Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Paste [ Cliphoard B I U ? v ? w x 2 x 2 A . 2 A . Font 2 x 2 q ,

Paste

Cliphoard

B

I

w

A

A

Font

FIN Chapter &

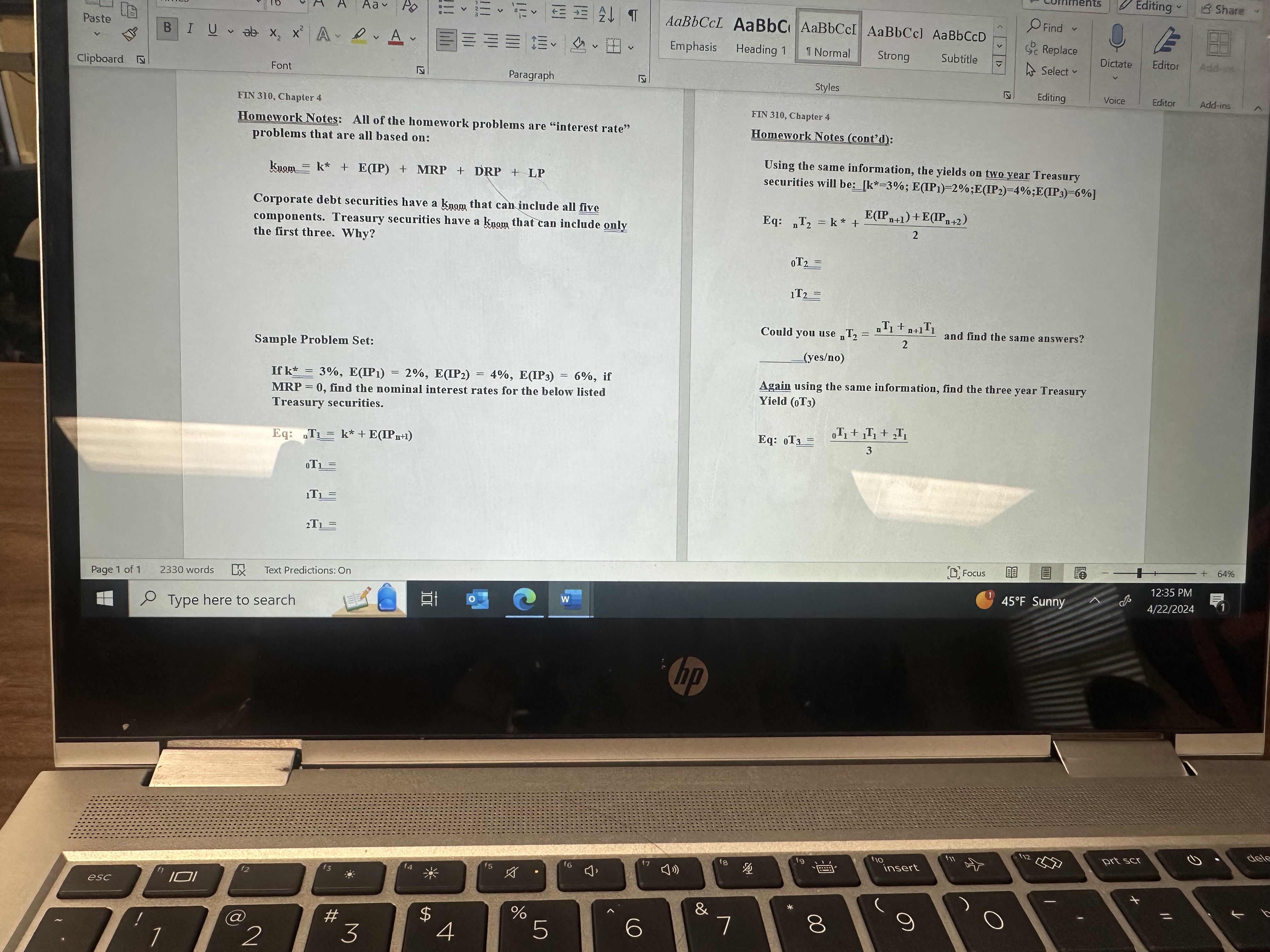

Homowork Notes: All of the homework problems are "interest rate" problems that are all based on:

kngra

Corporate debt securities have a knom that can include all five components. Treasury securities have a kawn that can include only the first three. Why?

FIN Chapter

Find

Emphasis

Heading

AaBbCcI

AaBbCc

I Normal

Strong

Subtitle

Replace

Select

Styles

Editing

Voice

Edfor

Addins

Homework Notes contd:

Using the same information, the ylelds on two year Treasury securities will be: ;;;

Sample Problem Set:

find the nominal interest rates for the below listed Treasury securities

:

Could you use and find the same answers?

yesno

Again using the same information, find the three year Treasury Yield

:

Page of

words

Ex

Text Predictions: On

Type here to search

Sunny

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started