Part Two

Part Three

Part Four

Part Five

Part Six

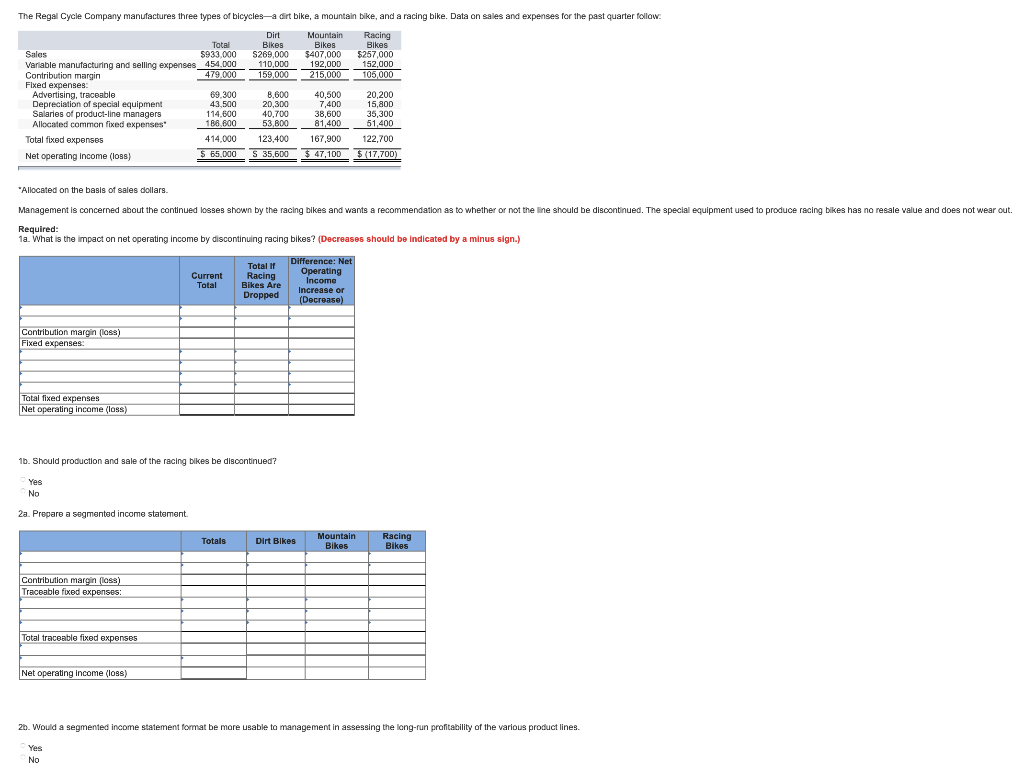

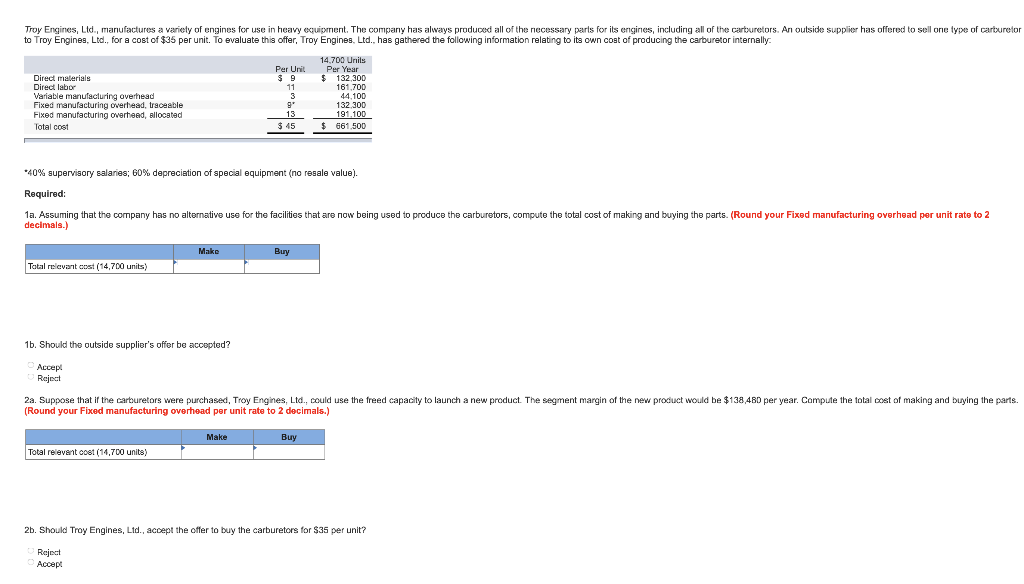

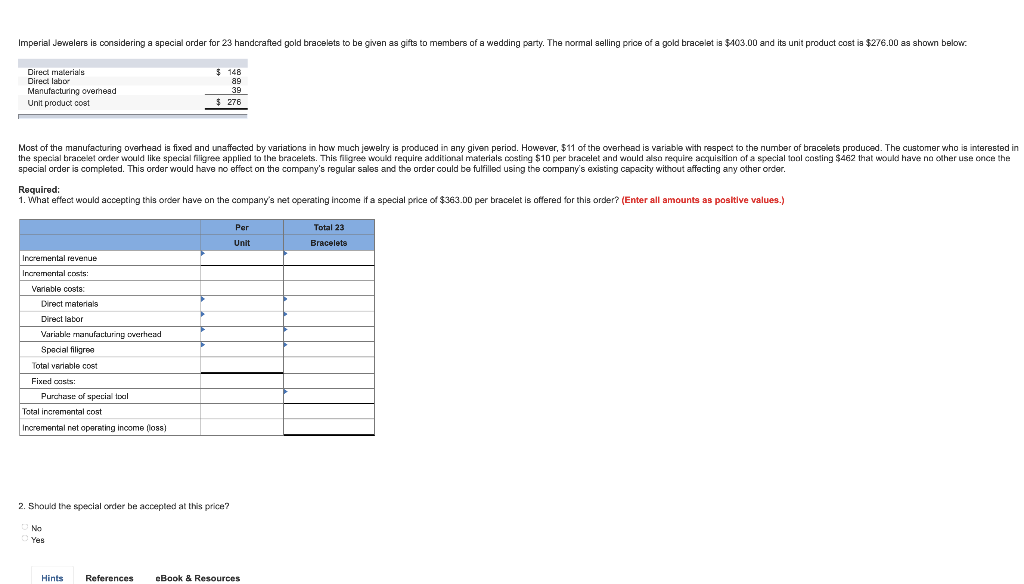

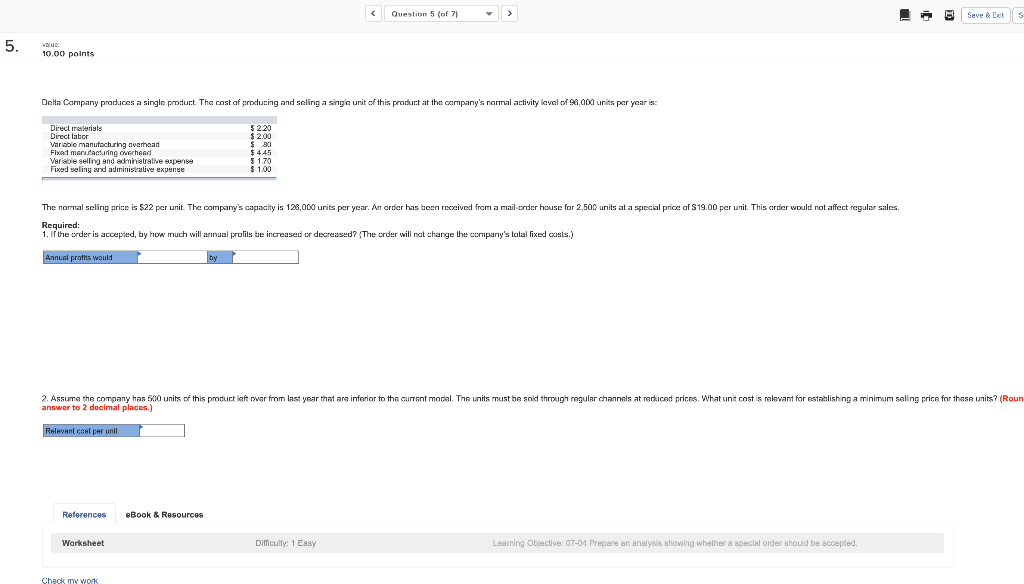

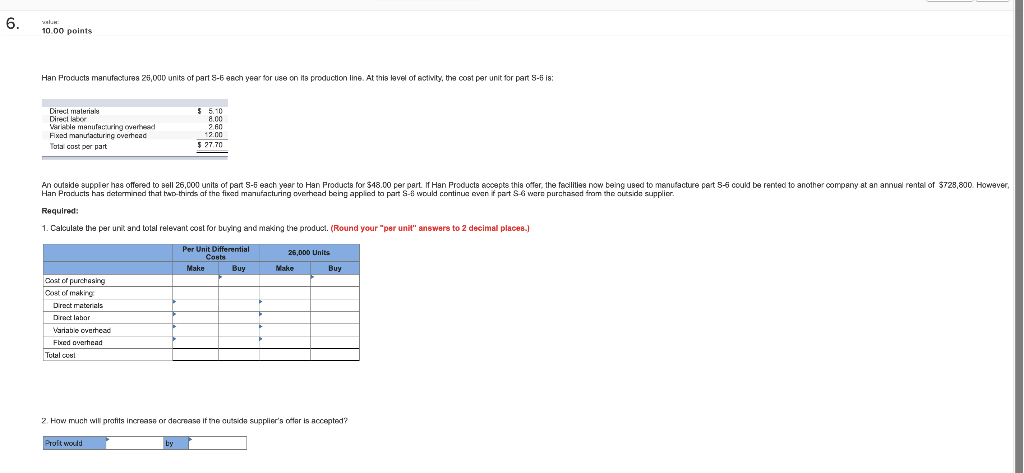

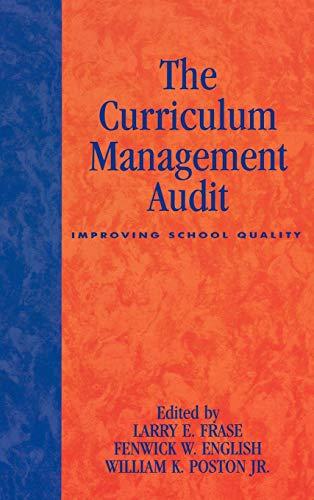

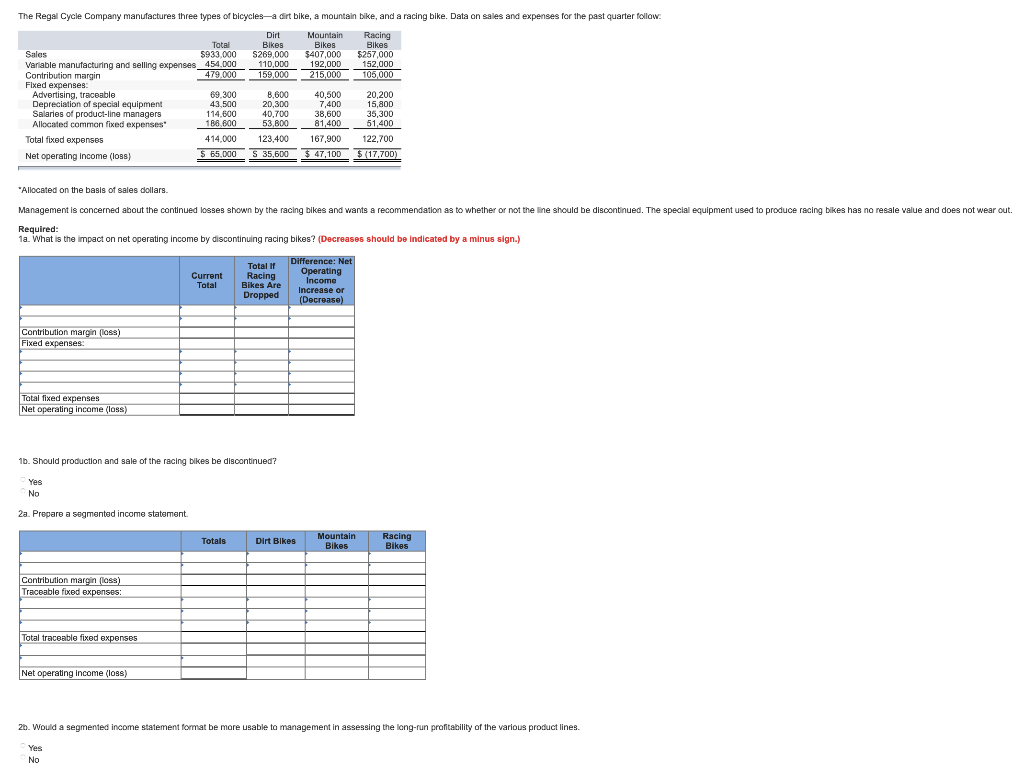

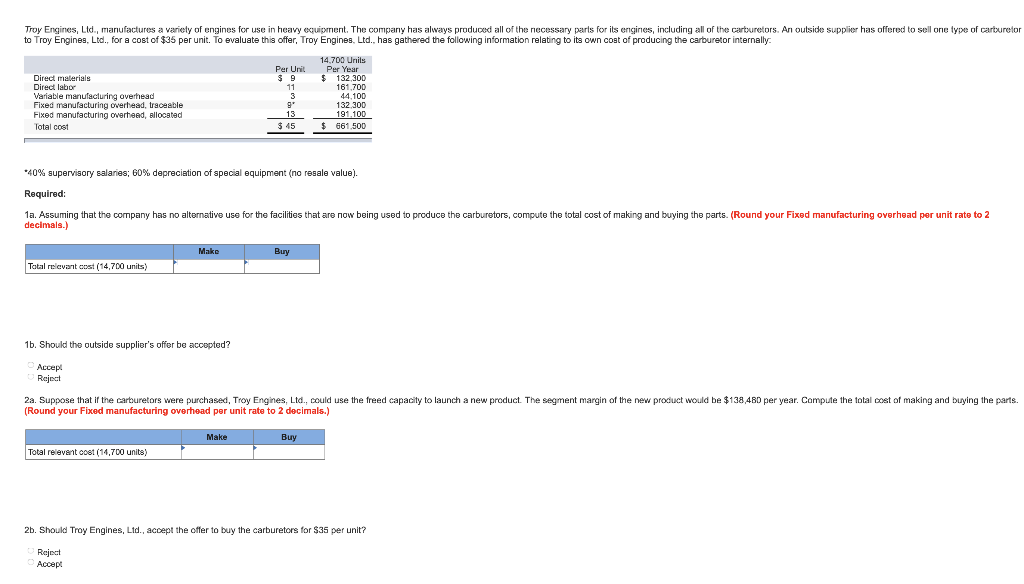

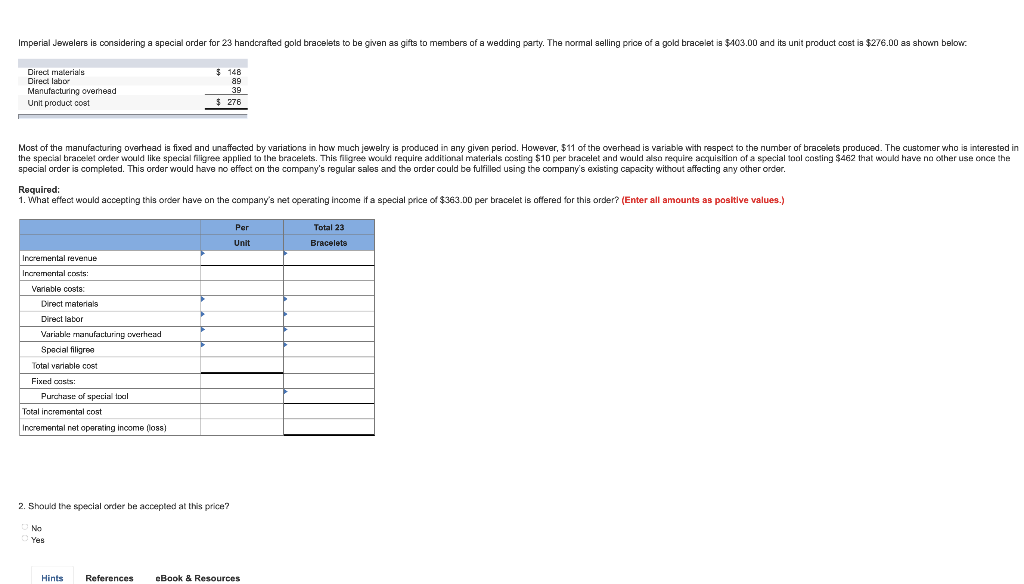

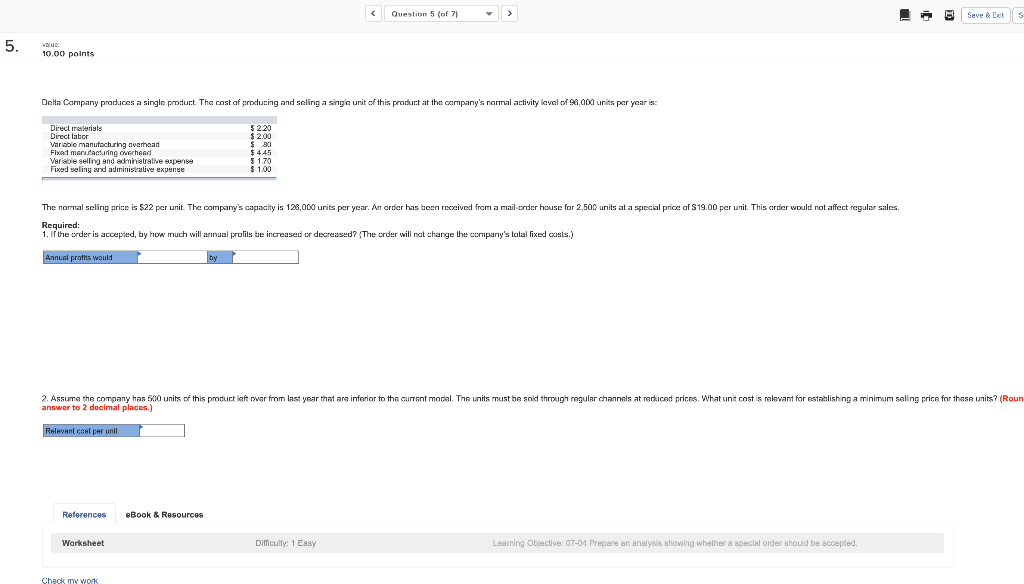

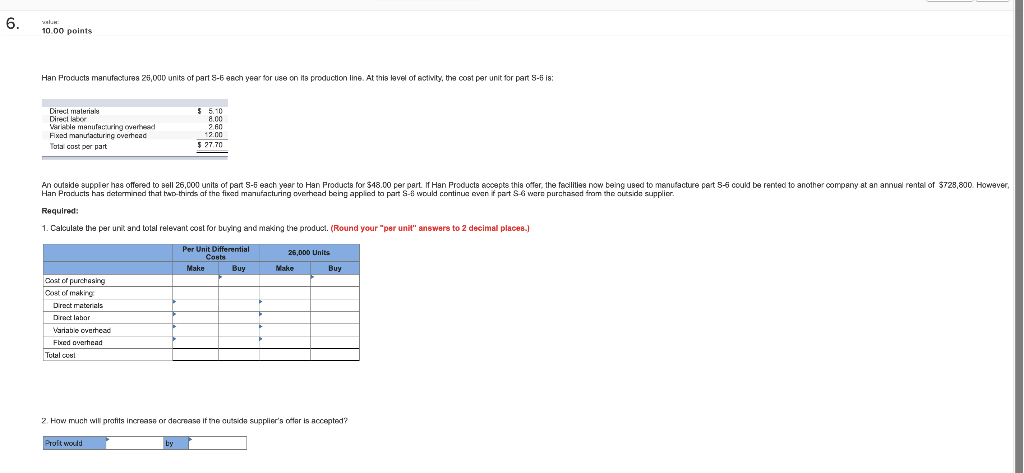

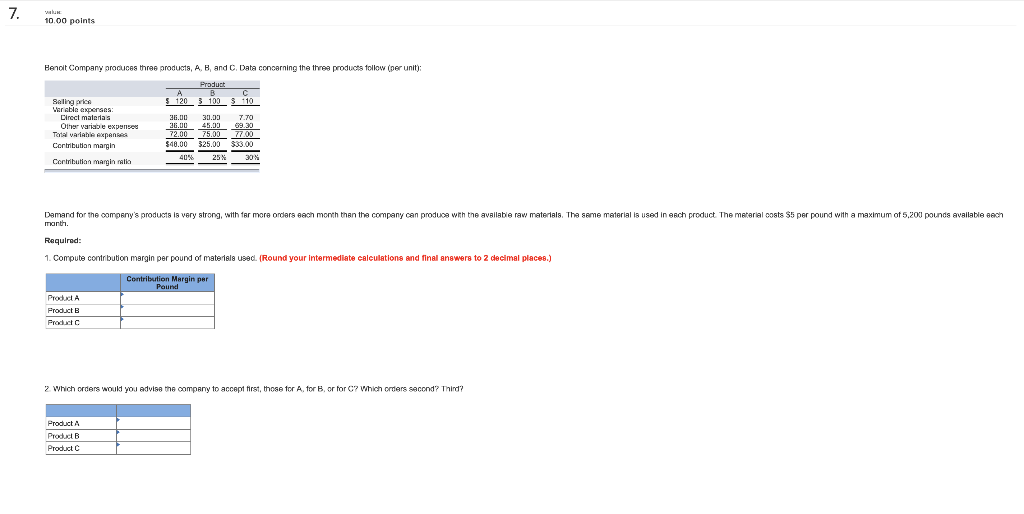

The Regal Cycle Company manufactures three types of bicycles-a dirt bike, a mountain bike, and a racing bike. Data on sales and expenses for the past quarter follow Maunlain Racing Bikon Total Sales $933,000 S269,000 $257,000 $407,000 le manufacturing and selling expenses Contribution margin 216.000 169 000 105.000- 479.000 Flx d isng traceable Depreciation of special equipment dd commen fixed expenses" 69.300 8.600 40,500 7,400 20.200 15.800 43.500 20.300 81 400 61 400 188.600 Total fixed expenses 414,000 123.400 167.900 122,700 S65.000 35,600 $ 47,100 $(17,700) Net operating income (loss) Allocated on the basis of sales dollars. y the racing bikes and wants a recommendation as to whether or not the line should be discontinued. The special equipment used to produce racing bikes has no resale value and does not wear out. Management is concerned about the continued losses shown keqt is the impact on net operating income by discontinuing racing bikes? (Decreases should b indicated by a minus sign.) Differen Net entin Total If Bikee Are Income Dropped Dorreao Contribution margin (loss) Fixed expenses: Total fixed expenses Net operating income (loss) 1b. Should production and sale of the racing bikes be discontinued? Yes No 2a. Prepare a segmented income statement Mountain Racing Bikes Totals Dirt Bikes Bikes Contribution margin (loss) Traceable fixed expenses: Total traceable fixed expensees Net operating income (loss) the various product lines. management in assessing 2b. Would a segmented income statement format more usable e long-run profitability Yes No use in heavy equipment. The company has always produced all of the necessary parls for its engines, including all of the carburetors. An outside supplier has offered to sell one type of carburelor Troy Engines, Ltd., manufactures a variety of engines to Troy Engines, Ltd., or a cost of $35 per unit. To evaluate this offer, Troy Engines, Ltd., has gathered the following information relating to its own cost of producing the carburetor internally 4,700 Unils Per Uni Year Direct malerials 11 ifee l dechuring overhead Fixed manufacturing overhead, traceable facturing overteed, allocatad 132.300 45 $661.500 Total cost 40% supervisory salaries; 60 % depraciation of special equipment (no resale value). Required: 1a. Assuming that the company has no alternative use for the facilities that are now being used to produce the carburetors, compute the total cost of making and buying the parts. (Round your Fixed manufacturing overhead per unit rate to 2 decimals.) Makc Bury Tatal relevant cpst (14.700 units) 1b. Should the outside supplier's offer be accepted? Accep Reinct 2a. Suppose that if the carburetors were purchased, Troy Engines, Ltd., could use the freed capacity to launch a new product. The segment margin of the new product would be $138480 per year. Compute the total cost of making and buying the