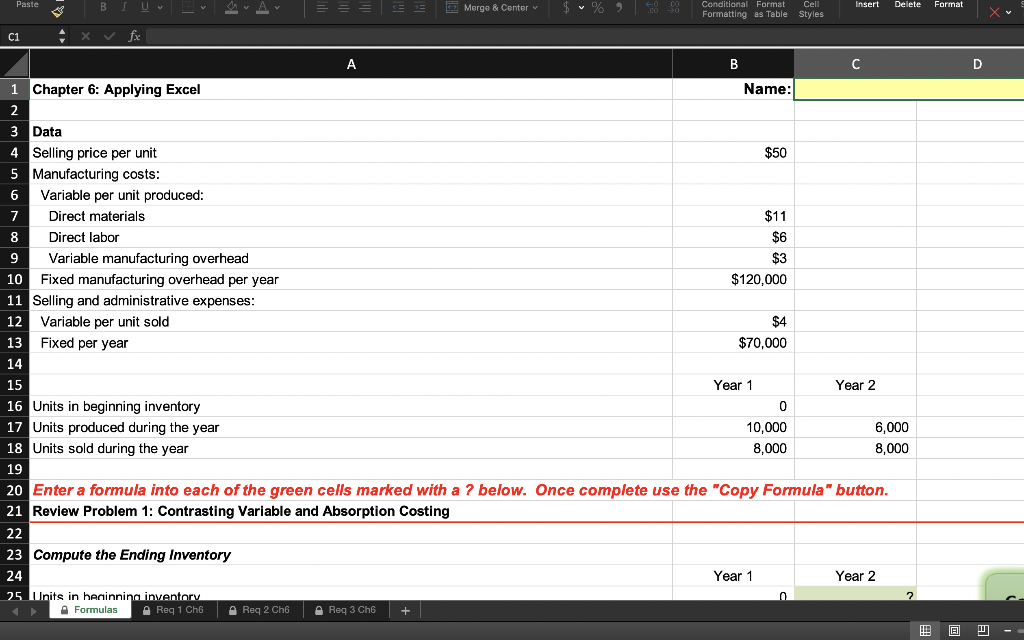

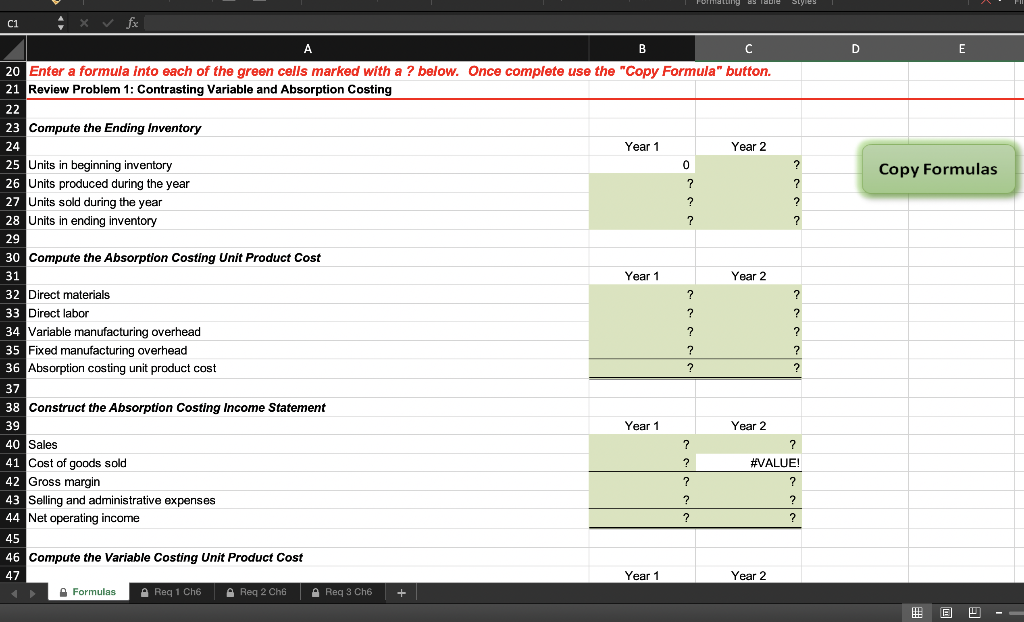

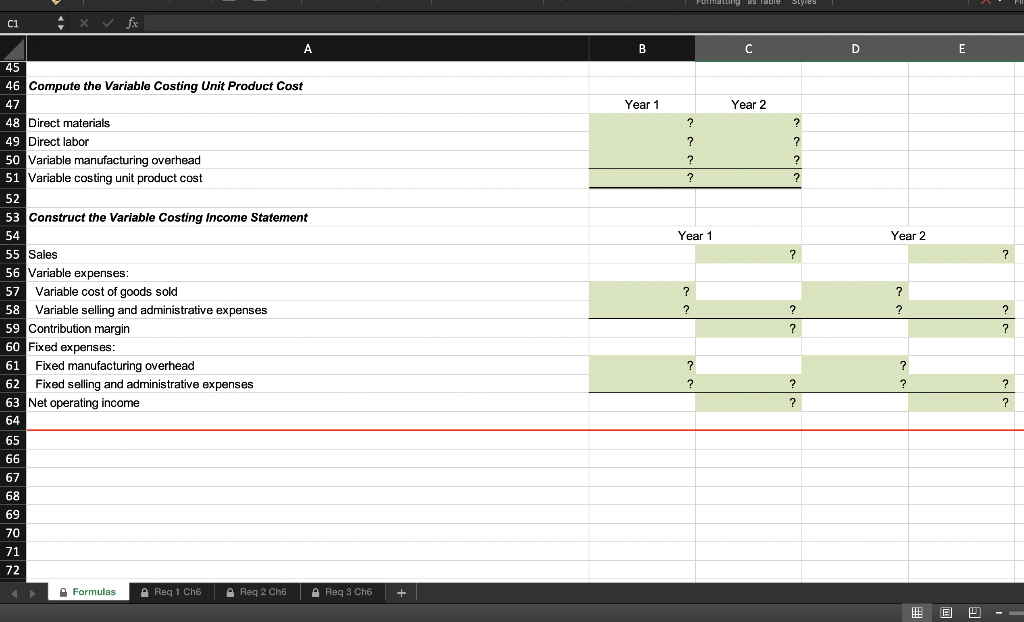

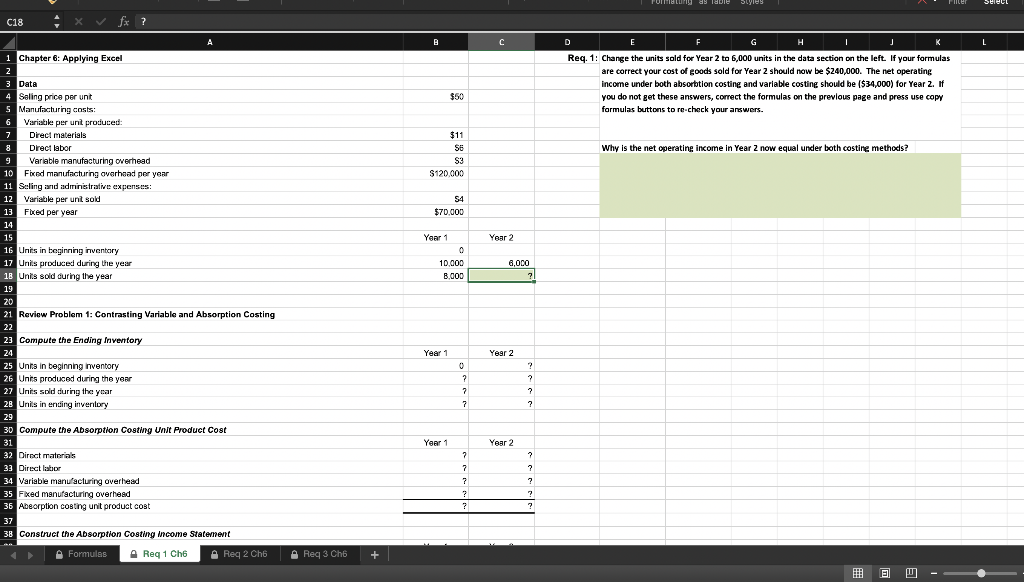

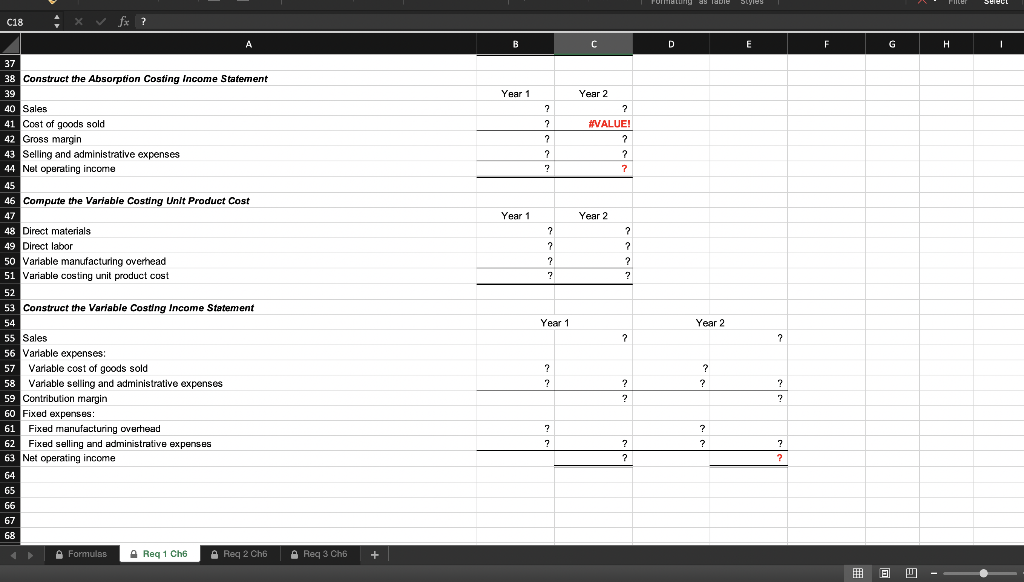

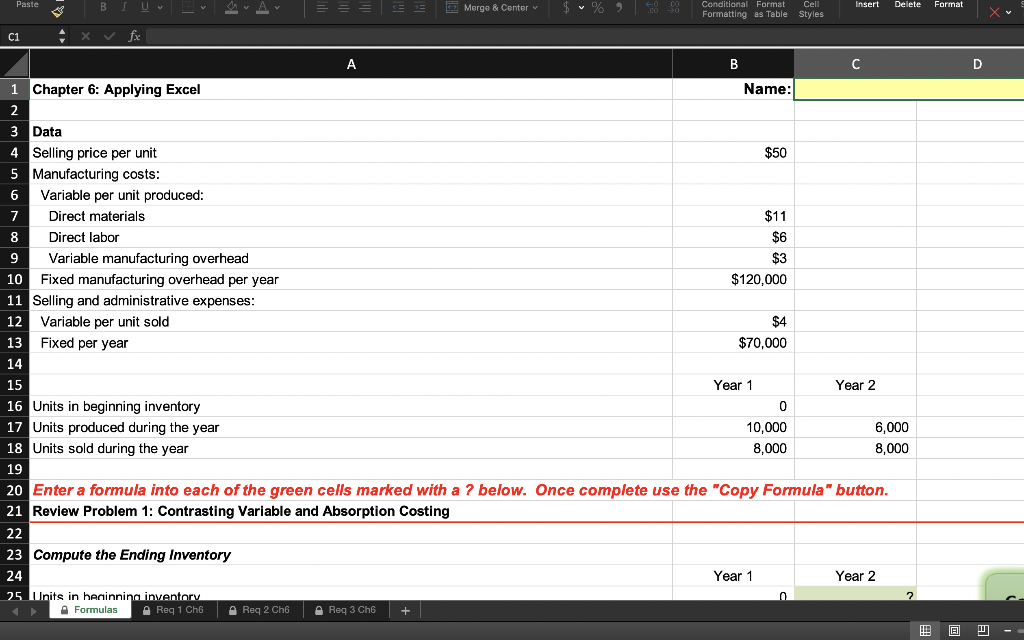

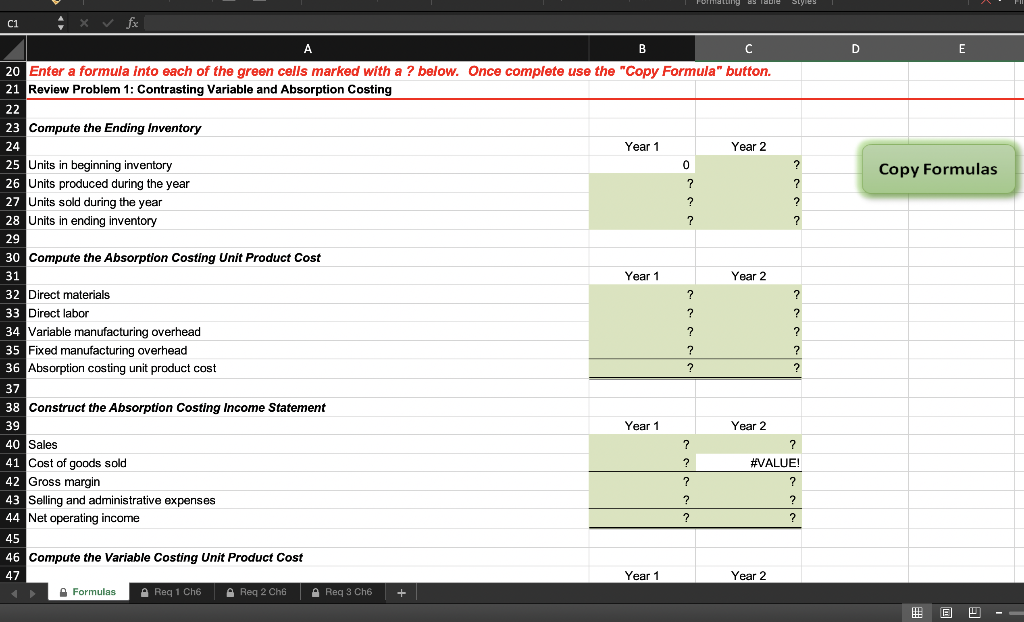

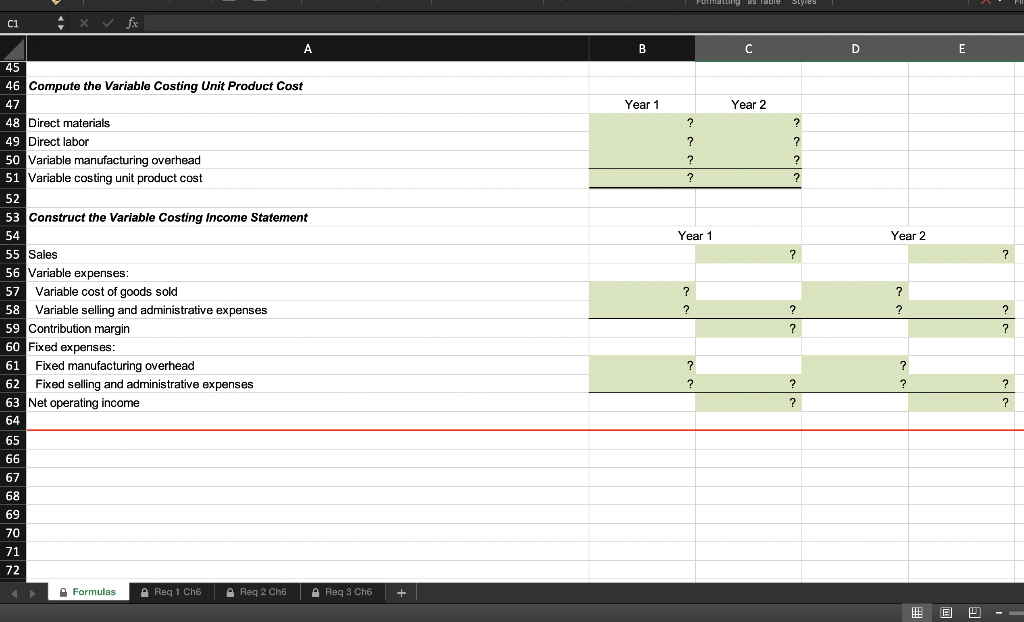

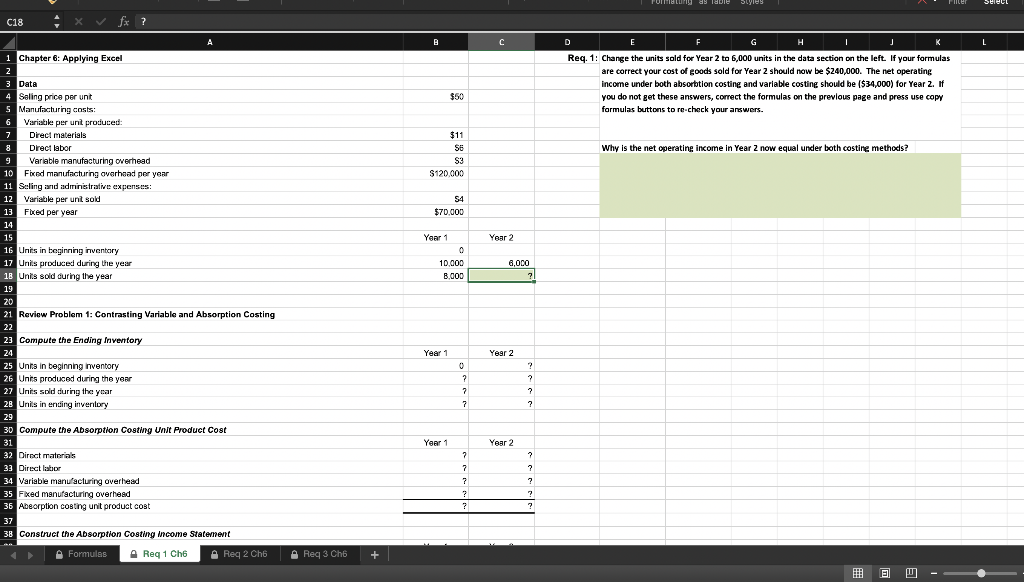

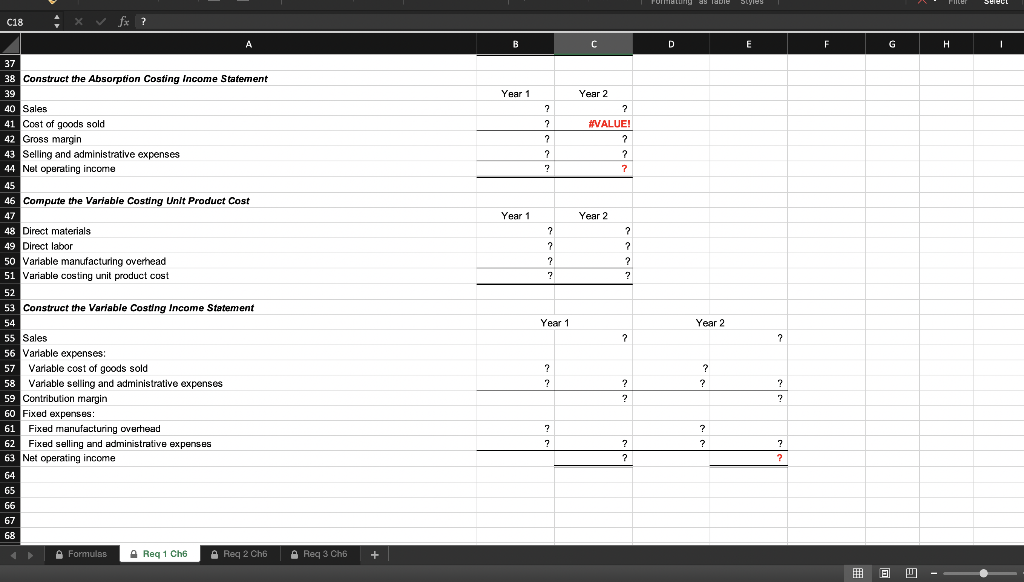

Paste Insert Delete Format D $50 Mergo & Center v % Conditional Format = = = Cell Formatting as Table Styles C1 fx A B 1 Chapter 6: Applying Excel Name: 2 3 Data 4 Selling price per unit 5 Manufacturing costs: 6 Variable per unit produced: 7 Direct materials $11 8 Direct labor $6 9 Variable manufacturing overhead $3 10 Fixed manufacturing overhead per year $120,000 11 Selling and administrative expenses: 12 Variable per unit sold $4 13 Fixed per year $70,000 14 15 Year 1 Year 2 16 Units in beginning