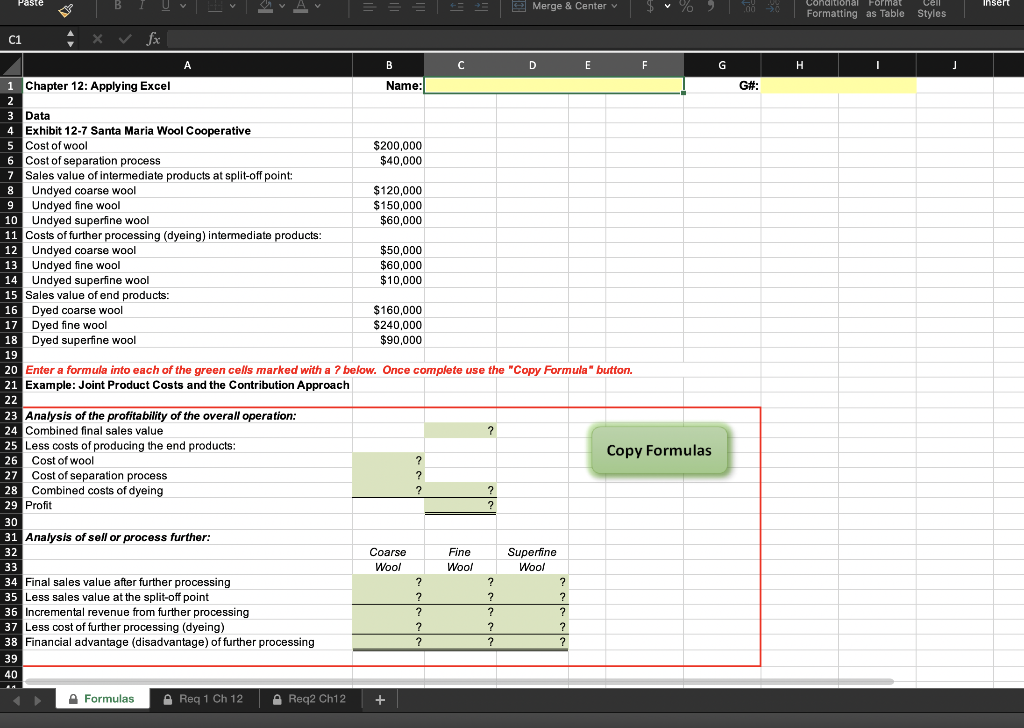

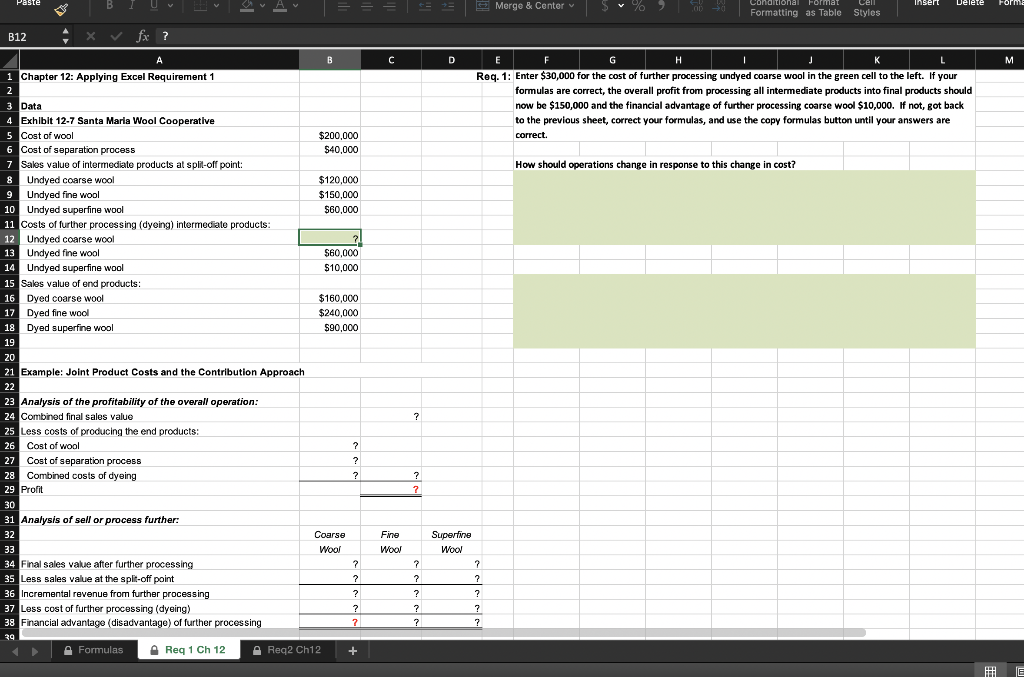

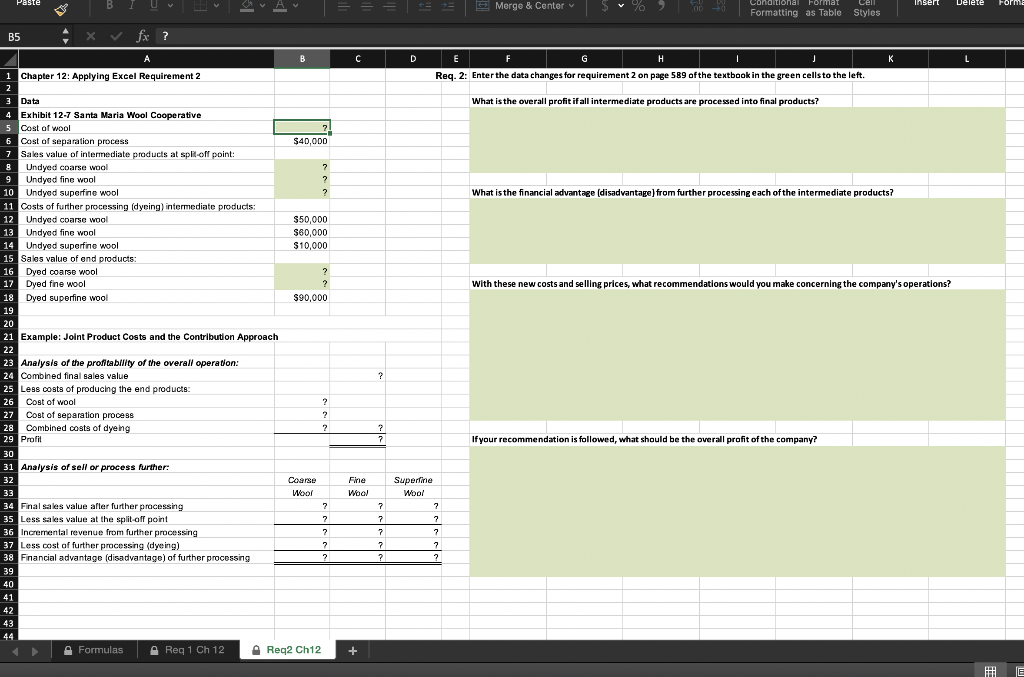

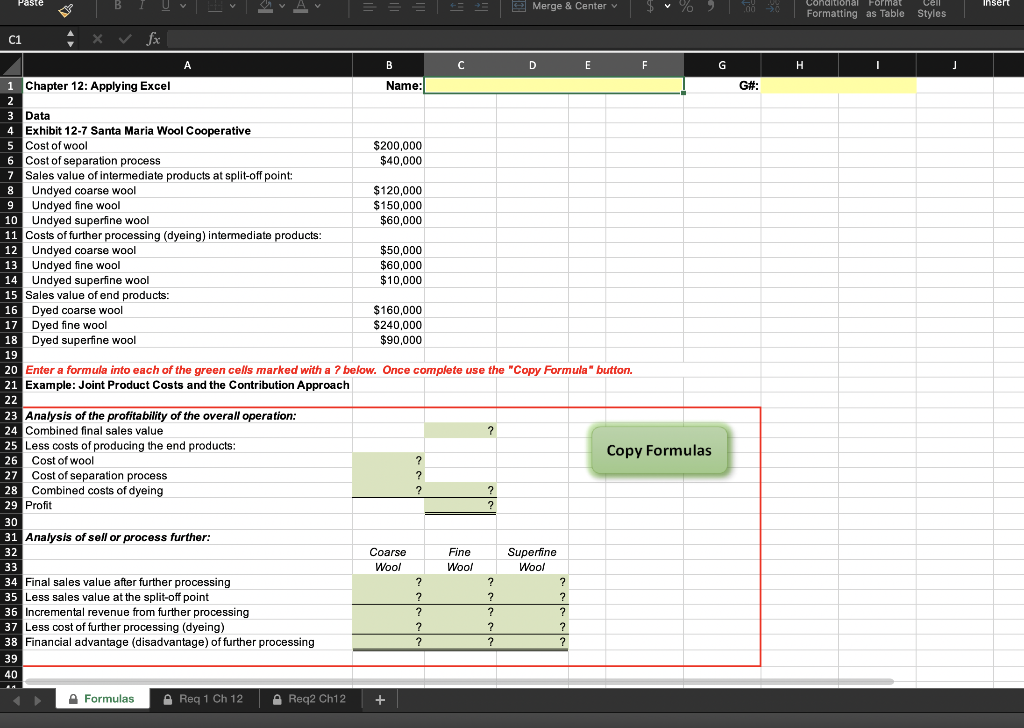

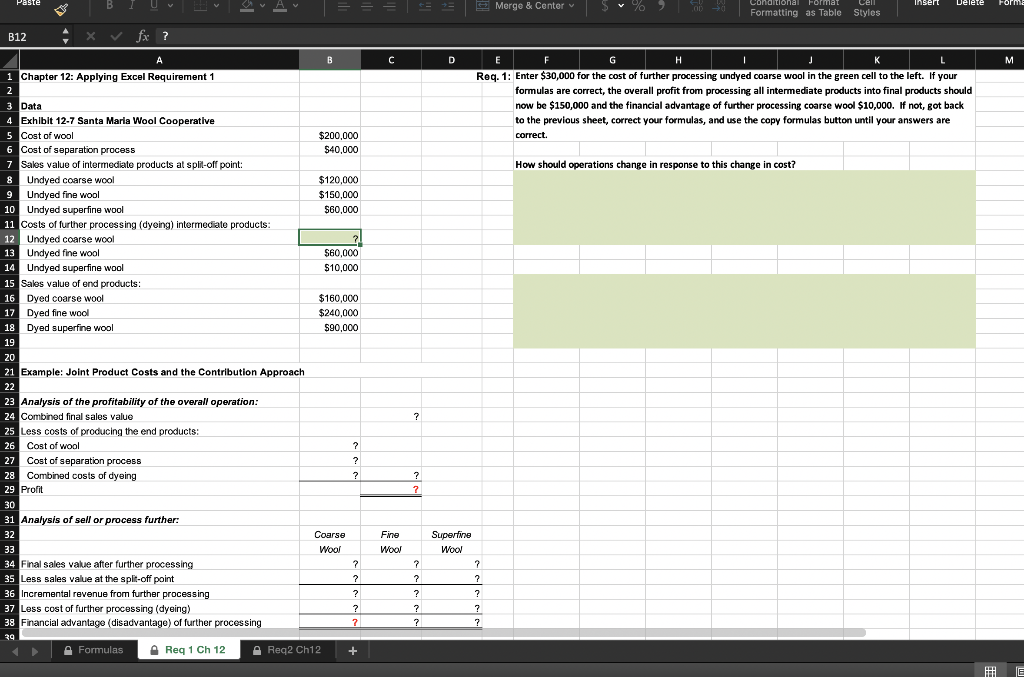

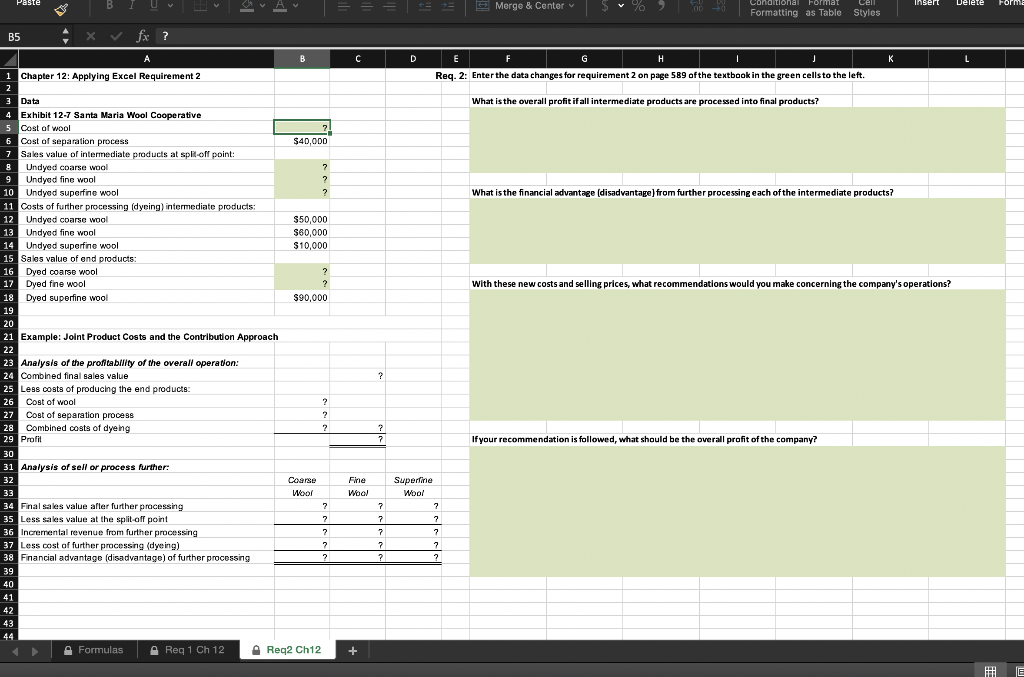

Paste B I = = = = = Merge & Center $ % insert Conditional Format Cell Formatting as Table Styles C1 - G H J G#: A B C D E F 1 Chapter 12: Applying Excel Name: 2 3 Data 4 Exhibit 12-7 Santa Maria Wool Cooperative 5 Cost of wool $200,000 Cost of separation process $40,000 7 Sales value of intermediate products at split-off point: 8 Undyed coarse wool $120,000 9 Undyed fine wool $150,000 10 Undyed superfine wool $60,000 11 Costs of further processing (dyeing) intermediate products: 12 Undyed coarse wool $50,000 13 Undyed fine wool $60,000 14 Undyed superfine wool $10,000 15 Sales value of end products: 16 Dyed coarse wool $160,000 17 Dyed fine wool $240,000 18 Dyed superfine wool $90,000 19 20 Enter a formula into each of the green cells marked with a ? below. Once complete use the "Copy Formula" button. 