Answered step by step

Verified Expert Solution

Question

1 Approved Answer

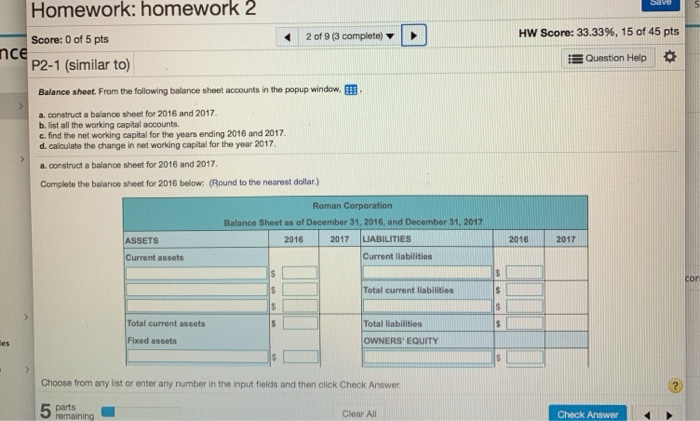

Parts a-d Homework: homework 2 0ave HW Score: 33.33% , 15 of 45 pts Score: 0 of 5 pts nce P2-1 (similar to) 2 of

Parts a-d

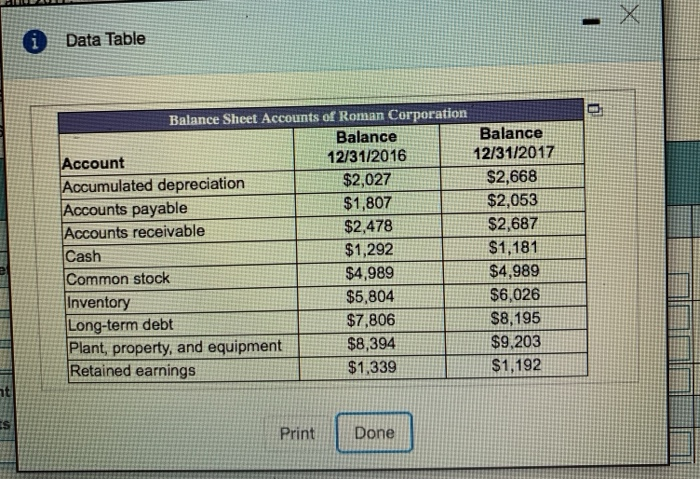

Homework: homework 2 0ave HW Score: 33.33% , 15 of 45 pts Score: 0 of 5 pts nce P2-1 (similar to) 2 of 9 (3 complete) Question Help Balance sheet. From the following balance sheet accounts in the popup window, a. construct a balance sheet for 2016 and 2017. b. list all the working capital accounts. c. find the net working capital for the years ending 2016 and 2017 d. calculate the change in net working capital for the year 2017 a. construct a balance sheet for 2016 and 2017. Complete the balance sheet for 2016 below: (Round to the nearest dollar) Roman Corporation Balance Sheet as of December 31, 2016, and December 31, 2017 2017 ASSETS 2016 LIABILITIES 2016 2017 Current liabilities Current assets cor Total current liabilities S Total liabilities Total current assets Fixed assets OWNERS' EQUITY es Choose from any list or enter any number in the input fields and then click Check Answer parts remaining Clear All Check Answer i Data Table Balance Sheet Accounts of Roman Corporation Balance 12/31/2017 Balance 12/31/2016 Account Accumulated depreciation Accounts payable Accounts receivable Cash Common stock Inventory Long-term debt Plant, property, and equipment Retained earnings S2,668 $2,053 $2,687 $1,181 $4.989 $2,027 $1,807 $2,478 $1,292 $4,989 $5,804 $7,806 $8,394 $1,339 $6,026 S8,195 $9.203 $1,192 Print Done

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started