inventory 0 17 Units produced during the year 10,000 6,000 18 Units sold during the year 8,000 8,000 19 20 Enter a formula into each of the green cells marked with a ? below. Once complete use the "Copy Formula" button. 21 Review Problem 1: Contrasting Variable and Absorption Costing 22 23 Compute the Ending Inventory 24 Year 1 Year 2 25 Units in herinning inventory Formulas Reg 1 Ch6 Req 2 Ch6 & Req3 Ch ? + as able Styles D E Copy Formulas ? C1 xv fx A B C 20 Enter a formula into each of the green cells marked with a ? below. Once complete use the "Copy Formula" button. 21 Review Problem 1: Contrasting Variable and Absorption Costing 22 23 Compute the Ending Inventory 24 Year 1 Year 2 25 Units in beginning inventory 0 ? 26 Units produced during the year ? 27 Units sold during the year ? ? 28 Units in ending inventory ? ? 29 30 Compute the Absorption Costing Unit Product Cost 31 Year 1 Year 2 32 Direct materials ? ? 33 Direct labor ? ? 34 Variable manufacturing overhead ? ? 35 Fixed manufacturing overhead ? ? 36 Absorption costing unit product cost ? ? 37 38 Construct the Absorption Costing Income Statement 39 Year 1 Year 2 40 Sales ? 41 Cost of goods sold #VALUE! 42 Gross margin ? ? 43 Selling and administrative expenses ? 44 Net operating income ? ? 45 46 Compute the Variable Costing Unit Product Cost 47 Year 1 Year 2 Formulas Req 1 Ch6 Req 2 Che Red 3 Ch6 + ? ? ? B mating a Table Styles C1 xv fx A B C E Year 1 Year 2 2 ? ? ? ? ? 2 ? Year 1 Year 2 ? 7 45 46 Compute the Variable Costing Unit Product Cost 47 48 Direct materials 49 Direct labor 50 Variable manufacturing overhead 51 Variable costing unit product cost 52 53 Construct the Variable Costing Income Statement 54 55 Sales 56 Variable expenses: 57 Variable cost of goods sold 58 Variable selling and administrative expenses 59 Contribution margin 60 Fixed