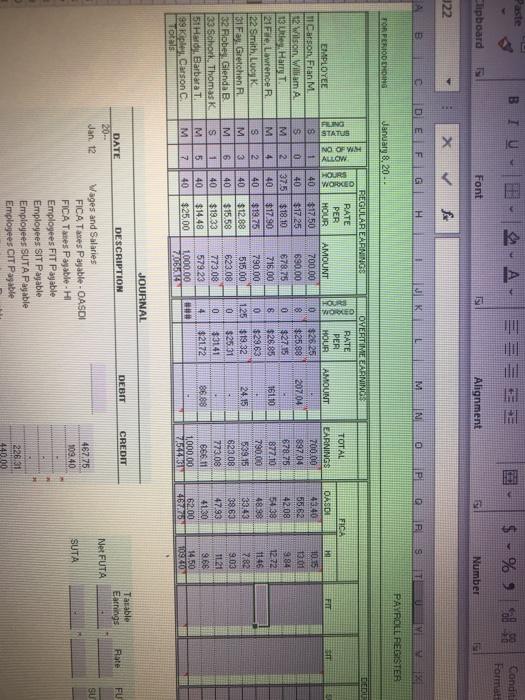

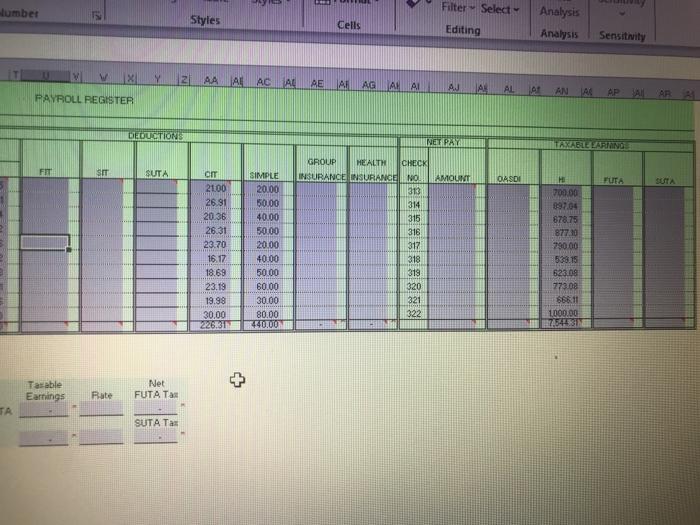

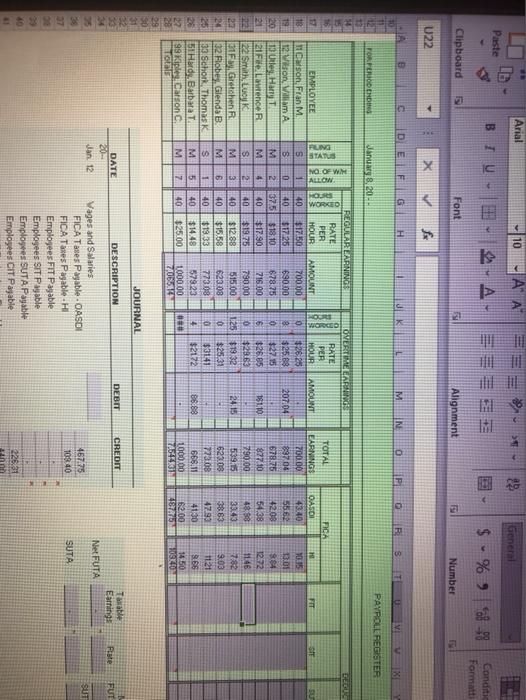

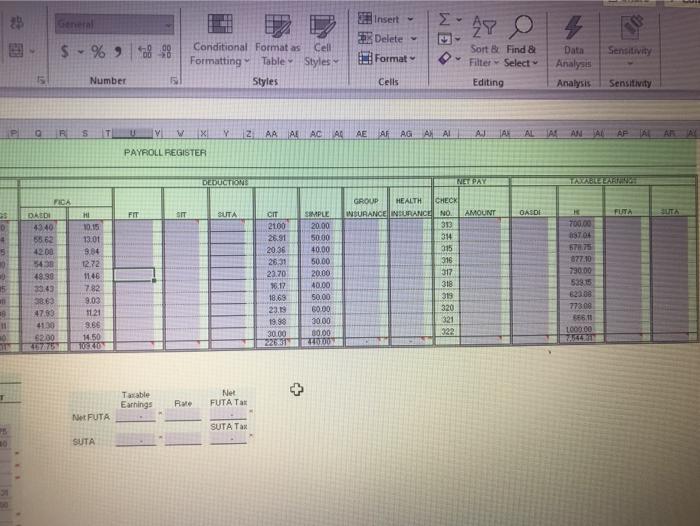

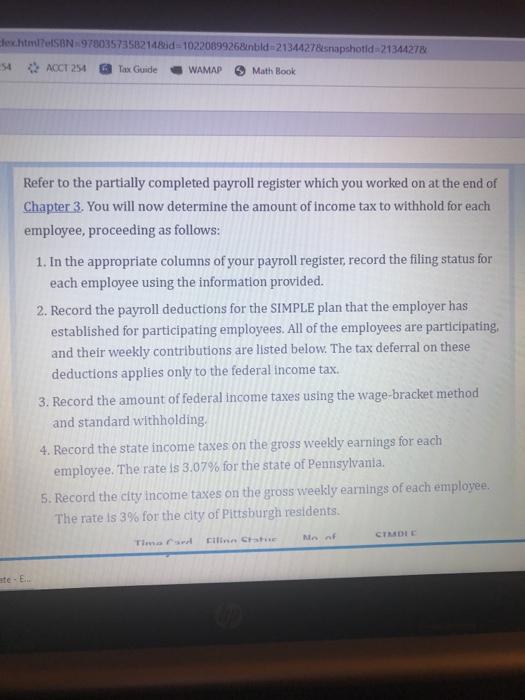

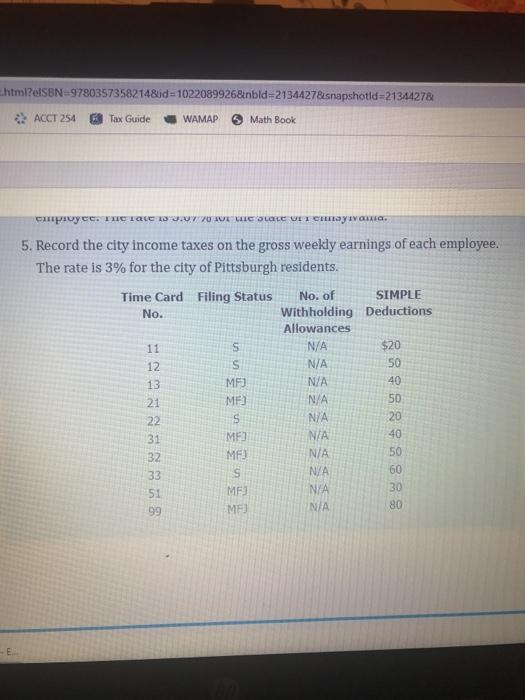

Paste BIU A- $ - % al 99 Conditi Format Elipboard Font Alignment Numbet 922 X fie B C DELFI G H 1 L M N @ BI s IT PAYROLL REGISTER TORFERIODENDANG January 8, 20. FLING 10 STATUS NO OF WIN FIT HI 10.15 13:01 EMPLOYEE Carson Fran M 12 Wilson, William A 13 Uly Harry 21 Fe, Lawrence R. 22 Smith Luck 31 Fay Gretchen R 32 Flobs Glenda B 33 Schork. Thomas K 51 Hady, Barbara 99 Kiple Carson C. Total s M M S M M 1 0 2 4 2 3 6 1 5 MOTIV OK OM SOOOOO REGULAREAANINGS BATE PER HOUR AMOUNT 40 $17.50 700.00 40 $17.25 690.00 37.5 $18.10 678.75 40 $17.90 716.00 40 $19.75 790.00 40 $12.88 515.00 40 $15.58 623.08 40 $19.33 77308 40 $14.48 579.23 40 $25,00 1,000.00 7206549 LLLLLLL OVERTIME EARNING RATE PER HOUR AMOUNT 0 $26.25 8 $25.88 207.04 0 $27.15 8 $26.85 161.00 0 $29.63 1.25 $19.32 24.15 0 $25.31 0 $3141 4 $2172 86.88 TOTAL EARNINGS 700.00 83704 678.75 877:10 790.00 539.15 623.08 773.08 666.11 1,000.00 7/54423 FICA DASDI 43.40 55,62 42.08 5439 48.99 33.43 38.63 47.93 4130 62.00 464870 9.84 1272 1146 2.82 9.03 1121 9.66 14.50 10970 JOURNAL DEBIT DESCRIPTION CREDIT Tasable Eatings Fate FU DATE 20 Jan 12 NetFUTA SU 467,75 109.40 SUTA Vages and Salaries FICA Tates Payable-OASDI FICA Tas Payable-H Employees FIT Payable Employees SIT Payable Employees SUTA Payable Employees CIT Pagable 226.31 440.00 Filter Select umber Styles Analysis Cells Editing Analysis Sensitivity MI XY 12 AA AAC AB AE AL AG A ALAJ A ALA ANAL APSALAR PAYROLL REGISTER DEDUCTIONS NET PAYI TAXALILLARMINO FIT SIT SUTA AMOUNT OASDI FUTA SOTA CIT 21.00 26.91 20.36 26.31 23.70 16.17 18.69 23.19 19.98 30,00 226.31 SIMPLE 20.00 50,00 40.00 50.00 20:00 40.00 50.00 60.00 30.00 80.00 1440.00 GROUP MEALTH CHECK INSURANCE INSURANCE NOI 313 314 315 316 317 318 319 320 321 322 H 700.00 89704 878.75 87720 790.00 538.15 623.08 773.08 66611 1000.00 + Tasable Earnings Net FUTA Tas Rate TA SUTA Tas = Aria 110 A A 3 23 General > Paste BIU- > A - A = $ % 91-98 Conditio Formatti Clipboard B Font Alignment Number U22 X e DEG H 1 JK M IN 0 P. OB s VEUX PAYROLL