21 Example: Joint Product Costs and the Contribution Approach 22 23 Analysis of the profitability of the overall operation: 24 Combined final sales value ? 25 Less costs of producing the end products: Copy Formulas 26 Cost of wool ? 27 Cost of separation process ? 28 Combined costs of dyeing ? ? 29 Profit ? 30 31 Analysis of sell or process further: 32 Coarse Fine Superfine 33 Wool Wool Wool 34 Final sales value after further processing ? ? ? 35 Less sales value at the split-off point ? ? ? 36 Incremental revenue from further processing ? ? ? 37 Less cost of further processing (dyeing) ? ? ? 38 Financial advantage (disadvantage) of further processing ? ? ? 39 40 Formulas Req 1 Ch 12 A Req2 Ch12 + Paste B Insert = = = = Merge & Center Delete Forma Conditional Format Cell Formatting as Table Styles B12 . x v fx ? C D M E F H T J K Req. 1: Enter $30,000 for the cost of further processing undyed coarse wool in the green cell to the left. If your formulas are correct, the overall profit from processing all intermediate products into final products should now be $150,000 and the financial advantage of further processing coarse wool $10,000. If not, got back to the previous sheet, correct your formulas, and use the copy formulas button until your answers are correct How should operations change in response to this change in cost? A B 1 Chapter 12: Applying Excel Requirement 1 2 3 Data Exhibit 12-7 Santa Maria Wool Cooperative 5 Cost of wool $200,000 6 Cost of separation process $40,000 7 Sales value of intermediate products at split-off point: 8 Undyed coarse wool $120,000 9 Undyed fine wool $150,000 10 Undyed superfine wool $60,000 11 Costs of further processing (dyeing) intermediate products: 12 Undyed coarse wool ? 13 Undyed fine wool $60,000 14 Undyed superfine wool $10,000 15 Sales value of and products: 16 Dyed coarse wool $160,000 17 Dyed fine wool $240,000 18 Dyed superfine wool $90,000 19 20 21 Example: Joint Product Costs and the Contribution Approach 22 23 Analysis of the profitability of the overall operation: 24 Combined final sales value 25 Less costs of producing the end products: 26 Cost of wool ? 27 Cost of separation process ? 28 Combined costs of dyeing ? 29 Profit 30 31 Analysis of sell or process further: 32 Coarse 33 Wool 34 Final sales value after further processing ? 