Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Note students: Prepare the Income Statement first, then prepare the Balance Sheet. If you do NOT follow this rule, the Balance Sheet will NOT

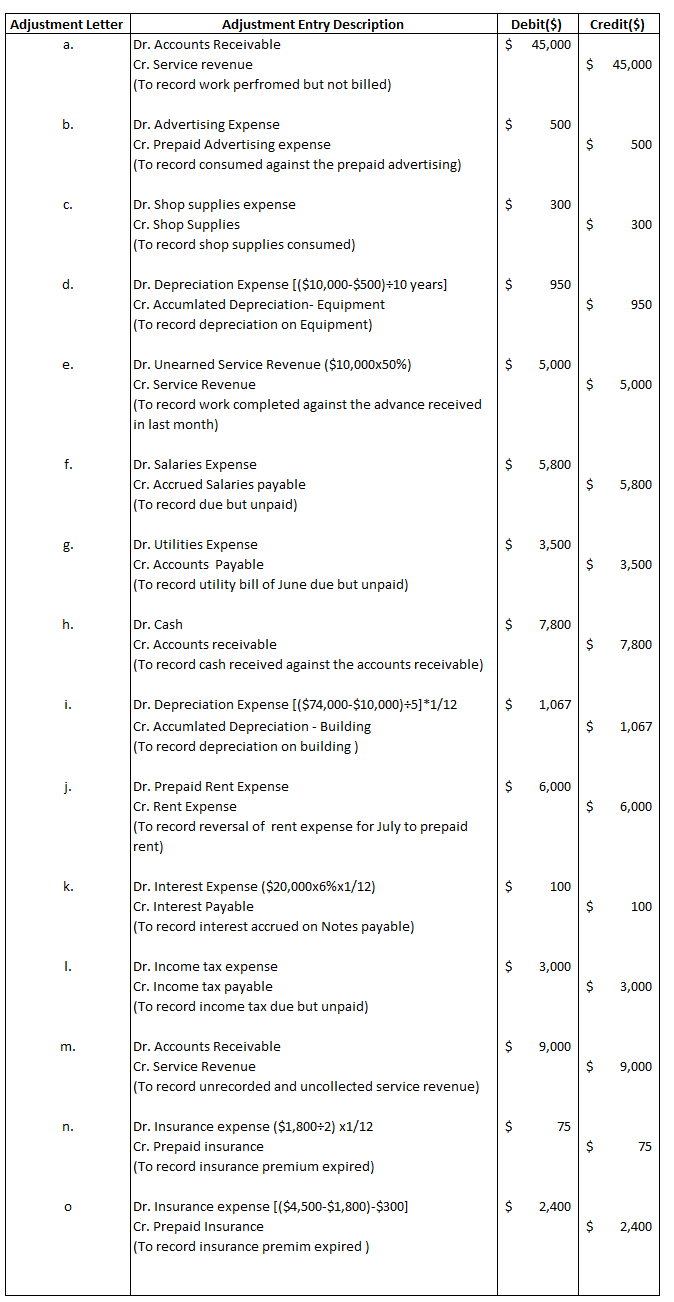

Note students: Prepare the Income Statement first, then prepare the Balance Sheet. If you do NOT follow this rule, the Balance Sheet will NOT Balance Smith and Smith Company Income Statement For the Year Ended June 30 Smith and Smith Company Balance Sheet As of June 30, 2016 Debit($) Credit($) 45,000 $ 45,000 Adjustment Letter a. Dr. Accounts Receivable Adjustment Entry Description $ Cr. Service revenue (To record work perfromed but not billed) b. Dr. Advertising Expense Cr. Prepaid Advertising expense (To record consumed against the prepaid advertising) 500 $ 500 Dr. Shop supplies expense Cr. Shop Supplies 300 $ 300 (To record shop supplies consumed) d. Dr. Depreciation Expense [($10,000-$500)+10 years] 950 Cr. Accumlated Depreciation- Equipment $ 950 (To record depreciation on Equipment) e. Dr. Unearned Service Revenue ($10,000x50%) $ 5,000 Cr. Service Revenue $ 5,000 (To record work completed against the advance received in last month) Dr. Salaries Expense Cr. Accrued Salaries payable $ 5,800 $ 5,800 (To record due but unpaid) g. Dr. Utilities Expense $ 3,500 Cr. Accounts Payable $ 3,500 (To record utility bill of June due but unpaid) Dr. Cash $ 7,800 Cr. Accounts receivable $ 7,800 (To record cash received against the accounts receivable) i. Dr. Depreciation Expense [($74,000-$10,000)+5]*1/12 $ 1,067 Cr. Accumlated Depreciation - Building $ 1,067 (To record depreciation on building) j. Dr. Prepaid Rent Expense $ 6,000 Cr. Rent Expense $ 6,000 (To record reversal of rent expense for July to prepaid rent) Dr. Interest Expense ($20,000x6%x1/12) $ 100 Cr. Interest Payable $ 100 (To record interest accrued on Notes payable) Dr. Income tax expense $ 3,000 Cr. Income tax payable $ 3,000 (To record income tax due but unpaid) m. Dr. Accounts Receivable Cr. Service Revenue $ 9,000 $ 9,000 (To record unrecorded and uncollected service revenue) n. Dr. Insurance expense ($1,800+2) x1/12 Cr. Prepaid insurance (To record insurance premium expired) Dr. Insurance expense [($4,500-$1,800)-$300] Cr. Prepaid Insurance (To record insurance premim expired) 75 75 $ 75 75 $ 2,400 $ 2,400

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started