REGISTER TOP ROD END January 2013 DUBE MORE FIT ST 17 18 19 20 21 22 20 24 EMPLOYEE 11 Carson, Fran M 12 Vison, William A 12 Utles, HAT 21 Flowene R 22. Smith.LK 21 Gretohen R 32 Robes, Glenda B 33. Schork, Thomas 51Hardy Barbara 99 kipley Carson Tots RUNG NO OF WIN ALLOM WORKED la 333 STATUS RE INT 01681850SN 1818 REGULARLARNINGS RATE PER HOUR AMOUNT 1 40 $17.50 700.00 0 40 $17.25 690.00 2325 $18.10 678.75 4 40 $17.90 716.00 2 40 $19.75 73000 3 40 $12.88 515.00 6 40 $15.58 623.08 1 40 $19.33 773.08 5 40 $14.48 579.23 7 40 $25.00 1000.00 Z4065 OVERTIMELINE RATE PER HOUR AMOUNT $26.25 8 $25.69 207.04 $27.5 6 $26.85 191.10 0 $28.63 125 $19.32 24.15 $25.31 $31.41 $2172 86.88 80 TOTAL EARNINGS 700.00 89704 678.75 $77.10 290700 5395 623.08 77308 666.11 100000 74542331 RA OASI 10 43.40 55.62 13.01 1208 54.38 12.72 48.98 1146 3343 782 3863 9.03 47.93 1121 4130 9.66 62.00 1450 BOSTON lll 11 CON JOURNAL DESCRIPTION DEBIT CREDIT Table Earnings Fate FUT DATE 20 Jan 12 Net FUTA SUT 46775 108.40 SUTA 8889 Vages and Salaries FICA Tastes Payable - OASOI FICA Taxes Payable. Hi Employees FIT Payable Employees SIT Payable Employees SUTA Payable Employees CIT Payable 226.31 General Insert - Delete 249 0 4 $ - % Sensitivity Het Format Conditional Format as Cell Formatting Table Styles Styles Sort B. Find & Filter Select Data Analysis Analysis 15 Number 15 Cells Editing Sensitivity P RS T U V W X Y Z AA ALACA . AG AAL AJAKALA ANAL AFAL ARAY PAYROLL REGISTER DEDUCTIONS NET PAY FIT SIT SUTA AMOUNT BASDI FUTA + 5 FICA DED 43:40 55.62 42.00 5430 48.30 30:49 HI 10.15 13.01 3.84 12.72 11:46 7.82 9.00 1121 3.66 14.50 CIT 2100 26.31 20.36 2631 23.70 9.12 18.69 23.9 19.90 30.00 SAMPLE 20.00 50.00 40.00 50.00 20.00 40.00 50.00 60.00 30.00 30.00 71000 GROUP HEALTH CHECK INSURANCE INSURANCE NO 313 314 315 316 317 318 319 320 321 322 700,00 T04 7.75 877.0 730.00 52915 623.08 773.00 656,10 L03.00 15 an 47.99 41.30 62.00 Taxable Earnings Net FUTA TX Rate NetFUTA SUTA Tax SUTA Elechtml?SAN9780357358214&id=1022009926&nbild-2134427&snapshotid 21344278 AOCT 254 Tax Guide WAMAD Math Book Refer to the partially completed payroll register which you worked on at the end of Chapter 3. You will now determine the amount of income tax to withhold for each employee, proceeding as follows: 1. In the appropriate columns of your payroll register, record the filing status for each employee using the information provided. 