Answered step by step

Verified Expert Solution

Question

1 Approved Answer

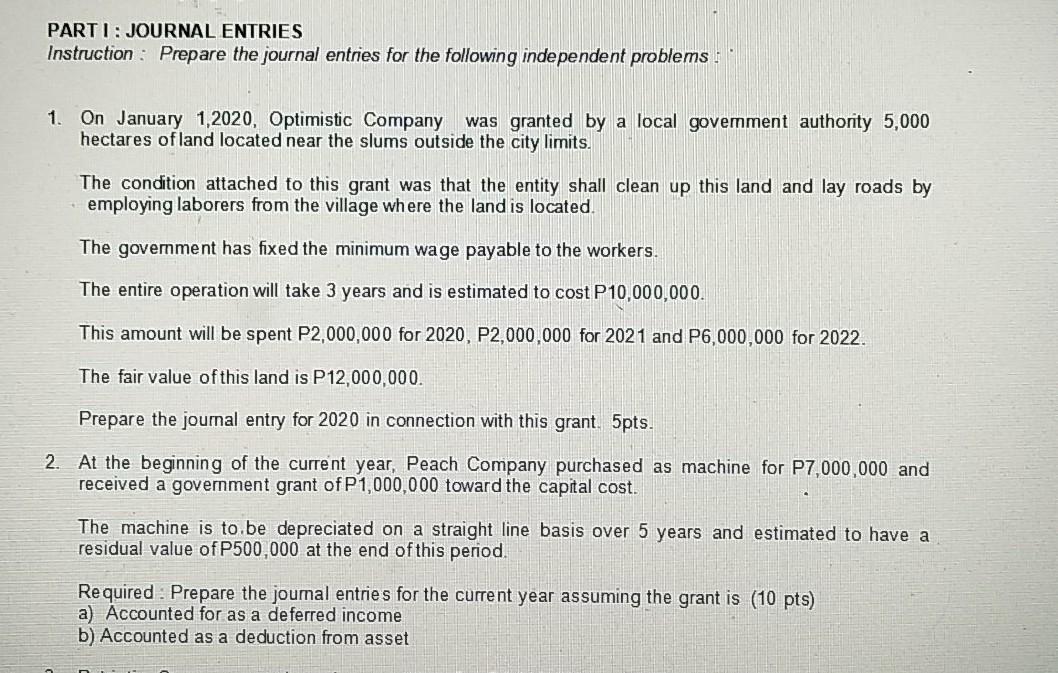

PARTI: JOURNAL ENTRIES Instruction : Prepare the journal entries for the following independent problems : 1. On January 1,2020, Optimistic Company was granted by a

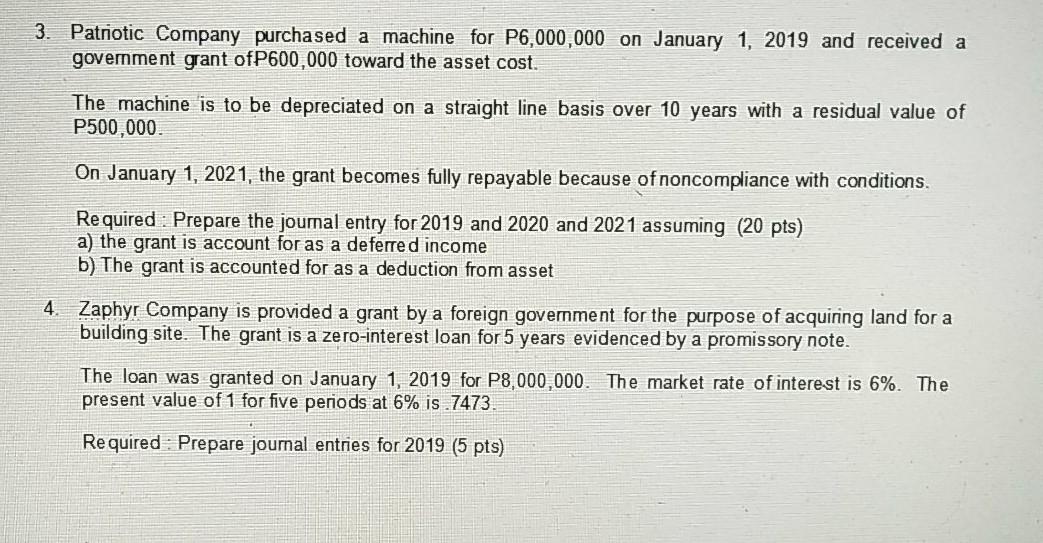

PARTI: JOURNAL ENTRIES Instruction : Prepare the journal entries for the following independent problems : 1. On January 1,2020, Optimistic Company was granted by a local govemment authonty 5,000 hectares of land located near the slums outside the city limits. The condition attached to this grant was that the entity shall clean up this land and lay roads by employing laborers from the village where the land is located The government has fixed the minimum wage payable to the workers. The entire operation will take 3 years and is estimated to cost P10,000,000. This amount will be spent P2,000,000 for 2020, P2,000,000 for 2021 and P6,000,000 for 2022. The fair value of this land is P12,000,000 Prepare the journal entry for 2020 in connection with this grant 5pts. 2 At the beginning of the current year, Peach Company purchased as machine for P7,000,000 and received a government grant of P1,000,000 toward the capital cost. The machine is to be depreciated on a straight line basis over 5 years and estimated to have a residual value of P500,000 at the end of this period. Required. Prepare the journal entries for the current year assuming the grant is (10 pts) a) Accounted for as a deferred income b) Accounted as a deduction from asset 3. Patriotic Company purchased a machine for P6,000,000 on January 1, 2019 and received a goverment grant ofP600,000 toward the asset cost. The machine is to be depreciated on a straight line basis over 10 years with a residual value of P500,000 On January 1, 2021, the grant becomes fully repayable because of noncompliance with conditions. Required : Prepare the joumal entry for 2019 and 2020 and 2021 assuming (20 pts) a) the grant is account for as a deferred income b) The grant is accounted for as a deduction from asset 4. Zaphyr Company is provided a grant by a foreign government for the purpose of acquiring land for a building site. The grant is a zero-interest loan for 5 years evidenced by a promissory note. The loan was granted on January 1, 2019 for P8,000,000. The market rate of interest is 6%. The present value of 1 for five periods at 6% is.7473. Required : Prepare journal entries for 2019 (5 pts)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started