35 Less sales value at the split-off point ? 36 Incremental revenue from further processing ? 37 Less cost of further processing (dyeing) ? 38 Financial advantage (disadvantage) of further processing ? 39 Formulas Req 1 Ch 12 A Req2 Ch12 + ? ? 7 Fine Wool ? ? ? ? ? Superline Wool ? ? ? ? ? Paste BIU = = = = = Merge & Center Insert Forma Delete Conditional FC Format Cell Formatting as Table Styles B5 x fx ? . B C D K L E F H Req. 2: Enter the data changes for requirement 2 on page 589 of the textbook in the green cells to the left. i Chapter 12: Applying Excel Requirement 2 2 What is the overall profit if all intermediate products are processed into final products? What is the financial advantage (disadvantage) from further processing each of the intermediate products? ? With these new costs and selling prices, what recommendations would you make concerning the company's operations? 3 Data Exhibit 12-7 Santa Maria Wool Cooperative 5 Cost of wool 7 6 Cost of separation process $40,000 7 Sales value of intermediate products at split off point: Undyed coarse wool ? 9 Undyed fine wool ? 10 Undyed superfine wool 2 11 Costs of further processing (dyeing) intermediate products: 12 Undyed coarse wool $50,000 13 Undyed fine wool $60,000 14 Undyed superfine wool $10,000 15 Sales value of and products: 16 Dyed coarse wool ? 17 Dyed fine wool 18 Dyed superfine wool $90,000 19 20 21 Example: Joint Product Costs and the Contribution Approach 22 23 Analysis of the profitability of the overall operation: 24 Combined final sales value 25 Less costs of producing the end products: 26 Cost of wool 27 Cost of separation process ? 28 Combined costs of dyeing ? 29 Profit 30 31 Analysis of sell or process further: 32 Coarse 33 Wool 34 Final sales value aller further processing ? 35 Less sales value at the split-off point ? 36 Incremental revenue from further processing 2 37 Less cost of further processing (dyeing) 2 38 Financial advantage (disadvantage) of further processing ? 39 40 41 42 43 44 A Formulas Reg 1 Ch 12 Req2 Ch12 ? ? ? 7 If your recommendation is followed, what should be the overall profit of the company? Fine Wool Superfine Wool ? ? 2 7 7 7 2 7 ? ? ? +