Answered step by step

Verified Expert Solution

Question

1 Approved Answer

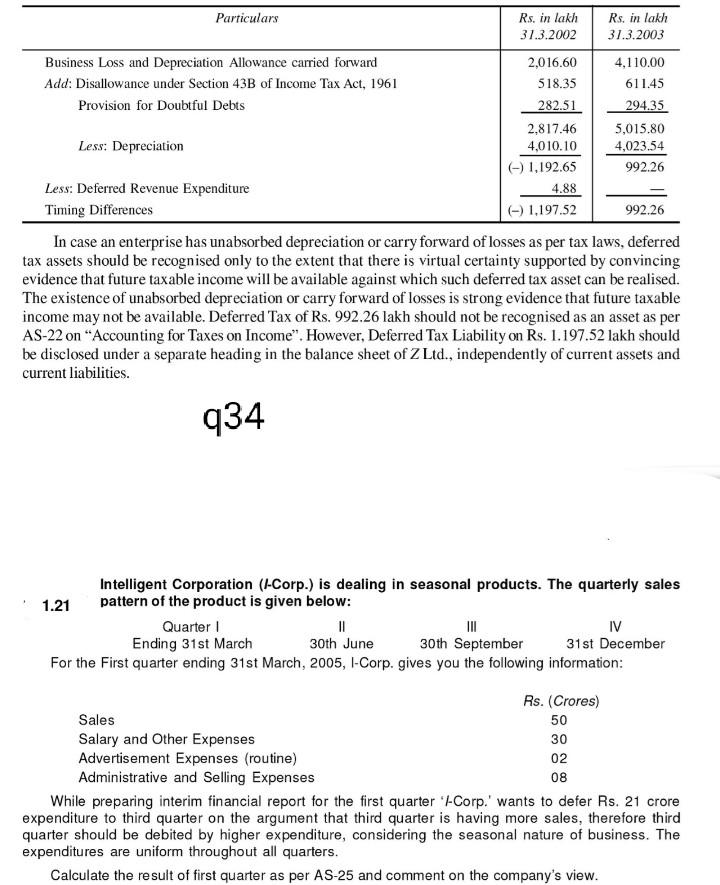

Particulars Rs.in lakh Rs.in lakh 31.3.2002 31.3.2003 Business Loss and Depreciation Allowance carried forward 2,016.60 4,110.00 Add: Disallowance under Section 43B of Income Tax Act,

Particulars Rs.in lakh Rs.in lakh 31.3.2002 31.3.2003 Business Loss and Depreciation Allowance carried forward 2,016.60 4,110.00 Add: Disallowance under Section 43B of Income Tax Act, 1961 518.35 611.45 Provision for Doubtful Debts 282.51 294.35 2,817.46 5,015,80 Less: Depreciation 4,010.10 4,023.54 (-) 1,192.65 992.26 Less: Deferred Revenue Expenditure 4.88 Timing Differences (-) 1.197.52 992.26 In case an enterprise has unabsorbed depreciation or carry forward of losses as per tax laws, deferred tax assets should be recognised only to the extent that there is virtual certainty supported by convincing evidence that future taxable income will be available against which such deferred tax asset can be realised. The existence of unabsorbed depreciation or carry forward of losses is strong evidence that future taxable income may not be available. Deferred Tax of Rs. 992.26 lakh should not be recognised as an asset as per AS-22 on Accounting for Taxes on Income. However, Deferred Tax Liability on Rs. 1.197.52 lakh should be disclosed under a separate heading in the balance sheet of 2 Ltd., independently of current assets and current liabilities. 934 Intelligent Corporation (1-Corp.) is dealing in seasonal products. The quarterly sales 1.21 pattern of the product is given below: Quarter 11 III IV Ending 31st March 30th Jun 30th September 31st December For the First quarter ending 31st March, 2005, l-Corp. gives you the following information: 30 Rs. (Crores) Sales 50 Salary and Other Expenses Advertisement Expenses (routine) 02 Administrative and Selling Expenses 08 While preparing interim financial report for the first quarter ' l-Corp.' wants to defer Rs. 21 crore expenditure to third quarter on the argument that third quarter is having more sales, therefore third quarter should be debited by higher expenditure, considering the seasonal nature of business. The expenditures are uniform throughout all quarters. Calculate the result of first quarter as per AS-25 and comment on the company's view

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started