Answered step by step

Verified Expert Solution

Question

1 Approved Answer

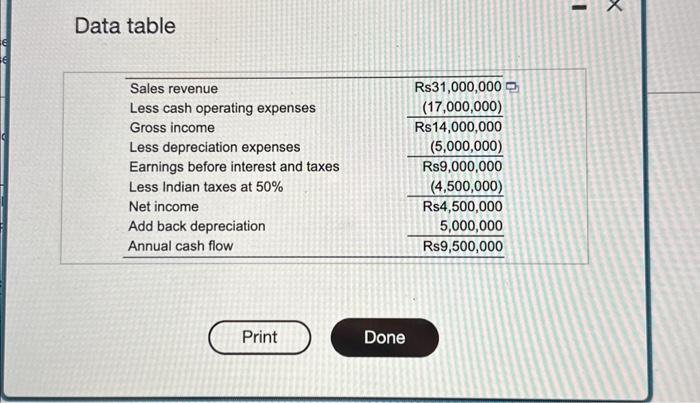

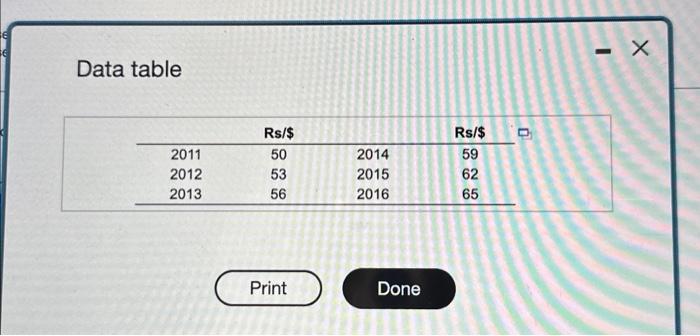

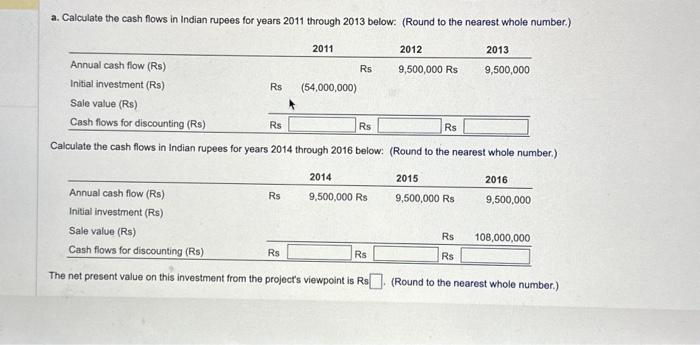

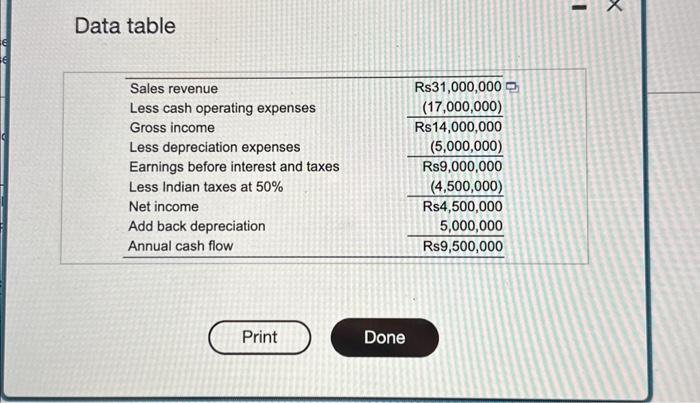

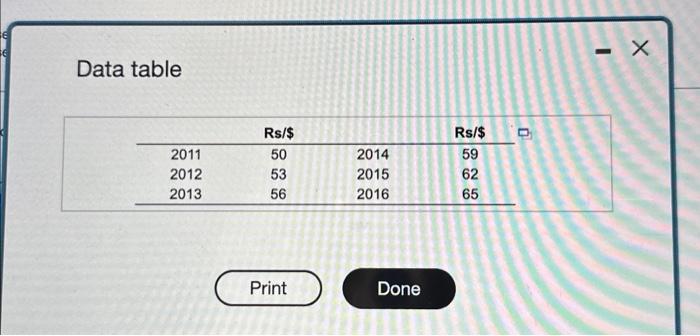

Parts a and B PLEASEE insla will equal 65% of actourting incorte. sopus table, 2. Calodate the cavh fows in insin rupeet for yearn 2011

