Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Partnership Dissolution: Withdrawal, Retirement, or Death of a Partner and Incorporation of Partnership Xye opted out of the partnership on September 30, 2021 by

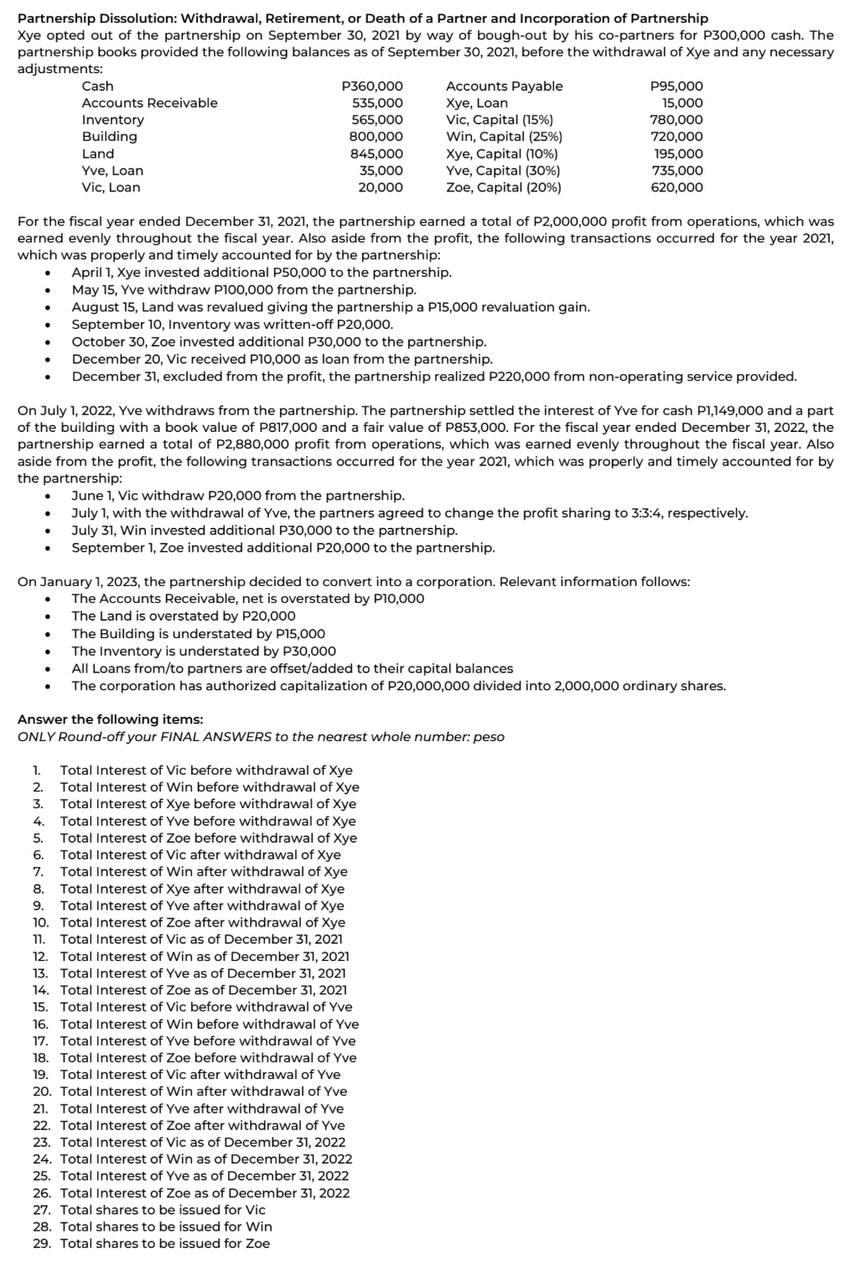

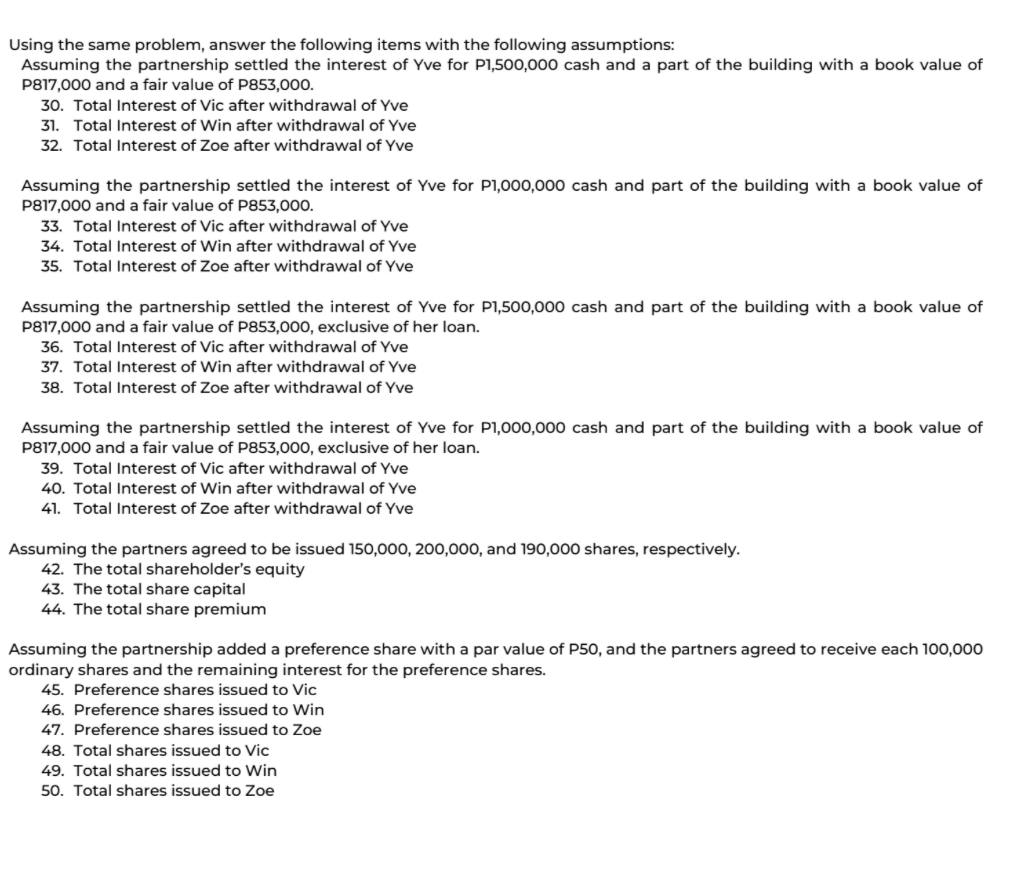

Partnership Dissolution: Withdrawal, Retirement, or Death of a Partner and Incorporation of Partnership Xye opted out of the partnership on September 30, 2021 by way of bough-out by his co-partners for P300,000 cash. The partnership books provided the following balances as of September 30, 2021, before the withdrawal of Xye and any necessary adjustments: Cash Accounts Receivable Inventory Building Land Yve, Loan Vic, Loan P360,000 535,000 Accounts Payable Xye, Loan P95,000 15,000 565,000 Vic, Capital (15%) 780,000 800,000 Win, Capital (25%) 720,000 845,000 Xye, Capital (10%) 195,000 35,000 Yve, Capital (30%) 735,000 20,000 Zoe, Capital (20%) 620,000 For the fiscal year ended December 31, 2021, the partnership earned a total of P2,000,000 profit from operations, which was earned evenly throughout the fiscal year. Also aside from the profit, the following transactions occurred for the year 2021, which was properly and timely accounted for by the partnership: April 1, Xye invested additional P50,000 to the partnership. May 15, Yve withdraw P100,000 from the partnership. August 15, Land was revalued giving the partnership a P15,000 revaluation gain. September 10, Inventory was written-off P20,000. October 30, Zoe invested additional P30,000 to the partnership. December 20, Vic received P10,000 as loan from the partnership. December 31, excluded from the profit, the partnership realized P220,000 from non-operating service provided. On July 1, 2022, Yve withdraws from the partnership. The partnership settled the interest of Yve for cash P1,149,000 and a part of the building with a book value of P817,000 and a fair value of P853,000. For the fiscal year ended December 31, 2022, the partnership earned a total of P2,880,000 profit from operations, which was earned evenly throughout the fiscal year. Also aside from the profit, the following transactions