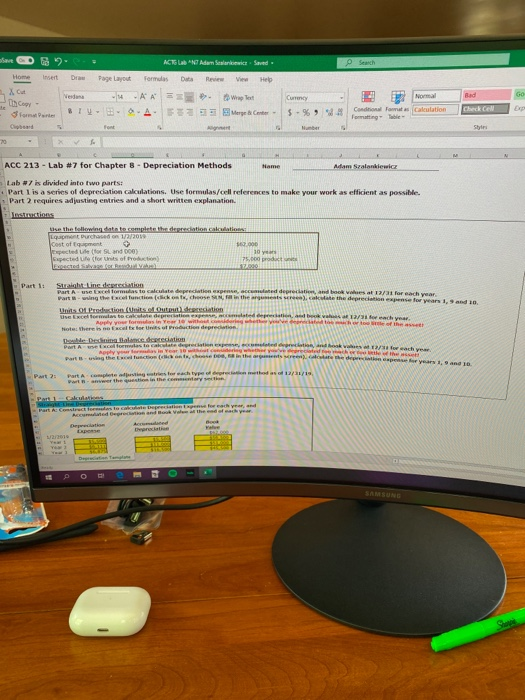

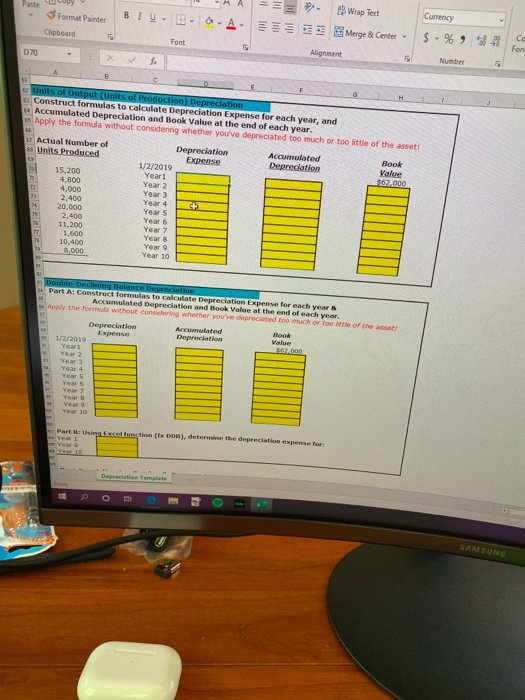

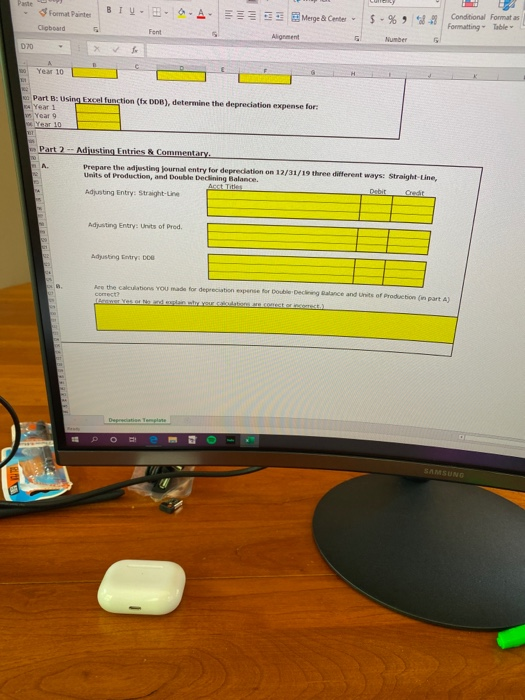

Pastasalaatta - the where the per year 11 G ACT Lab Adern Sie saved e Search Home Insert Draw Page Layout Formulas Data Review Vi Help -14 A = Wapat XIV A. Ferro Currency Normal Bad X cu Chcy - Soms Panter GO 9 W Conditional Forma Calculation Foting Table Font Number 20 H ACC 213 - Lab #7 for Chapter 8 - Depreciation Methods Name Adam Szalankiewicz Lab #7 is divided into two parts: Part 1 is a series of depreciation calculations. Use formulas/cell references to make your work as efficient as possible. Part 2 requires adjusting entries and a short written explanation. Instructions lose the following date to complete the depreciation calculations Lamont Purchased on 1/2/2009 cost of Equement + 10.000 expected to a CD) 10 Cxpected for units of Proton 75.000 Recevere 7200 Sheightline deglio Part A use Excel forms to calculate depreciation expected to his at 12/31 for each year. Part-wing the function ( coches in the area), calidate the depreciation expense to years and so Units O1 Production (color degreciation Use Excel toca de prendre 12/31 for each year th Hot Where is no Excel for US Product depreciation Declining balance de ceciation apply for Year whether you've for each yea Pat Part Acamere for each type of deprecated as of 13/1/ anwer the question in the crysta Part Astructors to creciendo cach year, and Acceder and all the end 2 Paste = BI- Format Painter Clipboard 23 Wrap Text - A Merge & Center Currency $ - %, 2-3 Font Ca Fom 070 Alignment Number 5 05 61 Units of Output (Units of Production) Depreciation Construct formulas to calculate Depreciation Expense for each year, and Accumulated Depreciation and Book Value at the end of each year. Apply the formda without considering whether you've depreciated too much or too little of the asset! Actual Number of Depreciation Units Produced Accumulated Book Expense Depreciation Value 1/2/2019 20 15.200 Yeart $622.000 4,800 Year 2 4.000 Year 13 2.400 Year 4 + 20,000 Years 2.400 Year 6 11,200 Year 7 1,600 Year 10,400 Year 3,000 Year 10 72 7 11 25 Double Declining Balance Depreciation * Part A: Construct formulas to calculate Depreciation Expense for each year Accumulated Depreciation and look Value at the end of each year, Apply the formula without considering whether you've deprecated too much or too letle of the asset Depreciation Accumulated flood Depreciation 1/2/2019 Value 0.000 Year Year 2 Years Year 4 Years Year Year Year Year Year 10 70 Part 1: Using weefmction (), determine the depreciation expense for Yu1 Year Serto Deciation Template SAMSUNG Paste Format Parts Clipboard BIU BOA Merye & Center Alignment 5 - % 9 ** Conditional Formatas Formatting Table Font Number 070 fo Year 10 - Part B: Using Excel function (Ex DDB), determine the depreciation expense for Year 1 Year 9 Year 10 Part 2 -- Adjusting Entries Commentary. Prepare the adjusting journal entry for depreciation on 12/31/19 three different ways: Straight-Line, Units of Production, and Double Declining Balance Aastates Debit Adjusting Entry: Straight-Line Adjusting Entry: Units of Prod. Adjusting Entry Doo Ree the calculations You made for depreciation expense for Double Declas Balance and its of Production in part ) conect Depreciation Template o SAMSUNG