Answered step by step

Verified Expert Solution

Question

1 Approved Answer

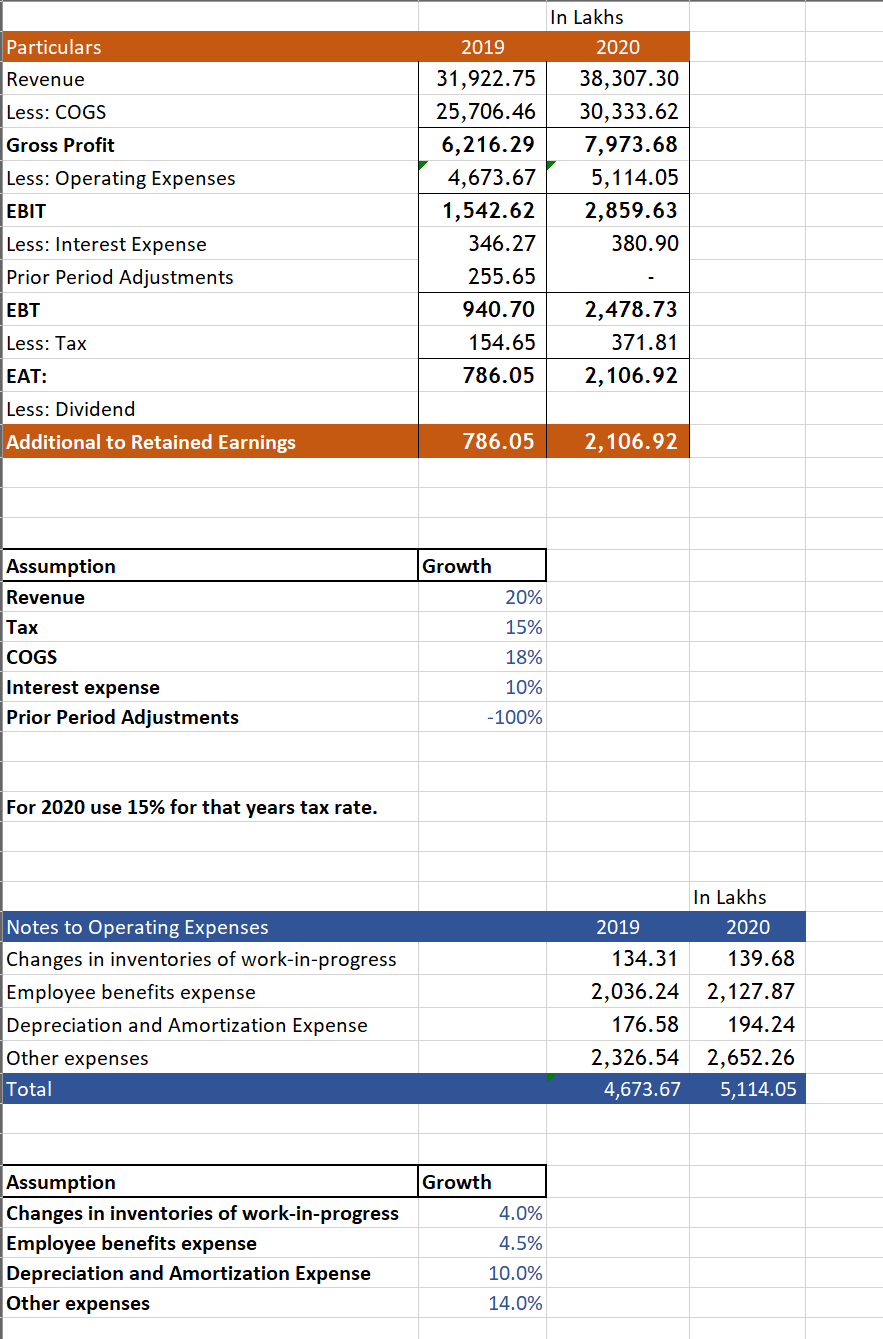

Particulars Revenue Less: COGS 2019 In Lakhs 2020 31,922.75 38,307.30 25,706.46 30,333.62 Gross Profit 6,216.29 7,973.68 Less: Operating Expenses 4,673.67 5,114.05 EBIT 1,542.62 2,859.63

