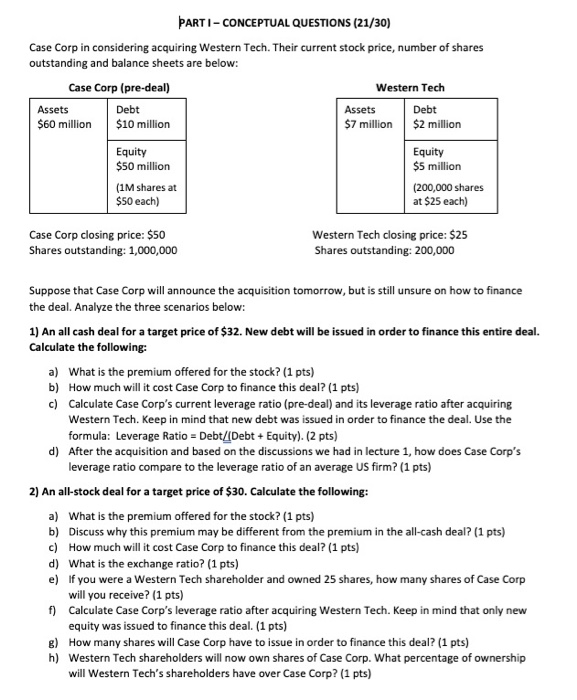

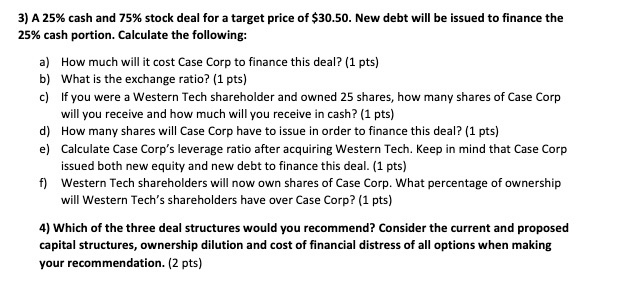

PARTI-CONCEPTUAL QUESTIONS (21/30) Case Corp in considering acquiring Western Tech. Their current stock price, number of shares outstanding and balance sheets are below: Case Corp (pre-deal) Western Tech Assets Debt Assets Debt $60 million $10 million $7 million $2 million Equity $50 million Equity $5 million (1M shares at $50 each) (200,000 shares at $25 each) Case Corp closing price: $50 Shares outstanding: 1,000,000 Western Tech closing price: $25 Shares outstanding: 200,000 Suppose that Case Corp will announce the acquisition tomorrow, but is still unsure on how to finance the deal. Analyze the three scenarios below: 1) An all cash deal for a target price of $32. New debt will be issued in order to finance this entire deal. Calculate the following: a) What is the premium offered for the stock? (1 pts) b) How much will it cost Case Corp to finance this deal? (1 pts) c) Calculate Case Corp's current leverage ratio (pre-deal) and its leverage ratio after acquiring Western Tech. Keep in mind that new debt was issued in order to finance the deal. Use the formula: Leverage Ratio - Debt/Debt + Equity). (2 pts) d) After the acquisition and based on the discussions we had in lecture 1, how does Case Corp's leverage ratio compare to the leverage ratio of an average US firm? (1 pts) 2) An all-stock deal for a target price of $30. Calculate the following: a) What is the premium offered for the stock? (1 pts) b) Discuss why this premium may be different from the premium in the all-cash deal? (1 pts) c) How much will it cost Case Corp to finance this deal? (1 pts) d) What is the exchange ratio? (1 pts) e) If you were a Western Tech shareholder and owned 25 shares, how many shares of Case Corp will you receive? (1 pts) f) Calculate Case Corp's leverage ratio after acquiring Western Tech. Keep in mind that only new equity was issued to finance this deal. (1 pts) 8) How many shares will Case Corp have to issue in order to finance this deal? (1 pts) h) Western Tech shareholders will now own shares of Case Corp. What percentage of ownership will Western Tech's shareholders have over Case Corp? (1 pts) 3) A 25% cash and 75% stock deal for a target price of $30.50. New debt will be issued to finance the 25% cash portion. Calculate the following: a) How much will it cost Case Corp to finance this deal? (1 pts) b) What is the exchange ratio? (1 pts) c) If you were a Western Tech shareholder and owned 25 shares, how many shares of Case Corp will you receive and how much will you receive in cash? (1 pts) d) How many shares will Case Corp have to issue in order to finance this deal? (1 pts) e) Calculate Case Corp's leverage ratio after acquiring Western Tech. Keep in mind that Case Corp issued both new equity and new debt to finance this deal. (1 pts) f) Western Tech shareholders will now own shares of Case Corp. What percentage of ownership will Western Tech's shareholders have over Case Corp? (1 pts) 4) Which of the three deal structures would you recommend? Consider the current and proposed capital structures, ownership dilution and cost of financial distress of all options when making your recommendation. (2 pts)