Answered step by step

Verified Expert Solution

Question

1 Approved Answer

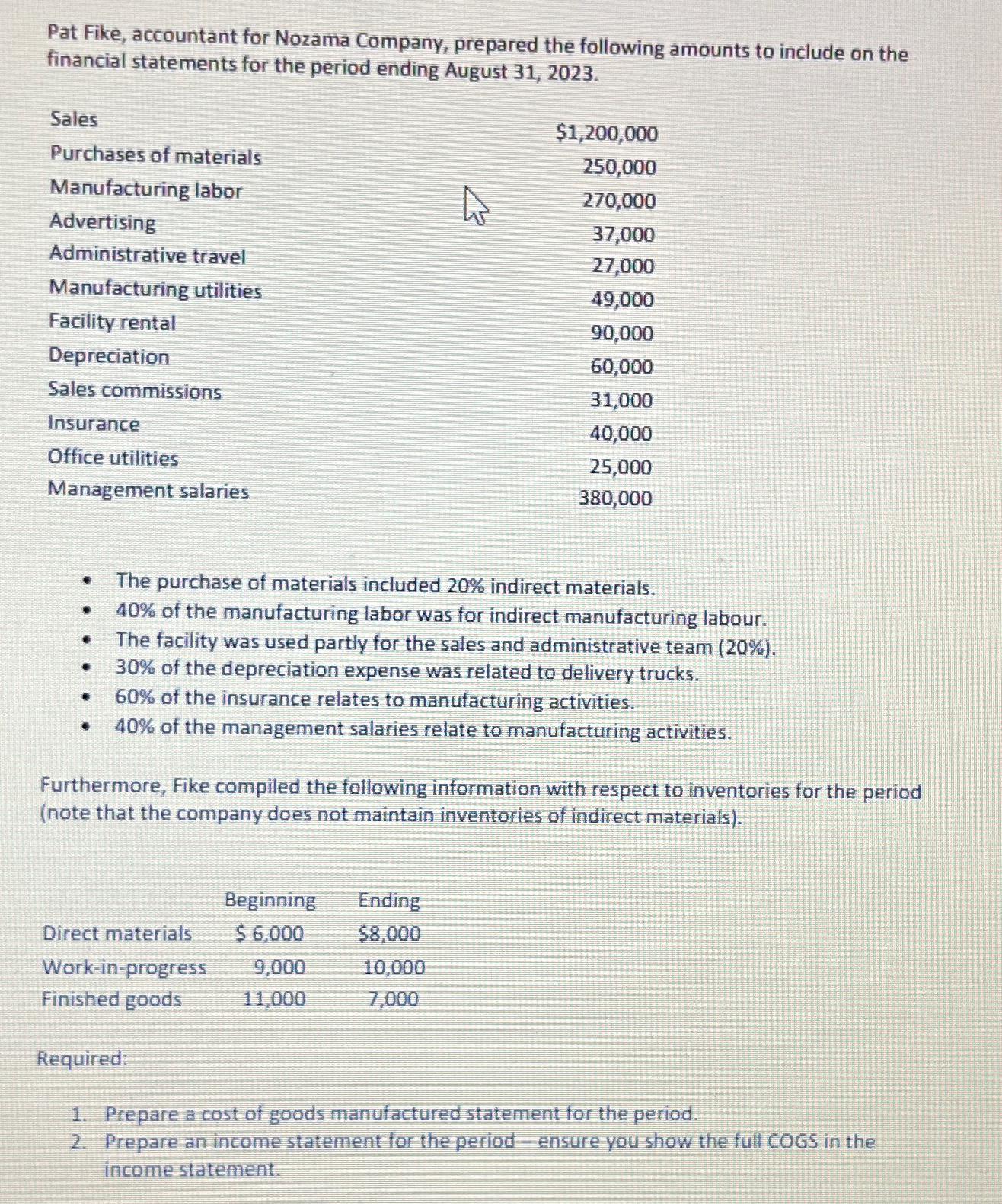

Pat Fike, accountant for Nozama Company, prepared the following amounts to include on the financial statements for the period ending August 31, 2023. Sales

Pat Fike, accountant for Nozama Company, prepared the following amounts to include on the financial statements for the period ending August 31, 2023. Sales $1,200,000 Purchases of materials 250,000 Manufacturing labor 270,000 Advertising 37,000 Administrative travel 27,000 Manufacturing utilities 49,000 Facility rental 90,000 Depreciation 60,000 Sales commissions 31,000 Insurance 40,000 Office utilities Management salaries 25,000 380,000 . The purchase of materials included 20% indirect materials. . 40% of the manufacturing labor was for indirect manufacturing labour. The facility was used partly for the sales and administrative team (20%). 30% of the depreciation expense was related to delivery trucks. 40% of the management salaries relate to manufacturing activities. 60% of the insurance relates to manufacturing activities. Furthermore, Fike compiled the following information with respect to inventories for the period (note that the company does not maintain inventories of indirect materials). Beginning Ending Direct materials $ 6,000 $8,000 Work-in-progress 9,000 10,000 Finished goods 11,000 7,000 Required: 1. Prepare a cost of goods manufactured statement for the period. 2. Prepare an income statement for the period ensure you show the full COGS in the income statement.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started