occurred for the year 2021, which was properly and timely accounted for by the partnership: June 1, Vic withdraw P20,000 from the partnership. July 1, with the withdrawal of Yve, the partners agreed to change the profit sharing to 3:3:4, respectively. July 31, Win invested additional P30,000 to the partnership. September 1, Zoe invested additional P20,000 to the partnership. On January 1, 2023, the partnership decided to convert into a corporation. Relevant information follows: The Accounts Receivable, net is overstated by P10,000 The Land is overstated by P20,000 The Building is understated by P15,000 The Inventory is understated by P30,000 All Loans from/to partners are offset/added to their capital balances The corporation has authorized capitalization of P20,000,000 divided into 2,000,000 ordinary shares. Answer the following items: ONLY Round-off your FINAL ANSWERS to the nearest whole number: peso 5. 6. 7. 1. Total Interest of Vic before withdrawal of Xye 2. Total Interest of Win before withdrawal of Xye 3. Total Interest of Xye before withdrawal of Xye 4. Total Interest of Yve before withdrawal of Xye Total Interest of Zoe before withdrawal of Xye Total Interest of Vic after withdrawal of Xye Total Interest of Win after withdrawal of Xye 8. Total Interest of Xye after withdrawal of Xye 9. Total Interest of Yve after withdrawal of Xye 10. Total Interest of Zoe after withdrawal of Xye 11. Total Interest of Vic as of December 31, 2021 12. Total Interest of Win as of December 31, 2021 13. Total Interest of Yve as of December 31, 2021 14. Total Interest of Zoe as of December 31, 2021 15. Total Interest of Vic before withdrawal of Yve 16. Total Interest of Win before withdrawal of Yve 17. Total Interest of Yve before withdrawal of Yve 18. Total Interest of Zoe before withdrawal of Yve 19. Total Interest of Vic after withdrawal of Yve 20. Total Interest of Win after withdrawal of Yve 21. Total Interest of Yve after withdrawal of Yve 22. Total Interest of Zoe after withdrawal of Yve 23. Total Interest of Vic as of December 31, 2022 24. Total Interest of Win as of December 31, 2022 25. Total Interest of Yve as of December 31, 