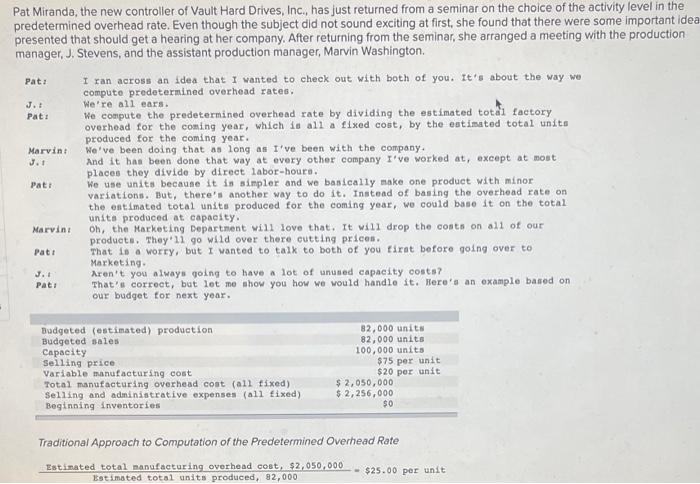

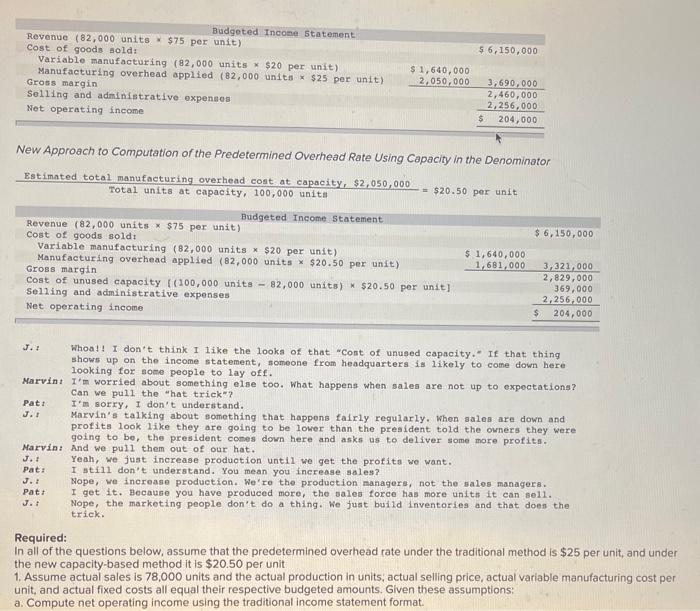

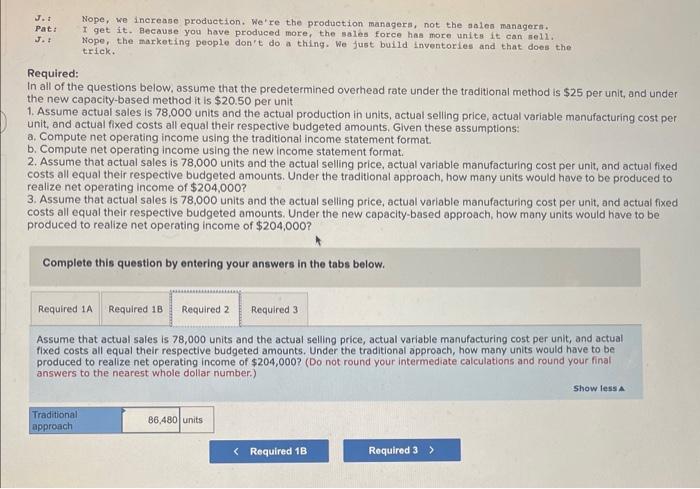

Pat Miranda, the new controller of Vault Hard Drives, Inc., has just returned from a seminar on the choice of the activity level in t predetermined overhead rate. Even though the subject did not sound exciting at first, she found that there were some importan presented that should get a hearing at her company. After returning from the seminar, she arranged a meeting with the producti manager, J. Stevens, and the assistant production manager, Marvin Washington. Pat: I ran across an idea that I wanted to check out with both of you. It's about the way wo compute predetermined overhead rates. J.tPat:overhoadforthecomingyear,whichisallafixedcost,bythproducedforthecomingyear.MarvintWevebeendoingthataslongasIvebeenwiththecompany.Wereallears.Wecomputethepredeterminedoverheadratebydividingtheest Marvin: Wa've been doing that as long as I've been with the company. S.t And it has been done that way at every other company I've worked at, except at most places they divide by direct labor-hours. Pati he use units because it is siepler and we basically make one product with minor variations. But, there's another way to do it. Instead of baning the overhead rate on the ontimated total unite produced for the coming year, wo could base it on the total units produced at capacity. Marvint oh, the Marketing Departnent will love that, It will drop the conts on all of our producte. They'11 qo wild over there eutting prices. Pate That in a worry, but I wanted to talk to both of you tirat before going over to Marketing. J.t Aren't you alwayn going to have a lot of unused capacity costs? Pati That'd correet, but let me show you how we would handle it. Ifere's an oxample baned on our budget for next year. Traditional Approach to Computation of the Predetermined Overhead Rate Estimated total manufacturing overhead cost, $2,050,000=$25.00 per unit New Approach to Computation of the Predetermined Overhead Rate Using Capacity in the Denominator Total units at capacity, 100,000 units I.f Whoa!f I don't think I like the looks of that "Cont of unused capacity." If that thing shows up on the income statement, nomeone from headquarters is likely to come down here looking for some people to lay off. Marvint I'm worried about something else too. What happens when sales are not up to expoctations? Can we pul1 the "hat trick"? Patt I'm sorry, I don't underetand. J.t Marvin's talking about something that happens fairly regularly. When sales are down and protits look like they are going to be lower than the preaident told the owners they were going to be, the president cones down here and askn us to deliver some more profits. Marrin: And we pull them out of our hat. J,f Yeah, we just