Answered step by step

Verified Expert Solution

Question

1 Approved Answer

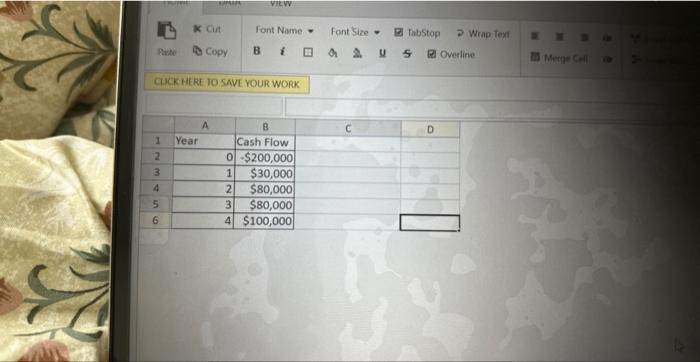

Paste 1 * Cut 2 3 4 5 6 Copy CLICK HERE TO SAVE YOUR WORK Year VIEW A Font Name Bi B Cash

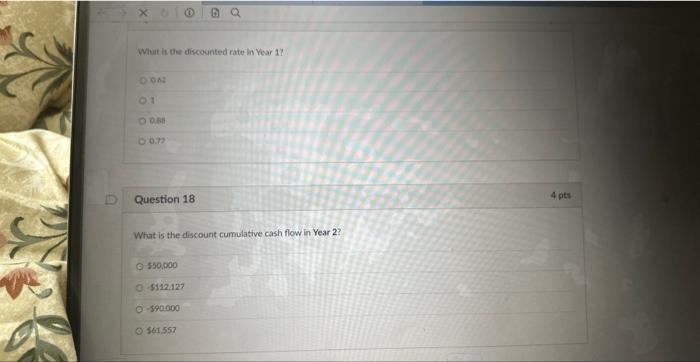

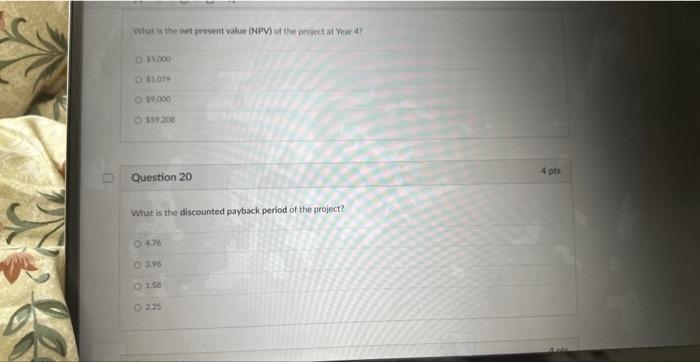

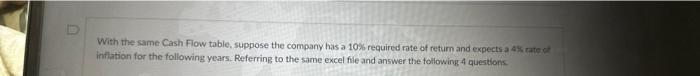

Paste 1 * Cut 2 3 4 5 6 Copy CLICK HERE TO SAVE YOUR WORK Year VIEW A Font Name Bi B Cash Flow 0-$200,000 1 $30,000 2 $80,000 3 $80,000 4 $100,000 Font Size TabStop S D Wrap Text Overline 3 Merge Cell What is the discounted rate in Year 17/ 2002 01 ODM -0.77 D Question 18 What is the discount cumulative cash flow in Year 2? $50,000 0-$112.127 0-$90.000 O $61.557 4 pts What is the net present value (NPV) of the project at Year 47 $5.000 O $1,079 0 $9,000 O $59,208 Question 20 What is the discounted payback period of the project? 0 4.76 02.96 O 1.58 0225 4 pts D With the same Cash Flow table, suppose the company has a 10% required rate of return and expects a 4% rate of inflation for the following years. Referring to the same excel file and answer the following 4 questions

Step by Step Solution

★★★★★

3.50 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Here are the steps to calculate the discounted cumulative cash flow in ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started