Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Paste BIU - A === Merge & Center Clipboard Font Alignment $ % 1 100 $10 C F Number 036 A B C D

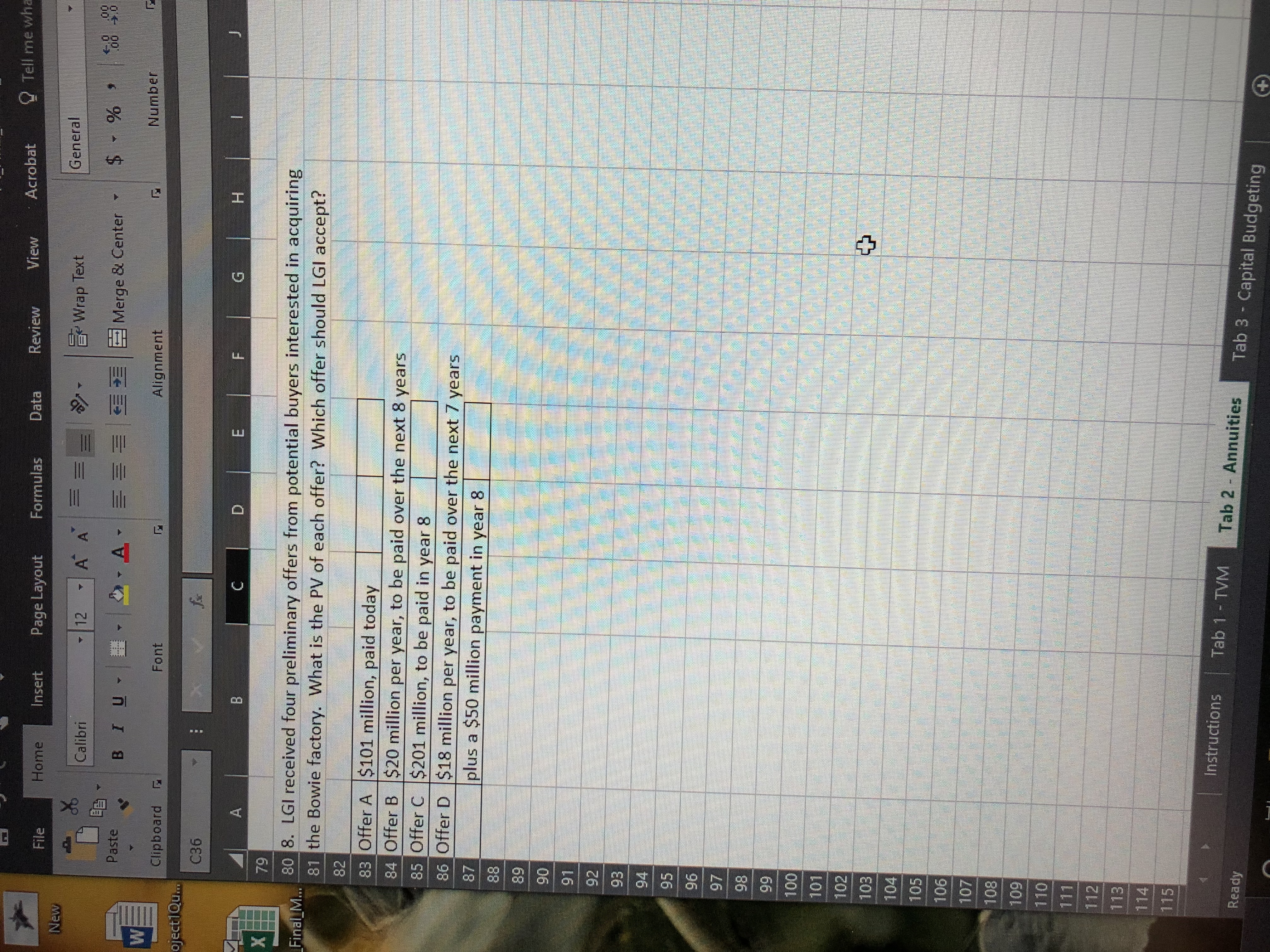

Paste BIU - A === Merge & Center Clipboard Font Alignment $ % 1 100 $10 C F Number 036 A B C D E F G H J 1 Tab 2 - Annuities 2 3 41. How many years would be required to pay off a loan with the following characteristics? 5 PV 6 RATE 7 PMT $11,500 8% 8 Time 11.12 years $1,600 (annual payments) OL 6 11 2. What is the annual payment required to pay off a loan with the following characteristics? 12 PV 13 RATE 14 NPER $14,700 9% 10 years 15 PMT 91 $2,290.56 18 3. Why is FV not part of the calculations for either question 1 or question 2? 19 When loan is the payoff all the payments for the loan are made and the future value will always be 0 20 21 22 4. At what annual rate of interest is a loan with the following characteristics? 23 24 NPER 12 years 25 PMT $100,000 26 PV $1,000,000 27 2.92% 28 29 30 For questions 5-8, LGI's cost of capital is 31 8.05% 32 5. LGI projects the following after-tax cash flows from operations from 33 its aging Bowie, Maryland plant (which first went on line in 1953) 34 over the next five years. What is the PV of these cash flows? 35 36 Projected after-tax cash flows Ready Instructions Tab 1 - TVM Tab 2 - Annuities Tab 3 - Capital Budgeting E OM XB M + Paste BIU - Clipboard Font C36 A B 31 A === Merge & Center $ - % - Alignment C D E F G 32 5. LGI projects the following after-tax cash flows from operations from 33 its aging Bowie, Maryland plant (which first went on line in 1953) 34 over the next five years. What is the PV of these cash flows? 35 Projected after-tax cash flows H 36 37 Year (in $ millions) 38 1 (45) 39 2 (45) P = 45 X [(1 - (1/(1+0.0805)^5))/0.0805] P = 45 X [(1 - (1/1.47273))/0.0805] 40 3 (45) P = 45 X [(1.06790) / 0.0805] 41 4 (45) P = 45 X (.321 / 0.0805) 42 5 (45) P = 45 X 3.9875 43 P = 179.44 44 45 48 49 46 6. LGI extended the analysis out for an additional 7 years, and generated the 47 following projections. What is the PV of these cash flows? Projected after-tax cash flows 50 Year (in $ millions) 51 1 52 N (45) (45) 53 3 (45) P = 45 X [(1 - (1 / (1 + 0.0805)^12)) / 0.0805] 54 4 (45) P = 45 X [(1 - (1 / 2.5322)) / 0.0805] 55 5 (45) P = 45 X [(1 - 39491) / 0.0805] 56 6 (45) P = 45 X (.60509 / 0.0805) 57 7 (45) P = 45 X 7.5166 58 8 (45) P = 338.25 59 9 (45) 60 10 (45) 61 11 (45) 62 12 (45) 63 64 65 Number J 66 7. The CFO asked the team to undertake a more detailed analysis of the plant's costs, noting that while Instructions Tab 1 - TVM Tab 2 - Annuities Tab 3 - Capital Budgeting Ready e OM W F File Home Insert Page Layout Formulas Data Review View Acrobat Tell me what you want to fx Define Name * ? A Q Use in Formula - Insert unction AutoSum Recently Financial Logical Text Date & Used Time Lookup & Math & Reference Trig More Functions Functions Name Manager Function Library Create from Selection Defined Names H27 A 55 x B C D E F G H K 56 7. The CFO asked the team to undertake a more detailed analysis of the plant's costs, noting that while 67 it is convenient for making calculations when projections result in data that can be treated like an annuity, 68 this does not always represent the most accurate estimate of future results. What is the PV of these cash flows? 