increase produation until we get the profita wo want. Pat: I still don't understand. You mean you increase sales? J. : Nope, we increase production. We're the production managers, not the salos managers. PattIgetit.Becauseyouhaveproducedmore,thesalesforcehasmoreunitiitcansell.J.tNope,themarketingpeopledontdoathing.Wejustbuildinventoriesandthatdoenthe trick. Required: In all of the questions below, assume that the predetermined overhead rate under the traditional method is $25 per unit, and under the new capacity-based method it is $20.50 per unit 1. Assume actual sales is 78,000 units and the actual production in units; actual selling price, actual variable manufacturing cost per unit, and actual fixed costs all equal their respective budgeted amounts. Given these assumptions: a. Compute net operating income using the traditional income statement format. J.t Nope, we increase production. We're the production managera, not the anlea managera. Pat: I get it. Because you have produced more, the sales force has more units it can sell. J. : Nope, the marketing people don't do a thing. We fust build inventories and that does the trick. Required: In all of the questions below, assume that the predetermined overhead rate under the traditional method is $25 per unit, and under the new capacity-based method it is $20.50 per unit 1. Assume actual sales is 78,000 units and the actual production in units, actual selling price, actual variable manufacturing cost per unit, and actual fixed costs all equal their respective budgeted amounts, Given these assumptions: a. Compute net operating income using the traditional income statement format. b. Compute net operating income using the new income statement format. 2. Assume that actual sales is 78,000 units and the actual selling price, actual variable manufacturing cost per unit, and actual fixed costs all equal their respective budgeted amounts. Under the traditional approach, how many units would have to be produced to realize net operating income of $204,000 ? 3. Assume that actual sales is 78,000 units and the actual selling price, actual variable manufacturing cost per unit, and actual fixed costs all equal their respective budgeted amounts. Under the new capacity-based approach. how many units would have to be produced to realize net operating income of $204,000 ? Complete this question by entering your answers in the tabs below. Assume that actual sales is 78,000 units and the actual selling price, actual variable manufacturing cost per unit, and actual flxed costs all equal their respective budgeted amounts. Under the traditional approach, how many units would have to be produced to realize net operating income of $204,000 ? (Do not round your intermediate calculations and round your final answers to the nearest whole dollar number.)