Answered step by step

Verified Expert Solution

Question

1 Approved Answer

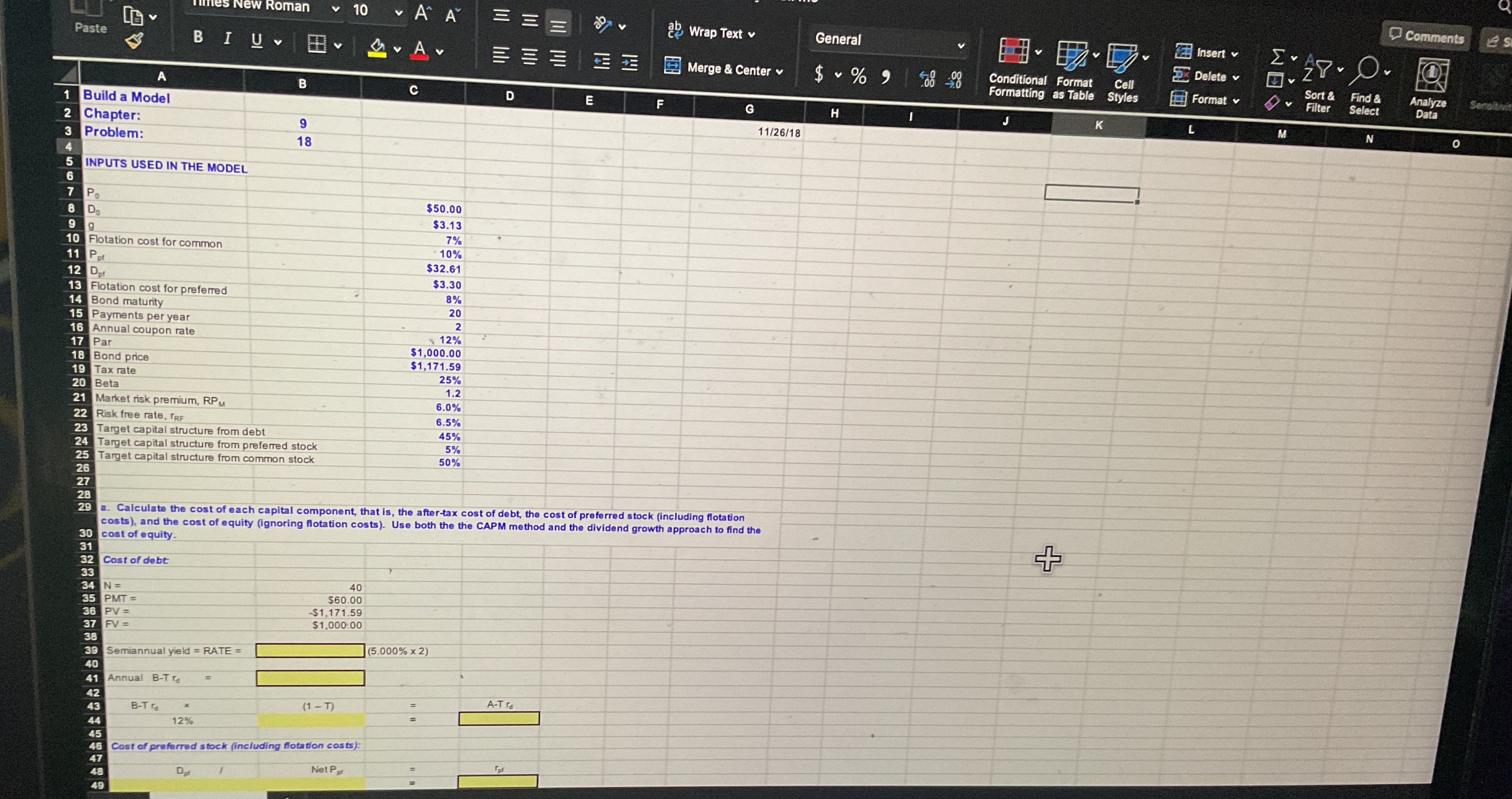

Paste A New Roman BIUV 1 Build a Model 2 Chapter: 3 Problem: 4 5 INPUTS USED IN THE MODEL Comments S 10 AA

Paste A New Roman BIUV 1 Build a Model 2 Chapter: 3 Problem: 4 5 INPUTS USED IN THE MODEL Comments S 10 AA = V Av lil % ab Wrap Text General Insert Delete v HI Merge & Center v $ % 9 .00 Conditional Format Formatting as Table Styles Cell Sort & Format v V Filter Find & Select Analyze Data Sensitivit B C D E F G H I 11/26/18 J K L M N 9 18 6 7 Po $50.00 8 Do $3.13 9 g 7% 10 Flotation cost for common 10% 11 Ppf $32.61 12 Dpf $3.30 13 Flotation cost for preferred 8% 14 Bond maturity 20 15 Payments per year 2 16 Annual coupon rate 17 Par 18 Bond price 19 Tax rate 20 Beta 21 Market risk premium, RPM 22 Risk free rate, TRF 12% $1,000.00 $1,171.59 25% 1.2 6.0% 6.5% 23 Target capital structure from debt 45% 24 Target capital structure from preferred stock 5% 25 Target capital structure from common stock 50% 26 27 28 29 a. Calculate the cost of each capital component, that is, the after-tax cost of debt, the cost of preferred stock (including flotation costs), and the cost of equity (ignoring flotation costs). Use both the the CAPM method and the dividend growth approach to find the 30 cost of equity. 31 32 Cost of debt 33 34 N= 35 PMT= 36 PV= 37 FV = 38 39 Semiannual yield = RATE = 40 41 Annual B-Tra = 40 $60.00 -$1,171.59 $1,000.00 42 43 B-Tr X 44 12% 45 (1-T) 46 Cost of preferred stock (including flotation costs): 47 48 49 Dat Net P (5.000% x 2) == A-Tra = +

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started