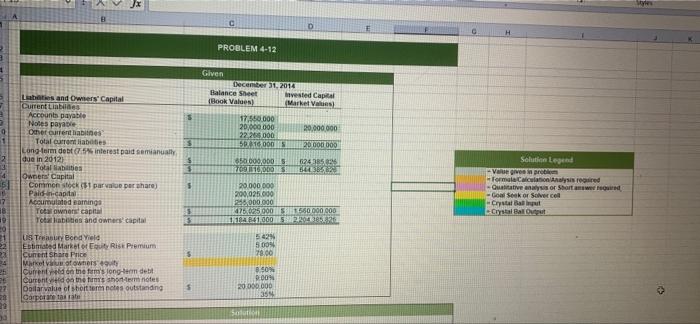

Question: Parts B and C only please 0 2 3 18 17 18 #9 25 25 27 28 29 Liabities and Owners' Capital Current Liabides Accounts

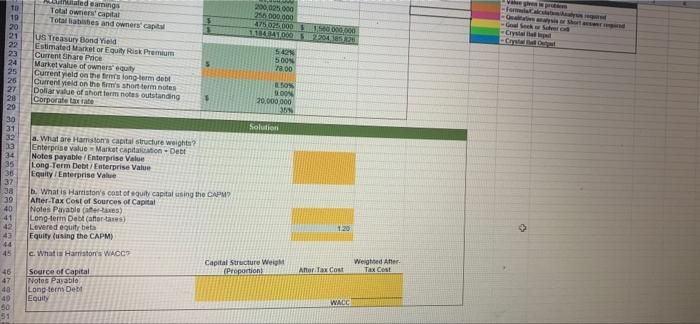

0 2 3 18 17 18 #9 25 25 27 28 29 Liabities and Owners' Capital Current Liabides Accounts payable Notes payable Other current liabitnes Total current liaboses Long-term debt (7.5% interest paid semianually, due in 2012) Total liabilities Owners' Capital Common stock ($1 par value per share) Paid-in-capital Accumulated earnings Total owners capital Total kabities and owners' capital US Treasury Bond Yield Estimated Market of Equity Risk Premium Cument Share Price Market valus of owners equity Current ved on the firm's long-term debt Current ved on the firm's anontemnotes Dollarvalue of short term notes outstanding Corporate tax rate S $ S $ $ S $ C PROBLEM 4-12 Given December 31, 2014 Balance Sheet (Book Values) 17,550.000 20,000.000 22,204.000 50. 16.000 650 000,000 S 709 #10,000 5:42% 5.00% 78.00 8.50% 9.00% 20.000.000 35% D invested Capital (Market Values) 20.000.000 200,025.000 255,000 000 1475.025.000 $650 000 000 1/184 841.000 2.204.385.826 Solution 20,000,000 20.000.000 624 385 826 64438582 G Solution Legend Value gives in problem Formala Calculation Analysis required -Qualitative analysis of Short answer required -Goal Seek or Solver cell Crystal Ball input Crystal Ball Output Styles 10 19 20 21 22 23 24 25 26 27 28 29 30 32 33 36 37 38 39 40 949985 ALEGINutated earnings Total owners' capital Total liabishes and owners' capital US Treasury Bond Yield Estimated Market or Equity Risk Premium Current Share Price 50 Market value of owners' equilty Current yield on the firm's long-term debt Current yeeld on the fim's short-term notes Dollar value of short terms notes outstanding Corporate tax rate 41 Long-term Debt (after-taxes) 42 Levered equity beta 43 44 45 51 a. What are Hamston's capital structure weights? Enterprise value-Market capitalization - Dett Notes payable/Enterprise Value Long-Term Debt/Enterprise Value Equity/Enterprise Value 1 b. What is Harriston's cost of equity capital using the CAPM? After-Tax Cost of Sources of Capital Notes Payable (after-taxes) 46 Source of Capital 47 Notes Payable Equity (using the CAPM) c. What is Harriston's WACC 40 Equity Long-term Deb 200,025,000 256 000 000 475.025.000 1.184.841.000 542% 500% 78.00 8.50% 100% 20,000,000 30% Solution Capital Structure Weight (Proportion) 1,500,000,000 2204 385 826 1.20 After Tax Cost WACC Weighted After Tax Cost Value give proti -FormCalculatoalysis repared -Qualitative analysis or Short acsent gond -Goal Seekor Sofer cad -Crystal Bhd ad

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts