Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Eastland AG and Westside AG are competing businesses. Both began operations 6 years ago and are quite similar in most respects. The current statements

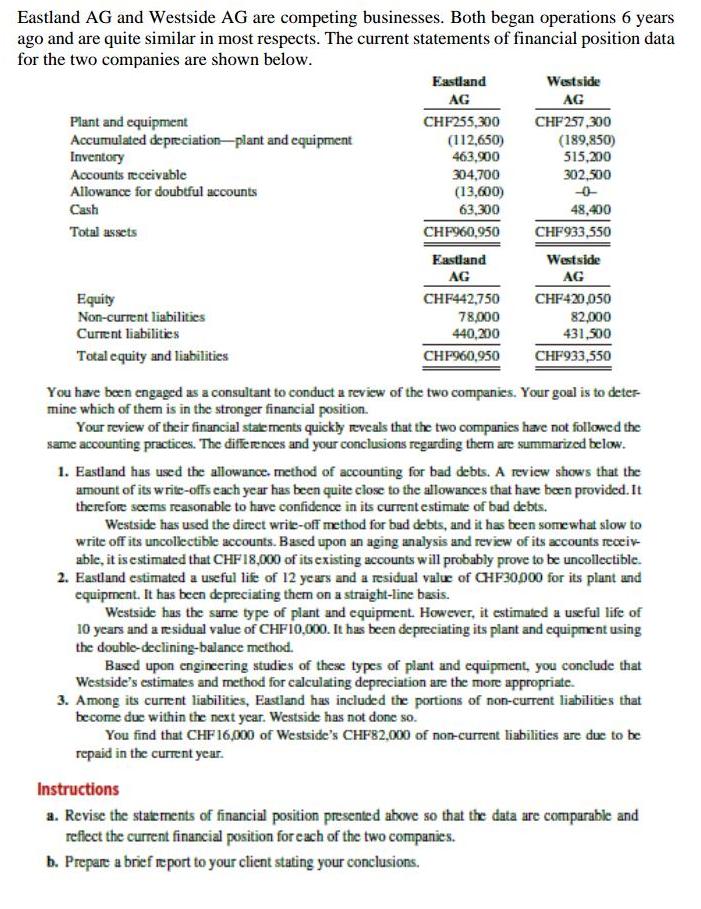

Eastland AG and Westside AG are competing businesses. Both began operations 6 years ago and are quite similar in most respects. The current statements of financial position data for the two companies are shown below. Eastland Westside AG AG CHF255,300 Plant and equipment Accumulated depreciation-plant and cquipment Inventory Accounts receivable Allowance for doubtful accounts CHF257,300 (112,650) 463,900 304,700 (13,600) 63,300 (189,850) 515,200 302,500 Cash 48,400 Total assets CHP960,950 CHF933,550 Eastland Westside AG AG Equity Non-current liabilities CHF442,750 CHF420,050 82,000 431,500 78,000 Current liabilities 440,200 Total cquity and liabilitics CHP960,950 CHF933,550 You have been engaged as a consultant to conduct a revicw of the two companies. Your goal is to deter mine which of them is in the stronger financial position. Your review of their financial state ments quickly reveals that the two companies have not followed the same accounting practices. The differences and your conclusions regarding them are summarized below. 1. Eastland has used the allowance. method of accounting for bad debts. A review shows that the amount of its write-offs cach year has been quite close to the allowances that hae been provided. It therefore seems reasonable to have confidence in its current estimate of bad debts. Westside has used the direct write-off method for bad debts, and it has been somewhat slow to write off its uncollectible accounts. Based upon an aging analysis and review of its accounts receiv able, it is estimated that CHF18,000 of its existing accounts will probably prove to be uncollectible. 2. Eastland estimated a useful lifk of 12 years and a residual valuc of CHF30000 for its plant and equipment. It has bcen depreciating them on a straight-line basis. Westside has the same type of plant and equipment. However, it estimated a useful life of 10 years and a residual value of CHFi0,000. It has been depreciating its plant and equipment using the double-declining-balance method. Based upon engineering studies of these types of plant and equipment, you conclude that Westside's estimates and method for calculating depreciation are the more appropriate. 3. Among its currnt liabilities, Eastland has included the portions of non-current liabilities that become due within the next year. Westside has not done so. You find that CHF 16,000 of Westside's CHF82,000 of non-current liabilities are due to be repaid in the current year. Instructions a. Revise the statements of financial position presented above so that the data are comparable and refiect the current financial position for cach of the two companies. b. Prepare a brief report to your client stating your conclusions.

Step by Step Solution

★★★★★

3.29 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Eastland Company Westside Company Plant and Equipment CHF255300 CHF257300 Accumulated Depreciation2 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started