expenses: 61 Fixed manufacturing overhead 62 Fixed selling and administrative expenses 63 Net operating income 64 65 66 ? ? ? ? ? ? ? ? ? ? 2 ? ? ? ? ? 67 68 69 70 71 72 Formulas Req 1 Ch6 1 Rea2CE * Req 3 Ch6 + Formaturgas labie Syles liler Select C18 X VSx ? A D L D E F H I J Req. 1: Change the units sold for Year 2 to 5,000 units in the data section on the left. If your formulas are correct your cost of goods sold for Year 2 should now be $240,000. The net operating income under both absorbtion costing and variable costing should be ($34,000) for Year 2. If you do not get these answers, correct the formulas on the previous page and press use copy formulas buttons to re-check your answers. $50 Why is the net operating income in Year 2 now equal under both costing methods? $11 S6 S3 $120.000 S4 $70,000 Yaar 1 Year 2 10.000 B.000 6,000 ? 1 Chapter 6: Applying Excel 2 3 Data 4 Saling price per unit S Manufacturing costs: 6 Varistike per unit produced 7 Direct materials Direct labor 9 Variable manufacturing overhead 10 Fixed manufacturing overhead per year 11 Seling and administrative expenses 12 Variable per un sold 13 Fked per year 14 15 16 Units in beginning inventory 17 Units produced during the year 18 Units sold during the year 19 20 21 Review Problem 1: Contrasting Variable and Absorption Costing 22 23 Compute the Ending Inventory 24 25 Unta in beginning inventory 26 Units produced during the year 27 Units sold during the year 28 Units in ending invenlory 29 30 Compute the Absorption Costing Unit Product Cost 31 32 Direct materials 33 Direct labor 34 Variable manufacturing overhead 35 Fixed manufacturing overhead 36 Absorption costing unit product cost 37 38 Construct the Absorption Costing Income Statement Formulas Reg 1 Cha - Raq? Ch Year 1 Year 2 0 ? 7 7 ? ? ? ? Year 1 Year 2 ? ? ? 2 ? ? ? ? ? ? A Req 3 Cho + LU Formaturg 45 Tale Styles liler Select C18 A B C D E F G H - Year 1 Year 2 ? ? ? ? ? 2 #VALUE! ? ? 7 Year 1 Year 2 ? ? ? ? ? ? ? ? 37 38 Construct the Absorption Costing Income Statement 39 40 Sales 41 Cost of goods sold 42 Gross margin 43 Selling and administrative expenses 44 Net operating income 45 46 Compute the Variable Costing Unit Product Cost 47 48 Direct materials 49 Direct labor 50 Variable manufacturing overhead 51 Variable costing unit product cost 52 53 Construct the Variable Costing Income Statement 54 55 Sales 56 Variable expenses 57 Variable Variable cost of goods sold 58 Variable selling and administrative expenses 59 Contribution margin 60 Fixed expenses: 61 Fixed manufacturing overhead 62 Fixed selling and administrative expenses 63 Net operating income 64 65 66 67 68 Year 1 Year 2 ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? Formulas 1 Reg 1 Ch Reg 2 Ch6 + H3Ch6 + El LU