Parts a and B

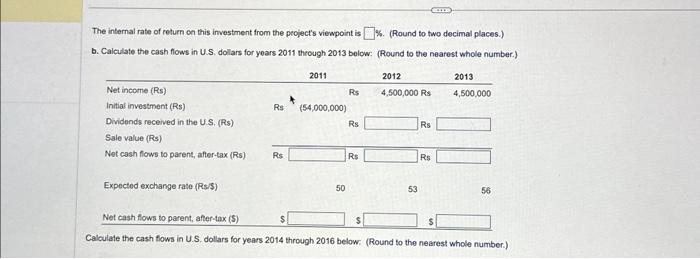

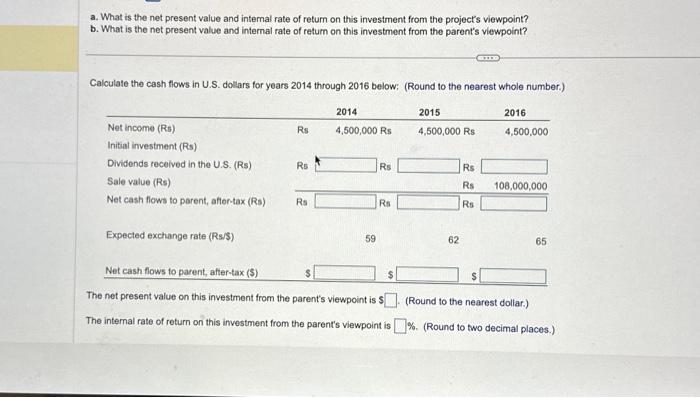

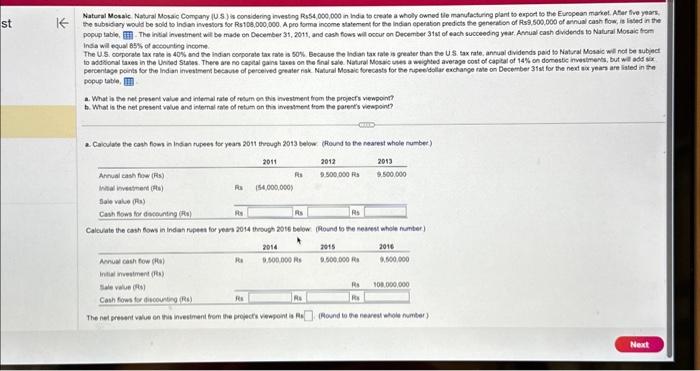

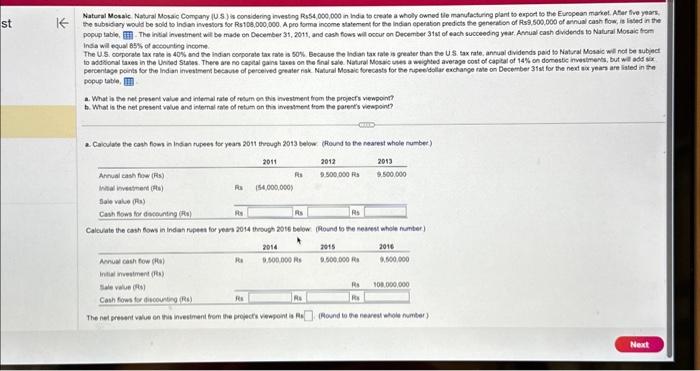

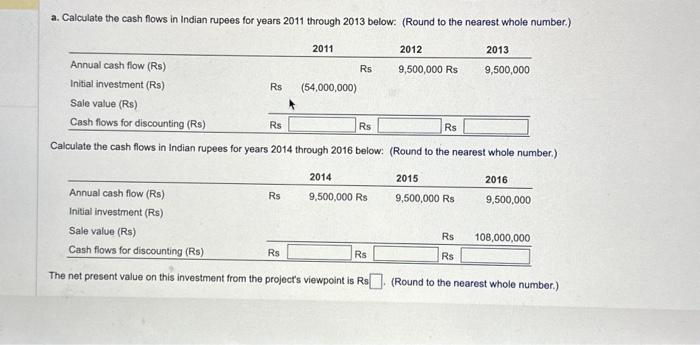

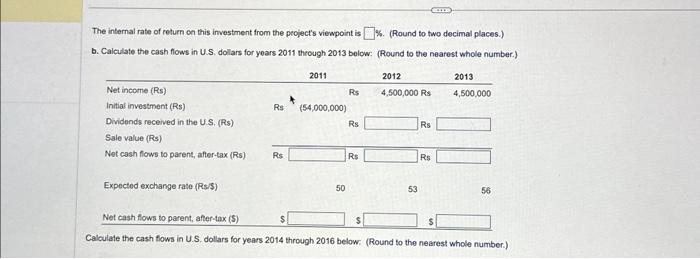

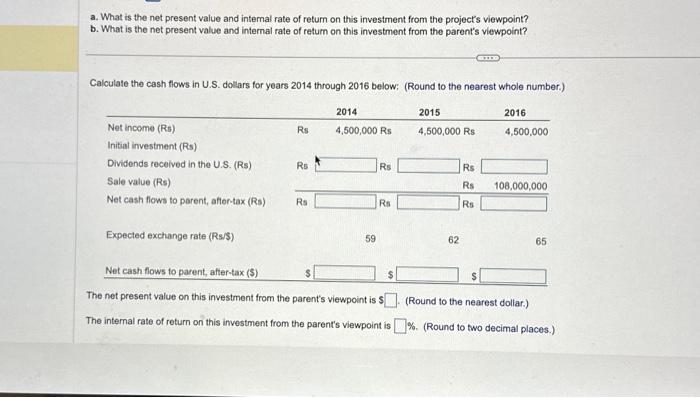

insla will equal 65% of actourting incorte. sopus table, 2. Calodate the cavh fows in insin rupeet for yearn 2011 through 2013 telow (hound ts the nearest while number) The nel present value en this invecirent bom the propoci vespont is As (Round to the neares wole number) Data table Data table a. Calculate the cash fows in Indian rupees for years 2011 through 2013 below: (Round to the nearest whole number.) Calculate the cash flows in Indian rupees for years 2014 through 2016 below: (Round to the nearest whole number.) The net present value on this investment from the project's viewpoint is Rs (Round to the nearest whole number.) The internal rate of return on this investment from the pecject's viewpoint is 3. (Round to two decimal places.) b. Calculate the cash flows in U.S. dollars for yoars 2011 through 2013 bolow: (Round to the nearest whole number.) Calculate the cash flows in U.S. dollars for years 2014 through 2016 below: (Round to the nearest whole number.) a. What is the net present value and intemal rate of return on this investment from the project's viewpoint? b. What is the net present value and internal rate of return on this investment from the parent's viewpoint? Calculate the cash flows in U.S. dollars for years 2014 through 2016 below; (Round to the nearest whole number.) The net present value on this investment from the parent's viewpoint is \$ (Round to the nearest doliar.) The internal rate of return on this investment from the parent's viewpoint is \%. (Round to two decimal places.) PLEASEE

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started