Answered step by step

Verified Expert Solution

Question

1 Approved Answer

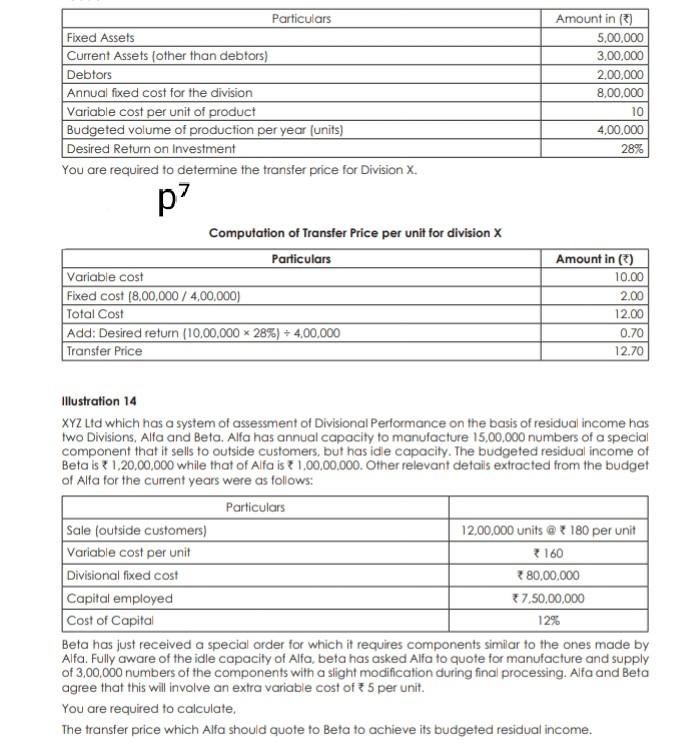

Particulars Fixed Assets Current Assets (other than debtors) Debtors Annual fixed cost for the division Variable cost per unit of product Budgeted volume of production

Particulars Fixed Assets Current Assets (other than debtors) Debtors Annual fixed cost for the division Variable cost per unit of product Budgeted volume of production per year (units) Desired Return on Investment You are required to determine the transfer price for Division X. Amount in (3) 5,00,000 3,00,000 2,00,000 8,00,000 10 4,00.000 28% p7 Computation of Transfer Price per unit for division X Particulars Variable cost Fixed cost (8.00.000 / 4,00,000) Total Cost Add: Desired return (10,00.000 * 28%) + 4,00.000 Transfer Price Amount in () 10.00 2.00 12.00 0.70 12.70 Illustration 14 XYZ Ltd which has a system of assessment of Divisional Performance on the basis of residual income has two Divisions, Alfa and Beta. Alfa has annual capacity to manufacture 15,00,000 numbers of a special component that it sells to outside customers, but has idle capacity. The budgeted residual income of Beta is 1,20,00,000 while that of Alfa is 1,00,00.000. Other relevant details extracted from the budget of Alta for the current years were as follows: Particulars Sale (outside customers) 12,00,000 units @ : 180 per unit Variable cost per unit 160 Divisional fixed cost 280,00.000 Capital employed 37.50,00,000 Cost of Capital 12% Beta has just received a special order for which it requires components similar to the ones made by Alfa. Fully aware of the idle capacity of Alfa, beta has asked Alfa to quote for manufacture and supply of 3,00,000 numbers of the components with a slight modification during final processing. Alfa and Beta agree that this will involve an extra variable cost of 5 per unit. You are required to calculate, The transfer price which Alfa should quote to Beta to achieve its budgeted residual income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started