2022 26. Total Interest of Zoe as of December 31, 2022 27. Total shares to be issued for Vic 28. Total shares to be issued for Win 29. Total shares to be issued for Zoe Using the same problem, answer the following items with the following assumptions: Assuming the partnership settled the interest of Yve for P1,500,000 cash and a part of the building with a book value of P817,000 and a fair value of P853,000. 30. Total Interest of Vic after withdrawal of Yve 31. Total Interest of Win after withdrawal of Yve 32. Total Interest of Zoe after withdrawal of Yve Assuming the partnership settled the interest of Yve for P1,000,000 cash and part of the building with a book value of P817,000 and a fair value of P853,000. 33. Total Interest of Vic after withdrawal of Yve 34. Total Interest of Win after withdrawal of Yve 35. Total Interest of Zoe after withdrawal of Yve Assuming the partnership settled the interest of Yve for P1,500,000 cash and part of the building with a book value of P817,000 and a fair value of P853,000, exclusive of her loan. 36. Total Interest of Vic after withdrawal of Yve 37. Total Interest of Win after withdrawal of Yve 38. Total Interest of Zoe after withdrawal of Yve Assuming the partnership settled the interest of Yve for P1,000,000 cash and part of the building with a book value of P817,000 and a fair value of P853,000, exclusive of her loan. 39. Total Interest of Vic after withdrawal of Yve 40. Total Interest of Win after withdrawal of Yve 41. Total Interest of Zoe after withdrawal of Yve Assuming the partners agreed to be issued 150,000, 200,000, and 190,000 shares, respectively. 42. The total shareholder's equity 43. The total share capital 44. The total share premium Assuming the partnership added a preference share with a par value of P50, and the partners agreed to receive each 100,000 ordinary shares and the remaining interest for the preference shares. 45. Preference shares issued to Vic 46. Preference shares issued to Win 47. Preference shares issued to Zoe 48. Total shares issued to Vic 49. Total shares issued to Win 50. Total shares issued to Zoe

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started