Answered step by step

Verified Expert Solution

Question

1 Approved Answer

part3 what does the CAPM allow you to calculate. does it imply that a stock with a beta of zero will offer a zero expected

part3 what does the CAPM allow you to calculate. does it imply that a stock with a beta of zero will offer a zero expected rate of return .why

all part to be solved

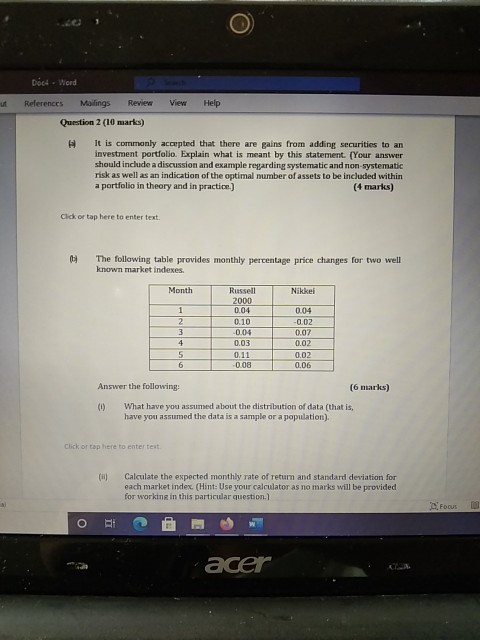

Doce - Word ut View Help References Mailings Review Question 2 (10 marks) It is commonly accepted that there are gains from adding securities to an investment portfolio. Explain what is meant by this statement. (Your answer should include a discussion and example regarding systematic and non-systematic risk as well as an indication of the optimal number of assets to be included within a portfolio in theory and in practice.) (4 marks) Click or tap here to enter text. The following table provides monthly percentage price changes for two well known market indexes. Month Nikkei 1 2 3 4. 5 6 Russell 2000 0.04 0.10 -0.04 0.03 0.11 -0.08 0.04 -0.02 0.07 0.02 0.02 0.06 Answer the following: (6 marks) (0) What have you assumed about the distribution of data (that is, have you assumed the data is a sample or a population) Click or tap here to entertext (a Calculate the expected monthly rate of return and standard deviation for each market index. (Hint: Use your calculator as no marks will be provided for working in this particular question.) Focus O BI acer Doce - Word ut View Help References Mailings Review Question 2 (10 marks) It is commonly accepted that there are gains from adding securities to an investment portfolio. Explain what is meant by this statement. (Your answer should include a discussion and example regarding systematic and non-systematic risk as well as an indication of the optimal number of assets to be included within a portfolio in theory and in practice.) (4 marks) Click or tap here to enter text. The following table provides monthly percentage price changes for two well known market indexes. Month Nikkei 1 2 3 4. 5 6 Russell 2000 0.04 0.10 -0.04 0.03 0.11 -0.08 0.04 -0.02 0.07 0.02 0.02 0.06 Answer the following: (6 marks) (0) What have you assumed about the distribution of data (that is, have you assumed the data is a sample or a population) Click or tap here to entertext (a Calculate the expected monthly rate of return and standard deviation for each market index. (Hint: Use your calculator as no marks will be provided for working in this particular question.) Focus O BI acerStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started