Answered step by step

Verified Expert Solution

Question

1 Approved Answer

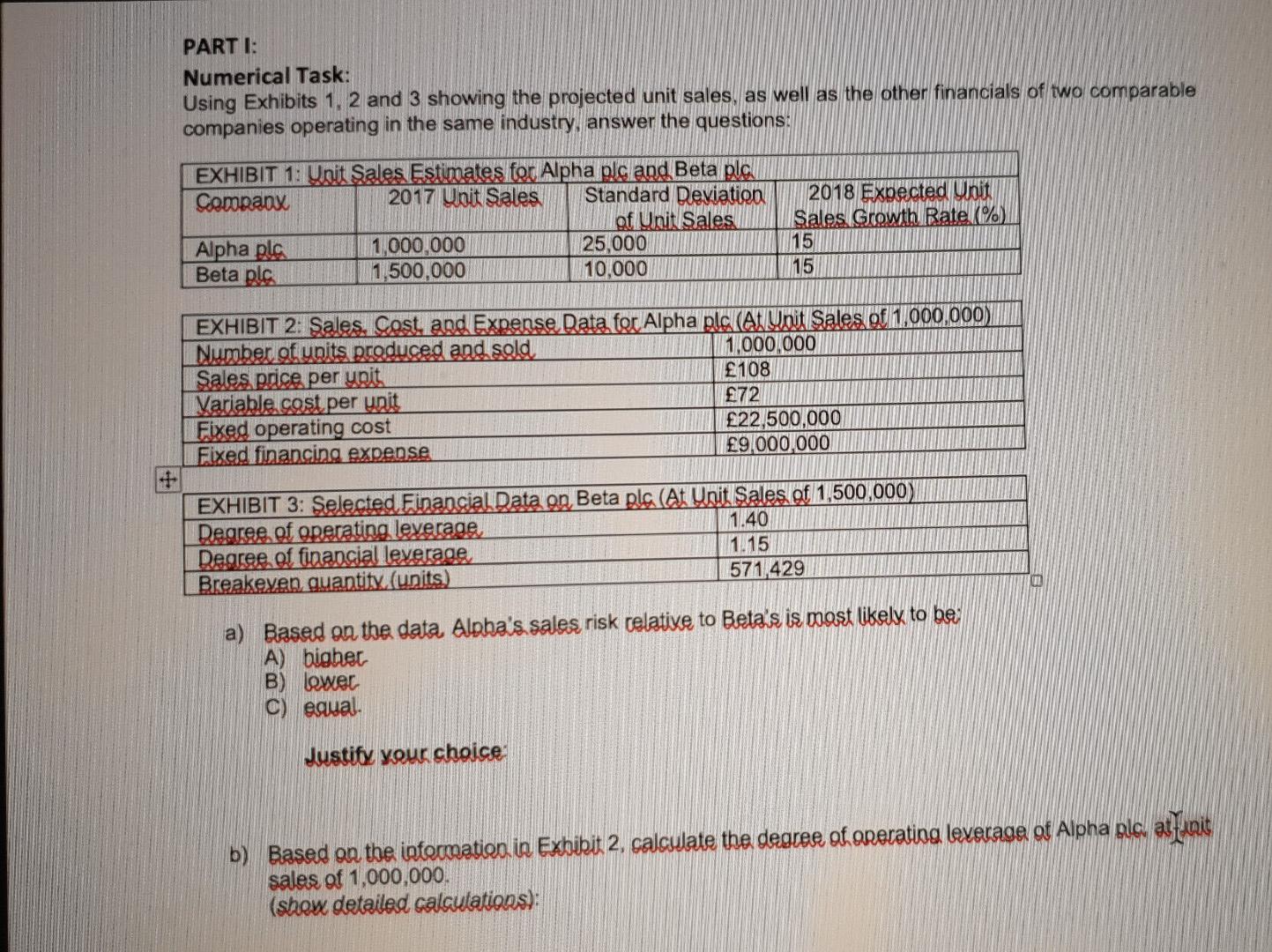

PARTI: Numerical Task: Using Exhibits 1, 2 and 3 showing the projected unit sales, as well as the other financials of two comparable companies operating

