash flows for Project A and Project B, as outlined below. Project A Project B Project A's revised investment is $228,800. The Project B's revised investment is $108.900. project's life and cash flow have changed to 7 The project's life and cash flow have changed years and $47,000, respectively, while expenses to 6 years and $80,000 while expenses have been eliminated. reduced slightly to $55,000. Compute the internal rate of return factor for Project A and Project B and then identify each project's corresponding percentage from the P ordinary annuity table. Note: Enter the IRR factor, to 5 decimal places. and this value corresponds to which percentage in the present value of ordinary Project A: The calculated IRR factor is annuity table? 10 % and this value corresponds to which percentage in the present value of ordinary Project B: The calculated IRR factor is annuity table? Feedback Feedback Next > Check My Work All work saved. Email Instructor Save and Exit Submit Assignment for Gradin Part Two Net Present Value Method Net present value (NPV) is one method that can be used to evaluate the fihancial viability of potential projects. It determines the present value of all future cash flows associated with potential projects and measures this against the cost of the project. To use net present value, a required rate of return must be defined. The required rate of return is the minimum acceptable rate of return that an investment must yield for it to make sense economically, Managers often choose a required rate of return above their cost of capital to ensure that the Inherent uncertainties surrounding future cash flows is addressed. This can be risky, however, as it biases the process toward short-term projects. If the NPV is positive, then the project should be accepted ; if it is negative, then the project should be rejected Let's look at a net present value example using the present value of an ordinary annuity table. The company has a project with a 5-year life that requires an initial investment of $210,000, and is expected to yield annual cash flows of $64,000. What is the net present value of the project if the required rate of return is set at 12%? Calculation Steps Present Value of an Annuity of $1 at Compound Interest. Net Present Value = ($ 64,000 Note: Round your answer to the nearest whole dollar. What NPV does the previous calculation yield? Based on the NPV computed above, what is indicated? 1. The project is profitable Check My Work Next > Part Three Present Value Index When funds for capital investments are limited, projects can be ranked using a present value index. A project with a negative net present value will have a present value index below 1.0. Also, it is important to note that a project with the largest net present value may, in fact, return a lower present value per dollar invested. Let's look at an example of how to determine the present value index. The company has a project with a 5-year life, an initial investment of $220,000, and is expected to yield annual cash flows of $56,500. Whathat is the present value index of the project if the required rate of return is set at 10%? Total present value of net cash flows Present value index Initial investment Calculation Steps Note: Round total present value of net cash flows and initial Investment to nearest dollar. Round present value index to two decimal places. Present value index 0.97 Feedback Check My Work Next > Darling Engineering is looking to invest in Project A or Project B. The data surrounding each project is provided below. Darling's cost of capital is 8%. Project A Project B This project requires an initial investment of $175,000. The project will have a life of 8 years. Annual revenues associated with the project will be $130,000 and expenses associated with the project will be $35,000. This project requires an initial investment of $135,000. The project will have a life of 7 years. Annual revenues associated with the project will be $115,000 and expenses associated with the project will be $60,000. Calculate the net present value and the present value Index for each project using the present value tables provided below. Present Value of $1 (a single sum) at Compound Interest. Present Value of an Annuity of $1 at Compound Interest. Note: Use a minus sign to indicate a negative NPV. If an amount is zero, enter "O". Enter the present value index to 2 decimals. Project A Project B Total present value of net cash flow Amount to be invested Net present value Check My Work Next > Present value index: Project A Project B Based upon net present value, which project has the more favorable profit prospects?' Project A Based upon the present value index, which project is ranked higher? Project AV Feedback Part Six APPLY THE CONCEPTS: Internal rate of return The Darling purchasing department has made revisions to their costs and annual cash flows for Project A and Project B, as outlined below. Project A Project B Project A's revised investment is $228,800. The Project B's revised investment is $108,900. project's life and cash flow have changed to 7 The project's life and cash flow have changed years and $47,000, respectively, while expenses to 6 years and $80,000 while expenses have been eliminated. reduced slightly to $55,000. Compute the internal rate of return factor for Project A and Project B and then identify each project's corresponding percentage from the PV ordinary annuity table. Check My Work Next > The Darling purchasing department has made revisions to their costs and annual cash flows for Project A and Project B, as outlined below. Project A Project B Project A's revised investment is $228,800. The Project B's revised investment is $108.900. project's life and cash flow have changed to 7 The project's life and cash flow have changed years and $47,000, respectively, while expenses to 6 years and $80,000 while expenses have been eliminated. reduced slightly to $55,000. Compute the internal rate of return factor for Project A and Project B and then identify each project's corresponding percentage from the P ordinary annuity table. Note: Enter the IRR factor, to 5 decimal places. and this value corresponds to which percentage in the present value of ordinary Project A: The calculated IRR factor is annuity table? 10 % and this value corresponds to which percentage in the present value of ordinary Project B: The calculated IRR factor is annuity table? Feedback Feedback Next > Check My Work All work saved. Email Instructor Save and Exit Submit Assignment for Gradin