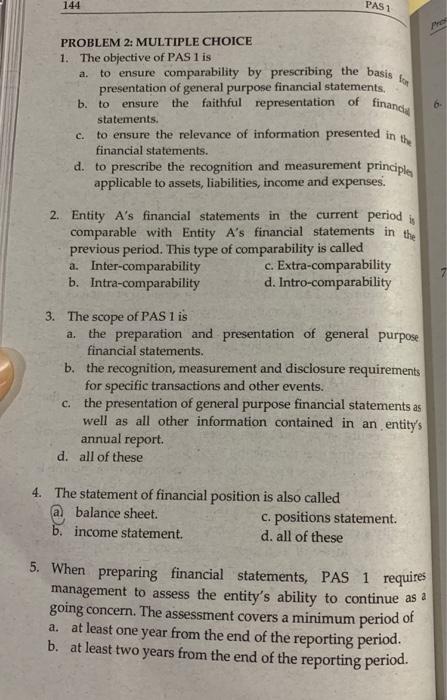

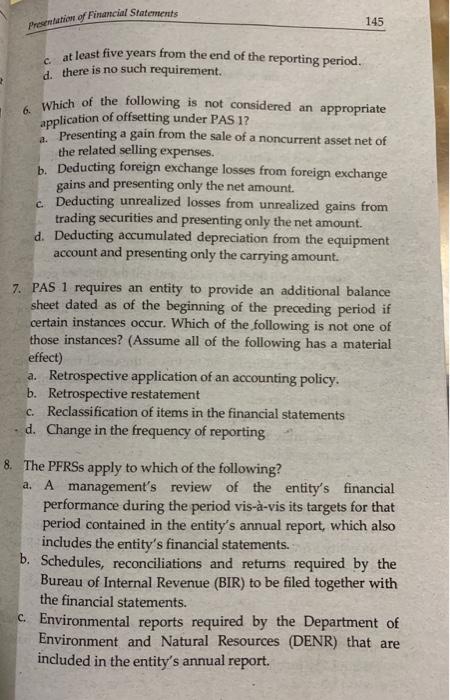

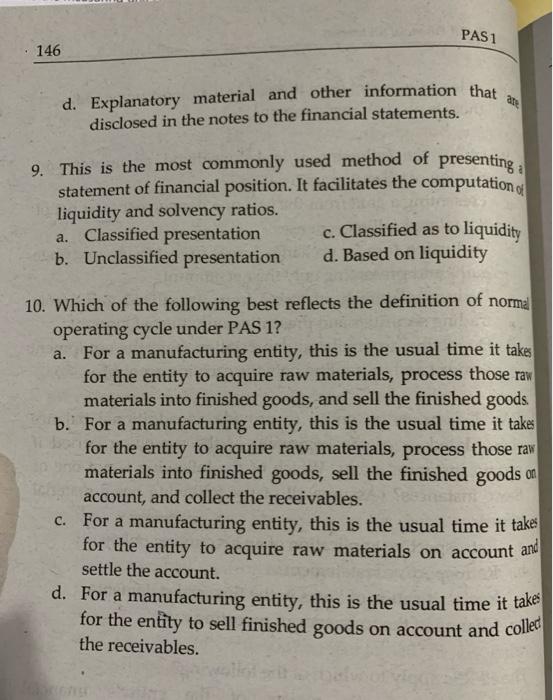

PAS 1 c. to ensure the relevance of information presented in the 144 PROBLEM 2: MULTIPLE CHOICE 1. The objective of PAS 1 is a. to ensure comparability by prescribing the basis presentation of general purpose financial statements. b. to ensure the faithful representation of financie statements. for 6 financial statements. d. to prescribe the recognition and measurement principles applicable to assets, liabilities, income and expenses. 2. Entity A's financial statements in the current period comparable with Entity A's financial statements in the previous period. This type of comparability is called a. Inter-comparability c. Extra-comparability b. Intra-comparability d. Intro-comparability 3. The scope of PAS 1 is a. the preparation and presentation of general purpose financial statements. b. the recognition, measurement and disclosure requirements for specific transactions and other events. c. the presentation of general purpose financial statements as well as all other information contained in an entity's annual report d. all of these 4. The statement of financial position is also called a balance sheet c. positions statement. b. income statement. d. all of these 5. When preparing financial statements, PAS 1 requires management to assess the entity's ability to continue as a going concern. The assessment covers a minimum period of a. at least one year from the end of the reporting period. b. at least two years from the end of the reporting period. Presentation of Financial Statements 145 c 2 at least five years from the end of the reporting period. d. there is no such requirement. Which of the following is not considered an appropriate application of offsetting under PAS 1? a Presenting a gain from the sale of a noncurrent asset net of the related selling expenses. b. Deducting foreign exchange losses from foreign exchange gains and presenting only the net amount. c Deducting unrealized losses from unrealized gains from trading securities and presenting only the net amount. d. Deducting accumulated depreciation from the equipment account and presenting only the carrying amount. 7. PAS 1 requires an entity to provide an additional balance sheet dated as of the beginning of the preceding period if certain instances occur. Which of the following is not one of those instances? (Assume all of the following has a material effect) a. Retrospective application of an accounting policy, b. Retrospective restatement c. Reclassification of items in the financial statements d. Change in the frequency of reporting 8. The PFRSs apply to which of the following? a. A management's review of the entity's financial performance during the period vis--vis its targets for that period contained in the entity's annual report, which also includes the entity's financial statements. b. Schedules, reconciliations and returns required by the Bureau of Internal Revenue (BIR) to be filed together with the financial statements. c. Environmental reports required by the Department of Environment and Natural Resources (DENR) that are included in the entity's annual report. PAS1 d. Explanatory material and other information that are d. For a manufacturing entity, this is the usual time it takes 146 disclosed in the notes to the financial statements. 9. This is the most commonly used method of presenting, statement of financial position. It facilitates the computation liquidity and solvency ratios. a. Classified presentation c. Classified as to liquidity b. Unclassified presentation d. Based on liquidity 10. Which of the following best reflects the definition of norma operating cycle under PAS 1? a. For a manufacturing entity, this is the usual time it takes for the entity to acquire raw materials, process those raw materials into finished goods, and sell the finished goods b. For a manufacturing entity, this is the usual time it takes for the entity to acquire raw materials, process those raw materials into finished goods, sell the finished goods on account, and collect the receivables. c. For a manufacturing entity, this is the usual time it takes for the entity to acquire raw materials on account and settle the account. for the entity to sell finished goods on account and collec the receivables