Answered step by step

Verified Expert Solution

Question

1 Approved Answer

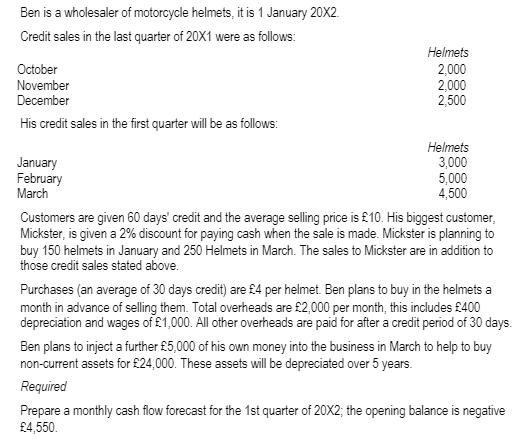

Ben is a wholesaler of motorcycle helmets, it is 1 January 20X2 Credit sales in the last quarter of 20X1 were as follows: October

Ben is a wholesaler of motorcycle helmets, it is 1 January 20X2 Credit sales in the last quarter of 20X1 were as follows: October November December His credit sales in the first quarter will be as follows: January February March Helmets 2,000 2,000 2,500 Helmets 3,000 5,000 4,500 Customers are given 60 days' credit and the average selling price is 10. His biggest customer, Mickster, is given a 2% discount for paying cash when the sale is made. Mickster is planning to buy 150 helmets in January and 250 Helmets in March. The sales to Mickster are in addition to those credit sales stated above. Purchases (an average of 30 days credit) are 4 per helmet. Ben plans to buy in the helmets a month in advance of selling them. Total overheads are 2,000 per month, this includes 400 depreciation and wages of 1,000. All other overheads are paid for after a credit period of 30 days. Ben plans to inject a further 5,000 of his own money into the business in March to help to buy non-current assets for 24,000. These assets will be depreciated over 5 years. Required Prepare a monthly cash flow forecast for the 1st quarter of 20X2; the opening balance is negative 4,550.

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

January Sales 3000 60 days credit 150 Mickster cash 3150 Purchases 3150 30 days credit 3150 Overhead...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started