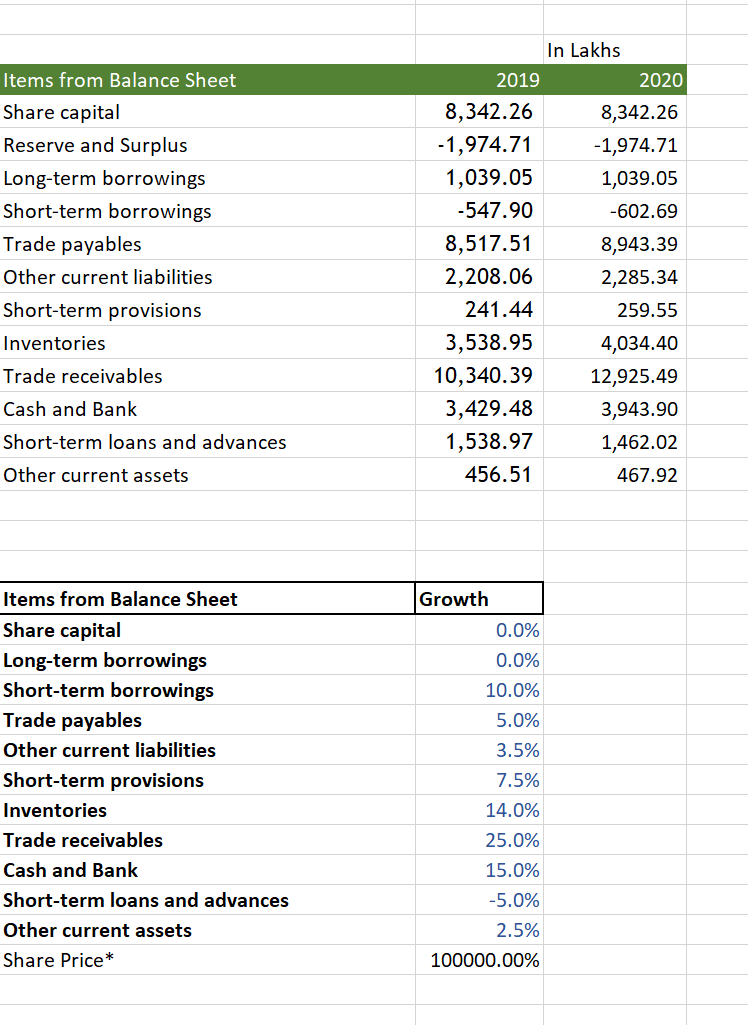

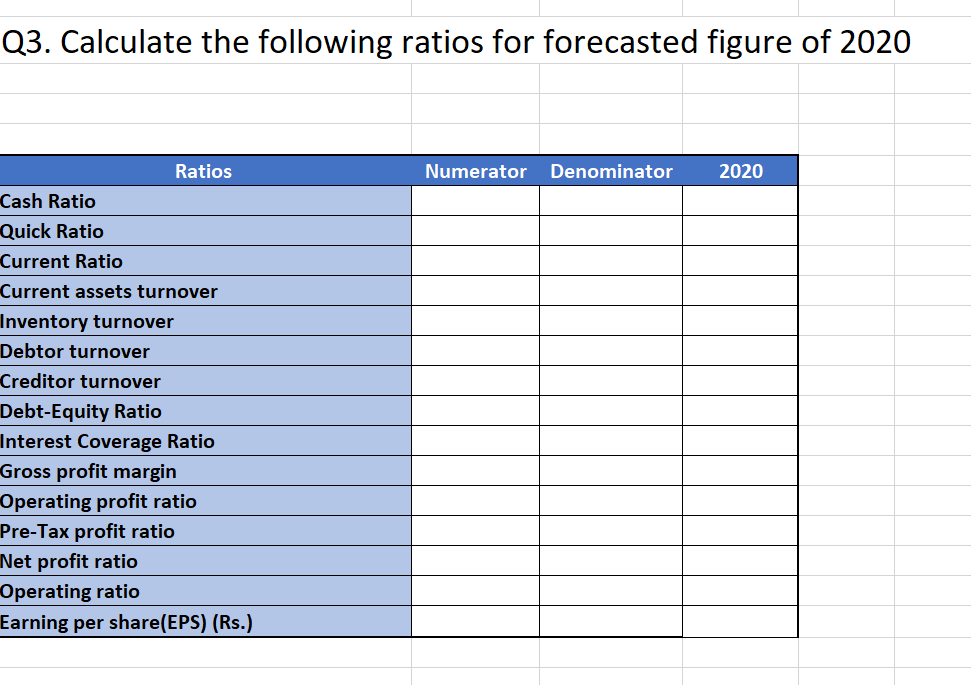

Particulars Revenue Less: COGS 2019 In Lakhs 2020 31,922.75 38,307.30 25,706.46 30,333.62 Gross Profit 6,216.29 7,973.68 Less: Operating Expenses 4,673.67 5,114.05 EBIT 1,542.62 2,859.63 Less: Interest Expense 346.27 380.90 Prior Period Adjustments 255.65 EBT 940.70 2,478.73 Less: Tax 154.65 371.81 EAT: 786.05 2,106.92 Less: Dividend Additional to Retained Earnings 786.05 2,106.92 Assumption Revenue Tax COGS Interest expense Prior Period Adjustments For 2020 use 15% for that years tax rate. Growth 20% 15% 18% 10% -100% Notes to Operating Expenses 2019 Changes in inventories of work-in-progress 134.31 In Lakhs 2020 139.68 Employee benefits expense 2,036.24 2,127.87 Depreciation and Amortization Expense 176.58 194.24 Other expenses 2,326.54 2,652.26 Total 4,673.67 5,114.05 Assumption Growth Changes in inventories of work-in-progress 4.0% Employee benefits expense 4.5% Depreciation and Amortization Expense 10.0% Other expenses 14.0% In Lakhs Items from Balance Sheet 2019 2020 Share capital 8,342.26 8,342.26 Reserve and Surplus -1,974.71 -1,974.71 Long-term borrowings 1,039.05 1,039.05 Short-term borrowings -547.90 -602.69 Trade payables 8,517.51 8,943.39 Other current liabilities 2,208.06 