parts (Round your Fixed manufacturing overhead per unit rate to 2 decimals.) Make Buy Total relevant cost (14,700 units) 2b. Should Troy Engines, Ltd., accept the offer to buy the carburetors for $35 per unit? Reject Accept handcrafted gold bracelets to be given as gifts to members of a wedding party. The normal selling price of a gold bracelet is $403.0 and its unit product cost is $276 0 as shown below Imperial Jewelers is considering a special order for $ 148 Direct malerials Menufacturing ovenead 30 276 Unit product c0st n secial race ld like seialfre al to the racelets This i d rere additinal maerialcig $1n racelet and the company's regular sales and the order could be fulfilled using the company's existing capacity without affecting any other order. ise asiio faial tol csting s tht l hve useccethe special order is completed. This order would have no effect Required: What effect would accepting this order have on the company's net operating income Ifa special price of $363.00 per bracelet is offered for this order? (Enter amounts as positive values.) Per Total 23 Unit Bracelets Incremental revenue Incramenial cbsts Direct materials Direct labor Variable manufacturing overhead Spacial filigree Total verieble cost Fixed oasts Purchase of special toal Total incramental cost Incremental net operating income loss) Should the special order accepted at this price? Hints References eBook & Resources Question 5 (of 7) Seve &Ext 5 vauc 10.00 points Delta Campany praduces a single product The cst of producing and seling a single unit of this product at the campany's narmal activity lavel of 96,000 units par yoar is Direct ralerials Direct laber h ring ovemeat 200 $ 445 Fixad manutactuing owerhead S100 Fixed seling ard administralive expense The nomal seling price is $22 per unit. The campany's capacity is 128,000 units per year. An arder has been received fram a mail-order house for 2,500 units at a special price af $19.00 per unit. This artder would nat affect reqular sales. Required: 1. If the erder is accepled, by how much decreased? (The crder will r l annual profils increased change the company's tolal fixed custs.) Annual pratits wnuld reduced orices. What unit cost is relavant: tovar from last vear that ara inferior to tha currant model 2. Assuma the company has 