2. Record the payroll deductions for the SIMPLE plan that the employer has established for participating employees. All of the employees are participating, and their weekly contributions are listed below. The tax deferral on these deductions applies only to the federal income tax. 3. Record the amount of federal income taxes using the wage bracket method and standard withholding, 4. Record the state income taxes on the gross weekly earnings for each employee. The rate is 3.07% for the state of Pennsylvania. 5. Record the city income taxes on the gross weekly earnings of each employee. The rate is 3% for the city of Pittsburgh residents. No of CIMDI File che ate E .html?eISBN=9780357358214&id=1022089926&nbid=2134427&snapshotld=21344278 ACCT 254 Tax Guide WAMAP S Math Book . . 5. Record the city income taxes on the gross weekly earnings of each employee. The rate is 3% for the city of Pittsburgh residents. Time Card Filing Status No. of SIMPLE No. Withholding Deductions Allowances 11 S N/A $20 S N/A 50 13 MA N/A 40 21 ME N/A 50 22 S N/A 20 31 MF) NIA 40 32 MF N/A 50 33 S N/A 60 51 ME) N/A 30 99 ME 80 NA 12 -E Paste BIU A- $ - % al 99 Conditi Format Elipboard Font Alignment Numbet 922 X fie B C DELFI G H 1 L M N @ BI s IT PAYROLL REGISTER TORFERIODENDANG January 8, 20. FLING 10 STATUS NO OF WIN FIT HI 10.15 13:01 EMPLOYEE Carson Fran M 12 Wilson, William A 13 Uly Harry 21 Fe, Lawrence R. 22 Smith Luck 31 Fay Gretchen R 32 Flobs Glenda B 33 Schork. Thomas K 51 Hady, Barbara 99 Kiple Carson C. Total s M M S M M 1 0 2 4 2 3 6 1 5 MOTIV OK OM SOOOOO REGULAREAANINGS BATE PER HOUR AMOUNT 40 $17.50 700.00 40 $17.25 690.00 37.5 $18.10 678.75 40 $17.90 716.00 40 $19.75 790.00 40 $12.88 515.00 40 $15.58 623.08 40 $19.33 77308 40 $14.48 579.23 40 $25,00 1,000.00 7206549 LLLLLLL OVERTIME EARNING RATE PER HOUR AMOUNT 0 $26.25 8 $25.88 207.04 0 $27.15 8 $26.85 161.00 0 $29.63 1.25 $19.32 24.15 0 $25.31 0 $3141 4 $2172 86.88 TOTAL EARNINGS 700.00 83704 678.75 877:10 790.00 539.15 623.08 773.08 666.11 1,000.00 7/54423 FICA DASDI 43.40 55,62 42.08 5439 48.99 33.43 38.63 47.93 4130 62.00 464870 9.84 1272 1146 2.82 9.03 