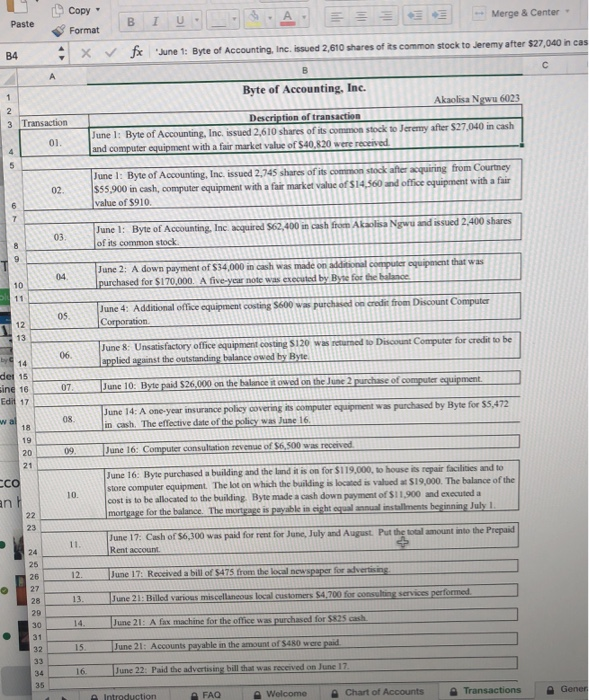

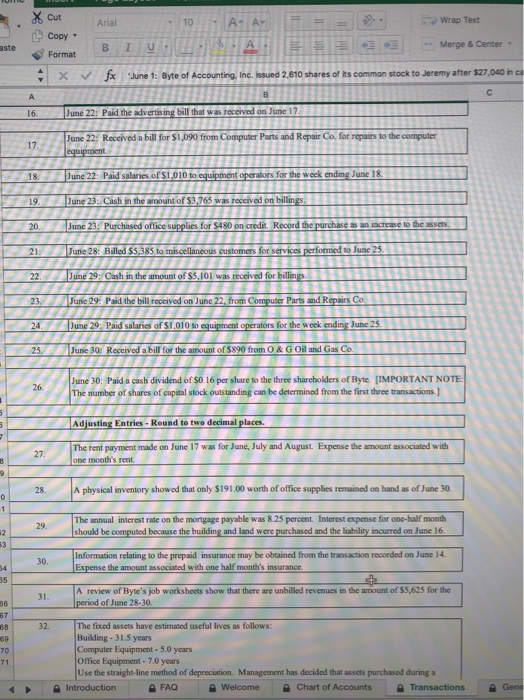

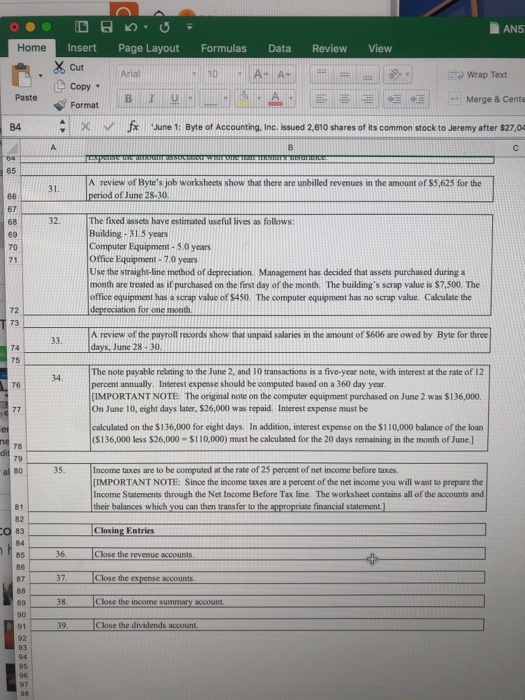

Paste Copy Format BIU-- - Merge & Center DA X fx June 1: Byte of Accounting, Inc. issued 2,610 shares of its common stock to Jeremy after $27,040 inca 3 Transaction Byte of Accounting, Inc. Akaolisa Ngwu 6023 Description of transaction June 1: Byte of Accounting, Inc. issued 2,610 shares of its common stock to Jeremy after $27.040 in cash and computer equipment with a fair market value of $40,820 were received June 1: Byte of Accounting, Inc. issued 2,745 shares of its common stock after acquiring from Courtney $55.900 in cash, computer equipment with a fair market value of $14,560 and office equipment with a fair value of $910. 1 1111111111111111 June 1: Byte of Accounting, Inc. acquired S62,400 in cash from Akalisa Ngwu and issued 2,400 shares of its common stock 1 111111111111 June 2: A down payment of $34,000 in cash was made on additional computer equipment that was purchased for $170,000. A five-year note was executed by Byte for the balance June 4: Additional office equipment costing $600 was purchased on credit from Discount Computer Corporation June 8: Unsatisfactory office equipment costing S120 was returned to Discount Computer for credit to be applied against the outstanding balance owed by Byte 07 June 10: Byte paid 526,000 on the balance towed on the June 2 parchase of computer equipment Line 16 Edit 17 June 14: A one-year insurance policy covering its computer equipment was purchased by Byte for $5,472 in cash. The effective date of the policy was June 16. 09 June 16: Computer consultation revenue of $6,500 was received 10. June 16: Byte purchased a building and the land it is on for $119,000, to house is nepair facilities and to store computer equipment. The lot on which the building is located is valued at $19,000. The balance of the cost is to be allocated to the building. Byte made a cash down payment of $11.900 and executed a mortgage for the balance. The mortgage is payable in eight equal installments beginning July 1 June 17: Cash of 56,300 was paid for rent for June July and August Put the amount mo me round Rent account. 