Answered step by step

Verified Expert Solution

Question

1 Approved Answer

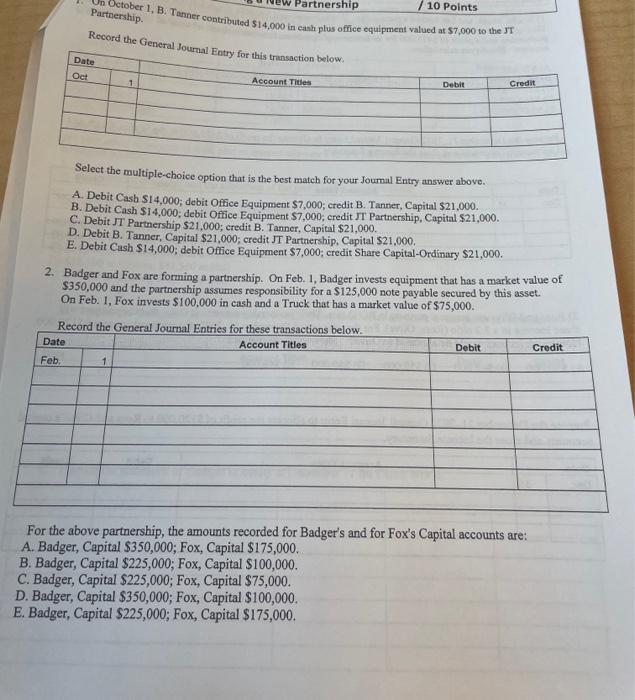

Partnership Partnership. October 1, B. Tanner contributed $14,000 in cash plus office equipment valued at $7,000 to the JT Record the General Journal Entry for

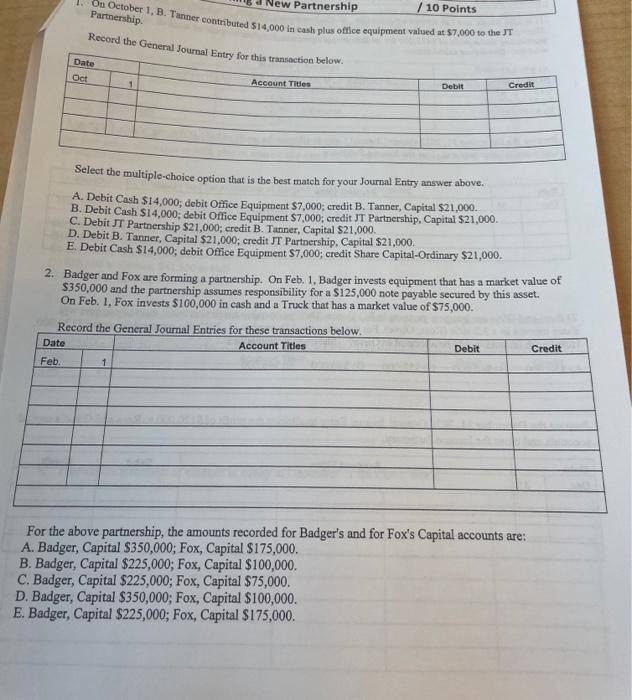

Partnership Partnership. October 1, B. Tanner contributed $14,000 in cash plus office equipment valued at $7,000 to the JT Record the General Journal Entry for this transaction below. Date Feb. Date Oct 1 Account Titles Record the General Journal Entries for these transactions below. Account Titles 1 /10 Points Select the multiple-choice option that is the best match for your Journal Entry answer above. A. Debit Cash $14,000; debit Office Equipment $7,000; credit B. Tanner, Capital $21,000. B. Debit Cash $14,000; debit Office Equipment $7,000; credit JT Partnership, Capital $21,000. C. Debit JT Partnership $21,000; credit B. Tanner, Capital $21,000. D. Debit B. Tanner, Capital $21,000; credit JT Partnership, Capital $21,000. E. Debit Cash $14,000; debit Office Equipment $7,000; credit Share Capital-Ordinary $21,000. Debit 2. Badger and Fox are forming a partnership. On Feb. 1, Badger invests equipment that has a market value of $350,000 and the partnership assumes responsibility for a $125,000 note payable secured by this asset. On Feb. 1, Fox invests $100,000 in cash and a Truck that has a market value of $75,000. Credit Debit For the above partnership, the amounts recorded for Badger's and for Fox's Capital accounts are: A. Badger, Capital $350,000; Fox, Capital $175,000. B. Badger, Capital $225,000; Fox, Capital $100,000. C. Badger, Capital $225,000; Fox, Capital $75,000. D. Badger, Capital $350,000; Fox, Capital $100,000. E. Badger, Capital $225,000; Fox, Capital $175,000. Credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started