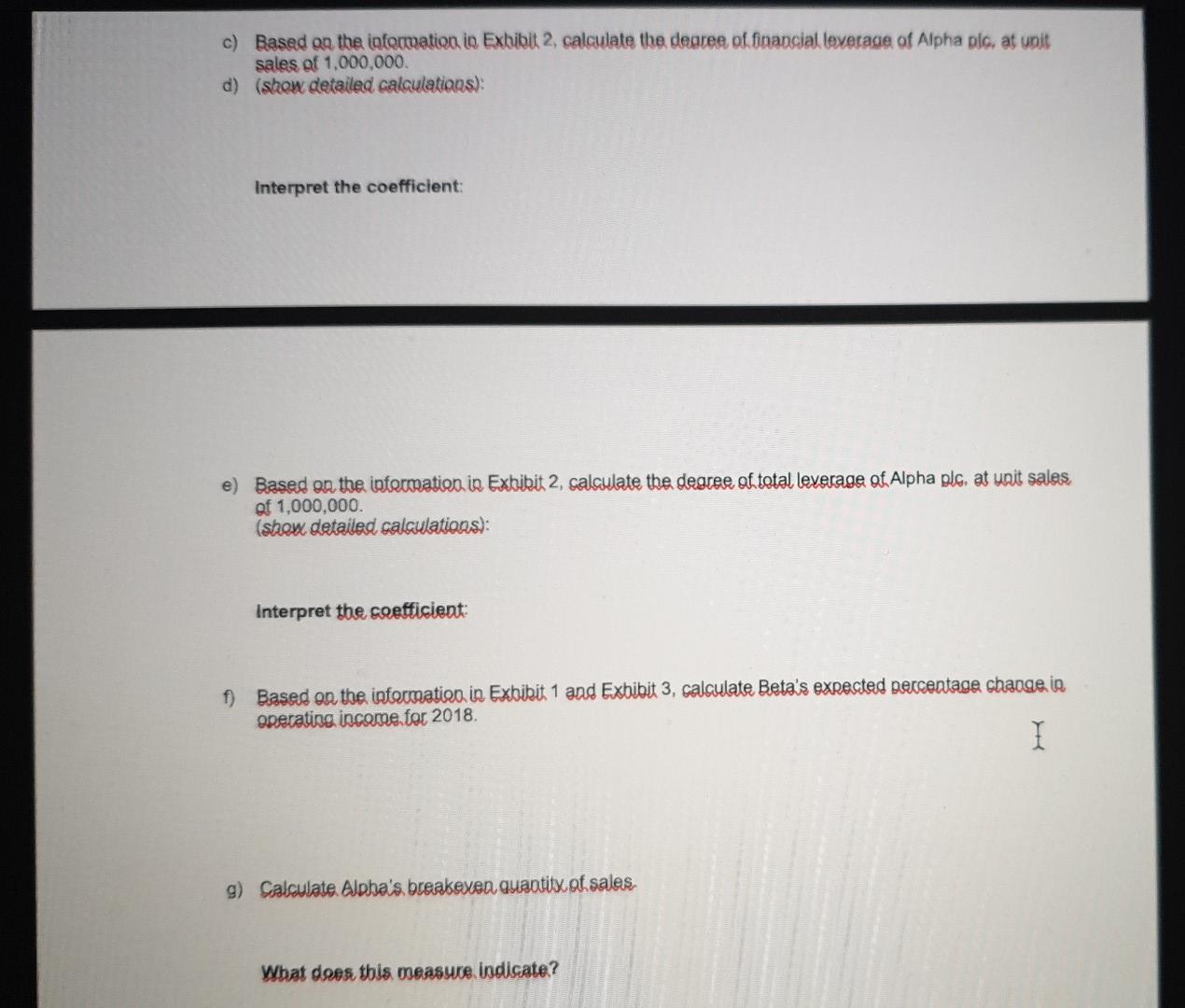

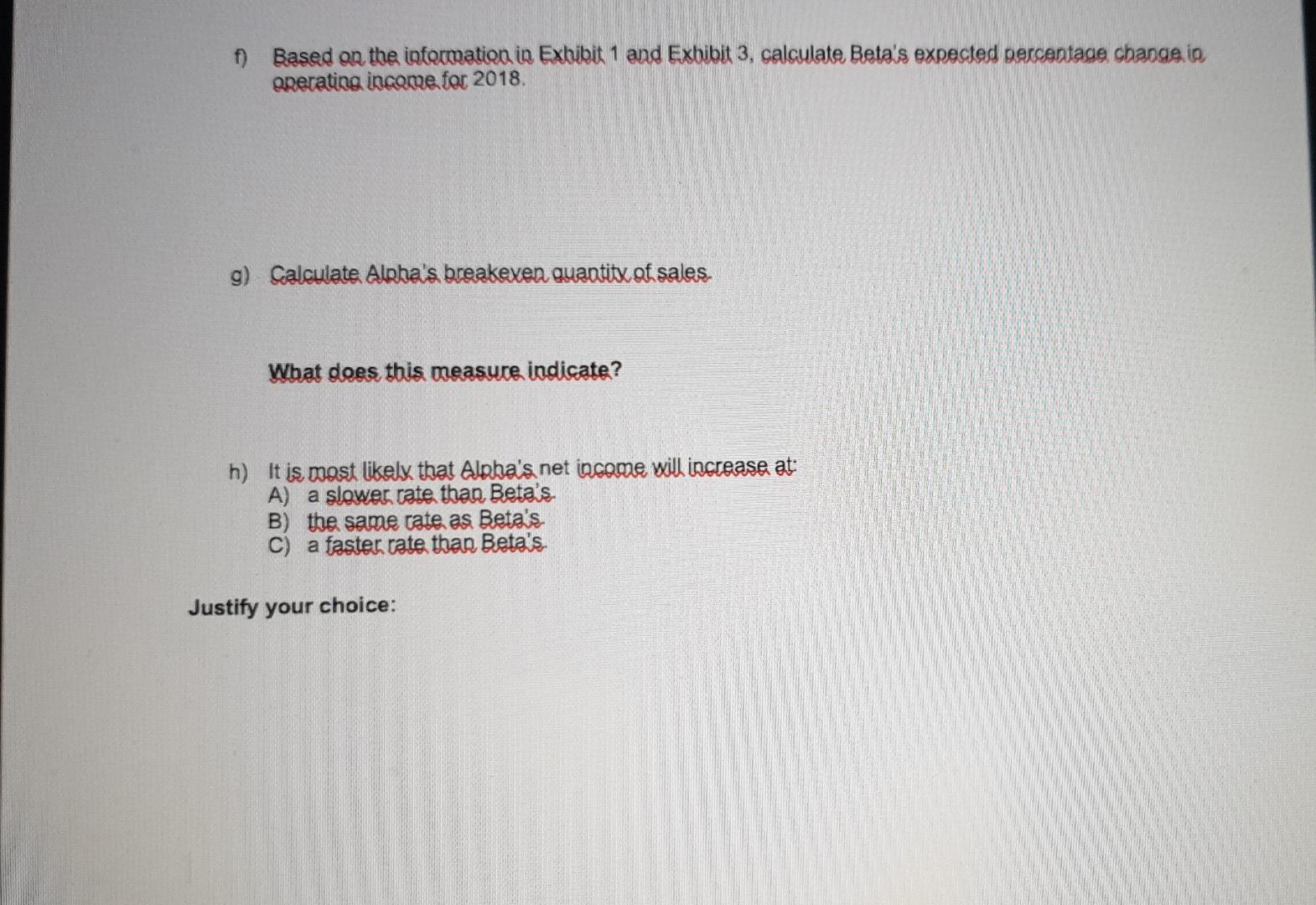

PARTI: Numerical Task: Using Exhibits 1, 2 and 3 showing the projected unit sales, as well as the other financials of two comparable companies operating in the same industry, answer the questions: EXHIBIT 1: Unit Sales Estimates for Alpha plc and Beta plc Companx 2017 Unit Sales Standard Deviation of Unit Sales Alpha pls. 1,000,000 25,000 Beta plc 1,500,000 10,000 2018 Expected Unit Sales Growth Rate(%) 15 15 EXHIBIT 2: Sales. Cost and Expense Data for Alpha plc (Al Unit Sales of 1,000,000) Number of units produced and sold 1,000,000 Sales, price per unit 108 Variable, cost per unit 72 Fixed operating cost 22,500,000 Fixed financing expense 9,000,000 EXHIBIT 3: Selected Financial Data on Beta pls (At Unit Sales of 1,500,000) Degree of operating leverage, 1.40 Degree of financial leverage 1.15 Breakeyen quantity (units) 571,429 Based on the data, Alpha's sales risk relative to Beta's is most likely to be A) bigher B) lewer C) egual. Justify your choice b) Based on the internation in Exhibit 2. calculate the degree of onerating leverage of Alpha pls alunit sales of 1,000,000. (show detailed calculations): c) Based on the information in Exhibit 2, calculate the degree of financial leverage of Alpha plo, at unit sales of 1,000,000 d) (show detailed calculations): Interpret the coefficient: e) Based on the information in Exhibit 2, calculate the degree of total leverage of Alpha plc, at unit sales of 1,000,000 (show detailed calculations): Interpret the coefficient: f) Based on the information in Exbibit 1 and Exhibit 3, calculate Beta's expected percentage change in operating income for 2018. I g) Calculate Alpha's breakeven quantity of sales Wbat does this measure indicate? f) Based on the information in Exhibit 1 and Exbibit 3. calculate Beta's expected percentage change in operating income for 2018. g) Calculate Alpha's breakeven quantity of sales. What does this measure indicate? h) It is most likely that Alpha's net income will increase at: A) a slower rate than Beta's. B) the same rate as Beta's C) a faster rate than Beta's. Justify your choice

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started