500 units of this product he units must be sold through reqular channals restablishing a minimum seling price for these units? (Roun answer to 2 decimal places.) Relevent coet per unit References Book & Resources Learning Objective: 07-04 Prepare an analysis showing whether a special order should be accepted. Difficulty: 1 Easy Worksheet Check my work 6. 10.00 noints it for part S- 18: t this lavel of ectvity Han Procucts manufactures 25,000 units of part S-6 esch year for use on ta production line. cost per s 510 Cireel ualeriabs L anutacuring oerh Fixad manutach.rng ovartcad S 27.70 Tata cost por part An outside suppler hes offered to sell 26,000 units of part S-5 each yeer to Han Products for $48.00 per pert. If Han Products eccepts this offer, the fecilities now being used to menufacture part S-5 could be rented to another compeny at an annual rentel of $728,800. However Han Pracucts h i datemined that two-thirds af the fixad manufacuring overhaad being applind to part S- would continua evan if part S- ware purchasad from the autside supplier Required: 1. Caloulate the per unit and totel relevant oost for buving and making e product. (Round your "per unit" anewers to 2 decimal places. Per Unit Differential 26.000 Units 0sbe Make Buy Make Buy Coat of purchesing Cost of making als Droct Labor ariahie cuertead Fbcd qverhcad Tulal cen 2. How much will profits increase decroasa it the qutsida sunnlier's oftar is accepted? Proft wold by 7 10.00 points Henoit Company procuces three products, , B, and C. Data conoarningg the threa products follow (per unit) Pradu A S 120 s100 110 ..... 3i.DD 30.0 .. expense Tatal varlable expani Certnbutan margin - - 405 25h Cortibution margin ratia r more ordars each month than the company can produce wth the available raw materials. The seme material is used in esch product The meterial costs $5 per pound with a maximum of 5,200 pounds available sech Damand fo the compeny's products is very strong, with Required: 1. Compute contribution margin r pound of materisla used. (Round your intermediate calculations and final answers to 2 decimal places.) Contribution Margin per Product A Froduct B Froduct C 2 Which orders would J advise the oompany to accept first, those for A, for B, or for C7 which orders second? Third? ProductA Product E