69 Projected after-tax cash flows 70 71 Year (in $ millions) 72 1 (45) 73 2 (50) 74 3 (55) 75 4 (60) 76 5 (70) 77 78 79 80 8. LGI received four preliminary offers from potential buyers interested in acquiring 81 the Bowie factory. What is the PV of each offer? Which offer should LGI accept? 82 83 Offer A $101 million, paid today + 84 Offer B $20 million per year, to be paid over the next 8 years 85 Offer C $201 million, to be paid in year 8 86 Offer D 87 $18 million per year, to be paid over the next 7 years plus a $50 million payment in year 8 88 89 90 Off 91 92 93 94 95 96 97 98 99 100 Instructions Tab 1 - TVM Tab 2 Annuities Tab 3 - Capital Budgeting e OM X W Clipboard Font 036 3 4 C 7 B C E P = 179.44 Alignment H G H 66. LGI extended the analysis out for an additional 7 years, and generated the 7 following projections. What is the PV of these cash flows? 8 6 Projected after-tax cash flows 0 Year (in $ millions) 1 (45) 2 2 (45) 3 3 (45) 4 4 (45) P = 45 X [(1 - (1 / (1 + 0.0805)^12)) / 0.0805] P = 45 X [(1 - (1/2.5322)) / 0.0805] 15 5 (45) P = 45 X [(1 - .39491) / 0.0805] 6 6 (45) P = 45 X (.60509 / 0.0805) 7 L (45) P = 45 X 7.5166 58 8 (45) P = 338.25 59 9 (45) 50 10 (45) 51 11 (45) 52 12 (45) 53 54 55 Number Formattin K 56 7. The CFO asked the team to undertake a more detailed analysis of the plant's costs, noting that while 57 it is convenient for making calculations when projections result in data that can be treated like an annuity, 58 this does not always represent the most accurate estimate of future results. What is the PV of these cash flows? 59 Projected after-tax cash flows 70 71 Year (in $ millions) 72 1 (45) 73 2 (50) 74 3 (55) 75 4 (60) 76 5 (70) 77 78 Instructions Tab 1 - TVM Tab 2 Annuities Tab 3 - Capital Budgeting Ready e OM XB New File Paste 8 EE Home Calibri Insert BIU B Page Layout Formulas Data Review View Acrobat Tell me wha 12 F A A Wrap Text General A Merge & Center $ - % %' 00 00.0 Alignment Number Font C D E F G H 80 8. LGI received four preliminary offers from potential buyers interested in acquiring 81 the Bowie factory. What is the PV of each offer? Which offer should LGI accept? W Clipboard oject 1Qu... C36 A X Final M... 79 82 83 Offer A $101 million, paid today 84 Offer B $20 million per year, to be paid over the next 8 years 85 Offer C $201 million, to be paid in year 8 86 Offer D 87 $18 million per year, to be paid over the next 7 years plus a $50 million payment in year 8 88 89 90 91 92 93 $6 776 96 97 98 99 100 101 102 103 104 105 106 107 108 109 110 111 112 113 114 115 Ready C + r Instructions Tab 1 - TVM Tab 2 - Annuities Tab 3 - Capital Budgeting

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started