Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Partner Company acquired 85% of the common stock of Simplex Company in two separate cash transactions. The first purchase of 108,000 shares (60%) on

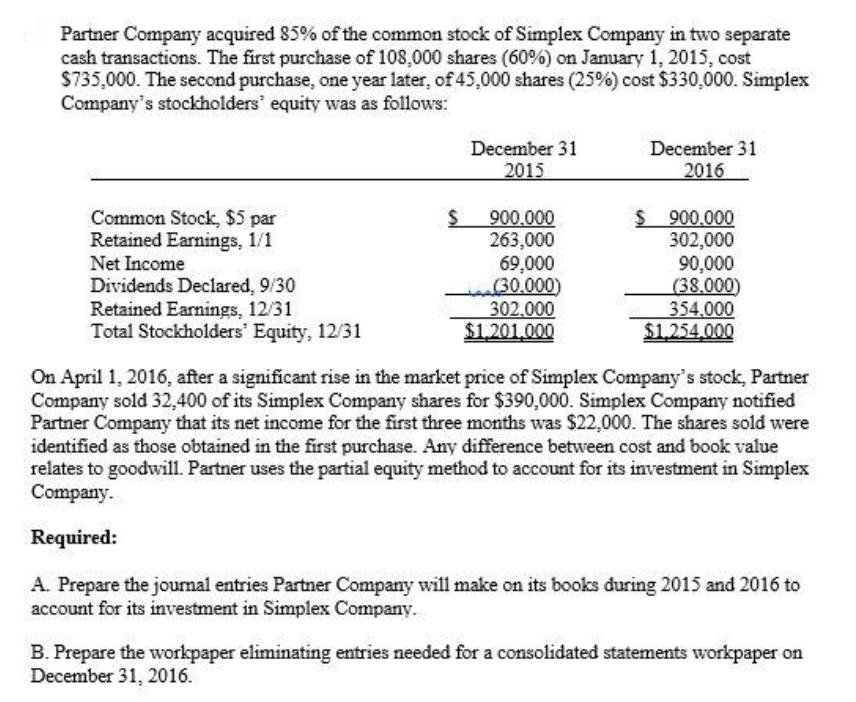

Partner Company acquired 85% of the common stock of Simplex Company in two separate cash transactions. The first purchase of 108,000 shares (60%) on January 1, 2015, cost $735,000. The second purchase, one year later, of 45,000 shares (25%) cost $330,000. Simplex Company's stockholders' equity was as follows: December 31 December 31 2015 2016 $ 900.000 302,000 90,000 (38.000) 354.000 $1.254.000 Common Stock, $5 par Retained Earnings, 1/1 Net Income 900.000 263,000 69,000 30.000) 302.000 $1,201.000 Dividends Declared, 9/30 Retained Earnings, 12/31 Total Stockholders' Equity, 12/31 On April 1, 2016, after a significant rise in the market price of Simplex Company's stock, Partner Company sold 32,400 of its Simplex Company shares for $390,000. Simplex Company notified Partner Company that its net income for the first three months was $22,000. The shares sold were identified as those obtained in the first purchase. Any difference between cost and book value relates to goodwill. Partner uses the partial equity method to account for its investment in Simplex Company. Required: A. Prepare the joumal entries Partner Company will make on its books during 2015 and 2016 to account for its investment in Simplex Company. B. Prepare the workpaper eliminating entries needed for a consolidated statements workpaper on December 31, 2016.

Step by Step Solution

★★★★★

3.45 Rating (174 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started