12. June 17: Received a bill of $475 from the local newspaper for hvertising 13 14 June 21: Billed various miscellaneous local kamers 54,700 for consulting se June 21: A fax machine for the office was purchased for $825 cash 15 June 21: Accounts payable in the amount of $480 were paid 34 1 6 June 22: Paid the advertising bill that was received on June 17. Introduction FAQ Welcome Chart of Accounts Transactions Gener o Deo Home Insert Page Layout * Cut Arial Copy Paste Format BIO Formulas Data 10 A- A A Review View = = = = Wrap Text - Merge & Cent 3 X f x une 1: Byte of Accounting, Inc. issued 2,610 shares of its common stock to Jeremy after 527,0 A review of Byte's job worksheets show that there are unbilled revenues in the amount of $5,625 for the period of June 28-30 The fixed assets have estimated useful lives as follows: Building - 31.5 years Computer Equipment - 5.0 years Office Equipment - 7.0 years Use the straight-line method of depreciation Management has decided that assets purchased during month are treated as if purchased on the first day of the month. The building's scrap value is $7.500. The office equipment has a scrap value of $450. The computer equipment has no scrap value. Calculate the depreciation for one month A review of the payroll records show that unpaid salaries in the amount of S606 are owed by Byte for three days, June 28. 30. The note payable relating to the June 2, and 10 transactions is a five-year note, with interest at the rate of 12 percent annually. Interest expense should be computed based on a 360 day year. (IMPORTANT NOTE: The original note on the computer equipment purchased on June 2 was $136,000 On June 10, eight days later, $26,000 was repaid. Interest expense must be calculated on the $136,000 for eight days. In addition, interest expense on the $110,000 balance of the loan (5136,000 less $26,000 - $110,000) must be calculated for the 20 days remaining in the month of June] Income taxes are to be computed at the rate of 25 percent of net income before taxes. [IMPORTANT NOTE: Since the income taxes are a percent of the net income you will want to prepare the Income Statements through the Net Income Before Tax line. The worksheet contains all of the accounts and their balances which you can then transfer to the appropriate financial statement) Closing Eatries Close the revenue accounts 37. Close the expense accounts 38 Close the income summary account I 39. Close the dividends account