1121 9.66 14.50 10970 JOURNAL DEBIT DESCRIPTION CREDIT Tasable Eatings Fate FU DATE 20 Jan 12 NetFUTA SU 467,75 109.40 SUTA Vages and Salaries FICA Tates Payable-OASDI FICA Tas Payable-H Employees FIT Payable Employees SIT Payable Employees SUTA Payable Employees CIT Pagable 226.31 440.00 Filter Select umber Styles Analysis Cells Editing Analysis Sensitivity MI XY 12 AA AAC AB AE AL AG A ALAJ A ALA ANAL APSALAR PAYROLL REGISTER DEDUCTIONS NET PAYI TAXALILLARMINO FIT SIT SUTA AMOUNT OASDI FUTA SOTA CIT 21.00 26.91 20.36 26.31 23.70 16.17 18.69 23.19 19.98 30,00 226.31 SIMPLE 20.00 50,00 40.00 50.00 20:00 40.00 50.00 60.00 30.00 80.00 1440.00 GROUP MEALTH CHECK INSURANCE INSURANCE NOI 313 314 315 316 317 318 319 320 321 322 H 700.00 89704 878.75 87720 790.00 538.15 623.08 773.08 66611 1000.00 + Tasable Earnings Net FUTA Tas Rate TA SUTA Tas = Aria 110 A A 3 23 General > Paste BIU- > A - A = $ % 91-98 Conditio Formatti Clipboard B Font Alignment Number U22 X e DEG H 1 JK M IN 0 P. OB s VEUX PAYROLL REGISTER TOP ROD END January 2013 DUBE MORE FIT ST 17 18 19 20 21 22 20 24 EMPLOYEE 11 Carson, Fran M 12 Vison, William A 12 Utles, HAT 21 Flowene R 22. Smith.LK 21 Gretohen R 32 Robes, Glenda B 33. Schork, Thomas 51Hardy Barbara 99 kipley Carson Tots RUNG NO OF WIN ALLOM WORKED la 333 STATUS RE INT 01681850SN 1818 REGULARLARNINGS RATE PER HOUR AMOUNT 1 40 $17.50 700.00 0 40 $17.25 690.00 2325 $18.10 678.75 4 40 $17.90 716.00 2 40 $19.75 73000 3 40 $12.88 515.00 6 40 $15.58 623.08 1 40 $19.33 773.08 5 40 $14.48 579.23 7 40 $25.00 1000.00 Z4065 OVERTIMELINE RATE PER HOUR AMOUNT $26.25 8 $25.69 207.04 $27.5 6 $26.85 191.10 0 $28.63 125 $19.32 24.15 $25.31 $31.41 $2172 86.88 80 TOTAL EARNINGS 700.00 89704 678.75 $77.10 290700 5395 623.08 77308 666.11 100000 74542331 RA OASI 10 43.40 55.62 13.01 1208 54.38 12.72 48.98 1146 3343 782 3863 9.03 47.93 1121 4130 9.66 62.00 1450 BOSTON lll 11 CON JOURNAL DESCRIPTION DEBIT CREDIT Table Earnings Fate FUT DATE 20 Jan 12 Net FUTA SUT 46775 108.40 SUTA 8889 Vages and Salaries FICA Tastes Payable - OASOI FICA Taxes Payable. Hi Employees FIT Payable Employees SIT Payable Employees SUTA Payable Employees CIT Payable 226.31 General Insert - Delete 249 0 4 $ - % Sensitivity Het Format Conditional Format as Cell