2,285.34 Short-term provisions 241.44 259.55 Inventories 3,538.95 4,034.40 Trade receivables 10,340.39 12,925.49 Cash and Bank 3,429.48 3,943.90 Short-term loans and advances 1,538.97 1,462.02 Other current assets 456.51 467.92 Items from Balance Sheet Growth Share capital 0.0% Long-term borrowings 0.0% Short-term borrowings 10.0% Trade payables 5.0% Other current liabilities 3.5% Short-term provisions 7.5% Inventories 14.0% Trade receivables 25.0% Cash and Bank 15.0% Short-term loans and advances -5.0% Other current assets 2.5% Share Price* 100000.00% Q3. Calculate the following ratios for forecasted figure of 2020 Ratios Cash Ratio Quick Ratio Current Ratio Current assets turnover Inventory turnover Debtor turnover Creditor turnover Debt-Equity Ratio Interest Coverage Ratio Gross profit margin Operating profit ratio Pre-Tax profit ratio Net profit ratio Operating ratio Earning per share(EPS) (Rs.) Numerator Denominator 2020

Step by Step Solution

★★★★★

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Here are the calculations for the required ratios in 2020 Cash Ratio Cash and Bank Current Liabilities Rs 394390 Lakhs Rs 254589 Lakhs Current Liabilities Other Current Liabilities Short Term Provisio...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started