Formatting Table Styles Styles Sort B. Find & Filter Select Data Analysis Analysis 15 Number 15 Cells Editing Sensitivity P RS T U V W X Y Z AA ALACA . AG AAL AJAKALA ANAL AFAL ARAY PAYROLL REGISTER DEDUCTIONS NET PAY FIT SIT SUTA AMOUNT BASDI FUTA + 5 FICA DED 43:40 55.62 42.00 5430 48.30 30:49 HI 10.15 13.01 3.84 12.72 11:46 7.82 9.00 1121 3.66 14.50 CIT 2100 26.31 20.36 2631 23.70 9.12 18.69 23.9 19.90 30.00 SAMPLE 20.00 50.00 40.00 50.00 20.00 40.00 50.00 60.00 30.00 30.00 71000 GROUP HEALTH CHECK INSURANCE INSURANCE NO 313 314 315 316 317 318 319 320 321 322 700,00 T04 7.75 877.0 730.00 52915 623.08 773.00 656,10 L03.00 15 an 47.99 41.30 62.00 Taxable Earnings Net FUTA TX Rate NetFUTA SUTA Tax SUTA Elechtml?SAN9780357358214&id=1022009926&nbild-2134427&snapshotid 21344278 AOCT 254 Tax Guide WAMAD Math Book Refer to the partially completed payroll register which you worked on at the end of Chapter 3. You will now determine the amount of income tax to withhold for each employee, proceeding as follows: 1. In the appropriate columns of your payroll register, record the filing status for each employee using the information provided. 2. Record the payroll deductions for the SIMPLE plan that the employer has established for participating employees. All of the employees are participating, and their weekly contributions are listed below. The tax deferral on these deductions applies only to the federal income tax. 3. Record the amount of federal income taxes using the wage bracket method and standard withholding, 4. Record the state income taxes on the gross weekly earnings for each employee. The rate is 3.07% for the state of Pennsylvania. 5. Record the city income taxes on the gross weekly earnings of each employee. The rate is 3% for the city of Pittsburgh residents. No of CIMDI File che ate E .html?eISBN=9780357358214&id=1022089926&nbid=2134427&snapshotld=21344278 ACCT 254 Tax Guide WAMAP S Math Book . . 5. Record the city income taxes on the gross weekly earnings of each employee. The rate is 3% for the city of Pittsburgh residents. Time Card Filing Status No. of SIMPLE No. Withholding Deductions Allowances 11 S N/A $20 S N/A 50 13 MA N/A 40 21 ME N/A 50 22 S N/A 20 31 MF) NIA 40 32 MF N/A 50 33 S N/A 60 51 ME) N/A 30 99 ME 80 NA 12 -E